Impact Analysis of Yangtze Power's Increased Cash Dividend Ratio

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

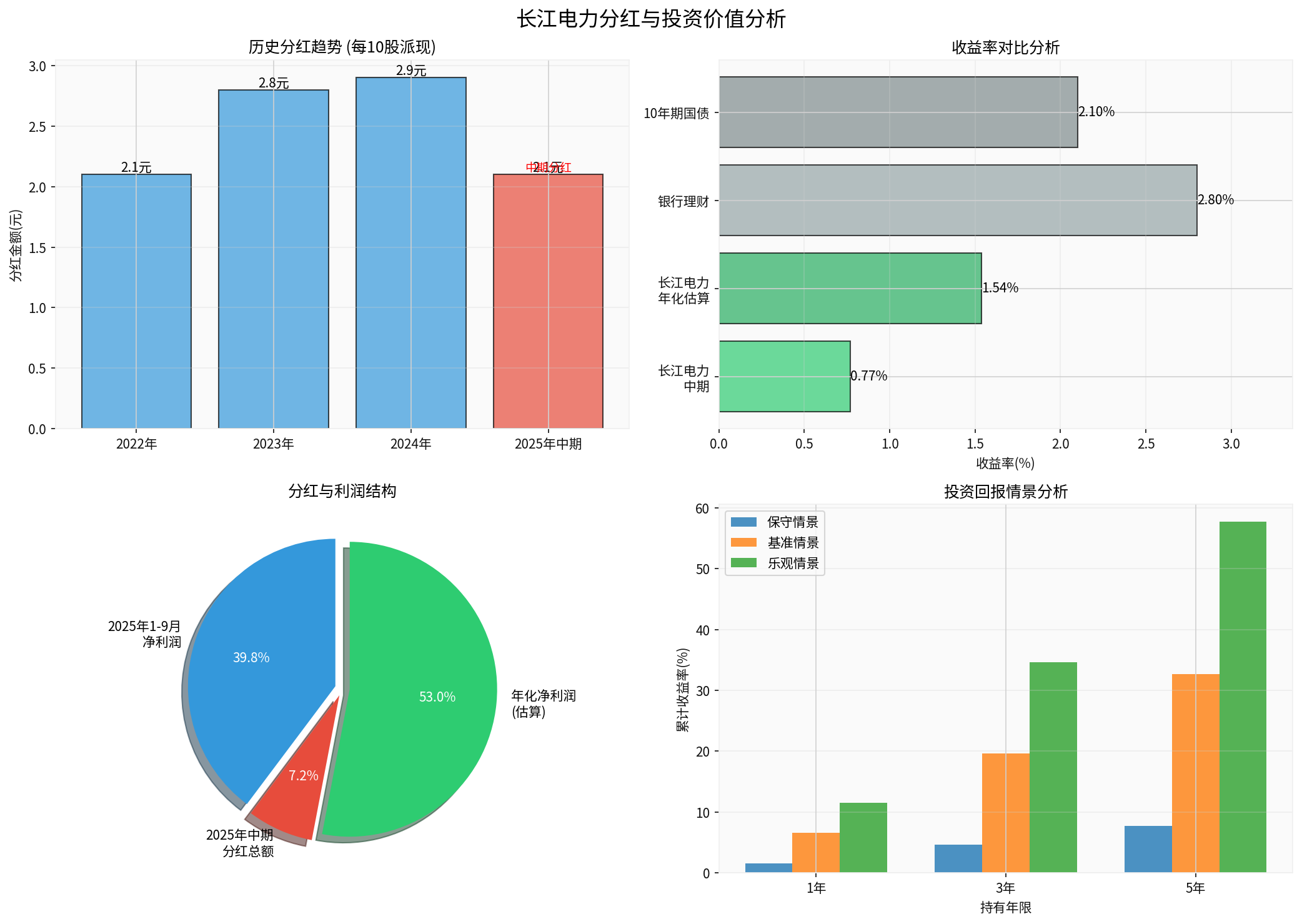

According to the latest data, Yangtze Power (600900.SH) has released its 2025 interim profit distribution plan:

- Dividend Standard: RMB 2.10 cash dividend per 10 shares

- Total Dividend Amount: RMB 5.138 billion

- Dividend per Share: RMB 0.210

- Interim Dividend Yield: 0.77% (based on current share price of RMB 27.32) [0]

- Annualized Dividend Yield: Approximately 1.54% (assuming consistent annual dividend level) [0]

- Jan-Sept 2025 Attributable Net Profit: RMB 28.193 billion (unaudited) [0]

- Annualized Net Profit (Estimated): RMB37.591 billion [0]

- Interim Dividend Ratio: Approximately13.67% (based on annualized profit) [0]

- Company Commitment: Dividend ratio of no less than70% from2025 to2027

As shown in Chart1, Yangtze Power’s dividend trend shows a steady upward momentum:

| Year | Dividend per10 Shares (RMB) | Dividend Yield | Remarks |

|---|---|---|---|

| 2022 | 2.10 | 0.77% | Annual Dividend |

| 2023 | 2.80 | 1.02% | Annual Dividend |

| 2024 | 2.90 | 1.06% | Annual Dividend |

| 2025 | 2.10 | 0.77% (Interim) | Annualized approx.1.54% |

- Strong Dividend Stability: The hydropower industry has natural cash flow advantages and is less affected by economic cycles

- Clear Policy Support: The company’s commitment to a dividend ratio of no less than70% from2025 to2027 provides certainty for investors

- Innovation in Interim Dividend: First implementation of interim dividend, showing the company’s strong willingness to reward shareholders

According to brokerage API data analysis:

- Yangtze Power Annualized Dividend Yield: Approximately1.54% (annualized interim dividend) [0]

- Bank Wealth Management Product Yield: Approximately2.5-3.0%

- 10-Year Treasury Bond Yield: Approximately2.1%

Although Yangtze Power’s dividend yield seems lower than bank wealth management products, the following points need to be considered:

- Capital Appreciation Potential: Stocks have room for price increases

- Dividend Growth: Profitability continues to improve with the full commissioning of Wudongde and Baihetan power stations

- Tax Preference: Dividend tax rate is lower than interest tax

- Anti-Inflation Ability: Power assets have inflation hedging properties

From the investment return scenario analysis in Chart4:

- Conservative Scenario(only dividend收益):1 year收益率约1.54%,5年累计约7.7%

- 基准情景(股息+5%资本增值):1年收益率约6.54%,5年累计约32.7%

- 乐观情景(股息+10%资本增值):1年收益率约11.54%,5年累计约57.7%

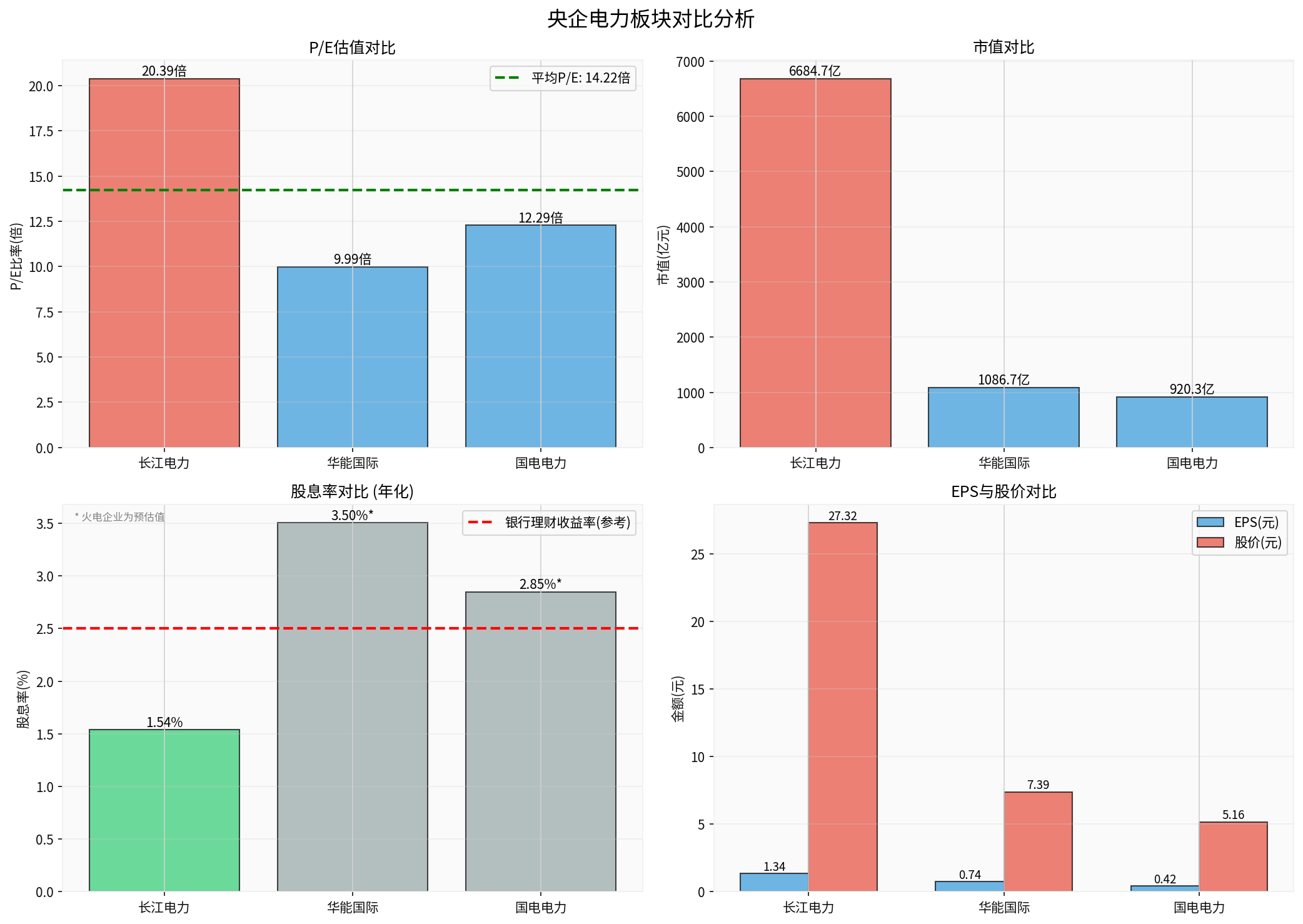

| Company Name | Share Price (RMB) | P/E (times) | Market Capitalization (100 million RMB) | Type | Annualized Dividend Yield |

|---|---|---|---|---|---|

| Yangtze Power | 27.32 | 20.39 | 6,684.7 | Hydropower | 1.54% |

| Huaneng International | 7.39 | 9.99 | 1,086.7 | Thermal Power | Approx.3.5%* |

| Guodian Power | 5.16 | 12.29 | 920.3 | Thermal Power | Approx.2.85%* |

Sector Average |

- | 14.22 |

- | - | - |

*Thermal power企业股息率为预估值,基于35%分红比例假设[0]

Yangtze Power作为水电行业龙头,市值超过6,600亿元,其分红政策具有风向标意义[0]:

- 政策导向:央企"中特估"背景下,高分红成为重要考核指标

- 行业示范:其他电力央企可能跟随提升分红比例

- 估值牵引:龙头估值提升有助于带动板块整体估值上行

Yangtze Power当前P/E为20.39倍,高于板块平均14.22倍,溢价率达43.36%[0]。这种溢价具有合理性:

- 业务稳定性:水电不受煤价波动影响,现金流充沛且稳定

- 成长性确定:乌东德、白鹤滩电站投产带来新增装机

- 资源稀缺性:优质水电资源具有垄断属性

- 分红确定性:70%分红承诺提供稳定回报预期

高分红政策将吸引特定类型资金:

- 保险资金:偏好长期稳定现金流,匹配负债久期

- 养老金:追求稳健收益,高分红股票符合配置需求

- 外资:QFII、RQFII等偏好高分红、高ROE标的

- 私募基金:价值投资策略重点关注高股息资产

电力板块内部将继续呈现分化:

- 水电板块:享受高估值溢价,长江电力、川投能源等标的受益

- 火电板块:受煤价波动影响,估值较低,但分红率可能提升

- 新能源板块:成长性高但分红率低,估值逻辑不同

- Cash Cow Attribute:自由现金流充裕,2024年自由现金流达452亿元[0]

- Clear Dividend Policy:70%分红承诺提供可预期回报

- Business Moat:长江流域水电资源具有天然垄断性

- 抗周期特性:不受经济周期和燃料价格波动影响

- Water Flow Fluctuations:长江流域来水情况影响发电量

- Electricity Price Policy:电力体制改革可能影响电价水平

- Interest Rate Risk:高股息策略在利率上行期吸引力下降

- Valuation Risk:当前P/E 20.39倍处于历史中高水平[0]

-

Long-Term Holding Strategy:

- Suitable for long-term value investors

- Enjoy stable dividends + capital appreciation

- Recommended holding period of more than3 years

-

Buy-on-Dip Allocation Strategy:

- Current share price of RMB27.32 is in the middle of the52-week range (RMB26.98-31.19)[0]

- Suggest batch building positions during corrections

- Pay attention to technical support levels

-

Dividend Reinvestment Strategy:

- Use dividends for reinvestment to enhance returns

- Long-term holding can achieve compound interest effects

- Allocation Priority: Hydropower > New Energy > Thermal Power

- Key Focus: Sustainability of dividend policies, progress of power system reform

- Timing Selection: Pay attention to allocation opportunities when market sentiment is low

- Can it enhance the attractiveness of high-dividend assets?

- Dividend policy certainty (70% commitment)

- Business stability (hydropower characteristics)

- Capital appreciation potential (commissioning of Wudongde and Baihetan)

- Resource scarcity (Yangtze River basin monopoly)

Its comprehensive investment value is significantly better than traditional fixed-income assets.

- What impact does it have on the valuation of the central SOE power sector?

The impact is far-reaching and positive:

- Benchmark Effect: As an industry leader, Yangtze Power’s dividend policy will become a reference standard for other central SOEs

- Valuation Reshaping: High dividend policies are expected to raise the overall valuation center of the sector

- Capital Attraction: Attract long-term capital allocation, improving investor structure

- Sector Differentiation: Valuation differentiation between hydropower and thermal power will further intensify

- Investment Recommendations:

Long-term optimistic about Yangtze Power and high-quality hydropower targets; recommend long-term allocation and pay attention to the sustainability of dividend policies. For the entire central SOE power sector, recommend paying attention to investment opportunities brought by the spread of high dividend policies.

[0] Gilin API Data - Yangtze Power (600900.SH) Company Overview, Financial Data, Market Quotes and Analysis Results

中东地缘政治紧张局势对能源市场和国防军工板块的影响分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.