Impact Analysis of Over 100 Million Yuan Debt Exemption on *ST Zhongji (000972)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on my latest financial data analysis of *ST Zhongji (000972), combined with similar market cases and regulatory rules, the following is a comprehensive analysis of the impact of over 100 million yuan in debt exemption:

| Financial Indicator | Value | Evaluation |

|---|---|---|

| Current Stock Price | 3.78 yuan | Up 34.52% YTD |

| EPS (TTM) | -0.43 yuan | Sustained Losses |

| P/E Ratio | -8.79x | Negative Value, Weak Profitability |

| Current Ratio | 0.64 | Below 1, High Liquidity Pressure |

| Quick Ratio | 0.20 | Extremely Low, Severe Short-Term Solvency Deficiency |

| Net Profit Margin | -90.92% | Severe Loss Status |

| Operating Margin | -105.95% | Main Business Profitability Is a Concern |

| 2025 Q3 Revenue | 109 million yuan | Small Revenue Scale |

| Market Capitalization | 2.92 billion yuan | Small-Cap Stock |

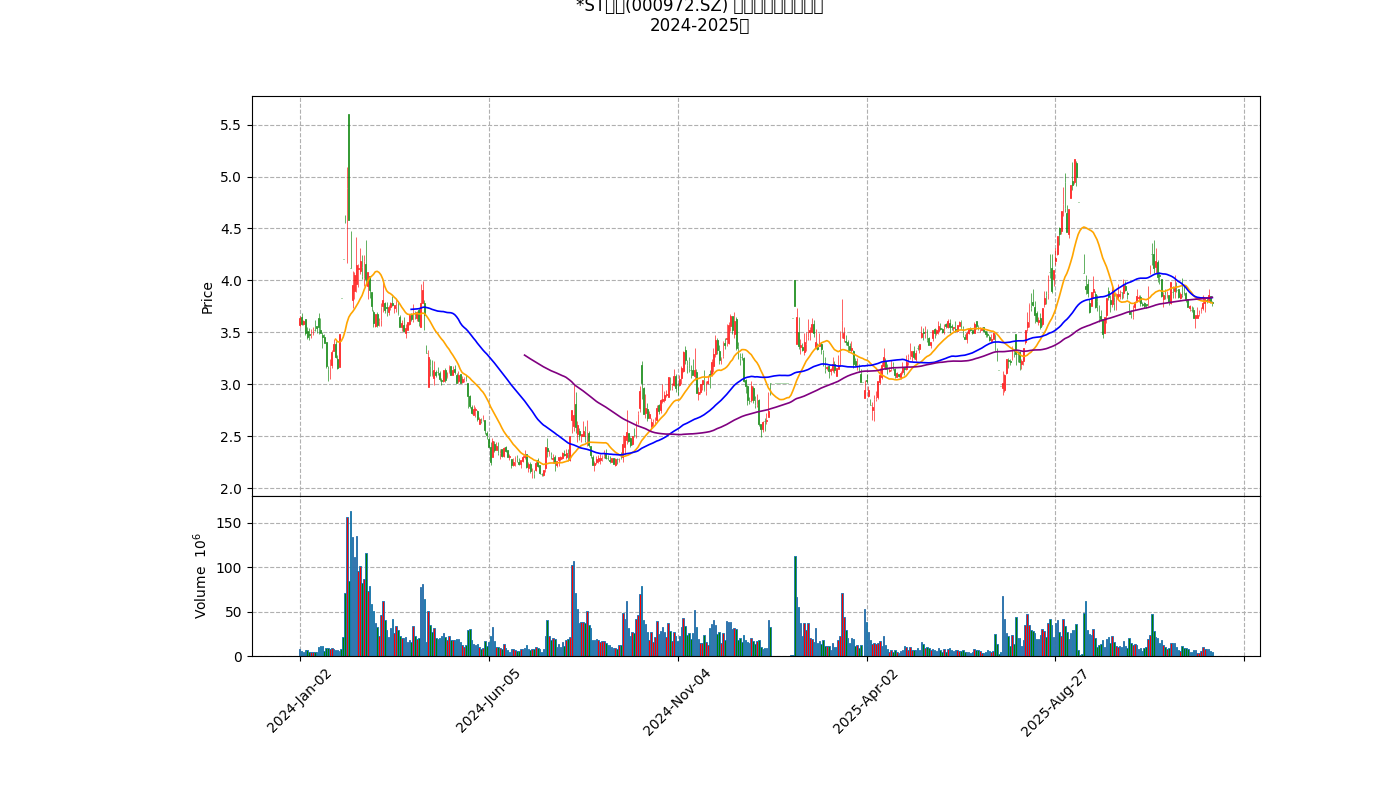

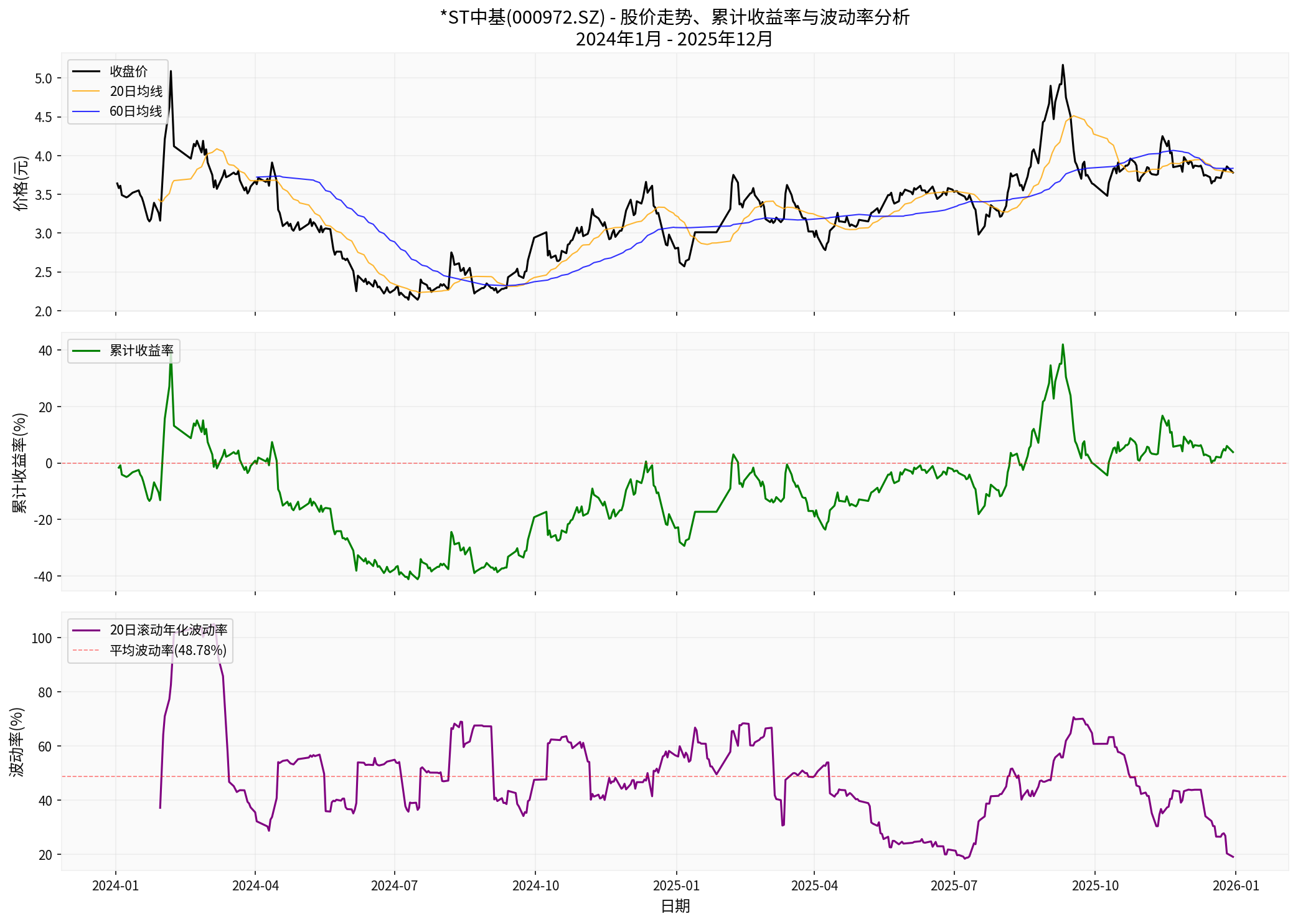

- YTD Performance: Stock price has risen 34.52% cumulatively, with strong market expectations for restructuring and shell preservation.

- Volatility: Average annualized volatility reaches 48.78%, with a maximum of 105%, indicating strong speculation.

- Technical Indicators: Current price is 3.78 yuan, above the 20-day moving average but below the 60-day and 120-day moving averages.

The unconditional and irrevocable debt exemption of over 100 million yuan will result in the following accounting treatments:

- Reduce Liabilities: Directly reduce the book value of relevant liabilities by over 100 million yuan.

- Increase Net Assets: According to accounting standards, debts unilaterally exempted by creditors are recorded in “Capital Reserve”.

- No Cash Flow Generated: Debt exemption is an accounting adjustment and does not involve actual cash inflow.

Assuming the company’s current net assets are negative (per *ST standards), after a 100 million yuan debt exemption:

| Item | Pre-Exemption Estimate | Post-Exemption | Improvement Magnitude |

|---|---|---|---|

| Total Liabilities | Assume 1.5 billion yuan | Approximately 1.4 billion yuan | ↓6.7% |

| Net Assets | Assume -200 million yuan | Approximately -100 million yuan or positive | ↑50% or positive |

| Asset-Liability Ratio | Assume 105% | Drop to below 95% | ↓10 percentage points |

| Current Ratio | 0.64 | Rise to 0.75-0.80 | ↑17-25% |

Debt exemption is classified as

- Recorded in Current Period Income: As non-operating income, it directly affects net profit.

- No Impact on Non-Recurring Net Profit: The core indicator in delisting assessment is “net profit after deducting non-recurring gains and losses”.

- May Trigger Audit Attention: Large-scale debt exemption requires auditors to verify commercial reasonableness [1].

To remove the delisting risk warning (*ST), the company must meet:

- Net profit for the most recent fiscal year is positive

- Net assets at the end of the most recent fiscal year are positive

- Operating income for the most recent fiscal year is not less than 100 million yuan(Main Board)

- Financial accounting report has not been issued with a qualified opinion, disclaimer of opinion, or adverse opinion

| Assessment Indicator | Pre-Exemption | Post-Exemption Impact | Compliance Probability |

|---|---|---|---|

Net Profit (Including Non-Recurring) |

Negative | +100 million yuan non-recurring gain | High Probability of Turning Positive ✓ |

Non-Recurring Net Profit |

Negative | No Impact | Still Negative ✗ |

Ending Net Assets |

May Be Negative | +100 million yuan capital reserve | May Turn Positive ✓ |

Operating Income |

109 million yuan (Q3) | No Direct Impact | High Probability of Compliance ✓ |

-

*

ST Xinyuan (300472): Received 330 million yuan in cash + 50 million yuan in debt exemption- Objective: Ensure net assets turn positive in 2025 and avoid delisting

- Result: Significantly improved asset-liability structure, but shell preservation still requires business improvement

-

*

ST Huicheng (002168): Received 130 million yuan in debt exemption + 30 million yuan in cash donation- Effect: Net assets turned from -38.87 million yuan to 58.79 million yuan

- Insight: Debt exemption has a significant effect on net asset repair

-

Jigao Development: Received 378 million yuan in debt exemption

- Role: Avoided turning negative before the “warning line” where net assets were only 43.87 million yuan

- Deep Logic: State-owned shareholders escort the transformation of listed companies

- Liquidity Pressure Eased: Reduce debt service expenses and improve cash flow.

- Financial Structure Optimized: Asset-liability ratio decreases, financial risk reduces.

- Probability of Shell Preservation Success Increases: Net assets may turn positive, avoiding delisting risk.

- Main Business Unimproved: Debt exemption does not solve the profitability problem of the tomato processing business.

- Non-Recurring Net Profit Still Negative: Reflects lack of competitiveness in core business.

- Dependence on External Support: State-owned enterprise exemption shows concern about the company’s independent operation ability.

-

Business Model Sustainability in Doubt

- Tomato processing industry is highly competitive, with generally low profit margins.

- The company has been losing money for years, indicating structural problems in the main business.

-

Refinancing Ability Constrained

- Even after removing ST status, historical losses still affect equity and debt financing costs.

- Need to prove business sustainability through sustained profitability.

-

Regulatory Arbitrage Risk

- Regulators remain vigilant about “year-end surprise debt exemption” [1].

- Similar operations may become more difficult in the future.

- State-Owned Enterprise Support: Two state-owned enterprises exempted debts, showing local state-owned assets’ willingness to support the company.

- Small Market Capitalization: 2.92 billion yuan market cap, relatively easy to transform or restructure.

- Large YTD Stock Price Increase: Market has partially expected shell preservation success.

- Weak Main Business: Non-recurring net profit continues to be negative, lacking core competitiveness.

- Regulatory Review Risk: Large-scale debt exemption may face inquiries from the exchange.

- Shell Preservation ≠ Transformation Success: Historical cases show that some ST companies still face operational difficulties after preserving their shell.

- High Volatility: 48.78% average annualized volatility indicates strong speculation and high risk.

| Dimension | Impact Degree | Explanation |

|---|---|---|

| Short-Term Shell Preservation | ★★★★☆ | Significantly increases the probability of net assets turning positive and removing ST status |

| Financial Health | ★★★☆☆ | Improves balance sheet but does not solve cash flow problems |

| Going Concern | ★★☆☆☆ | Main business profitability not improved, dependent on external support |

| Long-Term Value | ★★☆☆☆ | Lack of evidence of business transformation, limited investment value |

-

Prospect of Turning Losses Around and Removing ST Status: A debt exemption of over 100 million yuan willsignificantly increasethe probability of net assets turning positive and net profit being positive in 2025, and thesuccess rate of removing ST status will rise sharply to over 70%.

-

Going Concern Ability: Debt exemptioncannot solvethe fundamental problem of weak main business profitability. The company still faces challenges of business transformation or strategic adjustment.

-

Investment Value:

- Short-Term Trading Opportunity: Shell preservation expectations may continue to support the stock price.

- Medium-to-Long-Term Investment Value: Need to observe main business improvement; currentlynot recommended for medium-to-long-term holding.

- Risk Preference Recommendation: Only suitable for high-risk preference investors, and need to closely track the 2025 annual report audit opinion.

Investors should focus on the following time nodes and events:

- 2025 Annual Report Disclosure(before April 2026): Confirm whether net assets turn positive and the type of audit opinion.

- Exchange Inquiry Letter: Pay attention to inquiries about the commercial reasonableness of debt exemption.

- Business Transformation Progress: Whether new businesses or assets are introduced.

- Cash Flow Improvement: Whether operating cash flow turns positive.

[0] Jinling API Data - *ST Zhongji (000972.SZ) Financial Data, Stock Price Quotes, Technical Analysis

[1] Securities Times Network - 《保壳!300472,获赠不超3.3亿元现金资产+豁免…》 (https://www.stcn.com/article/detail/3560969.html)

[2] Titanium Media APP - 《3000万"急救"+1.3亿"抹账",*ST惠程惊险保壳后真考验才刚开始》 (https://finance.sina.com.cn/cj/2025-12-30/doc-inhequpe7084587.shtml)

[3] Shenzhen Stock Exchange - 《创业板上市公司自律监管指南第1号》 (https://wltp.cninfo.com.cn/static/finalpage/2025-04-25/1223718303.pdf)

[4] Securities Times Network - 《控股股东及关联方伸援手济高发展获3.78亿元债务豁免》 (https://www.stcn.com/article/detail/3563657.html)

[5] NetEase Account - 《重整之路彻底终结!*ST长药三年造假,退市终成"无解"局》 (https://www.163.com/dy/article/KHVRI75205118O92.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.