Analysis of Liren Lizhuang's Strategic Transformation: From Tmall Dependence to Douyin Omnichannel Layout

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on collected data and market information, I analyze Liren Lizhuang’s strategic transformation as follows:

Liren Lizhuang (605136.SS) is a leading beauty e-commerce agency in China, mainly providing e-commerce agency services for international beauty brands. As of December 30, 2025, the company’s market capitalization is approximately 4.32 billion yuan, current stock price is 10.78 US dollars, and price-to-book ratio is 1.76x [0].

| Indicator | Value |

|---|---|

| Price-to-Earnings Ratio (P/E) | -130.44x (Loss) |

| Return on Equity (ROE) | -1.34% |

| Net Profit Margin | -1.97% |

| Current Ratio | 10.55 (Very Healthy) |

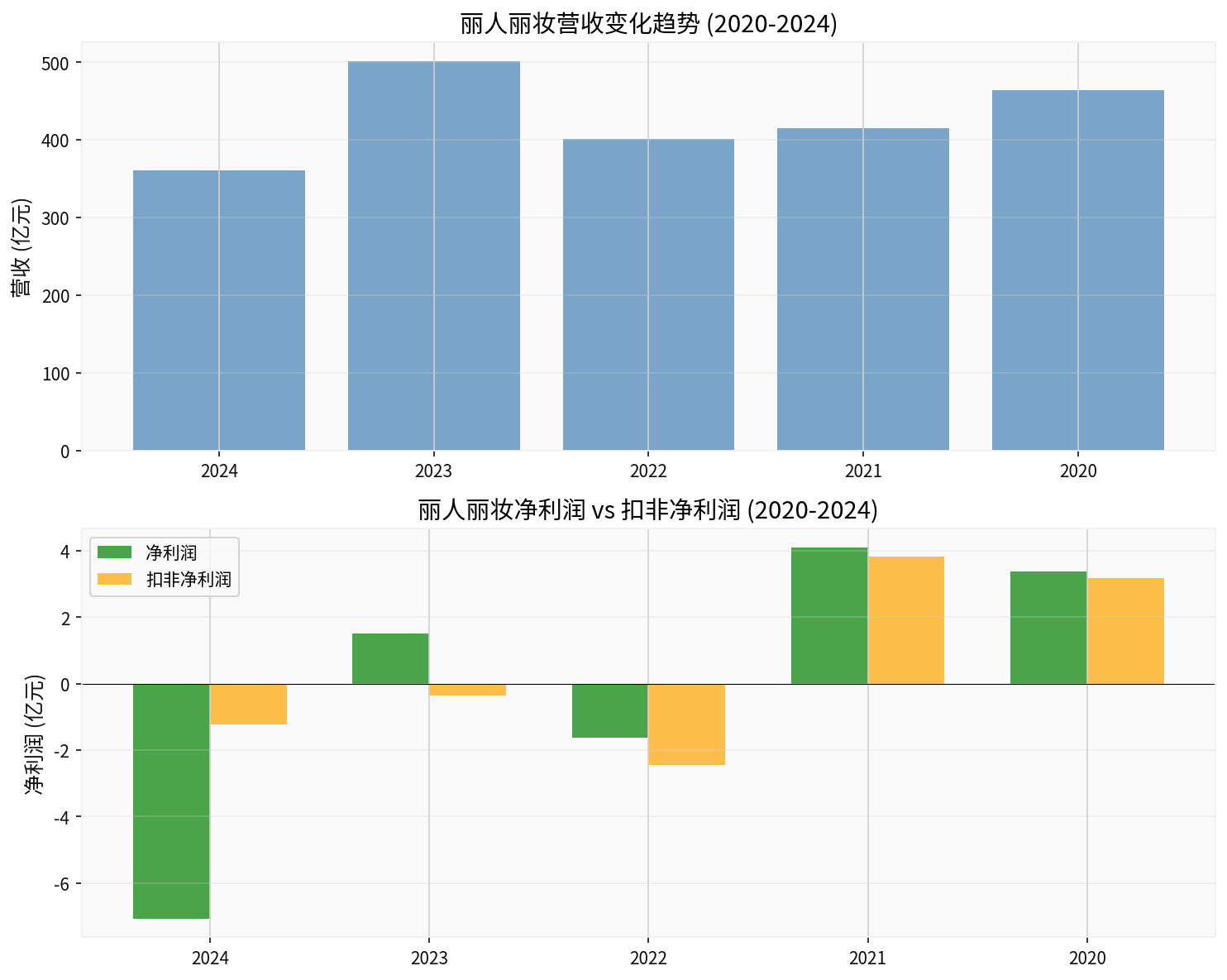

| Year | Operating Revenue | Net Profit | Non-Recurring Net Profit |

|---|---|---|---|

| 2024 | 360.95 | -7.08 | -1.24 |

| 2023 | 501.28 | 1.52 | -0.35 |

| 2022 | 401.24 | -1.63 | -2.45 |

| 2021 | 415.38 | 4.11 | 3.83 |

| 2020 | 464.21 | 3.39 | 3.17 |

From the table, it is clear that the company’s operating revenue declined from 46.4 billion yuan in 2020 to 36.1 billion yuan in 2024, a decrease of 22%. Non-recurring net profit even turned from a profit of 383 million yuan in 2021 to a loss of 124 million yuan in 2024, indicating a continuous deterioration in the profitability of the company’s core business [0].

Liren Lizhuang used to be highly dependent on the Alibaba ecosystem, and the Tmall platform was once the company’s main revenue source. However, with changes in the e-commerce traffic pattern, traditional platform e-commerce faces the following challenges:

- Fading traffic dividend: Customer acquisition costs on the Tmall platform continue to rise

- Intensified competition: Diversion by platforms such as JD.com and Pinduoduo

- Rise of live-streaming e-commerce: New channels like Douyin and Kuaishou are rapidly seizing market share

- Enhanced bargaining power of brands: Leading brands have begun to build their own e-commerce teams

Facing the bottleneck of the traditional model, Liren Lizhuang actively promotes a diversified channel strategy, focusing on Douyin e-commerce:

- Emerging channel revenue accounts for 36.5%: Marks a substantial progress in the company’s strategic transformation from single Tmall dependence to multi-platform collaboration

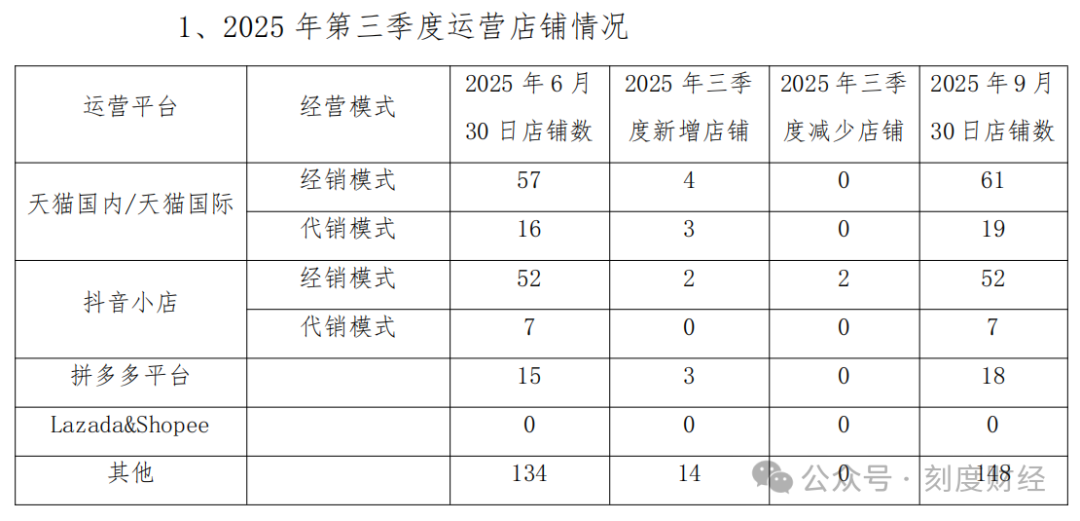

- Rapid growth in the number of Douyin-operated stores: Data from Q3 2025 shows that the number of stores operated by the company on the Douyin platform has formed an effective complement to Tmall

- Content e-commerce model fits the characteristics of beauty products: Beauty products are naturally suitable for live-streaming sales and short-video种草 (product recommendation via short videos), and Douyin’s traffic algorithm is conducive to the exposure of high-quality brands

- Optimized channel structure: Emerging channel share increased to 36.5%, reducing the risk of single platform dependence and enhancing risk resistance

- Traffic cost advantage: The traffic acquisition cost of Douyin e-commerce is relatively lower than that of Tmall, and it has social fission advantages

- Beauty category dividend: Douyin user profiles highly overlap with beauty consumer groups, resulting in high conversion efficiency

- Healthy cash flow: Current ratio of 10.55, sound financial position provides sufficient ammunition for the transformation

- Continuous loss pressure: Non-recurring net profit loss in 2024 was 124 million yuan, an expansion from the 35 million yuan loss in 2023, and the transformation has not yet improved profitability

- Gross margin pressure: Competition in emerging channels may lead to a decline in gross margin

- High operational capability requirements: Douyin e-commerce requires stronger content creation, influencer collaboration, and data operation capabilities

- Fierce industry competition: There are many competitors in the Douyin e-commerce track, including peers like YIWANGYICHUANG and RUOYUCHEN who are also actively布局

From the financial data, the company’s revenue decreased by 28% year-on-year in 2024, while non-recurring losses expanded, showing the pain period of “neither here nor there” during the transformation. Although the Douyin channel is growing rapidly, it may take longer to contribute substantial profits:

- Short term (1-2 years): Expected to remain in the investment period, non-recurring losses may continue, but the loss margin is expected to narrow

- Medium term (2-3 years): If the operational efficiency of the Douyin channel improves, it is expected to achieve break-even

- Long term (3-5 years): Depends on whether it can establish a differentiated competitive advantage in the Douyin ecosystem

- Current price-to-sales ratio (P/S) is about 0.12x, at a historical low

- Net profit is negative, traditional valuation methods are invalid, reference can be made to the price-to-book ratio of 1.76x

- Growth rate and gross margin change of Douyin channel revenue

- Stabilization of Tmall channel revenue

- Control of operating expense ratio

- Brand cooperation renewal status

- Policy regulatory risks in the e-commerce industry

- Risk of algorithm changes on the Douyin platform

- Risk of brand termination of cooperation

- Cash flow tension risk

Liren Lizhuang’s strategic transformation from Tmall to Douyin is an inevitable choice to respond to industry changes. The 36.5% share of emerging channel revenue indicates that the transformation has achieved phased results. However, from the reality of continuous non-recurring net profit losses, the transformation has not yet brought profit improvement. The company needs to establish sustainable profitability in the Douyin channel while controlling the investment rhythm during the transformation period.

[0] Jinling AI Broker API Data - Liren Lizhuang (605136.SS) Company Overview, Financial Analysis and Real-Time Market Quotes

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.