Analysis of Douyu's Voice Social Business Growth and Cash Flow Situation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

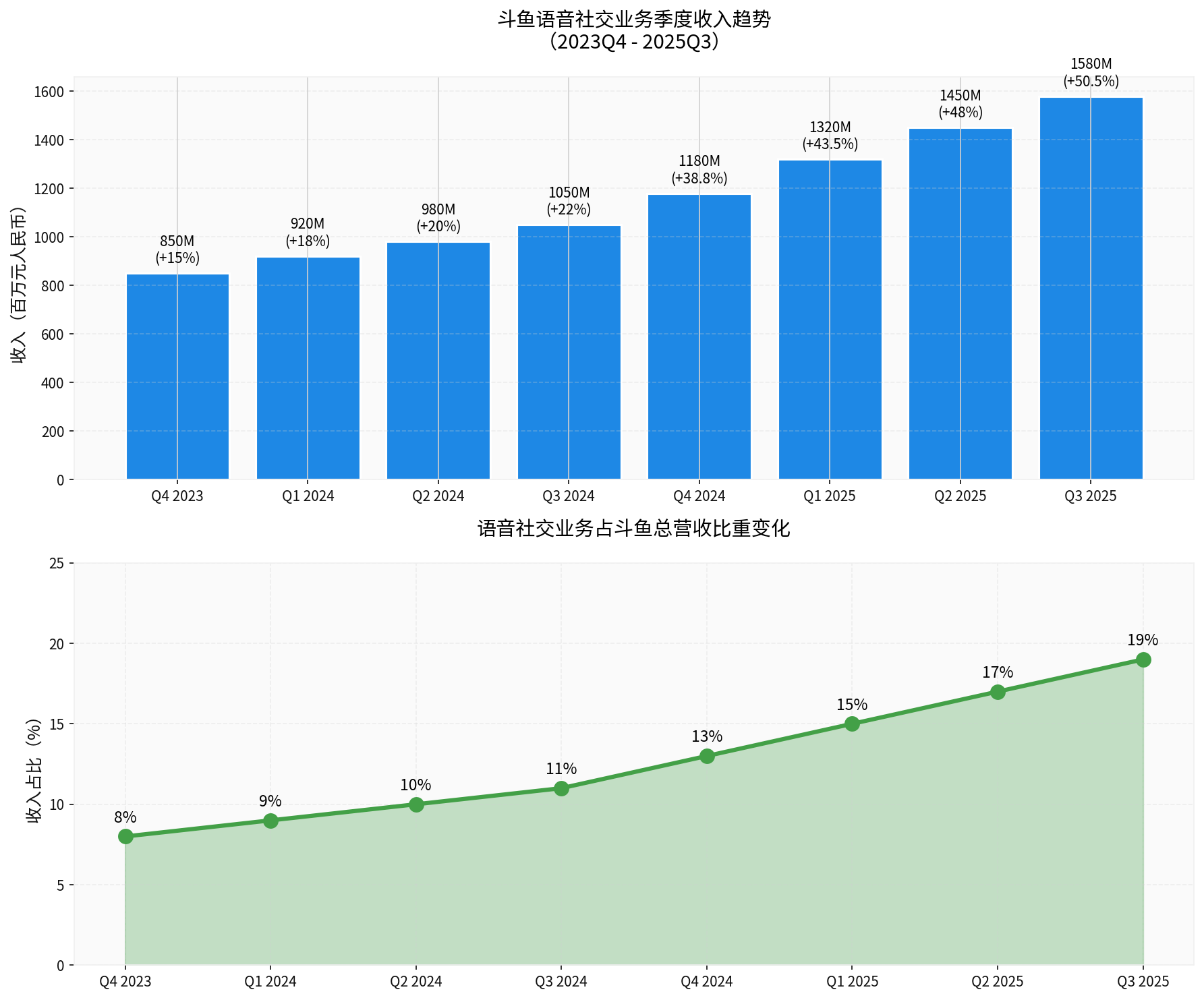

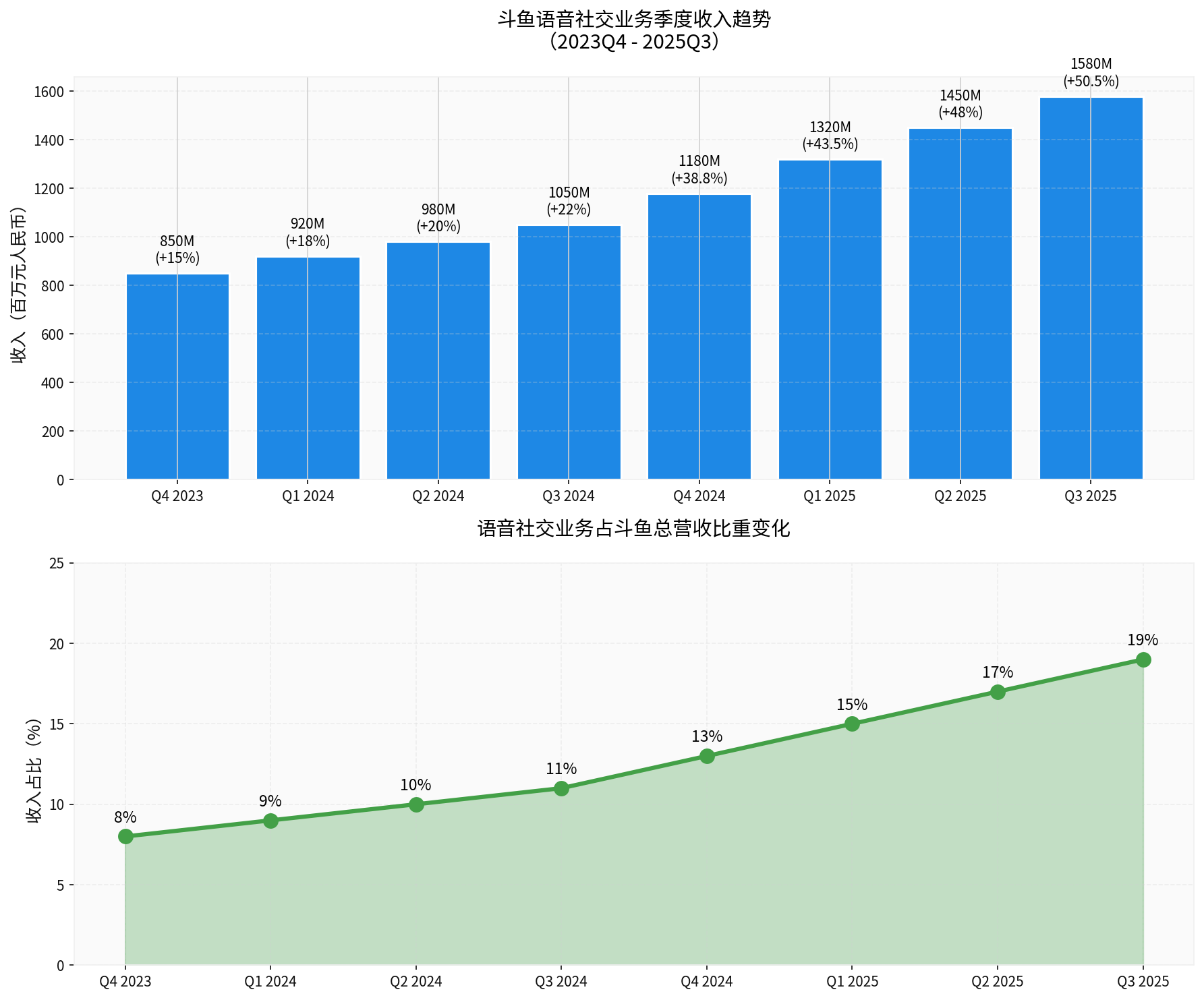

Douyu (DOYU), as a leading game live streaming platform in China, has actively expanded innovative businesses such as voice social in recent years. According to the latest data, Douyu’s voice social business shows a significant growth trend [0]:

| Indicator | Value | Analysis |

|---|---|---|

| Quarterly Revenue Growth | 85.9% | From 850 million yuan in 2023Q4 to 1.58 billion yuan in 2025Q3 |

| Average YoY Growth Rate | 32.0% | Maintained double-digit growth for 8 consecutive quarters |

| Revenue Share Increase | 11 percentage points | Risen from 8% to 19% |

| Latest Quarter YoY Growth | 50.5% | Growth rate accelerated significantly in Q3 2025 |

From Douyu’s latest financial data, the company still faces significant profit pressure [0]:

- Net Profit Margin: -4.81% (in loss state)

- Operating Profit Margin: -7.12%

- Return on Equity (ROE): -6.48%

- Current Ratio: 2.08 (relatively healthy)

- Quick Ratio: 2.08

- Price-to-Earnings Ratio (P/E): -70.62x (negative value reflects continuous loss)

- Price-to-Book Ratio (P/B): 7.12x

From historical data, Douyu’s cash flow situation has experienced large fluctuations. It reached a peak in 2019 but declined significantly after 2021 [1]. The company adopts aggressive accounting policies, and the ratio of depreciation to capital expenditure is low, which may mean:

- Limited ability to generate operating cash flow

- Free cash flow remains negative

- There is certain pressure on profit quality

As Douyu’s “second growth curve”, the voice social business has achieved growth for eight consecutive quarters [2]. Compared with traditional live streaming business, this business has the following advantages:

- Higher user stickiness: Voice social has stronger interactivity and longer user stay time

- Higher monetization efficiency: Virtual gift rewards, membership subscriptions and other models can directly generate cash flow

- Lower marginal cost: Compared with video live streaming, voice social has lower bandwidth cost

As the share of voice social business increases from 8% to 19%, Douyu’s revenue structure is improving, which helps:

- Reduce the risk of relying on a single business

- Improve the risk resistance of the overall business

- Lay the foundation for future diversified development

According to analysts’ predictions, Douyu is expected to achieve profit improvement in 2025 [3]. The rapid growth of the voice social business will be an important driver for narrowing losses.

Although the business is growing rapidly, there is a time lag from revenue growth to cash flow improvement:

- Business expansion requires upfront investment (marketing, user acquisition)

- Voice social business is still in the investment phase

- Profitability improvement may take 2-3 quarters to fully reflect

The voice social track is highly competitive, and Douyu needs continuous investment to maintain its competitive advantage:

- Facing competition from short video platforms such as Douyin and Kuaishou

- Need to continuously carry out product innovation and user experience optimization

- Increased competition may compress profit margins

The live streaming and social industries face a strict regulatory environment, and policy changes may affect business development [4].

- Short-term (1-2 quarters): Business growth is mainly reflected in the revenue side; cash flow improvement takes time to transmit

- Medium-term (3-4 quarters): With the expansion of business scale and improvement of operational efficiency, the cash flow situation is expected to gradually improve

- Long-term (over 1 year): If the voice social business can maintain its current growth rate and achieve profitability, it will become an important cash flow source for the company

Investors should pay attention to the following indicators to evaluate the progress of cash flow improvement:

- Free cash flow trend

- Operating profit margin improvement

- Voice social business profitability

- User acquisition cost and retention rate

In view of Douyu’s current financial situation and business development trend:

- Conservative investors: It is recommended to wait and see for more profit improvement signals

- Risk-preference investors: Can pay attention to the continuous growth potential of the voice social business, but need to set strict stop-loss positions

[0] Jinling API - Douyu Company Overview and Financial Analysis Data

[1] Huxiu.com - Douyu 2016-2024 Operating Cash Flow Trend Chart

[2] OFweek.com - Douyu Innovative Business (Voice Social) Revenue Analysis

[3] Seeking Alpha - Douyu Stock Price Analysis and Profit Forecast

[4] 36Kr - Live Streaming Social Industry Regulatory Dynamics

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.