Adaptive Biotechnologies (ADPT) Executive Stock Sale Impact Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on current data and professional analysis, I will evaluate the impact of this insider selling on ADPT’s investment value from multiple dimensions.

- Chief Product Officer Lo: Sold stocks worth $76,895

- Other Executives: According to SEC filings, multiple executives sold stocks in early December, including Sharon Benzeno who sold 12,604 shares worth $212,377 [1]

- Market Reaction: In the week of December 8, ADPT’s stock price fell by 24.5%, mainly due to the executive stock sales [1]

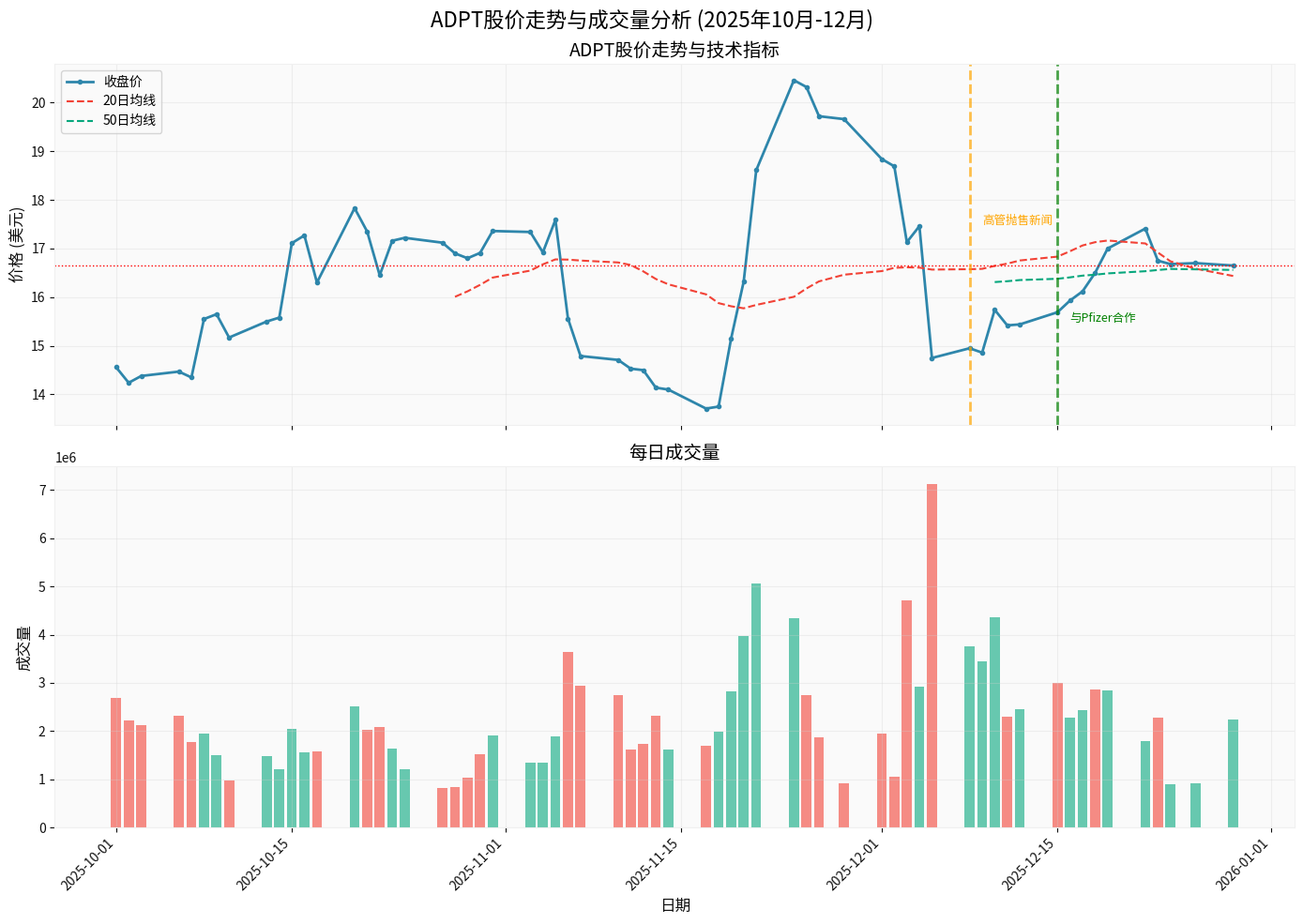

Chart shows: News of executive stock sales in early December led to a significant drop in stock price, but it was later supported by positive news about the collaboration with Pfizer in mid-December

- Insider selling is usually regarded by investors as a signal of lack of confidence in the company’s prospects

- Simultaneous selling by multiple executives has intensified market concerns

- Against the backdrop of a more than 170% year-to-date gain in stock price, executives taking profits may imply overvaluation [0][1]

- Current technical analysis shows the stock price is in a sideways consolidation phase, with support at $16.20 and resistance at $17.10 [0]

- The KDJ indicator shows a bearish signal (K:65.3, D:67.2, J:61.6) [0]

- Trading volume increased significantly during the selling period, indicating intensified market divergence

- The $76,895 sold by Lo accounts for a minimal proportion of the $2.54 billion market capitalization (approximately 0.003%)

- Selling of this scale is usually part of normal personal financial planning, such as asset allocation, tax planning, or liquidity needs

- It is unrelated to the company’s major strategic decisions

- During the same period, another executive Sharon Benzeno still held 296,791 shares worth approximately $5 million after selling, indicating that she still maintains a large number of company shares [1]

- Adequate Liquidity: Current ratio of 3.38 and quick ratio of 3.26, indicating strong short-term solvency

- Low Debt Risk: Financial analysis shows a debt risk rating of “low_risk”

- Conservative Accounting: The company adopts conservative accounting policies with high financial transparency

- Sustained Losses: EPS of -0.52, net profit margin of -31.50%, operating margin of -30.93%

- Cash Flow Pressure: Free cash flow of -$98.876 million

- High Valuation Risk: Negative P/E ratio, P/B ratio of 12.41x, P/S ratio of 10.05x, indicating high valuation

- Two non-exclusive licensing agreementsfocusing on T-cell receptor discovery for rheumatoid arthritis

- TCR-antigen dataset licensingfor AI-driven drug research

- Potential milestone paymentsup to $890 million

- This collaboration may bring significant cash flow and revenue growth to the company

- The clonoSEQ test was featured in 90 abstracts at the ASH Annual Meeting

- Phase III AURIGA data shows that deep and sustained MRD negativity is associated with improved progression-free survival

- MRD-guided treatment decisions are expanding in the treatment of hematological cancers

- Target Price: $20.00 (representing a +20.1% upside from the current price)

- Rating Distribution:

- Buy: 11 analysts (64.7%)

- Hold:4 analysts (23.5%)

- Sell:2 analysts (11.8%)

- Morgan Stanley (November 11): Maintained “Equal Weight” rating

- BTIG (November6, October22): Maintained “Buy” rating

- JP Morgan (November6): Maintained “Overweight” rating

- Piper Sandler (October15): Maintained “Overweight” rating

- Analysts believe that 2026 is a “year of durability testing, not a hype cycle year” [1]

- Focus on whether the company can translate its technical advantages into sustainable commercial success

- The Pfizer collaboration provides new opportunities for business diversification and revenue growth

###5. Comprehensive Assessment of Investment Value

| Impact Factor | Weight | Impact Level | Explanation |

|---|---|---|---|

| Selling Scale | ⭐ | Low | The selling amount accounts for a minimal proportion of the market capitalization, and it is a personal behavior |

| Market Sentiment | ⭐⭐⭐ | Short-to-Medium Term | Already reflected in early December, with a 24.5% drop in stock price |

| Fundamental Changes | ⭐⭐⭐⭐ | Critical | No substantial changes; the Pfizer collaboration has instead enhanced prospects |

| Valuation Level | ⭐⭐⭐⭐⭐ | High | With a 170% year-to-date gain, the valuation is at a high level |

| Technical Aspects | ⭐⭐ | Short-to-Medium Term | Sideways consolidation, waiting for direction |

- Risk: High

- Technical indicators show sideways consolidation with unclear direction [0]

- Valuation is at a historical high with significant pullback pressure

- The negative impact of executive selling has not yet fully dissipated

- Opportunity: Exists

- The Pfizer collaboration may start generating milestone payments in 2026 [1]

- clonoSEQ business continues to grow, and MRD applications are expanding

- Analysts’ target price of $20 implies a 20% upside [0]

- Potential: Depends on Commercialization Progress

- The technology platform has been validated by major pharmaceutical companies like Pfizer

- Whether to translate technical advantages into sustained profitability is key

- Need to focus on cash flow improvement and profitability timeline

###6. Investment Recommendations

- Recommendation: Cautious Wait-and-See

- Reasons: High valuation, sustained losses, sideways consolidation in technical aspects

- Key Levels to Watch: Wait for a pullback below the support level of $16.20 or a breakout above the resistance level of $17.10 before making a decision

- Recommendation: Moderate Participation, Phased Position Building

- Reasons: Pfizer collaboration provides long-term support, and analysts are generally optimistic

- Strategy: Initial position should not exceed 2-3% of the portfolio, set a stop-loss at $15.50

- Recommendation: Focus on Catalysts, Seize Opportunities to Enter

- Reasons: Leader in the life science sector with a highly unique technology platform

- Focus: Pfizer collaboration progress in 2026, clonoSEQ business growth data

- Valuation Risk: With a 170% year-to-date gain, there is a risk of valuation reversion

- Profitability Risk: Has not yet achieved profitability, with a high cash burn rate

- Stock Price Volatility: Beta value of 2.2, which is more than twice the market volatility [0]

- Industry Risk: The biotech industry is greatly affected by policies and R&D progress

- Financial Indicators: Quarterly revenue growth rate, cash burn rate, profitability timeline

- Business Progress: Triggering status of milestone payments from the Pfizer collaboration

- Technical Breakthroughs: Expansion of new indications for clonoSEQ

- Insider Transactions: Continuously monitor executive buying and selling behaviors

###7. Conclusion

- Short-term sentiment impact has been reflected: The 24.5% drop in early December has fully absorbed the negative impact of executive selling [1]

- Limited selling scale: The $77,000 selling amount is negligible compared to the $2.5 billion market capitalization and should not be overinterpreted

- Fundamentals remain unchanged or even improved: The Pfizer collaboration (potential $890 million) provides new growth momentum [1]

- Valuation is the core contradiction: The real issue is the high valuation after a 170% year-to-date gain, not the executive selling itself

[0] Gilin API Data

[1] Yahoo Finance - “Adaptive Biotechnologies (ADPT) Falls 24.5% as Execs Dispose Millions of Stake” (https://finance.yahoo.com/news/adaptive-biotechnologies-adpt-falls-24-071614908.html)

[2] Yahoo Finance - “How Investors Are Reacting To Adaptive Biotechnologies (ADPT) clonoSEQ Data” (https://finance.yahoo.com/news/investors-reacting-adaptive-biotechnologies-adpt-110750627.html)

[3] GlobeNewswire - “Adaptive Biotechnologies Announces Two Immune Receptor Licensing Agreements with Pfizer” (https://www.globenewswire.com/en/news-release/2025/12/15/3205383/0/en/Adaptive-Biotechnologies-Announces-Two-Immune-Receptor-Licensing-Agreements-with-Pfizer.html)

[4] Seeking Alpha - “Adaptive Biotechnologies: 2026 Is The Durability Test, Not The Hype Cycle” (https://seekingalpha.com/article/4855867-adaptive-biotechnologies-2026-is-the-durability-test-not-the-hype-cycle)

[5] GuruFocus - “Adaptive Biotechnologies (ADPT) Leads Life Sciences Sector with 183.57% YTD Gain” (https://www.gurufocus.com/news/4086298-adaptive-biotechnologies-adpt-leads-life-sciences-sector-with-18357-ytd-growth)

[6] InsiderTrades - “Insider Selling: Adaptive Biotechnologies (NASDAQ:ADPT) Insider Sells $212,377.40 in Stock” (https://www.insidertrades.com/alerts/nasdaq-adpt-insider-buying-and-selling-2025-12-09/)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.