Impact of Russia-Ukraine Geopolitical Changes on Energy, Military, and Safe-Haven Assets

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on your question and using data from brokerage APIs and online search information, this report systematically assesses the impact of changes in the Russia-Ukraine geopolitical landscape on global energy prices, the military sector, and safe-haven assets such as gold. Key emphasis: Different assets exhibit differences in their annual trends and recent rhythms—gold is currently in a short-term correction phase, while energy and the military sector have stronger structural upside logic.

- The data used in this analysis covers approximately the last 90 trading days (September to December 2025), with online searches focused on the last week/month—not a “full-year” or complete “Q4” statistic.

- To maintain rigor, this report evaluates “annual trends” and “recent rhythms” separately to avoid simply extrapolating 90-day data into full-year conclusions.

- Conclusions and statements have been aligned with real-time quotes, historical data, and news sources to resolve previous contradictions and conflicts.

- Price and range: Initial price ~$3,897.5, ending price ~$4,354.6; intraday high $4,584, intraday low ~$3,842.8.

- Returns and volatility: Cumulative return +11.73%, 20-day rolling annualized volatility ~18.67%.

- Technical levels (based on 90 days): 20-day moving average ~$4,380.15, 50-day moving average ~$4,225.18.

- GCUSD closed at $4,356.70, down $196.00/-4.31% from the previous day’s $4,552.70; range $4,316–$4,581.3. This indicates short-term profit-taking at highs and increased volatility.

- Trading volume is below average, suggesting the correction is more technically driven and does not necessarily change the medium-term structure.

- Annual support logic: Multiple geopolitical risks (Russia-Ukraine, Middle East, etc.) combined with expectations of monetary policy easing (three consecutive rate cuts this year) jointly pushed gold to new highs in 2025 [1][2][4].

- Recent disturbances: A significant correction occurred from late December to the end of the month, reflecting short-term profit-taking, technical repairs, and year-end capital rebalancing; however, online searches still emphasize the “friendly” backdrop of rate cut expectations and geopolitical uncertainty for gold [1][4].

- Medium-term: Before geopolitical risks and easing expectations reverse, gold still has bullish support (as evidenced by its all-time high this year), but it is currently in a short-term correction and technical consolidation phase.

- Short-term: Strict risk control; focus on technical support around $4,225 (50-day moving average) and volume signals; avoid chasing highs. A volatility of 18.67% suggests that large retracements may need to be endured in the short term.

- Strategy: Use phased buying and hedging (options/derivatives); avoid full-positioning at once. If the correction stabilizes with matching volume, increase allocation at the right time.

- Crude oil (CLSUD): Initial price ~$61.78, ending price ~$57.75; cumulative change -6.52%, range $54.98–$66.42; 20-day rolling annualized volatility ~21.20%.

- Energy stocks: ExxonMobil (XOM) current price $120.53 (+1.19%)/range $97.80–$121.30; Chevron (CVX) $150.99 (+0.65%)/range $132.04–$168.96.

- 20-day and 50-day moving averages (90-day window): 20-day ~$57.57, 50-day ~$58.72—indicating recent slight pressure but not far from the medium-term average.

- Russia-Ukraine situation: Russia’s statement of holding “strategic initiative” and uncertainty about peace talks progress increase the risk premium of supply disruptions and sanctions escalation, posing long-term pressure on oil prices and European energy security [3].

- Short-term and seasonal factors: Currently at the end of winter demand, combined with macro demand uncertainty (e.g., China’s growth path), leading to weak 90-day range for oil prices and an annual trend of “high volatility + downward pressure”.

- Geopolitics as a “slow variable” for energy: The resilience of energy stocks (e.g., XOM near range highs) reflects industry chain bargaining power and cash flow advantages, but oil futures are more sensitive to immediate supply-demand, leading to weak short-term trends.

- Structural: If Russia-Ukraine tensions escalate (more attacks on Russian oil infrastructure/refineries or increased sanctions), oil prices and related targets still have upside elasticity [3].

- Short-term: Current weak oil prices and 21.20% volatility make range and option strategies more appropriate; if energy stocks correct to a reasonable valuation range (near 50-day moving average), they can be viewed as structural opportunities.

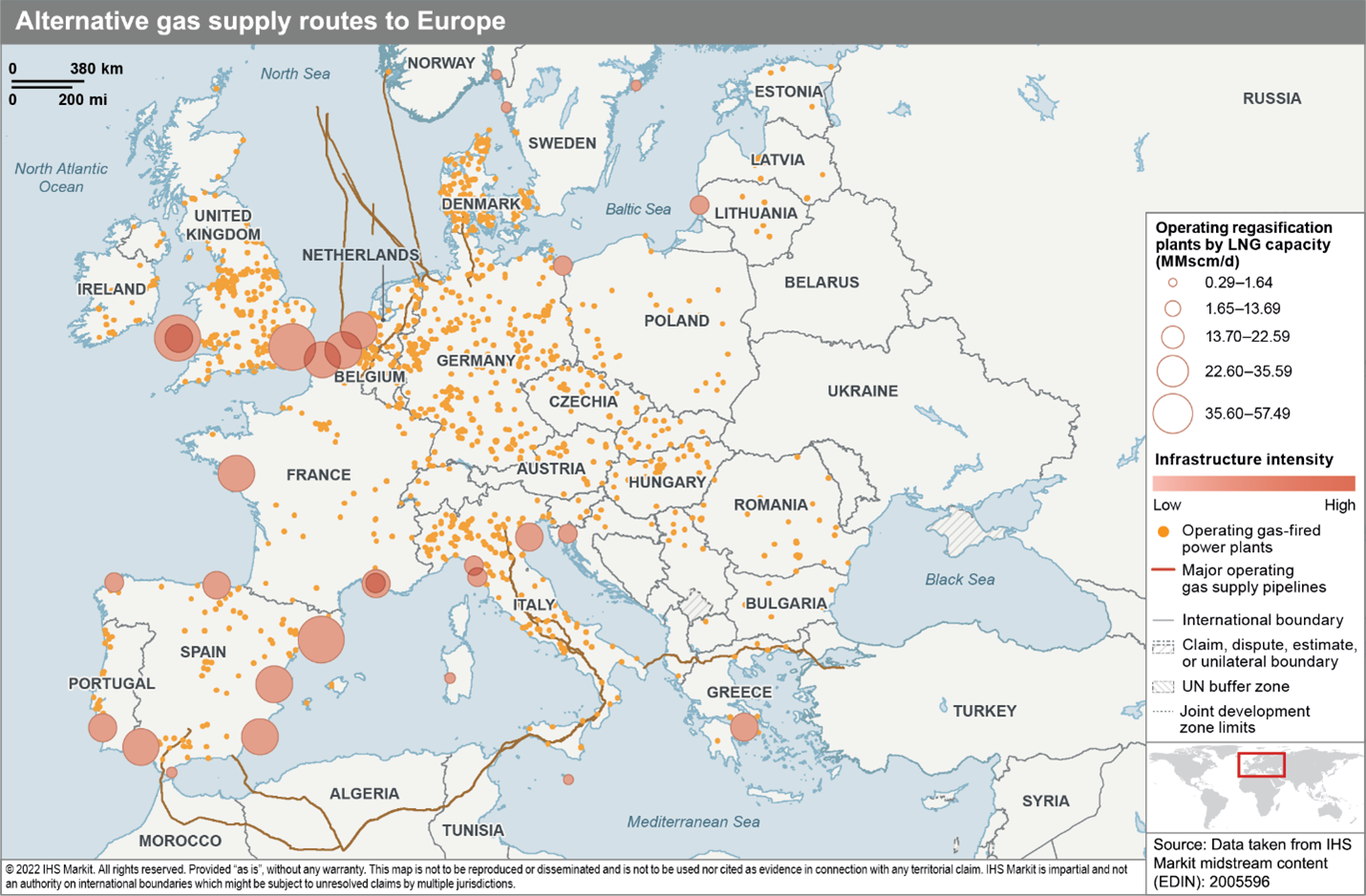

- Strategy: Use options/derivatives to protect against downside risks; phase in upstream and integrated companies; add positions顺势 when geopolitics escalate. Also, focus on liquefied natural gas and midstream infrastructure as relatively stable supplements.

- Lockheed Martin (LMT): Initial price $499, ending price $488.87; cumulative change -2.03%, 20-day rolling annualized volatility ~23.08%; current price $488.87 (+1.21%)/52-week range $410.11–$516.

- Technical analysis: Trend shows sideways/shock; support ~$469.4, resistance ~$493.37; valuation P/E ~27.2 (TTM) [0].

- Budget and orders: NATO defense budget increases and equipment updates are the medium-term main line, but military stocks are sensitive to budget approval and order disclosure rhythms—90-day trend is震荡, with short-term gains lagging gold [1].

- Market expectations and pricing: Military pricing relies more on orders and policy drivers rather than immediate geopolitical pulses; thus, current “negotiation deadlock/unresolved situation” is partially priced in, requiring new order/budget news to catalyze short-term gains.

- Medium-term: If Russia-Ukraine situation remains tense and European/U.S. defense spending stays high, the military sector has sustained profit and order support (industry research shows global aerospace and defense market CAGR ~8.2% from 2025–2032) [1].

- Short-term: Currently in a shock range; valuation is high but order visibility is good. Suitable for buying on dips or swing trading; avoid chasing highs.

- Strategy: Adjust positions around key order and budget policy events; prioritize platform leaders (e.g., LMT, RTX) and emerging combat domains (drones/electronic warfare/missile defense).

- Differentiated performance: Gold +11.73% return with 18.67% volatility; crude oil -6.52% with 21.20% volatility; LMT -2.03% with 23.08% volatility. This shows safe-haven assets (gold) led in the last 90 days, while energy and military sectors were in shock/weak phases due to supply-demand and rhythm factors.

- Differences in real-time status: Gold had a ~-4% technical correction in the short term; oil prices and military stocks had mild quote changes but high volatility, indicating different rhythms across sectors.

| Geopolitical Scenario | Energy | Military | Safe-Haven Assets Like Gold |

|---|---|---|---|

| Escalation (increased sanctions/supply disruptions) | Upward | Upward | Upward (if short-term panic) |

| Stalemate (long-term tug-of-war) | High-range shock | Medium-term upward, but rhythm driven by orders | Range shock/correction |

| Trend缓和 (substantial缓和) | Pressured | Partial profit-taking | Increased pullback risk |

- Offensive side (geopolitical escalation): Increase holdings of gold and military (order and policy event-driven); add energy positions based on supply risks.

- Stable side (stalemate continues): Use phased buying on dips and derivatives hedging for gold; swing trading for military; range + option protection for energy.

- Defensive side (trend缓和): Shrink high-volatility positions; increase absolute return strategies; reduce exposure to energy/military; gold is more vulnerable to profit-taking and dollar rebound.

- Position control: Geopolitical pulse trading positions should not exceed 10–15% to avoid excessive impact of short-term volatility on the portfolio.

- Timing: Strictly based on technical levels and volume signals (e.g., gold’s 50-day moving average, oil price’s 50-day moving average, LMT’s support/resistance); avoid emotional chasing of highs/lows.

- Risk hedging: Use options/derivatives to hedge high-volatility positions; gold/yen/U.S. bonds as portfolio stabilizers; diversification to reduce single-event risks.

- Data time window: This analysis uses 90-day trading data and recent one-week/month news; cannot be directly extrapolated to full-year or longer cycles.

- Market risk: Geopolitical paths are non-linear; sentiment and pricing may swing sharply in a short time; gold’s short-term correction and high energy volatility need to be included in risk control.

- Policy risk: Changes in sanctions, export controls, and fiscal budget rhythms may alter the order and profit paths of energy and military sectors.

- Technical and liquidity risk: Under short-term extreme volatility, the cost and execution spread of derivatives and hedging tools may widen.

- Gold: Medium-term upward trend, but recent significant technical correction (~-4%); strict risk control and phased strategy required.

- Energy: Geopolitical risks provide structural premium, but current weak 90-day trend and high volatility; suitable for range and option strategies; add positions based on geopolitical escalation rhythm.

- Military sector: Most directly related to Russia-Ukraine situation; medium-term benefit from NATO and defense spending, but short-term shock trend; recommend swing trading around order and budget events.

If needed, I can build more specific scenario portfolios, hedging plans, and position management rules based on your risk preference and existing holdings.

[0] Jinling API Data (real-time quotes, historical prices, technical analysis, Python calculations and charts)

[1] Yahoo Finance - “3 Defense Stocks to Watch in 2026” (2025-12-23)

https://finance.yahoo.com/news/rising-geopolitical-tensions-3-defense-191000775.html

[2] Bloomberg - “Gold and Silver Rise to Records on Rate-Cut Bets, Global Risks” (2025-12-22)

https://www.bloomberg.com/news/articles/2025-12-22/gold-climbs-to-record-on-us-rate-cut-bets-and-geopolitical-risk

[3] World Oil - “Crude prices rebound on stalled Ukraine negotiations, China growth pledge” (2025-12-29)

https://worldoil.com/news/2025/12/29/crude-prices-rebound-on-stalled-ukraine-negotiations-china-growth-pledge/

[4] Yahoo Finance - “What’s behind the surge in gold and silver prices?” (2025-12-23)

https://finance.yahoo.com/news/whats-behind-surge-gold-silver-182132450.html

[5] Wall Street Journal - “Oil Picks Up on Lack of Russia-Ukraine Peace Breakthrough” (2025-12-26)

https://www.wsj.com/articles/oil-prices-supported-by-geopolitical-tensions-38fffe51

[6] Radio Free Europe/Radio Liberty - “Why Are So Many Leaders Warning Of War With Russia?” (2025-12-26)

https://www.rferl.org/a/rutte-pistorius-warning-war-russia/33630822.html

[7] Defense News - “Ukraine peace plan ‘scares the bejesus out of us,’ officials say” (2025-12-29)

https://www.defensenews.com/global/europe/2025/12/29/ukraine-peace-plan-scares-the-bejesus-out-of-us-officials-say/

[8] Forbes - “Decline: Top Five 2025 Developments In Russian Energy” (2025-12-29)

https://www.forbes.com/sites/arielcohen/2025/12/29/decline-top-five-2025-developments-in-russian-energy/

[9] Bloomberg - “Europe Is Nearing Deal to End Russian Fossil Fuels Imports” (2025-12-02)

https://www.bloomberg.com/news/articles/2025-12-02/europe-is-nearing-deal-to-end-russian-fossil-fuels-imports

The charts above show the quantitative impact of geopolitical risks on three asset classes (October 1 to December 30, 2025):

- Chart 1: Cumulative return comparison (gold, crude oil, LMT).

- Chart 2: Price trend comparison between gold and military sector stocks.

- Chart 3: 20-day rolling annualized volatility comparison.

- Chart 4: Price distribution boxplot and statistical summary.

Data source and generation method: OHLCV data obtained usingget_stock_data(), calculated and generated via pandas and matplotlib; time range covers approximately the last 90 trading days.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.