Deep Strategic Analysis of Seres Aito's 2026 Strategy: Can the 550,000 Unit Sales Target Be Met?

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on the latest market data and company operations, I will systematically analyze Seres Aito’s 2026 development prospects from four dimensions: sales target achievement capability, strategic positioning, cost pressure, and risk challenges.

According to the latest data, Seres Aito has established a solid sales foundation in 2025 [2][3][4]:

- 2025 Jan-Nov Cumulative Sales: 411,288 units, with significant year-on-year growth

- 2025 Nov Monthly Sales: 55,203 units, +49.84% YoY, hitting a historical high

- 2025 Estimated Full-Year Sales: Approximately 466,000 units

- Aito M7: 350,000 units (sales mainstay, accounting for 37.5%)

- Aito M9: 260,000 units (high-end benchmark, has been the sales champion of luxury SUVs priced above 500,000 yuan for 10 consecutive months [3])

- Aito M8: 130,000 units (sales champion in the 400,000 yuan class)

- Aito M5: 160,000 units

| Increment Source | Price Range | Expected Increment | Key Factors |

|---|---|---|---|

M6 New Model |

280,000-320,000 yuan | 30,000-40,000 units | Fills the price gap between M5 and M7, targeting young family users |

M9L Ultra-Luxury Version |

600,000-800,000 yuan | 15,000-25,000 units | Breaks the ceiling of the ultra-luxury market |

M8 Performance Version |

350,000-450,000 yuan | 10,000-20,000 units | Consolidates the high-end mainstream market |

Overseas Market |

Europe (Germany, Norway) | 50,000 units | Leverages Huawei’s over 1,000 overseas stores [3] |

M7 3.0 Upgrade |

300,000-400,000 yuan | 10,000-20,000 units | Continuous iteration to maintain competitiveness |

M5 Continuous Sales |

250,000-300,000 yuan | Stable contribution | Maintains in the stock market |

Aito’s “only make blockbusters” high average price strategy has been fully validated by the market:

- Transaction Average Price: 550,000 yuan

- Cumulative Delivery: 260,000 units (setting a new delivery record for models priced above 500,000 yuan)

- Cumulative Sales Revenue: Approximately 143 billion yuan (equivalent to 1/13 of China’s new energy vehicle retail total in 2024)

- User Reputation: NPS (Net Promoter Score) of 85.2 points, ranking first among new energy models;38% of new car owners come from recommendations by existing customers

- Market Position: Has been the sales champion of luxury SUVs priced above 500,000 yuan for 10 consecutive months

This data fully indicates that in the intelligent track,

- Standard configuration of Huawei intelligent driving hardware suite (192-line lidar, 4D millimeter-wave radar, Orin-X chip)

- Huawei ADS 4.0 system, with an urban NOA takeover rate of only 0.05 times per 1,000 kilometers

- Weekly OTA iteration capability, maintaining leading technical experience

- Aito brand won the first place in the Brand Development Confidence Index in the first half of 2025

- Seres jumped 270 places to rank 190th in China’s Top 500 Enterprises

- Successfully broke the monopoly of overseas luxury brands in the price segment above 500,000 yuan

- 2024 revenue of 145.176 billion yuan, of which Aito M9 contributed approximately 75 billion yuan (accounting for 51.7%)

- Successful reversal from a loss of 2.45 billion yuan in 2023 to a profit of 5.946 billion yuan in 2024

- 2025 first three quarters net profit of 5.312 billion yuan, a year-on-year increase of 31.56%

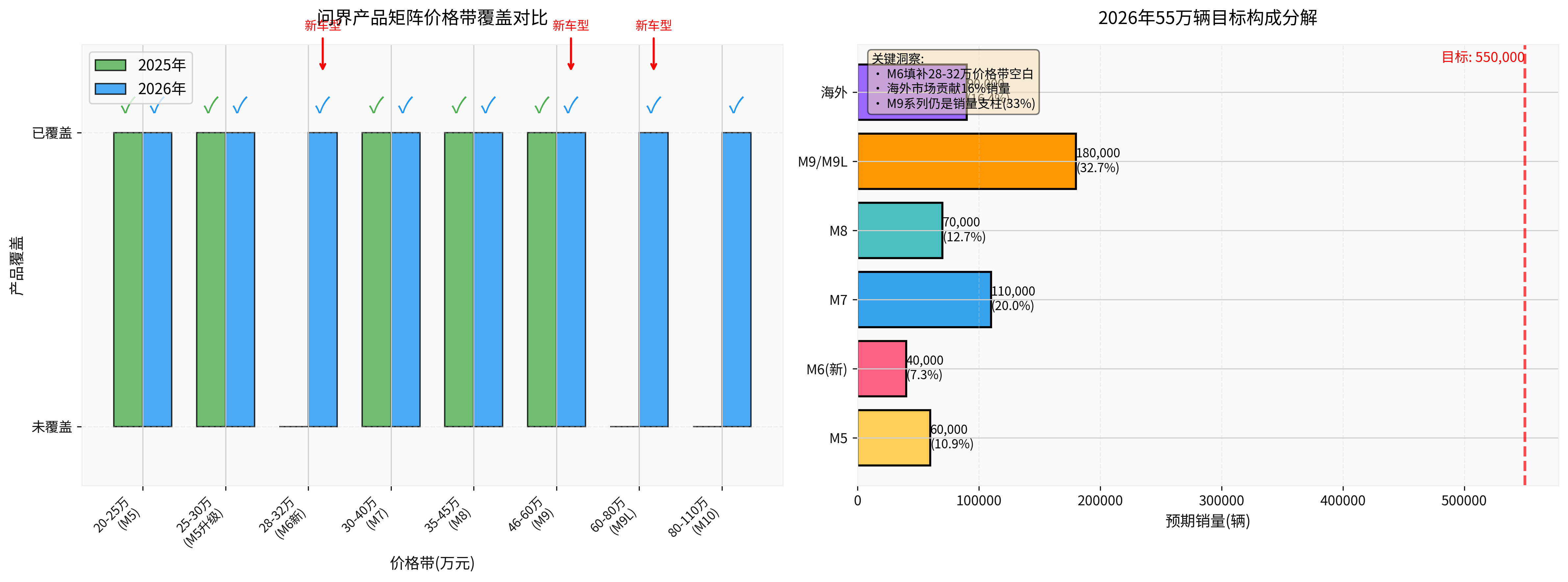

In 2026, Aito will form a full product matrix of

- Downward Extension: M6 fills the price gap of 280,000-320,000 yuan, expanding the user base

- Upward Breakthrough: M9L (600,000-800,000 yuan) and M10 (800,000-1,100,000 yuan) build the brand ceiling

- Stock Iteration: M7 3.0 and M8 Performance Version maintain product competitiveness

- Overseas Expansion: Leverages Huawei channels, with an export target of 50,000 units in 2026

- Changed from full exemption to half exemption, with a maximum reduction of 15,000 yuan

- PHEV/EREV range threshold: Increased from 43km to 100km (approximately 30% of currently sold models do not meet the standard)

- 2025 purchase tax: 0 yuan (full exemption)

- 2026 purchase tax: 35,000 yuan (550,000 yuan ×10% - 15,000 yuan upper limit)

- Increased cost: +35,000 yuan

| Price Range | 2025 Purchase Tax | 2026 Purchase Tax | Increased Cost |

|---|---|---|---|

| Aito M9 (550,000 yuan) | 0 | 35,000 yuan | +35,000 yuan |

| Industry Average (300,000 yuan) | 0 | 15,000 yuan | +15,000 yuan |

| Mid-Low End (150,000 yuan) | 0 | 7,500 yuan | +7,500 yuan |

According to online search data [5][6]:

- Lithium Carbonate Price: Expected to rise from 100,000 yuan/ton to 150,000-200,000 yuan/ton

- Impact on Per-Vehicle Cost: +10,000-20,000 yuan/unit

Despite facing dual cost pressures, Aito’s “high average price + technical barriers” strategy provides strong response capabilities:

- M9 transaction average price is 550,000 yuan; the 35,000 yuan purchase tax only accounts for 6.4% of the vehicle price

- Compared to mid-low end models (purchase tax accounts for 5% of 150,000 yuan models), Aito has greater cost transfer space

- Users of high-end models have relatively lower price sensitivity

- The scarcity of Huawei ADS system allows Aito to escape the price war red ocean

- User experience brought by leading intelligent driving technology forms strong user stickiness

- “Can’t go back” intelligent cockpit experience reduces price sensitivity

- In 2026, subsidies will shift from “universal” to “structural incentives”, tilting toward models with high range and intelligent levels [5]

- All Aito models have a pure electric range exceeding the 100km threshold, meeting the new subsidy standards

- L3-level autonomous driving policy liberalization: Aito has obtained 11 L3 test licenses and is expected to be the first to enjoy policy dividends

- 2025 estimated sales exceed 460,000 units, with significant scale effects

- R&D costs are diluted, and per-vehicle costs continue to decline

- Gross profit margin increased in the first three quarters of 2025, enhancing profitability

- Seres holds 10% equity in Yinwang Intelligence, a subsidiary of Huawei’s Automotive Business Unit

- Based on Yinwang Intelligence’s 2025 forecasted net profit of 5 billion yuan, Seres can obtain approximately 500 million yuan in investment income

- This part of income can directly offset cost increase pressures

- Overall auto market growth is only 1%-3%[5][6], with slowing demand

- Mid-low end market is under pressure, and competition intensifies

- Macroeconomic downturn may suppress high-end consumption

- M6 faces fierce competition from Li Auto, BYD, etc. in the 280,000-320,000 yuan price range

- M9L/M10 ultra-luxury market has a long cultivation cycle, with limited short-term sales contribution

- Production capacity爬坡 and supply chain security (such as chip shortage) may affect delivery

- Geopolitical uncertainty

- Establishing brand awareness in Europe takes time

- Challenges in regulatory certification and after-sales service system construction

- BBA (Mercedes-Benz, BMW, Audi) accelerate electrification transformation and counterattack in the luxury market

- Other new power brands (Li Auto, NIO, etc.) continue to发力 in the high-end market

- Whether there is resource allocation and competition within Huawei’s “Five Worlds” (Aito, Zhijie, Xiangjie, Shangjie, Zunjie)

- Can it quickly open the mainstream market of 280,000-320,000 yuan

- Competitive situation with competitors such as Li Auto L6 and BYD Tang

- Whether first-month sales can exceed 10,000 units

- Acceptance in the ultra-luxury market

- Can it replicate the success of M9 and break BBA’s monopoly

- Balance between pricing strategy and sales target

- Progress of channel layout in European markets (Germany, Norway)

- Synergy effect of Huawei’s overseas stores

- Right-hand drive model certification and delivery status

- Production capacity爬坡 and supply chain stability

- Year-end promotion strategy and order backlog situation

- Gap to the 550,000 unit target and remedial measures

- ✅ Aito M9 has proven high-end market capabilities and established strong brand momentum

- ✅ Huawei ADS technical barriers form differentiated competitive advantages

- ✅ High pricing strategy provides cost transfer space

- ✅ Overseas channels leverage Huawei to reduce expansion difficulty

- ✅ Product matrix is improved, covering a wider price range

- ✅ Equity investment in Yinwang Technology provides additional income

- ⚠️ Uncertainty in new model launch rhythm and production capacity爬坡

- ⚠️ Overseas market expansion faces geopolitical challenges

- ⚠️ Luxury market competition intensifies (BBA electrification counterattack)

- ⚠️ Overall auto market growth slows, with insufficient demand

- ⚠️ Rapid product line expansion may dilute brand focus

- Achievement Probability of 550,000 Unit Target: 60-70%

- Core Variables: M6 market performance + Overseas expansion progress + M9L acceptance

- Conservative Expectation: 500,000-550,000 units

- Optimistic Expectation:550,000-600,000 units (if M6 and overseas exceed expectations)

Seres Aito’s “

- High-End Market Is Relatively Resilient: Against the backdrop of overall auto market growth of only 1-3%, the penetration rate of luxury new energy vehicles is still low, with large growth space

- Technical Barriers Support Premium: The scarcity of Huawei ADS system allows Aito to escape the price war red ocean and shift to value competition

- Strong Cost Transfer Capability: The 550,000 yuan transaction average price provides sufficient pricing space, and the 35,000 yuan purchase tax increase can be partially transferred

- Improved Product Matrix: M6 fills gaps, M9L breaks the ceiling, and overseas markets contribute increments

The achievement of the 2026 550,000 unit target depends on:

- M6 Must Succeed: This is the most important incremental source in 2026 and needs to quickly gain volume

- Smooth Overseas Expansion: Leveraging Huawei channels, the 50,000 unit target is relatively conservative but not easy to execute

- Continuous Hot Sales of M9/M8: As sales pillars, they need to maintain monthly delivery of over 20,000 units

- Effective Cost Control: Through scale effects and supply chain management to hedge against raw material price increases

Investors need to pay close attention to the following risk signals:

- M6 sales fall short of expectations in the first 3 months after launch (monthly sales below 5,000 units)

- Slow progress in overseas market expansion (exports below 10,000 units in the first half of the year)

- M9/M8 market share declines due to intensified competition in the luxury market

- Macroeconomic downturn leads to萎缩 of high-end consumption demand

Against the backdrop of overall auto market growth of only 1%-3% and mid-low end market pressure in 2026, Seres Aito’s 550,000 unit sales target

[1] Dongcai Wealth - Under the high growth expectation of the L3 intelligent luxury car track, the underlying support for Seres’ high revenue and net profit growth

[2] Securities Times - Seres’ new energy vehicle sales in November were 55,203 units, with cumulative sales exceeding 410,000 units (2025-12-01)

[3] Sohu Auto - Aito M9 delivery exceeds 260,000 units leading the high-end market; Seres starts a new journey with capital benefits

[4] IT Home - Seres Kang Bo: Aito’s full range of models delivered over 50,000 new cars in November, hitting a monthly high (2025-12-02)

[5] The Paper - Over 20 cities adjust auto national subsidies, car companies launch year-end “order grabbing war” (2025-12-25)

[6] Wenxuecheng - Subsidies decrease, will buying a car be more expensive in 2026? (2025-12-25)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.