Analysis of Innoscience (02577.HK) Becoming a Popular Hong Kong Stock Due to AI Infrastructure Tailwinds

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

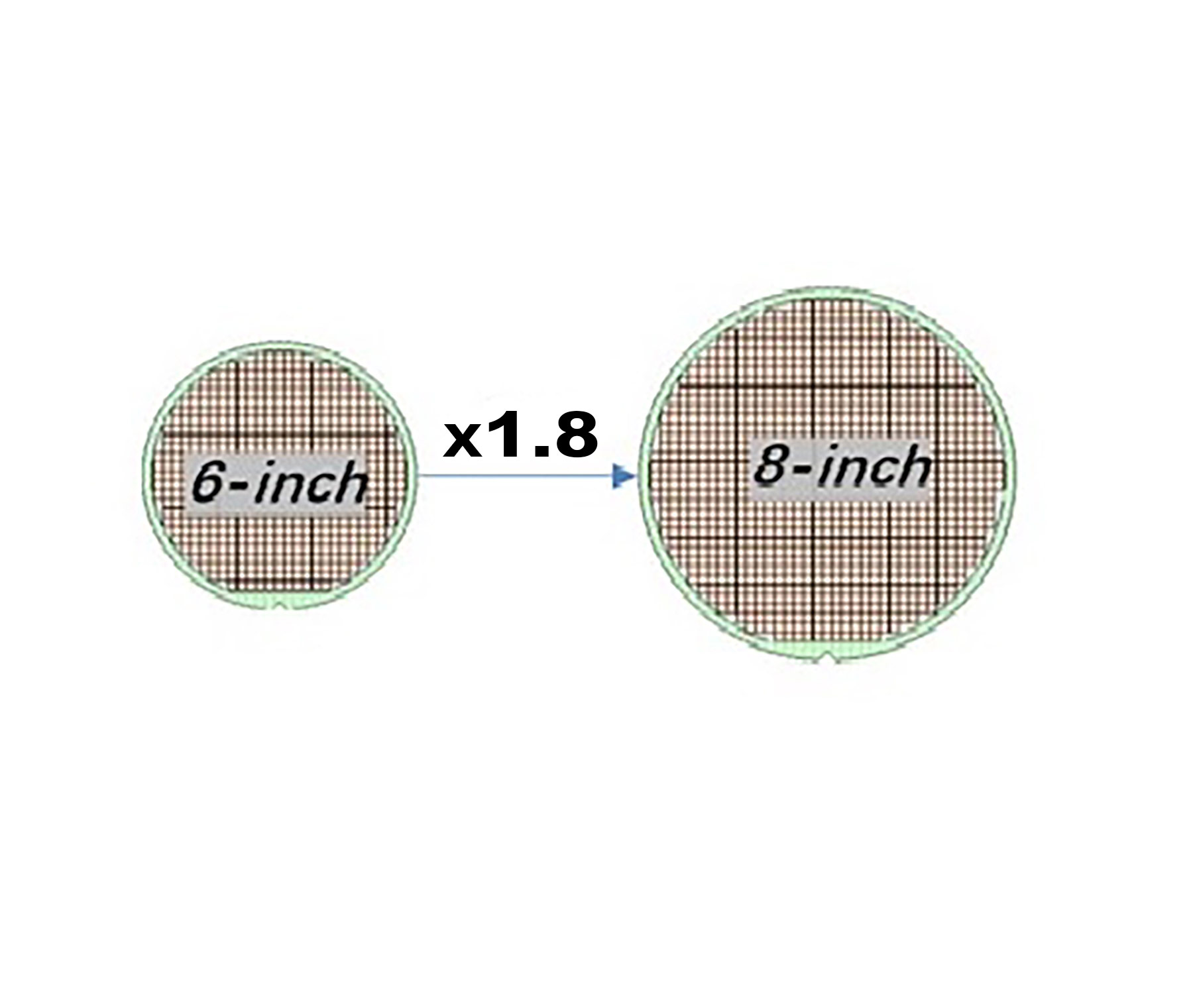

Innoscience (02577.HK) is a global leader in the power semiconductor industry, focusing on the R&D and production of gallium nitride (GaN) power semiconductors. It is the world’s first company to mass-produce 8-inch silicon-based GaN wafers, with products applied in consumer electronics, automotive electronics, new energy, and other fields [2]. On December 30, 2025, the company became a popular Hong Kong stock due to favorable news about AI infrastructure upgrades. The core catalyst was NVIDIA’s announcement of cooperation with ecosystem partners to fully transition AI data centers to an 800V DC architecture to support high-power density GPU systems. This technology places higher requirements on the efficiency and density of power semiconductors, and Innoscience’s GaN products are ideal for high-voltage and high-power applications [1].

Market data shows that on that day, Innoscience’s stock price rose over 10%, with an intraday maximum increase of over 12%, a price range of HK$66.40-HK$69.60, and finally closed at HK$73.95, with a trading volume of approximately HK$466 million, which was significantly higher than the average trading volume [2]. At the same time, the Hong Kong semiconductor sector rose overall, with leading stocks such as SMIC (00981.HK) and Huahong Semiconductor (01347.HK) rising synchronously, indicating positive sector sentiment [1].

- Technology Trend and Business Alignment: NVIDIA’s 800V DC architecture upgrade verifies the advantages of GaN technology in high-power applications. As a leader in the GaN industry, Innoscience’s products are highly matched to the power needs of AI data centers and directly benefit from the long-term growth trend of AI infrastructure.

- Sector Linkage Effect: Innoscience’s rise is not an isolated event but a microcosm of the Hong Kong semiconductor sector’s overall benefit from the increased demand for AI infrastructure, reflecting the market’s strong attention to AI-related hardware supply chains.

Innoscience (02577.HK) became a popular Hong Kong stock on December 30, 2025, with a rise of over 10% and significantly increased trading volume, driven by favorable news from NVIDIA’s 800V DC architecture upgrade. As a leading GaN power semiconductor company, its products meet the needs of high-power AI data centers and benefit from AI infrastructure thematic investments. Investors need to pay attention to short-term volatility risks, industry competition, and valuation levels.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.