Analysis of Feasibility and Growth Strategy for Seres AITO's 2026 550,000-unit Sales Target

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

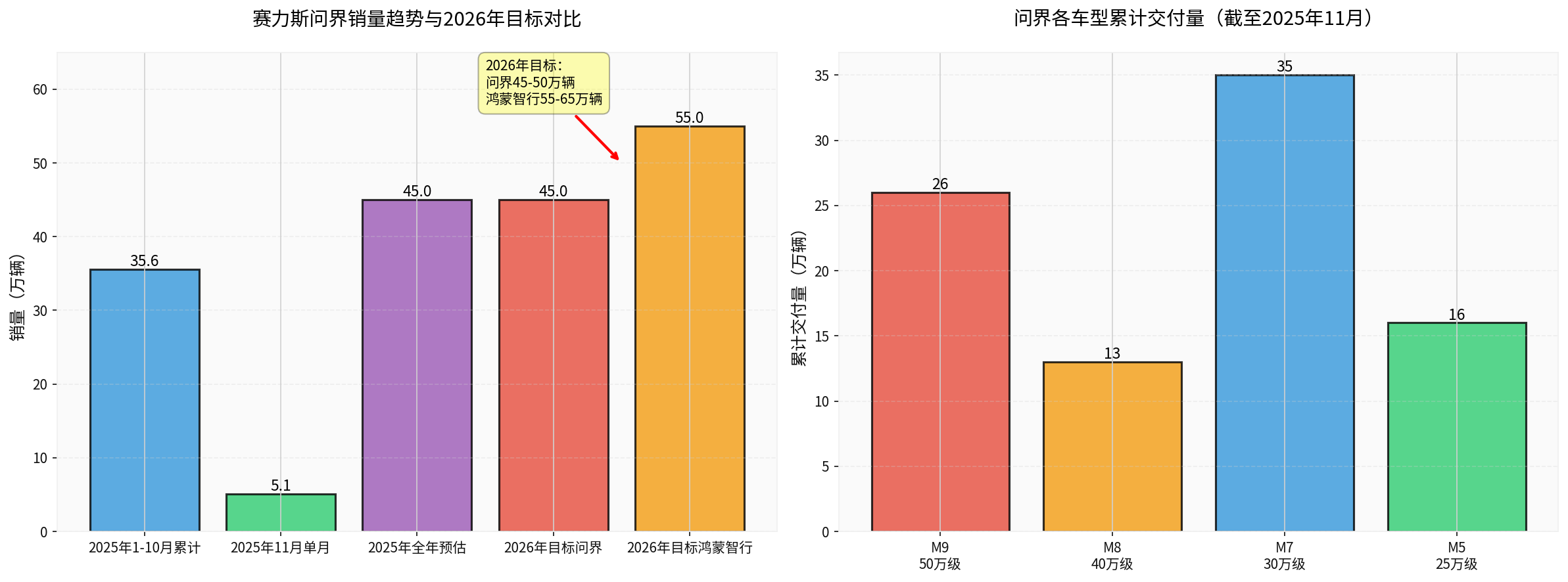

According to the latest data, the AITO brand performed strongly in 2025:

- Cumulative Sales: As of November 21, 2025, cumulative deliveries of the AITO series have exceeded900,000 units

- Sales in the first 10 months of 2025: 356,000 units [1]

- Single month of November 2025: Over 50,000 units delivered, setting a new monthly high [2]

- 2025 full-year estimate: Approximately 450,000 units

- AITO M9: 260,000 units (500,000-level segment, consecutive 10-month sales champion in this price range) [1]

- AITO M8: 130,000 units (400,000-level segment champion)

- AITO M7: 350,000 units

- AITO M5: 160,000 units

According to broker forecasts and industry analysis, there are different versions of AITO’s 2026 sales target:

| Forecast Source | 2026 Target | Growth Rate | Feasibility Assessment |

|---|---|---|---|

AITO Brand Forecast |

450,000-500,000 units | 0-11% | ★★★★☆ Relatively Stable |

HarmonyOS Intelligent Mobility Overall |

550,000-650,000 units | 22-44% | ★★★☆☆ Aggressive but Achievable |

Investor Post Target |

550,000 units | ~22% | ★★★☆☆ Challenging |

- Strong monthly sales capacity: Exceeded 50,000 units/month in November; if maintained in 2026, annualized sales could reach 600,000 units

- New model M6 increment: Fills the price gap of 280,000-320,000 yuan, expected monthly sales of 10,000 units [3]

- Product facelift and upgrade: Major facelift of M5 and version 3.0 of M7 will drive replacement demand

- Overseas market breakthrough: 2026 export target of 50,000 units [4]

- Purchase tax reduction phasing out: In 2026, the new energy vehicle purchase tax will be adjusted from full exemption to half exemption, with a maximum reduction of 15,000 yuan per vehicle [5]

- Slowing industry growth: The passenger car market is expected to decline by 2.1% year-on-year in 2026, with an overall market growth rate of only 1-3% [6]

- Intensified competition: BBA accelerates electrification transformation; new forces like Xiaomi and Li Auto are making efforts

To achieve the 550,000-unit target, AITO needs:

| Quarter | Target Sales Volume | Core Driver |

|---|---|---|

| Q1 2026 | 120,000-130,000 units | Launch of M6 and facelifted M5 |

| Q2 2026 | 130,000-140,000 units | Capacity ramp-up of M6 and launch of M7 3.0 |

| Q3 2026 | 140,000-150,000 units | Overseas model delivery and autumn promotion |

| Q4 2026 | 130,000-140,000 units | Year-end sales push and launch of facelifted M8/M9 |

- ADS System Iteration: The facelifted M5 will be equipped with the new generation HarmonyOS cockpit and Qiankun Intelligent Driving ADS 4.0 system [3]

- Full-scenario Autonomous Driving: Supports full-scenario autonomous driving from parking space to parking space, with reserved ADS 4.0 upgrade capability [7]

- Technological Leading Advantage: L3-level 120 km/h autonomous driving technology has not been surpassed by other companies in the short term [4]

- HarmonyOS Cockpit: Upgraded from simple question-and-answer interaction to a natural all-round partner

- Proactive Service: For example, if the owner is detected sleeping in the back seat, it automatically lowers the curtain, dims the windows, and reduces the volume [8]

- Vehicle-mounted Large Model: Introduces ByteDance Doubao Large Model to realize full-car interaction [8]

In 2026, AITO will form a complete SUV matrix:

| Model | Price Range | Positioning | 2026 Plan |

|---|---|---|---|

| M5 | 220,000-280,000 yuan | Entry Luxury | Major facelift, equipped with ADS 4.0 |

M6 |

280,000-320,000 yuan |

Mid-to-high-end Family |

New model, fills the gap |

| M7 | 300,000-350,000 yuan | Mainstream Family | Version 3.0 upgrade |

| M8 | 400,000-450,000 yuan | High-end Luxury | Facelift to enhance luxury |

| M9 | 500,000-590,000 yuan | Flagship Luxury | Facelift to sprint high-end market |

- Fills the price gap between M5 and M7, accurately targeting young family users who pursue high-end quality but have limited budgets

- Expected monthly sales of 10,000 units, becoming a key driver for expanding user base [3]

- Forms a complete SUV sequence of “M5-M6-M7-M8-M9”, realizing full coverage of the 220,000-590,000 yuan price range

- Average Product Price: In the first half of 2025, the average price of the AITO brand exceeded 400,000 yuan (including M9’s transaction average price of 550,000 yuan) [9]

- Gross Margin: Reached 28.93% in the first half of 2025, an increase of 4.9 percentage points year-on-year, ranking first among domestic car companies [10]

- Profit per Vehicle: Net profit attributable to parent company was 2.941 billion yuan, a year-on-year increase of 81.03% [10]

Sales structure in the first half of 2025:

- AITO M9 + M8: Accounted for over 65%, both are high-gross-margin models

- AITO M9: Single model sales revenue exceeded 140 billion yuan (calculated by 260,000 units × 550,000 yuan average price) [1]

- AITO M8 + M9 are produced on the same line: Effectively dilutes costs, with a gross margin of 28.93% [1]

- Markets Entered: AITO pure electric series has entered 11 overseas countries [7]

- European Breakthrough: At the Paris Auto Show, AITO M9 received 13,000 orders in 1 minute, setting a record for Chinese high-end models going overseas [7]

- Pricing Advantage: Starting price of 60,000 euros is only 70% of European competitors of the same level, showing strong international competitiveness [7]

- 2026 Target: Export 50,000 units, relying on Huawei’s overseas channels (over 1,000 stores) for rapid penetration [4]

- Indonesia Smart Factory: Annual capacity gradually increases to 100,000 units [7]

- Mexico Factory: Planned to reach production in 2026 to radiate the North American market [7]

- 3 Super Factories: Have the capacity to deliver 1 million units annually [1]

- Chongqing Super Factory:

- Covers 2,700 mu, deploys 1,600 intelligent equipment and 3,000 industrial robots

- 100% automation in stamping, welding, and painting links; over 80% automation in final assembly links

- Comprehensive capacity of 30 seconds per unit, can cover more than 500 configuration combinations [7]

- R&D Investment: Approximately 5.2 billion yuan in R&D investment in the first half of 2025, a year-on-year increase of 154.9% [1]

- Battery Cost: Cooperates with CATL to build factories, reducing battery costs by 15% [11]

- Supply Chain Optimization: Vehicle manufacturing cost reduced by 18% [11]

- Magic Cube Platform: Parts commonality rate reaches 85% [11]

- In 2026, the new energy vehicle purchase tax will be adjusted from full exemption to half exemption

- The tax reduction per new energy vehicle does not exceed 15,000 yuan [5]

- Cross-year Purchase Tax Subsidy: Launches cross-year purchase tax subsidy programs for M9, M8, M7 2026 model, and M5, with a maximum of 15,000 yuan [2]

- High-end Market Resilience: The high-end market is less affected by policies, resisting shocks with technological advantages and brand premium [5]

- Enterprise Profit Concession to Hedge: Uses enterprise profit concessions to smooth expected fluctuations caused by policy switching

- “Anti-involution” is unfavorable to mid-to-low-end car companies, making it more difficult to compete by low-price promotion and large price cuts

- Has little impact on high-price-range car companies, as brand power and emotional value are more important [6]

- High-end Positioning Advantage: AITO’s average price exceeds 400,000 yuan, which is in the favorable range of the “anti-involution” policy

- Value Competition Replaces Price Competition: The intelligent luxury car track breaks away from the price war red ocean and shifts to value competition based on technical barriers, scenario experience, and brand premium [4]

- Create User Demand: Create demand through technology and brand instead of simple price cuts [6]

- Overall Market: Passenger car market is expected to reach 23.8 million units, a year-on-year decrease of 2.1% [6]

- New Energy Market: Penetration rate is expected to exceed 60% [6]

- HarmonyOS Intelligent Mobility: Overall sales in the first half of the year will reach 550,000-650,000 units, with monthly average sales maintained at 90,000-110,000 units, a year-on-year increase of 45%-60% [3]

- BBA: Accelerate electrification transformation, posing a threat to AITO’s high-end market

- Xiaomi Auto: Forecast sales of 250,000-300,000 units in the first half of 2026, relying on YU7 and facelifted SU7 [3]

- Li Auto: Steady growth with multi-brand strategy

- Xpeng, Leapmotor: Compete for the top of the third echelon with differential strategies [3]

- Base Sales: Approximately 450,000 units in 2025

- Target Increment: Need to grow by about 100,000 units (+22%)

- Core Support: New model M6 (monthly increase of 10,000 units) + facelift upgrades + 50,000 units from overseas markets

- Time Nodes: If M6 is launched in Q2, it needs to maintain an average monthly delivery of 55,000 units from Q2 to Q4

- M6 is launched on schedule and capacity ramps up quickly

- The facelifted M5 has a warm market response

- Overseas markets break through as planned

- Facelifted M8/M9 continue to sell well

- Technical Barriers: Huawei ADS 4.0 intelligent driving system + HarmonyOS cockpit, leading advantage in L3-level autonomous driving

- Product Matrix: Full coverage of M5-M9, M6 fills key price gaps

- High-end Premium: Average price exceeds 400,000 yuan, gross margin of 28.93% (industry-leading)

- Global Layout: 11 overseas markets + 13,000 orders for M9 at Paris Auto Show, 2026 export target of 50,000 units

- Manufacturing Advantages: 3 super factories, annual capacity of 1 million units, outstanding intelligent manufacturing and cost control capabilities

- Intensified Market Competition: BBA accelerates electrification transformation, posing a threat to AITO’s high-end market

- Impact of Policy Phasing Out: Half-exemption of purchase tax may抑制部分中低端需求 (suppress some mid-to-low-end demand)

- Huawei Dependency Risk: Highly dependent on Huawei for intelligent driving and cockpit technologies; need to pay attention to cooperation stability

- Uncertainty in Overseas Markets: Geopolitics and trade policies may affect overseas expansion progress

- Capacity Ramp-up Risk: Uncertainty about whether new models like M6 can quickly meet demand

[1] Economic Observer - AITO M9 Delivers Over 260,000 Units to Lead High-end Market; Seres Starts New Journey with Capital Good News

https://www.163.com/dy/article/KFMLVGPC05199DKK.html

[2] IT Home - Seres Kang Bo: AITO’s Full Series Models Delivered Over 50,000 New Cars in November, Setting a New Monthly High

https://www.ithome.com/0/901/981.htm

[3] Autohome - Five Realms Compete! HarmonyOS Intelligent Mobility’s 2026 New Energy Market Battle

https://chejiahao.autohome.com.cn/info/24596151

[4] Xueqiu - Under the High Growth Expectation of L3 Intelligent Luxury Car Track, the Underlying Support for Seres’ High Revenue and Profit Growth

https://caifuhao.eastmoney.com/news/20251219124745165221510

[5] Sina Finance - Car Companies “Guarantee” Purchase Tax at the End of the Year; New Energy Vehicle Market Buffers Cross-year

https://cj.sina.cn/articles/view/7517400647/1c0126e4705907xajs

[6] Sichuan Online - 2026 New Energy Vehicle Market Outlook: Penetration Rate Expected to Exceed 60%

https://sichuan.scol.com.cn/ggxw/202511/83161448.html

[7] Sohu Auto - CCTV Certified, AITO with 900,000 Deliveries, Paves the Way for China’s Auto Power with Innovation

https://m.sohu.com/a/963661907_118579?scm=10001.325_13-325_13.0.0-0-0-0-0.5_32

[8] 36Kr - Doubao Large Model on Board Seres’ Own Brand

https://m.36kr.com/p/3423694660275841

[9] Wall Street Journal Chinese Edition - Seres Half-year Report Released: Revenue Slightly Declines, Net Profit Surges 81% Year-on-Year

https://wallstreetcn.com/articles/3754568

[10] Economic Reference Network - Seres Reports Good News in Both Sales and Capital; High-endization Strategy Initially Shows Profit Effect

http://jjckb.xinhuanet.com/20251202/e467bba73a2144584df85f06c415784/c.html

[11] East Money - Seres 2025 Q3 and Full-year Performance Forecast Analysis

https://caifuhao.eastmoney.com/news/20251013144400588223710

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.