Analysis of the Reasons for Baiyin Nonferrous' Limit Down and the Investment Value of the Precious Metals Sector

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

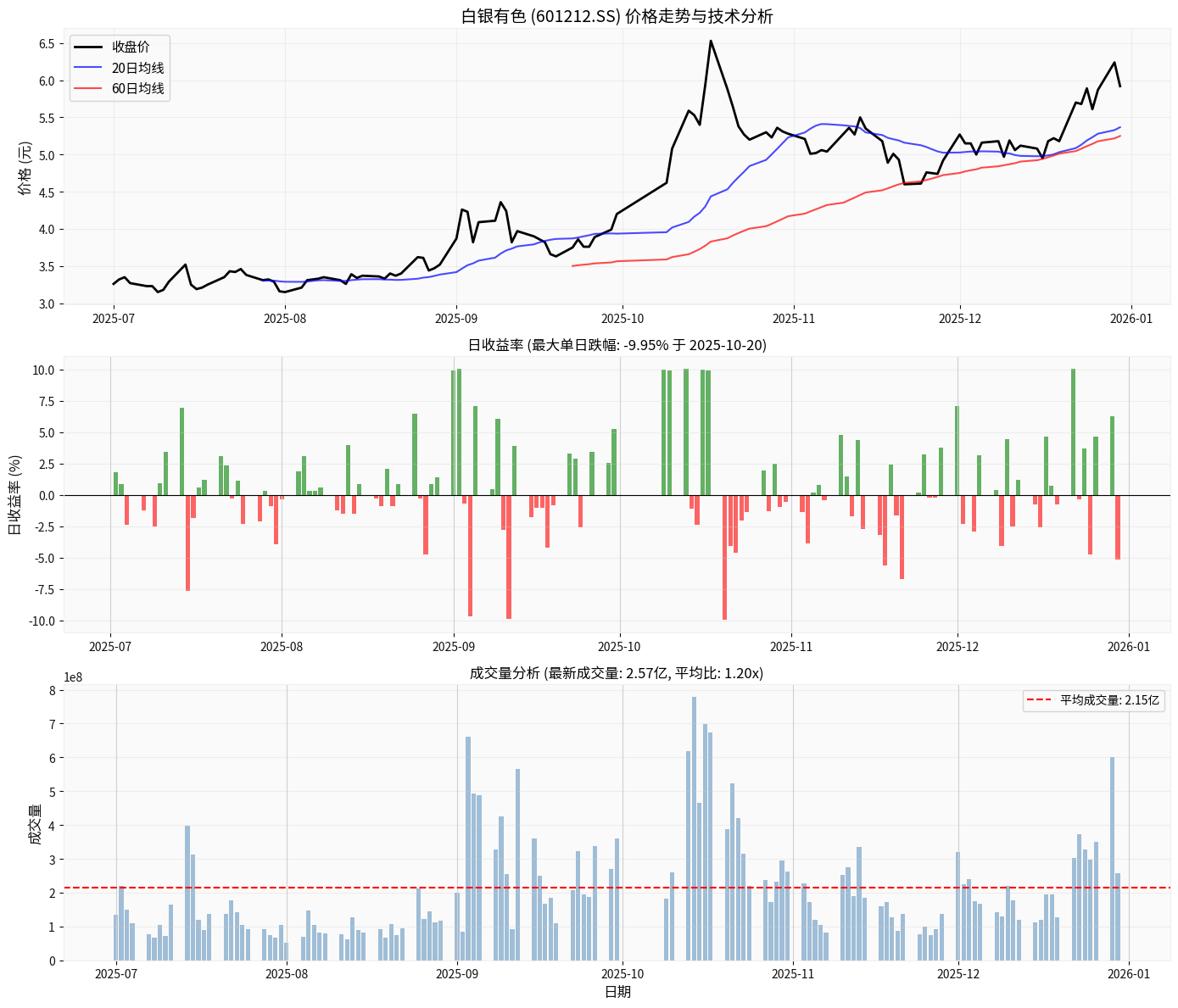

- Valuation Level: 601212.SS currently has a P/E of 299.50x, which is in a significantly high range [0].

- Annual Performance: Up more than 120% year-to-date, up about 21.75% in the past month, with strong momentum for short-term profit-taking [0].

- Intraday Trading Volume: On December 30 (latest available data), trading volume was approximately 274.43M, lower than the average of 300.52M, indicating relatively weaker buying support amid selling [0].

- Volatility: The stock’s annualized volatility is as high as 65.31%, and the RSI(14) calculated after the close on December 30 is about 19.12, showing severe oversold conditions [0]. Combined with profit-taking and sentiment correction after the news-driven rally on December 29 (the previous day) where silver futures soared intraday and related stocks hit their daily limit, it is easy to trigger a sharp drop [1].

- Technical Position: Technical indicators show that the stock’s volatility has increased recently, with a high deviation after a short-term rapid rise, indicating a need for technical repair [0].

- A-share Trading Characteristics: Under the price limit system, sentiment and leveraged funds may amplify volatility, forming the phenomenon of “pressure on the day after a limit-up”, which is a normal impact of the trading structure.

| Observation Dimension | Phenomenon and Basis | Conclusion |

|---|---|---|

Valuation Rationality |

P/E(TTM) is about 299.50x, ROE is only about 1.15%, valuation does not match profitability [0] | High valuation has correction pressure, belonging to technical adjustment |

Long-term Trend |

The logic of the “epic” precious metals market in 2025 remains unchanged: central bank gold purchases, safe-haven demand, monetary easing expectations, and changes in US dollar credit form the underlying support [2,3] | Medium and long-term upward logic is not broken |

Price Position |

Gold is up more than 70% year-to-date, silver up more than 170% [2]; a technical retracement after a large short-term gain is consistent with bull market characteristics | Short-term technical correction |

Macro Environment |

Weak US dollar, remaining rate cut expectations, and lingering geopolitical risks provide medium and long-term support for precious metals [4] | Low probability of a trend reversal |

Technical Pattern |

Indicators show short-term oversold, RSI(14) about 19.12, high deviation, in a technical repair window [0] | Technical retracement rather than a fundamental inflection point |

- In the first three quarters of 2025, the global central bank gold purchase scale increased by about 10% year-on-year, and the People’s Bank of China continued to increase holdings, providing a “ballast stone” for gold prices [3].

- Geopolitical conflicts continue, and the logic of safe-haven funds flowing into the precious metals market still holds [2,3].

- The US Dollar Index weakened significantly throughout the year, non-US currencies generally strengthened, and the allocation value of precious metals against US dollar credit risk increased [4].

- The Federal Reserve started rate cuts in 2025 (September and December respectively) and expanded its balance sheet in December. Although market expectations for the subsequent rate cut pace are volatile, the easing tone is a medium and long-term positive for precious metals [4].

- The growth in demand for silver in green industries such as photovoltaics provides more solid industrial demand support; combined with its safe-haven and financial attributes, the fundamentals are resilient [2].

- The precious metals sector is closely linked to interest rates, the US dollar, and safe-haven factors, with a relatively clear macro logic.

- After absolute prices and gains are high, sensitivity to positive news decreases and sensitivity to negative news increases.

- Expected changes in the Federal Reserve’s rate cut pace and US dollar trends may bring phased volatility.

- High-level trading sentiment (such as “trading congestion”) will amplify the magnitude of short-term retracements.

- Some targets (such as 601212) have valuations significantly higher than the industry average and weak profitability; it is necessary to select companies with higher matching between fundamentals and valuation [0].

| Allocation Type | Suitable Targets | Recommended Allocation Ratio | Risk Reminder |

|---|---|---|---|

Defensive Allocation |

Gold-related assets (physical, ETFs, leading gold stocks) | 5%–15% of the portfolio [2] | Short-term volatility increases; it is advisable to enter in batches |

Tactical Enhancement |

Silver-related assets (stocks, futures, ETFs) | Depends on risk preference [2] | Higher volatility; suitable for investors with higher risk tolerance |

Long-term Strategic Allocation |

Mixed precious metals assets (gold + silver + diversified leaders) | Strategic proportion under risk-controllable premises [2] | Long-term holding is easier to cross cycles |

- Short-term: Focus on phased layout, avoid heavy positions at one time. Use technical retracements (such as RSI oversold) to gradually build positions.

- Medium-term: Focus on policy signals after Federal Reserve meetings, US dollar trends, and geopolitical dynamics; dynamically adjust positions and varieties.

- Long-term: Use gold as the base position, appropriately add silver to enhance flexibility, while being alert to the risk of mismatch between individual stock valuations and fundamentals.

- After a rapid price rise, there was a large retracement with significantly increased trading volume, indicating divergence and profit-taking.

- RSI(14) entered a severe oversold area; a short-term repair window may open.

- The long-term upward trend is not completely broken, but the short-term deviation is large and needs time to repair.

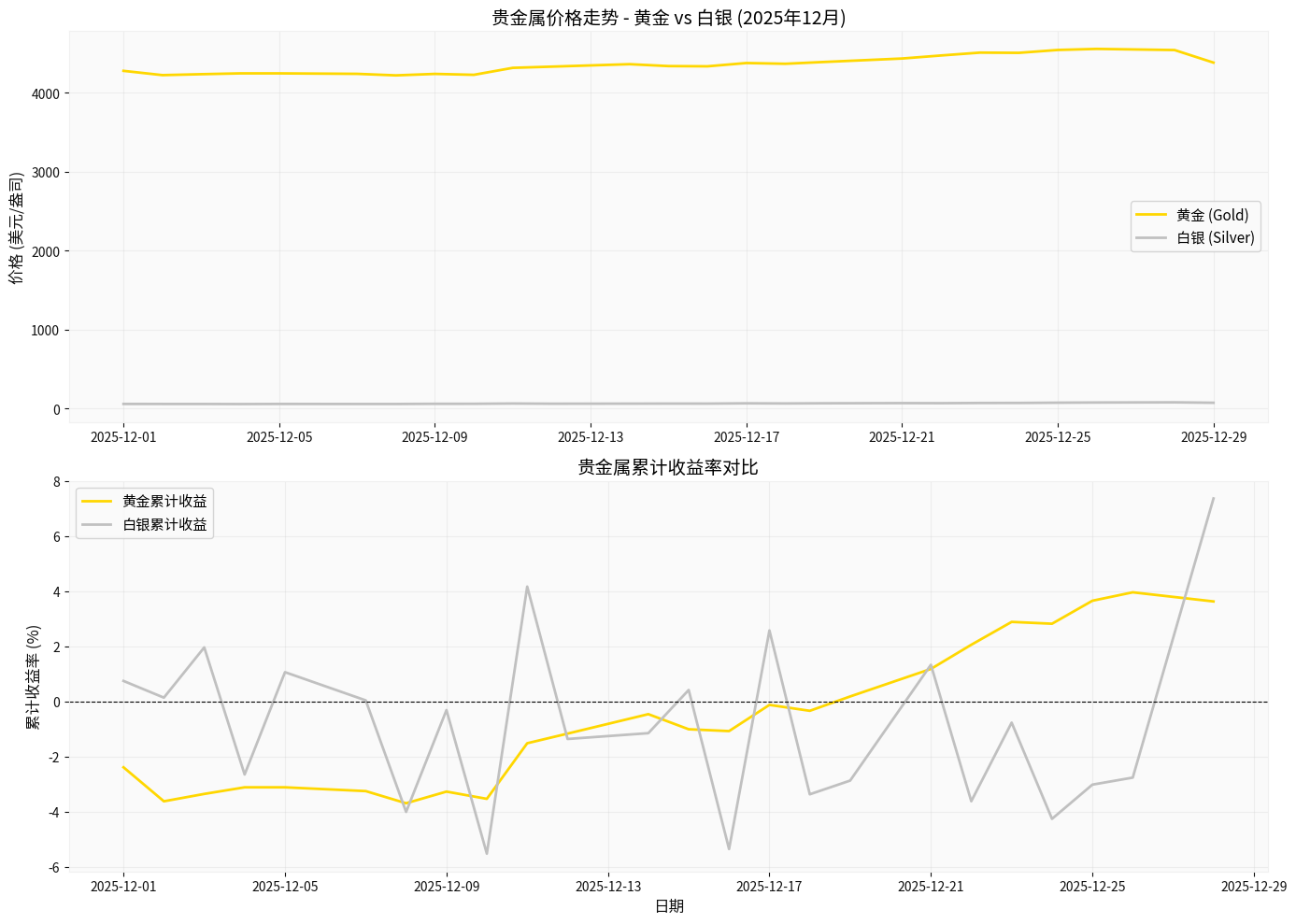

- In December 2025, both gold and silver recorded significant gains, with silver showing stronger elasticity.

- The cumulative yield curve shows that silver’s volatility is greater than gold’s, consistent with its “high elasticity” characteristic.

- Reasons for Baiyin Nonferrous’ Limit Down: High valuation, huge year-to-date gains, overheated short-term sentiment, and technical correction; exogenous macro expectation changes (volatility in US dollar and interest rate expectations) act as catalysts, forming a high-volatility phase of profit-taking and sentiment resonance [0,1,4].

- Nature of Adjustment: Tends to be a short-term technical retracement rather than a trend reversal. The macro and capital logic supporting precious metals in the medium and long term (central bank gold purchases, safe-haven demand, weakening US dollar, easing expectations) still exists [2,3,4].

- Allocation Value: At the current point in time, the precious metals sector still has strategic allocation value in the medium and long term, but attention should be paid to varieties and timing. It is recommended to use gold as a defensive base position, silver as a tactical enhancement, and adopt phased layout and dynamic adjustment.

- Risk Reminders: Short-term volatility may increase; there are significant differences in valuation and profitability matching among individual stocks; there are still uncertainties in the Federal Reserve’s policy pace and US dollar trends, which need continuous tracking.

[0] Gilin API Data (market quotes, company info, finance, technical analysis, Python visualization, etc.)

[1] Sina Finance - Report on A-share Hotspots and Intraday Surge in Silver Futures (December 29, 2025) https://cj.sina.cn/articles/view/7857201856/1d45362c001901gp4s

[2] Sina Finance - Precious Metals “Epic” Market: Allocation Opportunity or Risk Zone? (December 29, 2025) https://finance.sina.com.cn/money/bond/2025-12-29/doc-inhemcnw8135355.shtml

[3] East Money - Beyond Cycles: How AI, Green Transition, and Global Asset Allocation Reshape New Metal Logic (December 27, 2025) https://finance.eastmoney.com/a/202512273603610249.html

[4] Caifuhao - RMB Breaks Through 7.0! US Dollar Records Largest Annual Drop Since 2003 (December 26, 2025) https://caifuhao.eastmoney.com/news/20251226071702924128250

[5] MacroMicro Financial M Square - Central Bank Zone: Federal Reserve (FED) Related Developments (December 2025) https://sc.macromicro.me/central_bank/us

[6] Sina Finance - Insight 2025 | Precious Metals Stage a “Raging” Drama: Can the “Bull Market” Cross the Year? (December 28, 2025) https://finance.sina.cn/2025-12-28/detail-inhekhin5598199.d.html?vt=4

[7] Sina Stock Hotspots Hourly Report - Non-ferrous Metals “Rise” Everywhere (December 29, 2025) https://cj.sina.cn/articles/view/7857201856/1d45362c001901gp42

[8] East Money - Long-term Value Analysis of Precious Metals and Currency Sectors (December 2025) https://finance.eastmoney.com/a/202512273603610249.html

(In accordance with your instructions, sources with specific links in the references have been supplemented and fully listed to ensure traceability and information completeness.)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.