Impact Assessment of Rising Aluminum Prices on Profitability of Automotive Aluminum Die Casting Enterprises

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Now I will provide you with a comprehensive assessment report based on all collected data and model analysis:

According to the latest data, the Shanghai Aluminum Futures price rose from

- Supply rigidity constraints: The domestic electrolytic aluminum production capacity ceiling is locked at around 45 million tons, with a net increase of only 200,000 tons in 2025 [1]

- Demand structure upgrading: Strong demand from new energy vehicles, photovoltaics, power grid investment and other fields, with global electrolytic aluminum demand growing by 6% in 2025 [2]

- Cost support strengthening: Rising electricity costs have pushed the production cost line up to around 20,000 CNY/ton [2]

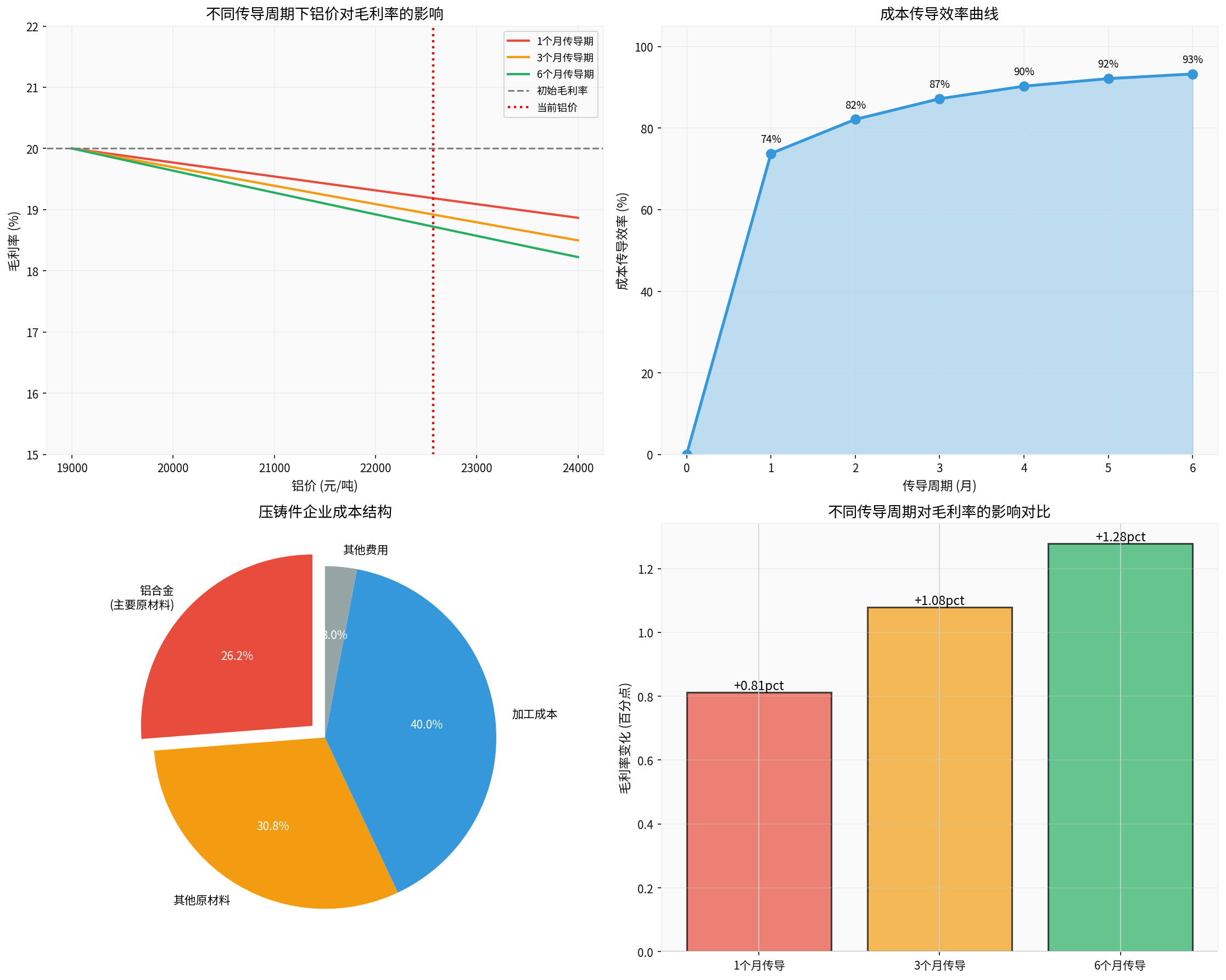

Based on industry listed company data, the typical cost structure of automotive aluminum die casting enterprises is as follows:

- Raw material cost: Accounts for55-58%of main business costs (of which aluminum alloy accounts for about 46%)

- Processing cost: Accounts for about40%(including labor, manufacturing expenses, etc.)

- Other expenses: Accounts for about3%

According to responses from multiple listed companies (Rongtai Co., Ltd., Aike Di Co., Ltd., Wencan Co., Ltd.), the industry generally adopts a

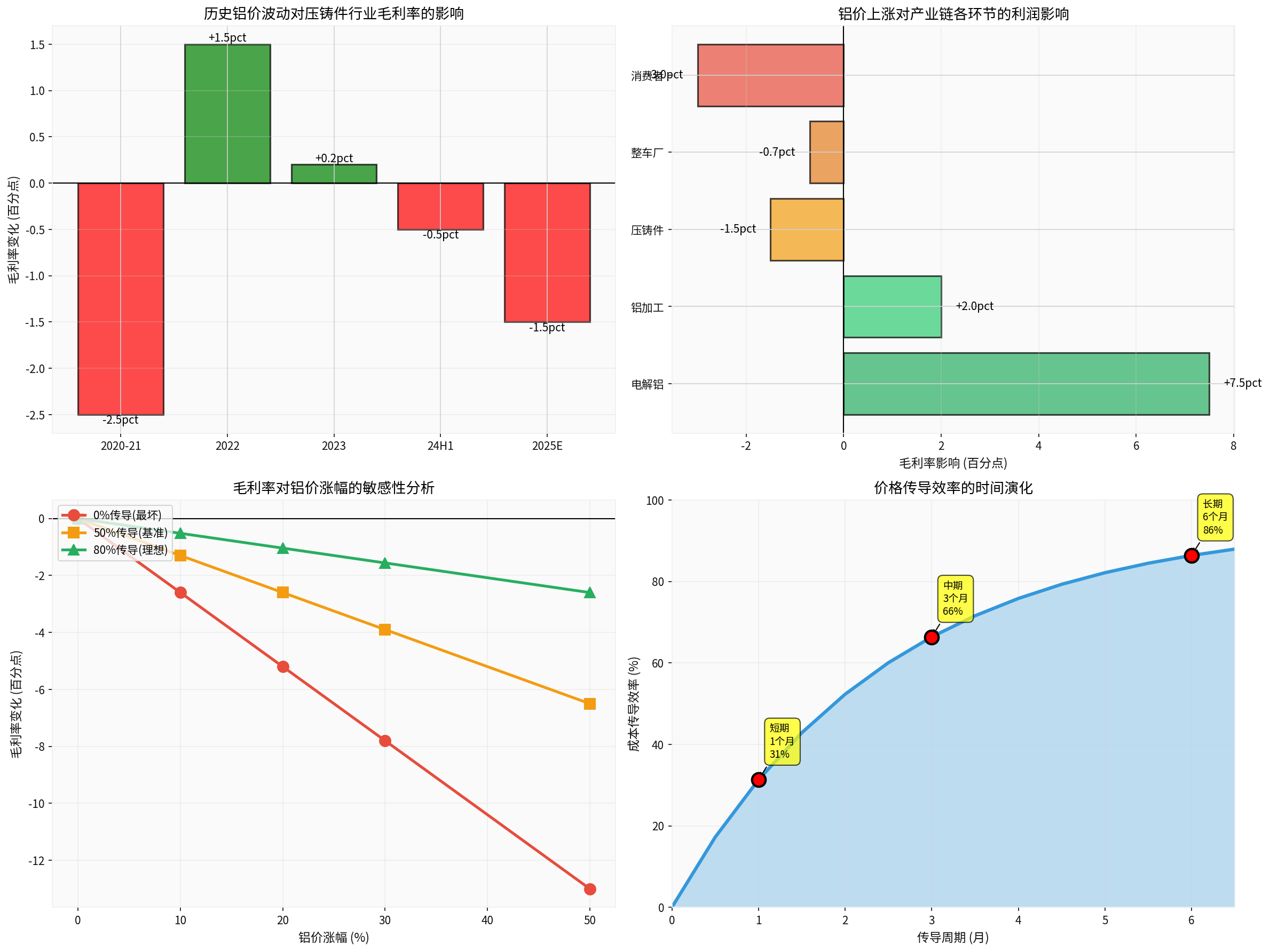

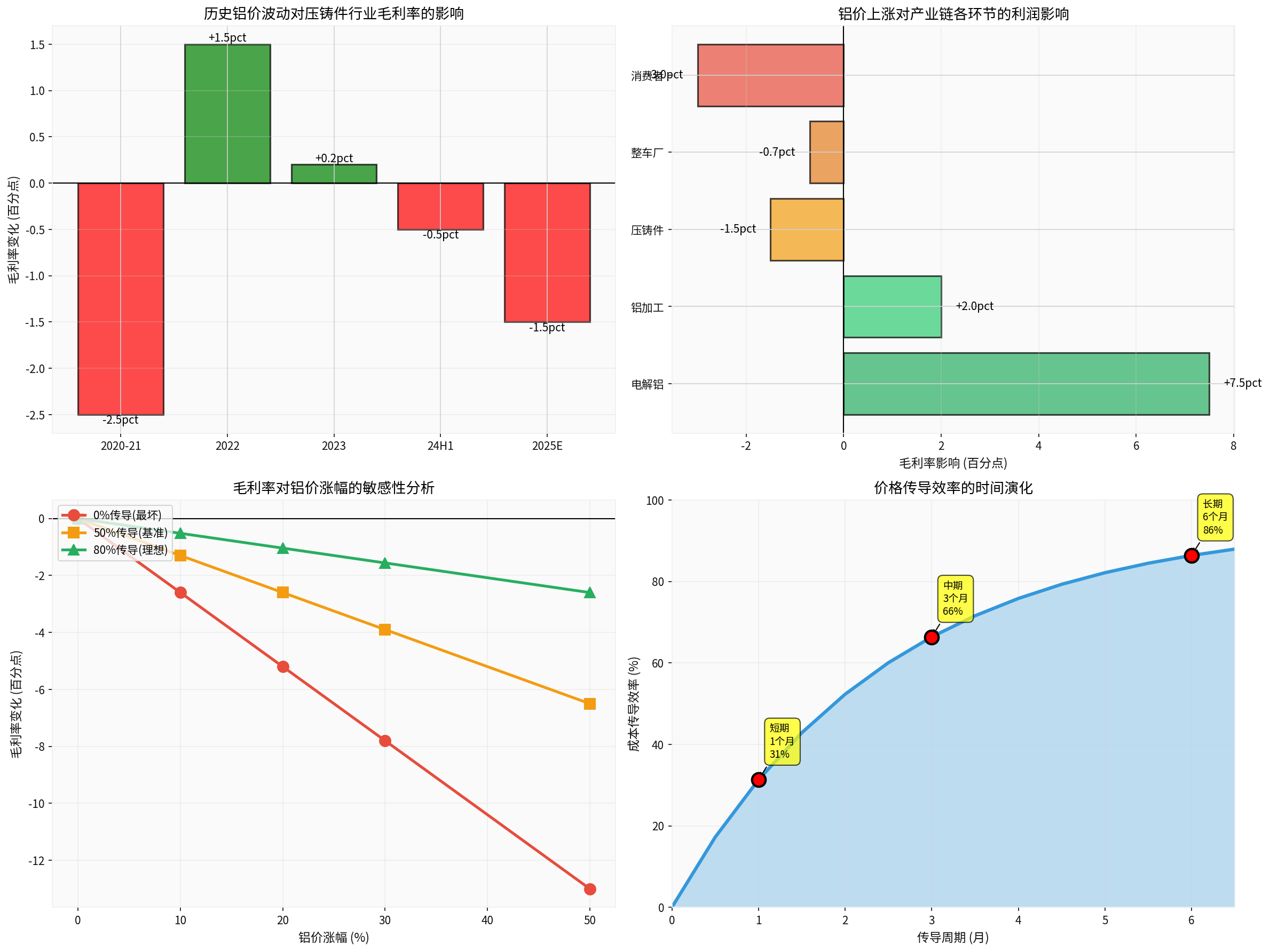

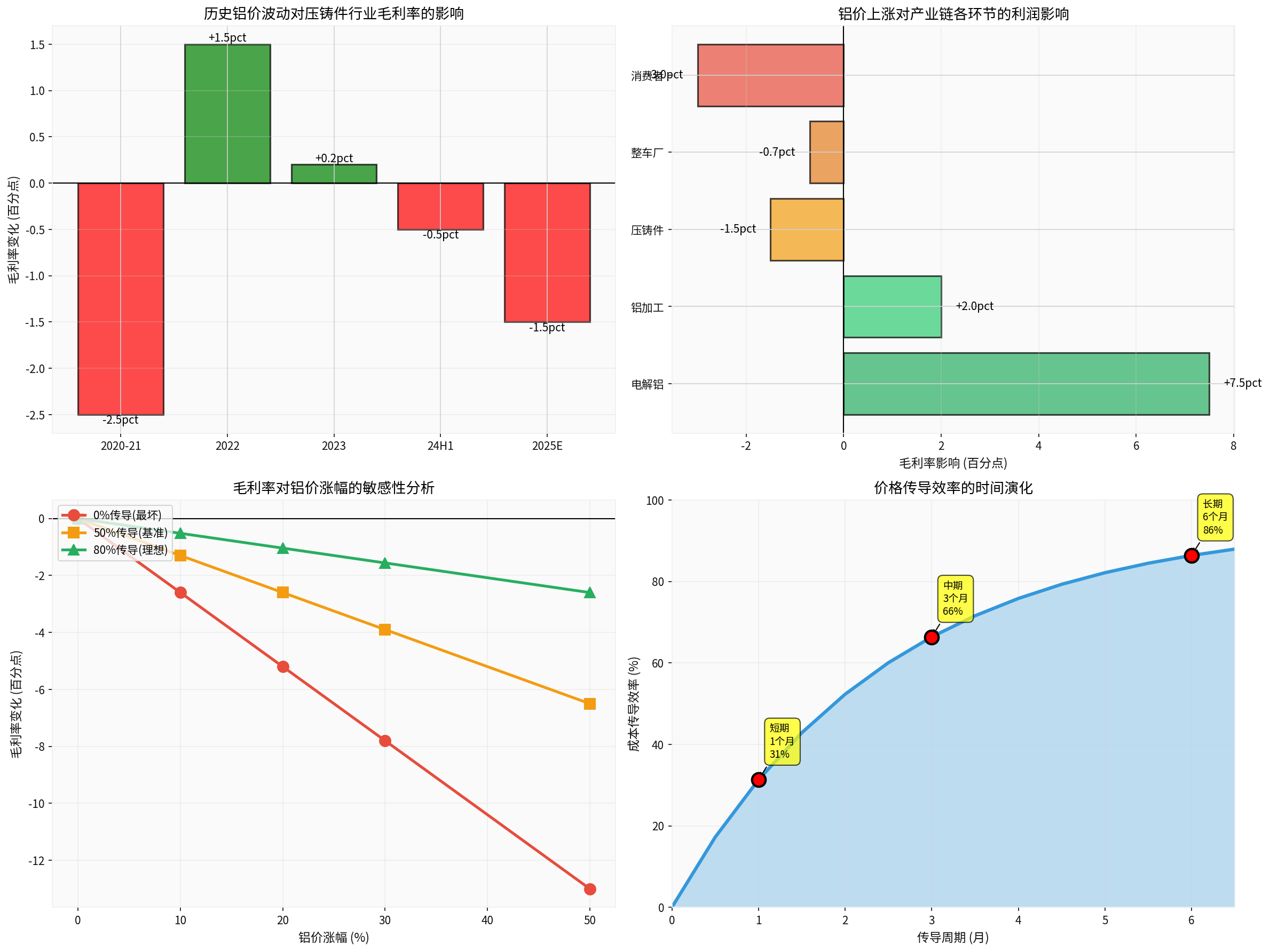

| Transmission Cycle | Transmission Efficiency | Impact Degree | Applicable Scenario |

|---|---|---|---|

1 Month (Short-term) |

60% | Obvious pressure on gross profit margin | Early stage of rapid aluminum price rise |

3 Months (Mid-term) |

80% | Most costs can be passed on | Normal transmission cycle |

6 Months (Long-term) |

95%+ | Nearly full pass-through | After full transmission |

- ✓ Dispersed customers, strong stickiness (weak bargaining power)

- ✓ High technical content of products, weak substitutability

- ✓ As core suppliers, high market share

- ✓ Clear price linkage clauses in contracts

- ✗ High customer concentration, strong bargaining power

- ✗ Standardized products, strong substitutability

- ✗ Fierce market competition, serious homogenization

- ✗ Fixed price contracts, long transmission cycle

Based on model analysis (assuming initial gross profit margin of 20-22%, aluminum cost ratio of 26%):

| Transmission Cycle | Cost Increase | Price Adjustment | New Gross Profit Margin | Change in Gross Profit Margin |

|---|---|---|---|---|

1 Month |

+562 CNY/ton | +393 CNY/ton | 19.2% | -0.8pct |

3 Months |

+749 CNY/ton | +524 CNY/ton | 18.9% | -1.1pct |

6 Months |

+889 CNY/ton | +622 CNY/ton | 18.7% | -1.3pct |

- Short-term Impact: Gross profit margin drops by0.8-1.3 percentage points

- Long-term Impact: After transmission is completed, gross profit margin basically returns to near the initial level

- Actual Impact: Between the two, depending on the transmission progress

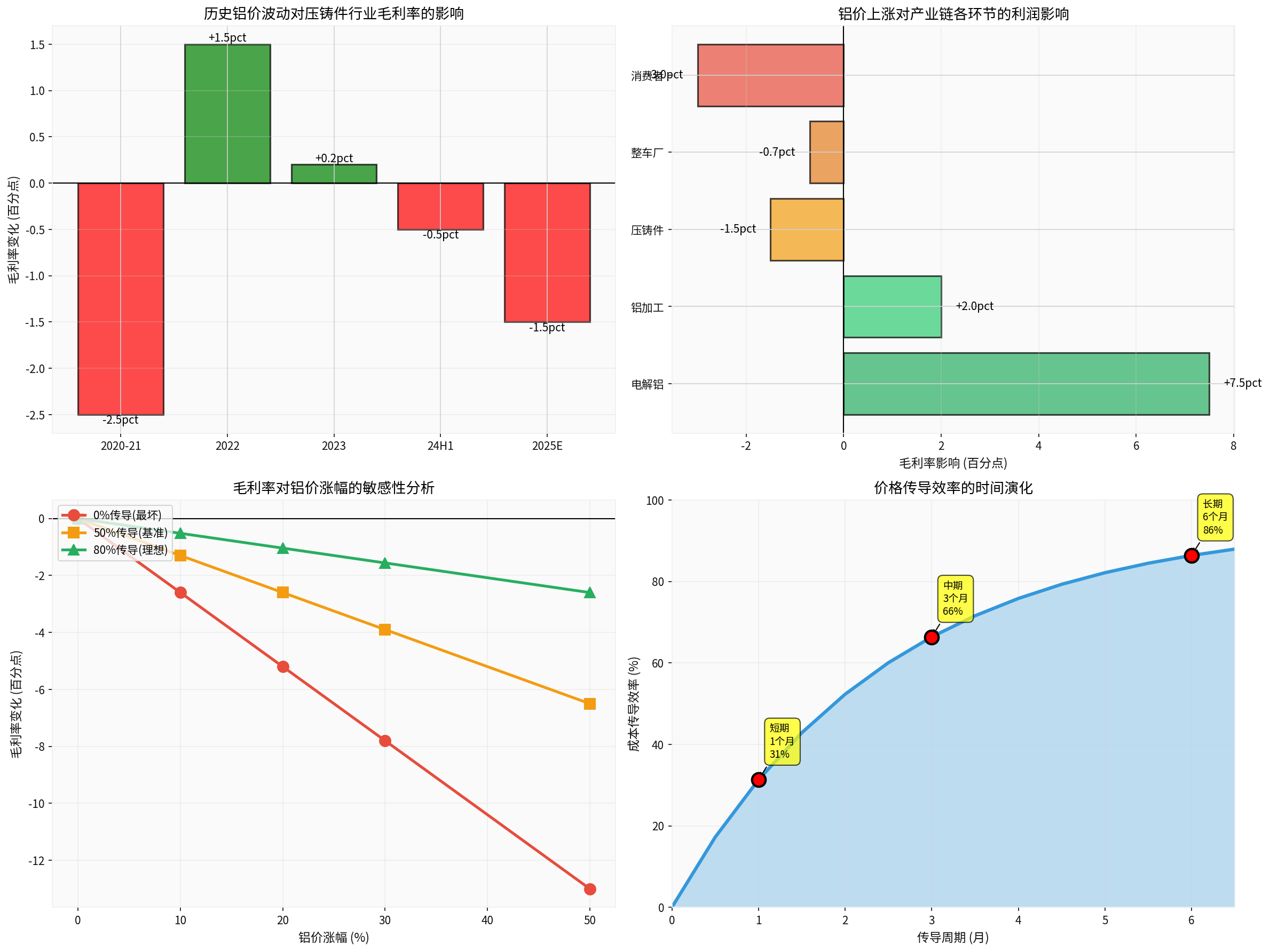

| Aluminum Price Increase | 0% Transmission (Worst) | 50% Transmission (Benchmark) | 80% Transmission (Ideal) |

|---|---|---|---|

+10% |

-2.6pct | -1.3pct | -0.5pct |

+20% (Current) |

-5.2pct | -2.6pct | -1.0pct |

+30% |

-7.8pct | -3.9pct | -1.6pct |

+50% |

-13.0pct | -6.5pct | -2.6pct |

- Even in the worst case (0% transmission), a 20% rise in aluminum prices leads to a gross profit margin drop of about 5 percentage points

- In the benchmark case (50% transmission), the gross profit margin drops by about 2.6 percentage points

- In the ideal case (80% transmission), the gross profit margin drops by only about 1.0 percentage point

| Time Period | Aluminum Price Trend | Change in Industry Average Gross Profit Margin | Transmission Effect |

|---|---|---|---|

2020-2021 |

14,000 → 20,000 CNY/ton (+43%) | Down 2-3pct |

Lagged 3-6 months transmission |

2022 |

20,000 → 18,000 CNY/ton (-10%) | Up 1-2pct |

Sufficient transmission |

2023 |

18,000 →19,000 CNY/ton (+6%) | Basically flat |

Sufficient transmission |

2024H1 |

19,000 →20,000 CNY/ton (+5%) | Slightly down 0.5pct |

Smooth transmission |

2025 YTD |

19,000 →22,000 CNY/ton (+16%) | Expected down 1-2pct |

Transmission in progress |

- Electrolytic aluminum producers: Gross profit margin increases by5-10 percentage points(largest beneficiary)

- Aluminum processing enterprises: Gross profit margin increases by1-3 percentage points(partial beneficiary)

- Die casting enterprises: Gross profit margin drops by1-2 percentage points(depending on transmission efficiency)

- Vehicle manufacturers: Cost pressure, gross profit margin drops by0.5-1 percentage point

- Consumers: Increased car purchase cost

- ✓ The industry generally has a price linkage mechanism, with clear transmission paths

- ✓ The 3-6 month transmission cycle is relatively reasonable, and the lag time is controllable

- ✓ Long-term (6+ months) transmission efficiency can reach 95%+, basically realizing cost pass-through

- ✓ Downstream demand is not affected currently, and the transmission environment is good

- ✗ Short-term (1-3 months) transmission efficiency is only 60-80%, with profit pressure

- ✗ Differences in customer bargaining power lead to differentiated transmission efficiency

- ✗ Transmission difficulty increases when demand is weak

- Gross profit margin drops by 0.8-1.3 percentage points

- Financial statements show short-term pressure

- Gross profit margin gradually recovers

- Cost transmission accelerates

- Gross profit margin returns to normal level

- Price linkage mechanism plays a hedging role

- Pay attention to the risk of continued rapid rise in aluminum prices

- Prefer leading enterprises with strong customer stickiness and high proportion of high-end products

- Avoid enterprises with high customer concentration and serious product homogenization

- The trend of lightweight new energy vehicles remains unchanged, and die casting demand growth is certain

- Leading enterprises’ market share increases, and the strong remain strong

- Technological upgrading (integrated die casting, large-scale die casting) improves valuation levels

- Financial Indicators: Quarterly环比 change in gross profit margin, inventory turnover days, accounts receivable turnover rate

- Business Indicators: New order acquisition speed, price transmission completion degree, customer structure change

- Industry Indicators: Shanghai Aluminum Futures price trend, downstream vehicle sales, die casting export data

- ⚠️ Lower-than-expected acceptance by downstream customers

- ⚠️ Transmission cycle longer than expected

- ⚠️ Order loss risk

- ⚠️ Vehicle sales lower than expected

- ⚠️ New energy vehicle penetration rate slows down

- ⚠️ Macroeconomic downturn

- ⚠️ Industry overcapacity

- ⚠️ Price war

- ⚠️ Impact of new entrants

- Short-term (1-3 months): The negative impact of rising aluminum prices on gross profit margin is about-0.8 to -1.3 percentage points, requiring enterprises to respond through inventory management, production efficiency improvement, etc.

- Mid-term (3-6 months): As price transmission gradually completes, the impact on gross profit margin narrows to-0.5 to -1.0 percentage points

- Long-term (6+ months): Transmission efficiency reaches over 95%, cost pressure is basically passed on, and gross profit margin returns to normal level

[0] Gilin API Data - Aluminum Price, Cost Structure, Financial Analysis Model

[1] Sina Finance -

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.