Wood Group's UK T&D Business Sale: Strategic and Valuation Impact Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

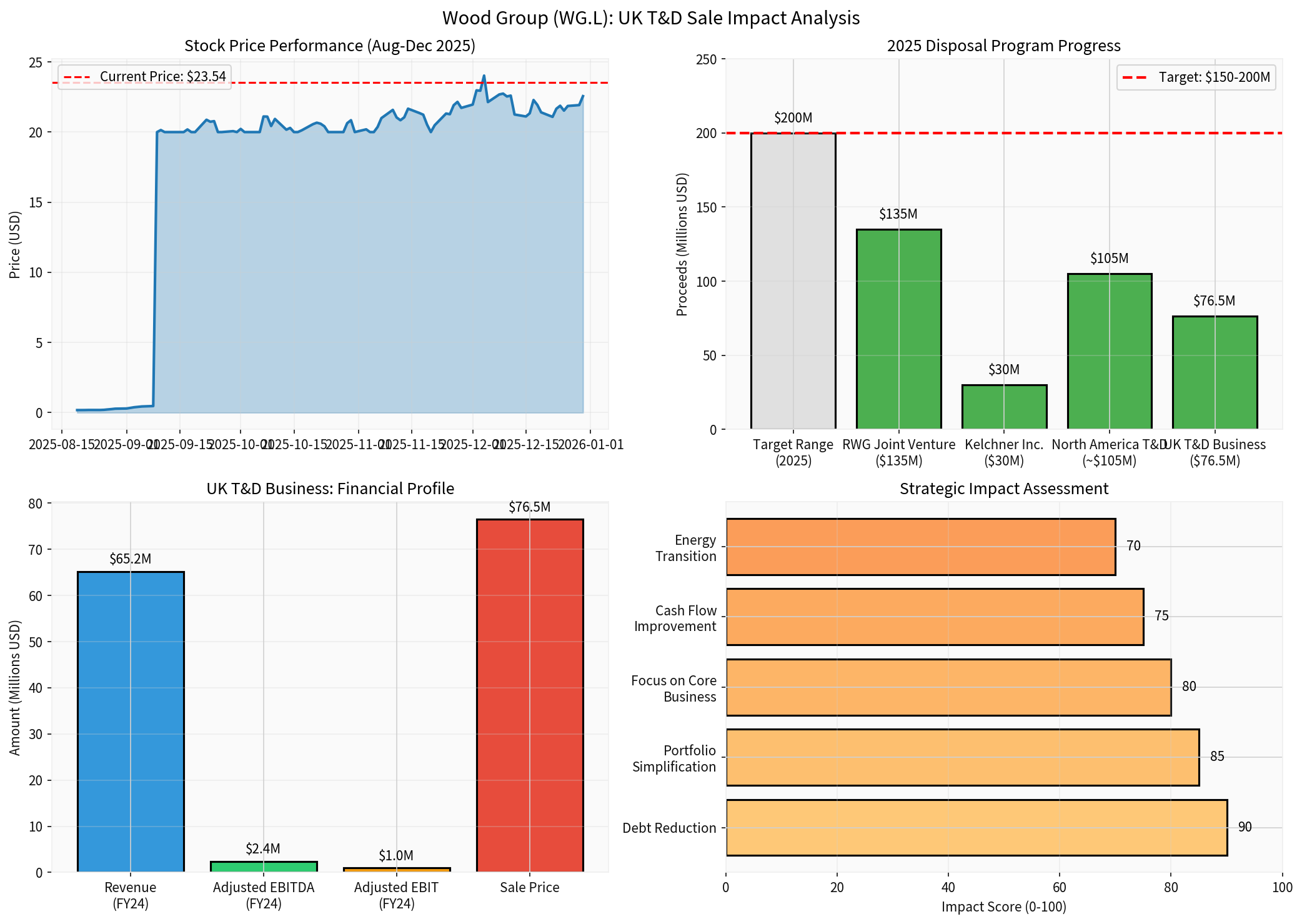

Wood Group’s sale of its UK Transmission & Distribution (T&D) business to United Infrastructure for £57.5 million ($76.5 million) represents a significant milestone in the company’s broader portfolio transformation strategy[1]. This transaction, combined with other disposals in 2025, has generated approximately $345 million in total proceeds—substantially exceeding the original target range of $150-200 million[2]. The strategic divestment is designed to strengthen Wood’s financial position, simplify its business portfolio, and accelerate its focus on core high-margin services within the energy transition theme.

Parameter |

Value |

|---|---|

Buyer |

UI Telecoms & Power Holdco Limited (United Infrastructure) |

Sale Price |

£57.5 million (~$76.5 million) |

Expected Completion |

December 31, 2025 |

FY24 Revenue |

$65.2 million |

FY24 Adjusted EBITDA |

$2.4 million |

FY24 Adjusted EBIT |

$1.0 million |

Net Assets (FY24) |

$(1.6) million |

Source: Company disclosures[1]

The UK T&D business provided engineering, procurement, construction, and installation services for overhead line and underground cable projects in the UK, serving Distribution Network Operators (DNOs)[3].

The UK T&D sale is part of Wood Group’s comprehensive disposal program targeting non-core businesses. In 2025 alone, the company has agreed to four major transactions:

- RWG Joint Venture:$135 million (sale to Siemens Energy)

- Kelchner Inc.:$30 million (U.S. civil construction services)

- North America T&D:~$105 million (sale to Qualus)

- UK T&D Business:$76.5 million (sale to United Infrastructure)[2]

The disposal program aligns with Wood’s strategy to:

- Exit lower-margin infrastructure services(T&D operations historically generated thin margins)

- Concentrate on core high-margin servicesin energy consulting, project management, and technical solutions

- Enhance exposure to energy transition marketsincluding renewables, carbon capture, hydrogen, and decarbonization[4]

- Reduce reliance on large-scale lump sum turnkey (LSTK) contractswhich carry higher execution risk[4]

By divesting UK and North American T&D assets, Wood is strategically reallocating capital to higher-growth regions, particularly:

- Middle East:Strong demand in Iraq and wider region (contracts up nearly 20% in 2025)[5]

- Emerging energy transition marketsacross 60+ countries globally[4]

- Current Net Debt:~$1.1 billion (as of 2024)[2]

- 2025 Expected Free Cash Flow:Negative $(150) million to $(200) million[2]

- Debt Classification:High risk per financial analysis[0]

- Immediate cash infusionof $76.5 million to reduce net debt by approximately 7%

- Proceeds utilization:Specifically earmarked for debt reduction and general corporate purposes[6]

- Debt-to-equity improvement:Supports deleveraging efforts amid challenging capital structure

With ~$345 million in total disposal proceeds (vs. $150-200 million target), Wood is positioned to:

- Offset the 2025 negative free cash flow entirely

- Maintain net debt at 2024 levels of ~$1.1 billion

- Create liquidity buffer for operational improvements[2]

- Annual revenue reduction:~$65.2 million (UK T&D contribution)[1]

- EBITDA reduction:~$2.4 million (minimal impact on consolidated profitability)[1]

- Capital structure:Sale of a business with negative net assets (-$1.6 million) improves balance sheet quality[1]

- Exit low-margin T&D services:Historically thin margins in infrastructure construction

- Portfolio mix improvement:Shift toward higher-margin consulting and technical services

- Simplification benefits:Reduced complexity, overhead, and working capital requirements

The UK T&D business generated

Metric |

Value |

Interpretation |

|---|---|---|

Market Cap |

$162.57 million | Severely depressed valuation |

Current Price |

$23.54 | Post-restructuring recovery from $0.18 low[0] |

P/E Ratio |

-1.97x | Negative earnings (loss-making) |

P/B Ratio |

0.06x | Trading at deep discount to book value |

ROE |

-3.01% | Negative return on equity[0] |

- Debt reduction of ~7%improves financial stability during restructuring

- Strategic clarityfrom accelerated portfolio simplification

- Focus on higher-growth, higher-margin segmentsmay justify improved multiple

- Cash generationfrom disposals exceeds expectations, demonstrating execution capability

- Loss of $65.2M revenue(though low-margin) reduces top-line

- Continued negative earningsuntil turnaround materializes

- High leverage persistsdespite disposals (net debt still ~$1B+)

- Execution riskin transitioning business model

The disposals, including UK T&D, support Wood’s target of

- Stabilization of legacy claims liabilities (~$150M over 3 years)

- Working capital normalization

- Margin expansion from portfolio simplification (~$60M annual savings from 2025)[4]

If successful, this turnaround could justify a significant valuation re-rating from current distressed levels.

The UK T&D sale accelerates Wood’s transformation into a

-

Core Business Concentration:

- Energy consulting and advisory services

- Project management for energy transition projects

- Technical solutions for decarbonization

- Digital and innovation-led services[4]

-

Geographic Prioritization:

- Middle East:Strong growth in Iraq (contracts up nearly 20% in 2025)[5]

- Energy transition hubs:Renewables, hydrogen, carbon capture globally

- Selective presence:Maintaining operations only in high-return markets

-

Business Model Evolution:

- Reduced LSTK exposure:Lower risk, higher predictability

- Fee-based services:More stable, asset-light revenue streams

- Partnership-led growth:Collaborating rather than owning entire project lifecycle

Proceeds from disposals (including UK T&D) will support:

- Debt reduction(primary priority)

- Investment in digital solutionsand energy transition capabilities[4]

- Selective strategic acquisitionsin core focus areas

- Working capital stabilizationduring transition

- Transition disruption:Divesting multiple businesses simultaneously creates operational complexity

- Talent retention:Key employee departures during organizational restructuring

- Client relationships:Potential revenue attrition from dispositions

- Insufficient proceeds:Even with ~$345M in disposals, net debt remains elevated at ~$1.1B

- Cash flow pressure:Negative FCF in 2025 requires careful liquidity management

- Legacy liabilities:~$150M in claim costs over 3 years continues to strain cash flow[2]

- Energy transition timing:Pace of renewable energy adoption affects growth opportunities

- Competitive pressure:Established competitors in core consulting segments

- Macro volatility:Oil & gas price volatility impacts traditional client base

- Debt reduction remains criticalto stabilize balance sheet

- Focus on cash generationto achieve positive FCF in 2026 (as targeted)[2]

- Monitor executionof portfolio transition and margin improvement

- Successful delivery of positive FCFcould trigger valuation re-rating

- Proof of strategic transformationthrough revenue mix shift to energy transition

- Potential strategic alternativesincluding partnership or M&A if standalone execution falters

- Current valuation(P/B 0.06x) prices in significant distress, creating potential upside if turnaround succeeds

- Disposal executionhas exceeded expectations, demonstrating management credibility

- Key catalystsinclude 2026 positive FCF delivery and sustained margin expansion

- Employees:Focus on core segments offers clearer career path in high-growth areas

- Clients:Simplified portfolio may enable deeper expertise in energy transition

- Counterparties:Reduced leverage from disposals improves credit profile (though still high-risk)

Wood Group’s sale of its UK T&D business to United Infrastructure for $76.5 million represents a strategically prudent step in an ambitious portfolio transformation. The transaction, combined with other 2025 disposals totaling ~$345 million, provides immediate financial relief through debt reduction while positioning the company for sustainable growth in higher-margin energy transition services.

The

Ultimately, the UK T&D sale is a necessary component of Wood’s broader reinvention from a diversified energy services conglomerate to a focused, high-margin advisor in the global energy transition. The success of this strategy will determine whether current valuations represent a compelling opportunity or a value trap.

https://www.woodplc.com/news/latest-press-releases/2025/sale-of-uk-t-and-d-busines

https://www.woodplc.com/news/latest-press-releases/2025/business-update

https://unitedinfrastructure.com/news/acquisition-of-woods-uk-transmission-and-distribution-business/

https://matrixbcg.com/blogs/growth-strategy/woodplc

https://www.iraqinews.com/iraq/wood-sees-strong-iraq-demand-as-middle-east-awards-jump-nearly-20/

https://www.woodplc.com/news/latest-press-releases/2025/sale-of-north-america-t-and-d-to-qualus

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.