Shanghai Electric (02727.HK) Hong Kong Stock Hot Stock Analysis: Catalyzed by Cooperation with SPIC

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

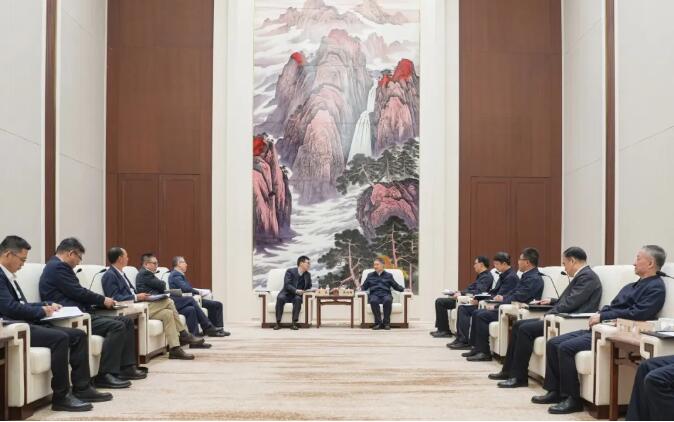

- Strategic Position Upgrade: The cooperation with SPIC combines Shanghai Electric’s technical manufacturing capabilities with the domestic leading energy investor’s ‘15th Five-Year Plan’ energy layout, consolidating the company’s market position in the new energy equipment sector, which is an important development opportunity under the background of green transition.

- Divergent Market Sentiment: The long-term growth trend is strong, but the short-term share price volatility is obvious (down 11.0% in the past week and 4.2% in the past month) [5]. Coupled with the recent trading volume being far below the average, it reflects the market’s cautious attitude towards the company’s high valuation.

- The strategic cooperation with SPIC is expected to bring new energy project orders and accelerate the green transition layout.

- The growth of new energy sector orders and policy support will promote the company’s long-term development.

- Valuation Risk: The price-to-earnings ratio (P/E) is as high as 160.08, far higher than the industry average, and there is a possibility of overvaluation [1].

- Short-term Volatility: The recent short-term volatility of the share price is large, which may affect investment sentiment [5].

- Insufficient Trading Volume: The recent trading volume is far below the average, which may affect the stability of the subsequent share price trend.

Shanghai Electric (02727.HK) became a hot Hong Kong stock due to its strategic cooperation with SPIC, with long-term growth potential but facing overvaluation and short-term volatility risks. Investors need to continuously pay attention to the progress of cooperation, changes in trading volume, and dynamic adjustments of valuation levels.

周大福 (01929.HK) 热门股票分析报告

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.