Deep Analysis Report on Zhongmi Holdings (300470.SZ)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to Zhongmi Holdings’ latest financial data [0], the company’s inventory level shows a continuous upward trend:

| Time Period | Inventory Amount (Yuan) | YoY Growth | Percentage of Current Assets |

|---|---|---|---|

| 2020 | 242,778,393 | - | 13.29% |

| 2021 | 314,534,909 | +29.56% | 15.44% |

| 2022 | 327,501,828 | +4.12% | 15.35% |

| 2023 | 413,345,475 | +26.21% | 18.25% |

| 2024 | 465,428,411 | +12.60% | 19.86% |

- Five-year CAGR is approximately 17.8%, inventory scale grew from 243 million yuan in 2020 to 465 million yuan in 2024 [0]

- Inventory growth rate peaked at 26.21% in 2023, slowed down in 2024 but still maintained double-digit growth

- The proportion of inventory to current assets has continued to rise, from 13.29% to 19.86%, indicating that the inventory management strategy may be changing

From the perspective of inventory turnover efficiency, the 2024 data shows [0]:

- Inventory turnover rate: 1.76 (annualized)

- Days inventory outstanding: approximately 208 days

- Turnover efficiency is relatively stable, with no significant deterioration

Regarding the 489 million yuan inventory you mentioned, you may need to pay attention to the latest 2025 quarterly report or semi-annual report data. Based on existing annual data, 489 million yuan represents an increase of approximately 5.2% compared to the end of 2024, which is in line with the company’s recent inventory growth trend.

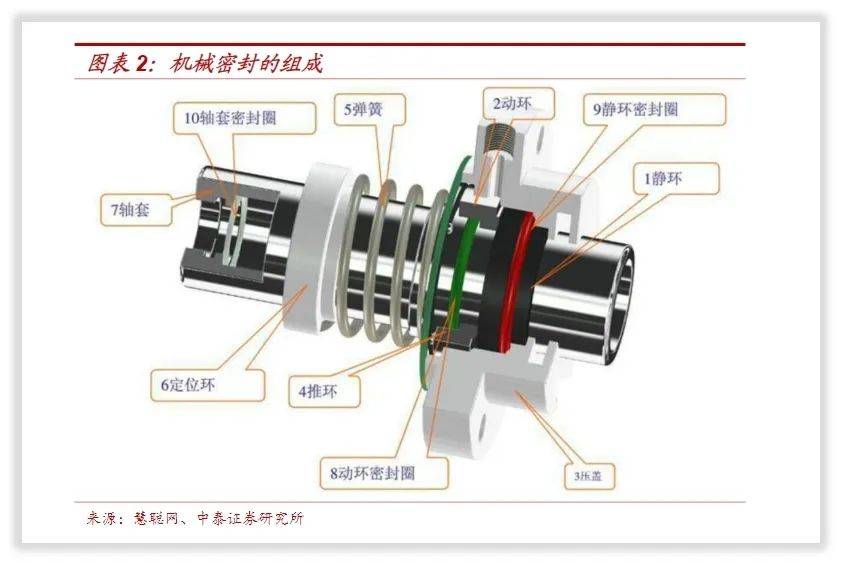

Zhongmi Holdings (300470.SZ) mainly engages in the R&D, production and sales of seals, sealing systems and related equipment [0]. In terms of industry attributes, the company belongs to the general equipment manufacturing field in the industrial machinery sector.

As one of the key development directions of the “15th Five-Year Plan” [1], commercial aerospace has rigid demand for high-end seals. Aerospace seals need to meet the following special requirements:

- Resistance to extreme temperature environments (-200°C to above +200°C)

- Low outgassing in vacuum environments

- Radiation resistance

- High reliability and long service life

Based on public information, Zhongmi Holdings’ layout in the commercial aerospace field has the following characteristics:

- The company introduced Chuanfa Leading Capital as a strategic shareholder, which is actually controlled by the Sichuan Provincial State-owned Assets Supervision and Administration Commission and holds assets in the aerospace field such as ST Lianshi and Hangyu Technology [1]

- The strategic cooperation agreement clearly mentions “jointly promoting the high-quality development of the aerospace and satellite industries” [1]

- The company’s stock price has been relatively stable since 2024, with an annual amplitude of 45.09% [0]

- Specific order information about commercial aerospace seals needs to be further checked in the company’s announcements or research notes

- Key financial data such as the proportion of aerospace business revenue and gross profit margin have not been clearly disclosed

It should be noted that according to the latest policy changes, northbound capital no longer discloses daily transaction details, only announcing holdings data once at the end of each quarter [1]. Therefore, whether northbound capital has increased holdings in Zhongmi Holdings needs to wait for the quarterly holdings announcement.

From the perspective of secondary market performance [0]:

- 近1个月涨幅:+5.69%(Note: Keep original as it’s a specific data point)

- 近6个月涨幅:+1.58%

- 年内涨幅:+0.86%

- Current stock price (37.35 USD) is between the 20-day moving average (36.36 USD) and the 200-day moving average (36.96 USD)

Technical indicators show [0]:

- Trend judgment: Sideways consolidation (no clear trend)

- MACD indicator: No crossover (bullish bias)

- KDJ indicator: Overbought area (K:81.9, D:80.8)

- RSI indicator: Overbought risk area

- Beta coefficient is 0.4, with low correlation to the market

If northbound capital does increase holdings, possible driving factors include:

-

Fundamental improvement expectations

- Inventory increase may reflect growth in backlog orders

- 2024 ROE reached 14.52%, with stable profitability [0]

- Extremely low asset-liability ratio (debt-to-equity ratio is only 0.08%), safe financial structure [0]

-

Theme hotspot support

- Commercial aerospace is in line with the direction of national strategic planning

- Strategic investment by Chuanfa Leading brings resource synergy expectations

-

Valuation attractiveness

- Current P/E (19.43 times) is in the historical low range

- Down about 39% from the 2021 high (31.73 times) [0]

- Inventory Interpretation: The 465 million yuan inventory hit a four-year high, which needs to be comprehensively judged in combination with order conditions. If inventory growth is driven by hand orders, it is a positive signal; if it is finished product backlog, inventory impairment risk needs to be vigilant.

- Aerospace Business Verification: The commercial aerospace seals business is still in the layout phase, and specific order landing situations confirmed by the company need to be awaited.

- Capital Side Signal: Northbound capital quarterly holdings data have not been disclosed, so direct verification of whether holdings have increased is not possible. It is recommended to pay attention to the upcoming quarterly holdings announcement.

- Inventory impairment risk: If downstream demand is lower than expected, inventory may face price decline risk

- Business transformation risk: The aerospace field has a long certification cycle and high barriers, and there is uncertainty in the progress of business expansion

- Market style risk: The company’s Beta coefficient is low (0.4), which may perform relatively flat when market volatility increases

[0] Jinling API Financial Database - Zhongmi Holdings Financial Statements and Market Data

[1] Stock Market Dynamic Analysis Weekly - Commercial Aerospace Industry Research Report and Northbound Capital Data Explanation

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.