AAR Corp (AIR) Q2 2026 Earnings Preview: Market Impact and Risk Considerations

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

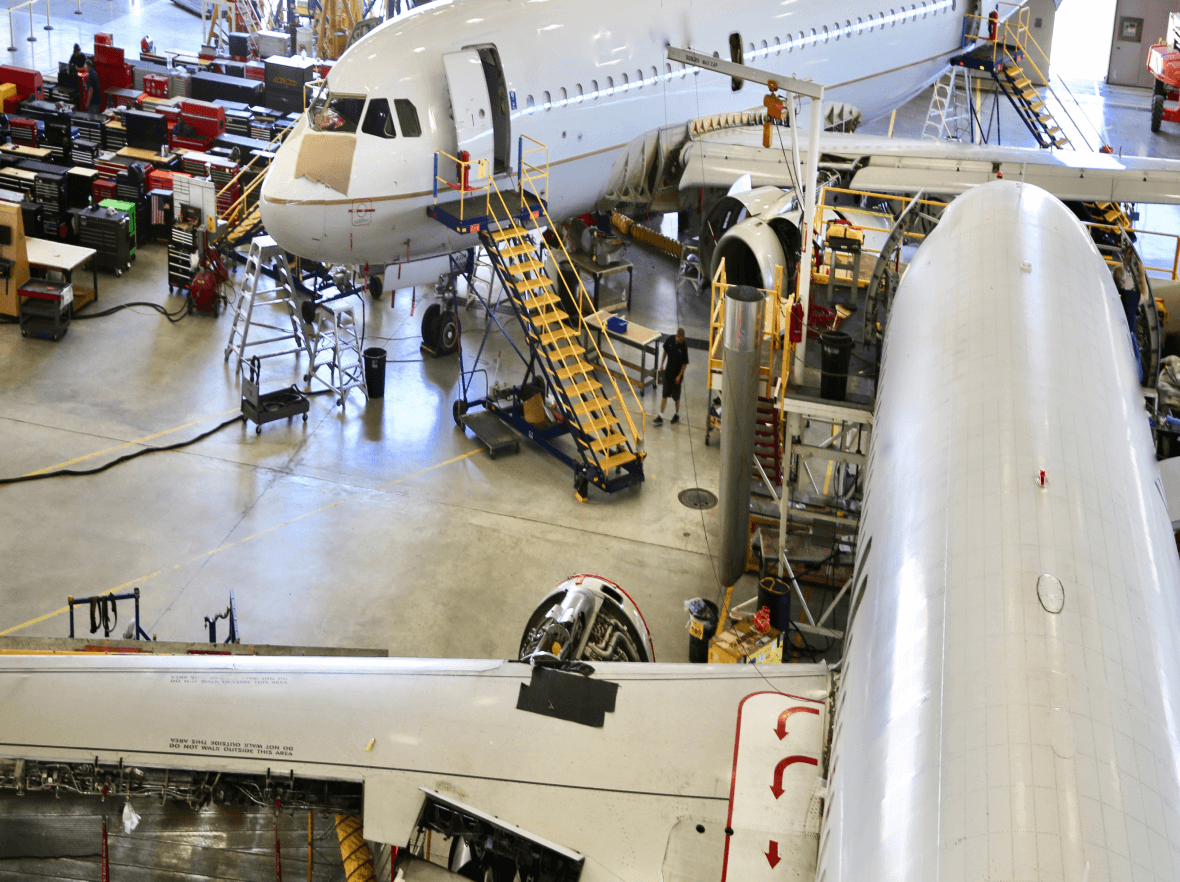

This analysis is based on the Benzinga report [1] published on December 30, 2025, which announced AAR Corp’s (NYSE: AIR) upcoming Q2 2026 earnings release before market open on January 6, 2026. AAR is a leading Aerospace & Defense company with a $3.02B market cap [0]. Its stock has delivered strong year-to-date growth of 37.21% in 2025, closing at $84.51 on December 30, 2025 [0].

The company’s most recent earnings (Q3 2025) showed robust performance, with record sales of $678 million (+20% YoY) and adjusted EBITDA of $81.2 million (+39% YoY) [0]. This growth was driven by its Parts Supply (+12% YoY) and Repair & Engineering (+53% YoY) segments. Operating in the Aerospace & Defense sector, AAR is positioned in a market identified as a recommended diversification play for 2026 alongside financials and value stocks [2]. Analysts maintain a bullish consensus, with 68.4% rating the stock “Buy” and a consensus price target of $91.50, representing an 8.3% upside from current levels [0].

-

Growth vs. Margin Disparity: AAR has demonstrated strong top-line growth (Q3 2025 sales +20% YoY [0]) but maintains a low trailing 12-month net profit margin of 1.01% [0]. This contrast creates elevated risk, as even small operational misses could lead to significant earnings shortfalls due to limited margin buffers.

-

Valuation Sensitivity: With a P/E ratio of 106.97x [0], significantly above industry averages, AIR’s stock is highly sensitive to earnings performance and guidance. Market expectations for continued growth are already priced in, making the stock vulnerable to any disappointment.

-

Sector Tailwinds: The Aerospace & Defense sector’s status as a diversification play for 2026 [2] provides a supportive backdrop, but AAR’s performance will depend on executing its margin expansion strategies and growing high-margin segments like Trax maintenance software [0].

- Earnings Miss Risk: Low net profit margin leaves little room for error; even minor operational underperformance could trigger significant stock price volatility.

- USM Market Volatility: Temporary deferrals in used serviceable materials (USM) demand could impact near-term results.

- Integration Risks: Ongoing integration of the Product Support acquisition may face delays or cost overruns.

- High Valuation: Elevated P/E ratio makes the stock sensitive to any earnings or guidance disappointment.

- Geopolitical & Sector Risks: Changes in government defense spending and geopolitical tensions could affect the Aerospace & Defense sector.

- Sector Diversification Play: Aerospace & Defense has been identified as a recommended diversification option for 2026 [2].

- Margin Expansion: AAR’s focus on operational efficiencies and high-margin segments (e.g., Trax software) offers growth potential.

- Strong Analyst Sentiment: Bullish consensus rating and price target indicate market confidence in future performance.

AAR Corp (NYSE: AIR) will release Q2 2026 earnings on January 6, 2026 pre-market. Key metrics to monitor include:

- Margin expansion progress and Trax segment performance

- Government contract updates in the Integrated Solutions segment

- USM market demand trends

- Analyst forecast revisions (once available, as referenced in the Benzinga report [1])

Investors should consider the contrast between AAR’s strong top-line growth, low net margin, and high valuation when evaluating the potential impact of the earnings release.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.