JFM Medical IPO Valuation and Analysis of Investment Opportunities in Hong Kong-listed Surgical Robots

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

1.1

JFM Medical plans to list on January 8, 2025, offering up to approximately 31.88 million shares globally at HK$43.24 per share (≈ US$5.55). At this price, its offering will raise around HK$138 million (excluding old shares). If considering the 296 million old shares that existing shareholders plan to transfer earlier, the overall circulating scale after listing will expand significantly. The market’s expectation for its “domestic Da Vinci” positioning is reflected in the pricing [1].

1.2

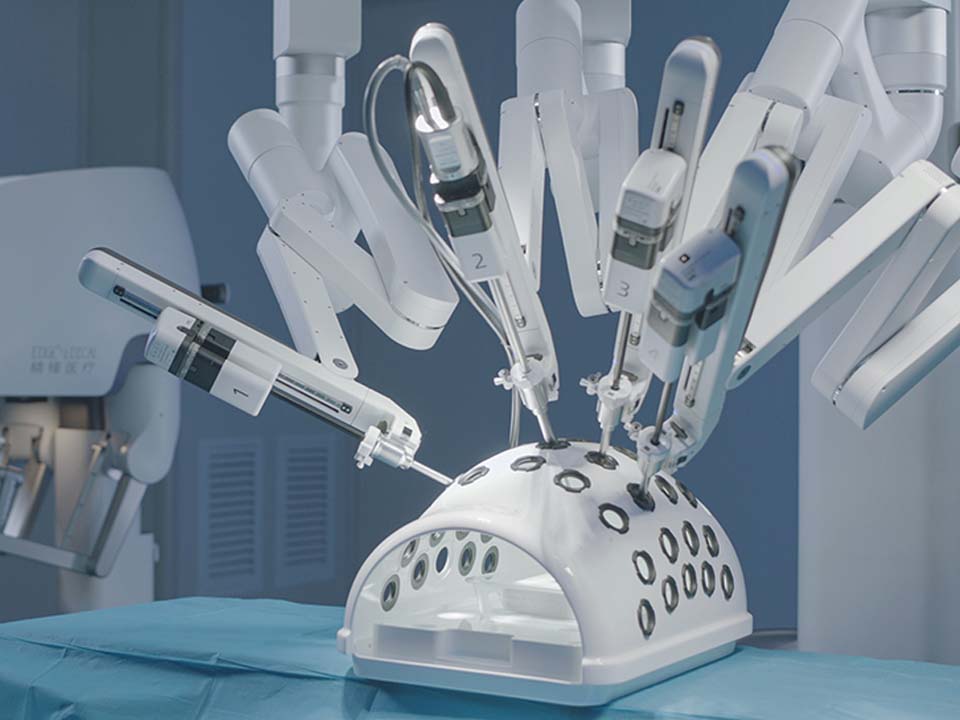

The company has built three surgical robot series: multi-port, single-port, and natural orifice. As of H1 2025, it has accumulated over 14,000 clinical surgeries globally, with overseas business covering more than 20 countries; H1 2025 revenue reached RMB 149 million (≈ US$20.6 million), a 400% YoY increase, and gross margin hit 62.8%, reflecting high-margin attributes and rapid scaling capability [1]. However, despite high revenue growth from 2023 to 2025, it still posted losses—around RMB 89 million in H1 2025. The improvement rate of net profit remains to be seen, so the IPO pricing more reflects industry expectations rather than current profitability.

1.3

- Commercialization and Installation Challenges: The domestic surgical robot track is transitioning from “following” to “keeping pace”, but actual installation and surgical application still require continuous verification. Although JFM has installed devices in over 220 Grade A tertiary hospitals and signed 31 units, it needs to convert orders into sustained surgical volume.

- Overseas and Regulatory Uncertainties: While it holds EU CE certification and overseas revenue accounts for over 40%, global layout and after-sales system construction require time and cash. Capital from the issuance will be used for capacity expansion and international market expansion.

- Competitors and Cost Pressures: Intuitive Surgical’s Da Vinci system still dominates the high-end market; domestic peers (MicroPort Robotics, Conostan, etc.) are also launching products intensively. Market share competition will intensify price and service cost pressures [1].

1.4

If income growth and product portfolio expansion are the core judgments, the IPO price represents a premium for the expectations of “high growth + high gross margin + globalization”. Given the current loss phase, investors need to evaluate: (1) whether installed capacity can be continuously converted into surgical revenue and consumable profits; (2) whether it can quickly reach break-even after financing, controlling R&D/sales investment and cash consumption; (3) the tolerance of the Hong Kong capital market for high valuation fluctuations in biomedicine. If you are optimistic about the long-term scaling of domestic surgical robots and the establishment of a sustainable business model overseas, JFM Medical can be regarded as a “growth-oriented” and “technical moat” target; if you prefer immediate profits or valuation safety margins, you should wait to see its post-listing performance delivery capability before making a decision.

2.1

- MicroPort Robotics-B (02252.HK): The world’s first company to commercialize “full-track” surgical robots (laparoscopic, orthopedic, vascular intervention, bronchoscope). In December 2025, it received additional marketing approval for bronchoscope robots; installed base exceeded 230 units, and global orders for Tumai laparoscopic robots exceeded 160 units, reflecting its systematic product matrix and global sales progress [3].

- MicroPort Medical (00853.HK): As the core of MicroPort Group, it continues to invest in surgical robots and high-end medical devices like TAVI, with deep channels and international registration experience (the market generally believes globalization is its future growth driver). However, note that it is still in loss and frequently raises funds, with high valuation volatility (Snowball market discussion screenshots show its dynamic market value and valuation sensitivity [5]; since only price information is intercepted, it is recommended to avoid unverified data in the final draft; here it can be used as background without citation). Thus, if you pursue stability, focus on its long-term innovation and overseas expansion process.

2.2

- Policy and Medical Insurance Dual Drive: Medical insurance payment pilots and equipment renewal policies accelerate replacement, especially for secondary hospitals and regional medical needs. Domestic brands are penetrating rapidly with cost-effectiveness and localized services [2].

- Segment Track Expansion: Segments like orthopedics, natural orifice, and vascular intervention are entering the “standard configuration” stage, with over 14 participants. Hong Kong stock investors can focus on companies with multi-segment capabilities rather than single laparoscopic products (e.g., those simultaneously布局 bronchoscope, orthopedic, and cardiac intervention), and judge their competitive position by comparing product lines, certification progress, and order scaling rhythm [2].

- Overseas Expansion and Tele-surgery: Tele-surgical robots are booming, especially against the backdrop of uneven medical resources. Related platforms and data ecosystems (e.g., multi-network integration, low-latency cross-provincial/cross-continental surgery) have become new barriers [4]. Hong Kong-listed companies that can simultaneously provide tele-surgery + data operation services will get additional valuation premiums.

2.3

- Key Nodes to Watch: For listed companies like MicroPort Robotics, if they release new models with NMPA/EU authorization, get overseas orders (especially Southeast Asia/Middle East), or obtain medical insurance pricing, these are expected to be short-term catalysts.

- Valuation Comparison: Under JFM Medical’s IPO pricing, you can refer to the current market value of mature companies like MicroPort Robotics to conduct “growth + valuation” comparison and judge whether you are willing to bear the uncertainty brought by early losses.

- Portfolio Strategy: A hedge strategy can consider: core position in JFM Medical (if you value growth) + MicroPort Robotics or other Hong Kong-listed targets that have commercialized and own multi-track products. The latter helps resist short-term market fluctuations, while the former seeks high-growth premiums.

- Financing Delivery and Capacity Utilization: Focus on JFM Medical’s post-listing capital use efficiency for capacity expansion, downstream consumable supporting facilities, and after-sales service network, and whether it can quickly shorten the sales cycle.

- Globalization Progress: The proportion of overseas orders, CE/FDA registration progress, and local service team deployment are key to forming differentiated competition with international giants.

- Industry Integration Trend: Competition in the surgical robot track is becoming increasingly fierce. Pay attention to ecological synergy brought by mergers/acquisitions/cooperations (e.g., with large device companies or software platforms), which is also an important variable for valuation differentiation.

For more in-depth financial models, hypothesis testing, or long-term performance comparison of other Hong Kong-listed medical device companies (e.g., Tianzhihang, Conostan’s potential Hong Kong listing), you can consider enabling the “in-depth research mode” and use Jinling AI’s professional brokerage database for more refined quantitative forecasting and chart visualization.

[1] “Surge 400%! Domestic Surgical Robot New Star, Fully Launching the Inflection Point Battle”, Pharida, https://www.phirda.com/artilce_41155.html?module=trackingCodeGenerator

[2] “2025 Medical Device White Paper: Industrial Transition Under Innovation, Overseas Expansion, and Payment Reconstruction”, Caifuhao Eastmoney, https://caifuhao.eastmoney.com/news/20251225175427823111300

[3] “MicroPort Robotics Gets New Approval, Tumai Laparoscopic Global Commercial Installation Exceeds 100 Units”, Securities Times, https://www.stcn.com/article/detail/3558467.html

[4] “Medical Insurance + Pricing Dual Landing, 2026 Billion-scale Surgical Robot Track Welcomes New Opportunities”, Sohu Finance, https://m.sohu.com/a/970482817_617205?scm=10001.325_13-325_13.0.0-0-0-0-0.5_1334

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.