In-depth Analysis of ST Baling (002592.SZ)'s Transaction to Transfer 36% Equity of Beijing Hongtian

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

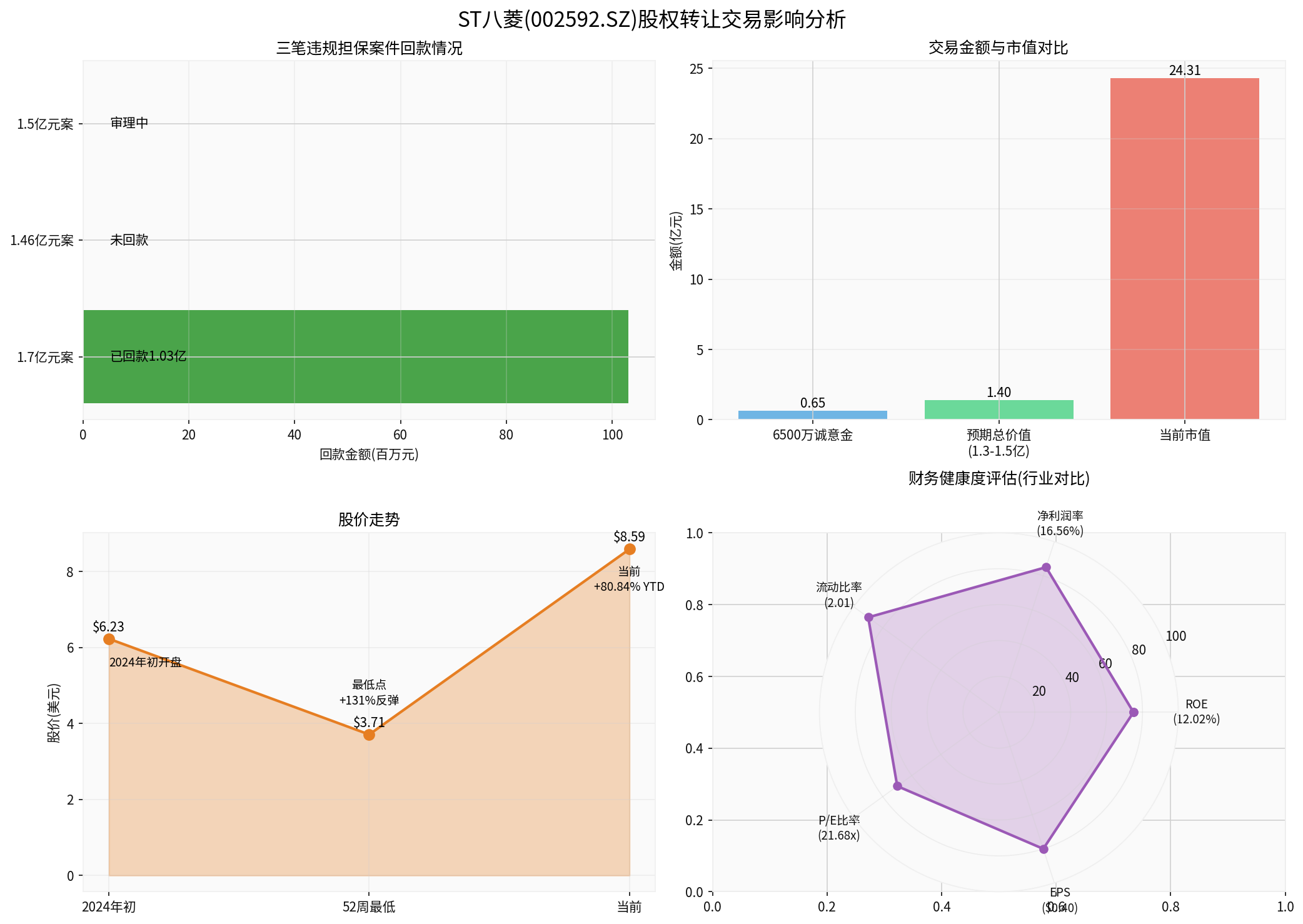

- Market Cap: $2.43 billion

- Current Stock Price: $8.59 (2025 increase: 80.84%)

- P/E Ratio: 21.68x

- ROE: 12.02%

- Net Profit Margin: 16.56%

- Current Ratio: 2.01

- EPS: $0.40

According to a Sina Finance report [1], on December 29, 2025, ST Baling signed the “Equity Transfer Framework Agreement” with Detianhou Company, Beijing Hongtian, Hainan Hongtian, and Wanhou Company:

| Item | Details |

|---|---|

Transaction Target |

36% Equity of Beijing Hongtian |

Transferee |

Detianhou Company |

Earnest Money |

RMB 65 million (to be paid within 3 days after signing the agreement) |

Final Consideration |

To be determined through negotiation |

Conditions for Determining Consideration |

After final judgments and fund recovery for the RMB 146 million and RMB 150 million cases |

| Case | Amount | Status | Impact on ST Removal |

|---|---|---|---|

| RMB 170 million case | RMB 170 million | Executed , RMB 103 million received [1] |

✓ Positive |

| RMB 146 million case | RMB 146 million | No execution funds received [1] |

✗ Negative |

| RMB 150 million case | RMB 150 million | Under trial , no judgment yet [1,7] |

? Uncertain |

The chart shows the fund recovery status of ST Baling’s three guarantee cases, comparison between transaction amount and market cap, stock price trend, and financial health assessment

According to the agreement, the RMB 65 million earnest money is

- ✓ Improve the company’s cash flow and balance sheet

- ✓ Reduce short-term financial pressure

- ✓ Demonstrate the company’s determination to resolve historical issues

- ✗ No direct increase in 2025 net profit

- ✗ No impact on current profit and loss statement performance

- ✗ The earnest money accounts for only about 2.67% of market cap, with relatively limited impact

The company’s stock price has performed strongly recently, with 4 daily limit-ups in 5 trading days [9], reflecting positive market sentiment toward this transaction:

- Investors believe this is an important step to resolve historical issues

- The market expects the total transaction value to reach RMB 130-150 million

- Expectations of ST removal are rising, driving valuation recovery

Assuming the final transaction consideration is RMB 130-150 million (estimated based on the recovery ratio of the RMB 170 million case):

| Indicator | RMB 65 million Earnest Money | Expected Total Value (RMB 140 million) |

|---|---|---|

| Market Cap Ratio | 2.67% | 5.76% |

| EPS Increase | RMB 0.23/share | RMB 0.49/share |

| EPS Contribution Rate | 57.5% (relative to current EPS) | 122.5% (relative to current EPS) |

According to Shenzhen Stock Exchange rules, companies designated as ST due to illegal guarantees can have the ST label removed if they meet:

- ✓ Illegal guarantee matters have been properly resolved or terminated

- ✓ Sound internal control system has been established

- ✓ Normal production and operation activities

- ✓ No other circumstances requiring ST designation

- Resolve Historical Burdens: Gradually divest assets related to illegal guarantees through equity transfer

- Optimize Asset Structure: Recovered funds can be invested in core business to enhance competitiveness

- Demonstrate Rectification Determination: Proactively handle historical issues, sending positive signals to regulators

- Improve Market Image: Eliminate uncertainties and boost investor confidence

Current (December 2025)

↓

Step 1: Resolve illegal guarantee issues [In progress]

├─ RMB 170 million case ✓ Resolved

├─ RMB 146 million case ✗ In progress

└─ RMB 150 million case ? Under trial

↓

Step 2: Improve internal control system [Partially completed]

└─ Company has strengthened risk management

↓

Step 3: Apply to exchange for ST removal [To be initiated]

└─ Submit application when conditions are met

↓

Step 4: Exchange review [Estimated 1-2 months]

└─ Regulator reviews application materials

↓

Step 5: Formal ST removal [Estimated mid-2026]

└─ Remove other risk warnings

| Time Node | Event | Probability |

|---|---|---|

| Q1 2026 | Progress in fund recovery for RMB 146 million case | Medium |

| Q2 2026 | First-instance judgment for RMB 150 million case | High |

| Q3 2026 | Submit ST removal application | Medium |

| Q4 2026 | Complete ST removal | Medium |

-

Uncertainty in Fund Recovery for the RMB 146 Million Case

- Currently no funds received [1]

- If no recovery, will directly affect transaction consideration

- May affect stability of the RMB 170 million case judgment

-

Judgment Result of the RMB 150 Million Case

- Validity of guarantee contract [7]

- If lose the case, company needs to bear guarantee liability

- May face large compensation risk

-

Uncertainty in Determining Transaction Consideration

- Final consideration to be negotiated after judgments of the two cases [1]

- May be lower than market expectations

- Risk of transaction failure exists

-

Earnest Money Not Included in 2025 Profit and Loss

- No short-term improvement in profit statement

- Market may be disappointed

-

ST Removal Approval Time

- Exchange review cycle has uncertainty

- May be longer than expected

| Valuation Indicator | Value | Industry Comparison | Assessment |

|---|---|---|---|

| P/E Ratio | 21.68x | - | Moderate |

| P/B Ratio | 2.48x | - | Reasonable |

| ROE | 12.02% | Mechanical industry average ~10% | Good |

| Net Profit Margin | 16.56% | Industry average ~8% | Excellent |

Assuming ST removal is successful:

- Valuation Increase: ST label removed, valuation expected to return to industry average

- Liquidity Improvement: Institutional investor restrictions lifted, shareholder structure optimized

- Stock Price Catalyst: ST removal usually leads to short-term stock price increase

| Scenario | Stock Price Target | Probability | Potential Return |

|---|---|---|---|

| Optimistic | $12-15 | 30% | +40%-75% |

| Baseline | $9-11 | 50% | +5%-28% |

| Pessimistic | $5-7 | 20% | -42%-19% |

- ✓ Yes, but to a limited extent

- Short-term: Cash flow improved, but no impact on profit statement

- Medium-to-long-term: If all cases are properly resolved, total transaction value of RMB130-150 million will significantly improve financial condition

- Core business itself is healthy; this transaction mainly resolves historical burdens

- ✓ Yes, it’s an important step but not a sufficient condition

- Positive factors: Demonstrate rectification determination, resolve RMB170 million case

- Key obstacles: Still need to resolve RMB146 million and RMB150 million cases

- Expected time: Earliest mid-2026, latest 2027

- ✓ Consider appropriate allocation to pursue ST removal gains

- Suggestion: Build positions in batches, control position size

- Stop-loss level: $7.00 (break below 20-day moving average)

- ⚠ Suggest wait-and-see, wait for more certain signals

- Focus on nodes: Judgment result of RMB150 million case, execution progress of RMB146 million case

- Best entry point: After formal submission of ST removal application

-

Short-term (1-3 months):

- Arrival status of RMB65 million earnest money

- First-instance judgment of RMB150 million case

- Frequency of company announcement updates

-

Medium-term (3-6 months):

- Execution progress of RMB146 million case

- Signing of formal equity transfer agreement

- Improvement of internal control system

-

Long-term (6-12 months):

- Submission time of ST removal application

- Exchange review progress

- Sustainability of core business growth

[0] Gilin API Data - ST Baling (002592.SZ) financial data, market data, technical analysis

[1] Sina Finance - “ST Baling (002592.SZ): Signs Equity Transfer Framework Agreement” (2025-12-30)

https://finance.sina.com.cn/stock/bxjj/2025-12-30/doc-inhequph9494235.shtml

[6] Lixinger - ST Baling (002592) Announcement Information

https://www.lixinger.com/equity/company/detail/sz/002592/2592/announcement

[7] Xueqiu - “ST Baling (SZ002592) Stock Price”

https://xueqiu.com/S/SZ002592

[9] 36Kr - “ST Baling Hits 4 Daily Limits in 5 Days: Plans to Transfer 36% Equity of Beijing Hongtian” (2025-12-30)

https://www.36kr.com/newsflashes/3617950030660616

立方制药美沙拉秦肠溶片MAH转让战略及财务影响分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.