Investment Value Analysis of Junda Co., Ltd.'s Perovskite Battery Technology Breakthrough

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Junda Co., Ltd. (002865.SZ) has recently made significant progress in the perovskite battery field. The laboratory efficiency of its perovskite tandem battery has突破 32.08%, and on December 22, 2025, it signed a strategic cooperation agreement with Shangyi Optoelectronics to lay out the space energy application track [1][2]. This technology breakthrough marks a key step in the company’s transformation from a traditional photovoltaic battery manufacturer to an advanced energy solution provider.

| Indicator | Value | Evaluation |

|---|---|---|

| Current Stock Price | 53.63 CNY | High Volatility |

| Market Cap | 12.29 billion USD | Mid-sized Photovoltaic Enterprise |

| P/E Ratio | -26.30x | Loss-making State |

| ROE | -13.84% | Profitability Under Pressure |

| 2025 Q1-Q3 Revenue | 5.682 billion CNY | Considerable Scale |

| Net Profit Attributable to Parent Company | -419 million CNY | Facing Industry Cycle Pressure |

From the financial data, Junda Co., Ltd. is currently in the trough of the industry cycle. The negative net profit is mainly affected by the overall overcapacity and low price operation of the photovoltaic industry [0]. Notably, the company’s stock price has risen by 35.22% in the past month, indicating the market’s positive expectations for the perovskite technology breakthrough [0].

Junda Co., Ltd. has a global market share of 30% in the TOPCon battery field, with a strong industrialization foundation [2]. Its overseas sales account for over 50%, and it is advancing local capacity building in the North American market, forming a dual-drive model of “overseas localization + technology upgrade” [1][2].

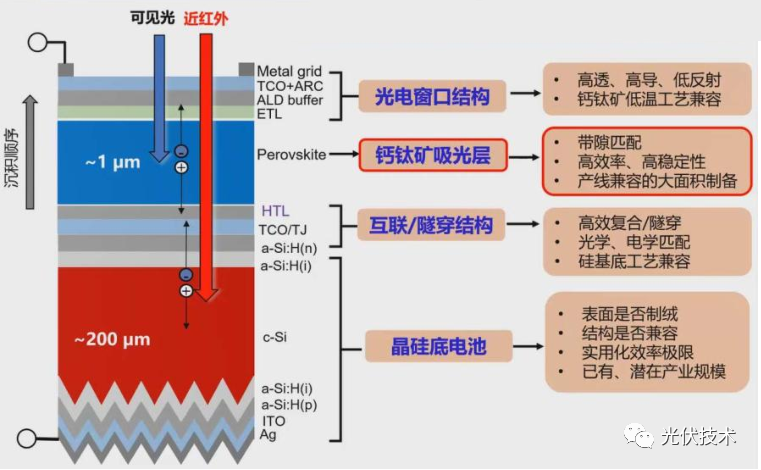

Perovskite batteries have significant technical advantages over traditional crystalline silicon batteries:

| Comparison Dimension | Crystalline Silicon Battery | Perovskite Battery |

|---|---|---|

| Theoretical Efficiency Limit | 27-29% | 30-33% |

| Current Laboratory Efficiency | 26.81% | 27.3% (single-junction) |

| Capacity Investment Intensity | 1 billion CNY/GW | 500 million-700 million CNY/GW |

| Potential Cost | High | Expected to drop below 0.5 CNY/W |

| Low-light Response | Average | Excellent |

| Application Scenarios | Mainly ground-based power stations | Covers BIPV, car roofs, space, etc. |

Junda Co., Ltd.'s laboratory efficiency of 32.08% is close to the theoretical limit of 33.7% for perovskite-crystalline silicon tandem batteries, demonstrating the company’s R&D strength in this cutting-edge technology field [1][3].

The cooperation with Shangyi Optoelectronics is of strategic significance. As a technology company with a Chinese Academy of Sciences background, Shangyi Optoelectronics has completed the first-principles verification of perovskite materials in extreme space environments and mastered key processes such as flexible film and radiation-resistant structure design [2]. The urgent demand for lightweight and high-efficiency power sources in low-orbit satellite constellations provides a historic opportunity for Chinese manufacturers with cost and performance advantages.

The gradual implementation of GW-level perovskite production lines in 2025 marks the approaching critical point of perovskite batteries from laboratory to mass production [3]. Soochow Securities predicts that perovskite capacity is expected to exceed 100 GW by 2030, and the module market size will approach 40 billion CNY [3].

| Enterprise | Technical Route | Efficiency Breakthrough | Industrialization Progress |

|---|---|---|---|

| Longi Green Energy | Crystalline Silicon-Perovskite Tandem | 34.85% | Continuous R&D |

| Junda Co., Ltd. | Perovskite Tandem | 32.08% | Commercialization Advancement |

| GCL Integrated | Perovskite | Layout of 1 GW Pilot Line | In Progress |

| Aiko Solar | ABC Battery + Perovskite | Silver-free Technology | 400% Shipment Growth |

The perovskite battery field shows a strong trend of “simultaneous progress in technological breakthroughs, industrial implementation, and supply chain autonomy” [4]. Among mainstream technical routes in 2025, the market share of perovskite will rapidly rise to 35%, forming a pattern of two mainstream technical routes developing side by side with TOPCon (45%) [5].

- Performance Pressure Risk: Current P/E is negative, net profit is in loss, and it is difficult to achieve performance reversal in the short term.

- Technology Implementation Uncertainty: Space photovoltaic is still in the pre-mass production stage, and the actual delivery rhythm needs to be observed.

- Industry Cycle Risk: The photovoltaic industry has overall overcapacity and low price operation.

- Technical Route Risk: The long-term stability of perovskite batteries still faces tests, and large-scale application has uncertainties.

- Technological Leading Position: The 32.08% laboratory efficiency is at the forefront of the industry.

- New Growth Curve: Space energy applications open up new market space.

- Global Layout: Overseas sales account for over 50%, with international competitive advantages.

- Valuation Repair Space: Perovskite technology breakthrough may drive valuation reconstruction.

| Dimension | Evaluation | Explanation |

|---|---|---|

| Short-term | Wait-and-see |

Performance is under pressure, need to wait for capacity release signals |

| Medium-term | Focus |

Perovskite mass production progress and space application orders |

| Long-term | Layout |

Technological leadership + new track positioning, has transformation potential |

Junda Co., Ltd.'s 32.08% laboratory efficiency breakthrough in perovskite batteries has important investment reference value. This breakthrough not only verifies the company’s R&D strength in the perovskite technology field, but more importantly, through strategic cooperation with Shangyi Optoelectronics, it has successfully positioned itself in the trillion-level new space energy track. If the company’s strategic transformation from “battery manufacturer” to “advanced energy solution provider” can be successfully implemented, it will reconstruct its competitive position in the global photovoltaic industry [2].

However, investors need to note that the company is currently in a loss-making state, and large-scale commercialization of perovskite batteries still takes time. It is recommended to take Junda Co., Ltd. as one of the long-term layout targets in the perovskite sector, while closely monitoring the progress of industry capacity clearance, the cost reduction progress of perovskite technology, and the landing of space photovoltaic orders.

[1] Caizhongshe - Junda Co., Ltd.: Signs Strategic Cooperation Agreement with Shangyi Optoelectronics to Promote Perovskite Battery Applications (https://m.caizhongshe.cn/news-7409036542608078050.html)

[2] East Money - Junda Co., Ltd. Cooperates with Shangyi Optoelectronics, 32% Efficiency Perovskite Battery Ignites New Space Energy Track (https://caifuhao.eastmoney.com/news/20251226131030012796760)

[3] Soochow Securities - GW Lines Gradually Land, Perovskite Industry Dawn Approaches (https://pdf.dfcfw.com/pdf/H3_AP202507021701784586_1.pdf)

[4] Securities Times - Listed Companies Compete to Lay Out Perovskite Battery Track (https://www.stcn.com/article/detail/3490324.html)

[5] Solarbe - Photovoltaic Industry Anti-involution: Structural Change from Scale Expansion to Value Deepening (https://www.solarbe.com/topics/66)

杰瑞股份(002353.SZ)估值分析报告

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.