In-depth Analysis of Permanent TSB Stock Trading Activities and the Investment Value of the Irish Banking Sector

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to regulatory filings, J&E Davy Unlimited Company, acting as an exempt principal trader, conducted the following transactions on Permanent TSB Group Holdings PLC (PTSB) on

| Transaction Type | Number of Shares | Price Range (EUR) |

|---|---|---|

Buy |

194,522 shares | €2.75 - €2.82 |

Sell |

292,221 shares | €2.799 - €2.82 |

Net Sell |

97,699 shares | - |

- The transaction price was within PTSB’s daily trading range (€2.78-€2.83), reflecting normal market pricing mechanisms [0]

- Net sell of approximately 97,700 shares, but the proportion relative to PTSB’s total share capital (about 545 million shares) is extremely small (about 0.018%), which will not cause substantial pressure on the stock price [1][2]

- As an operation of a ‘customer service’ nature, such transactions more reflect the liquidity provision function of market makers rather than a change in investment views [1]

| Indicator | Value |

|---|---|

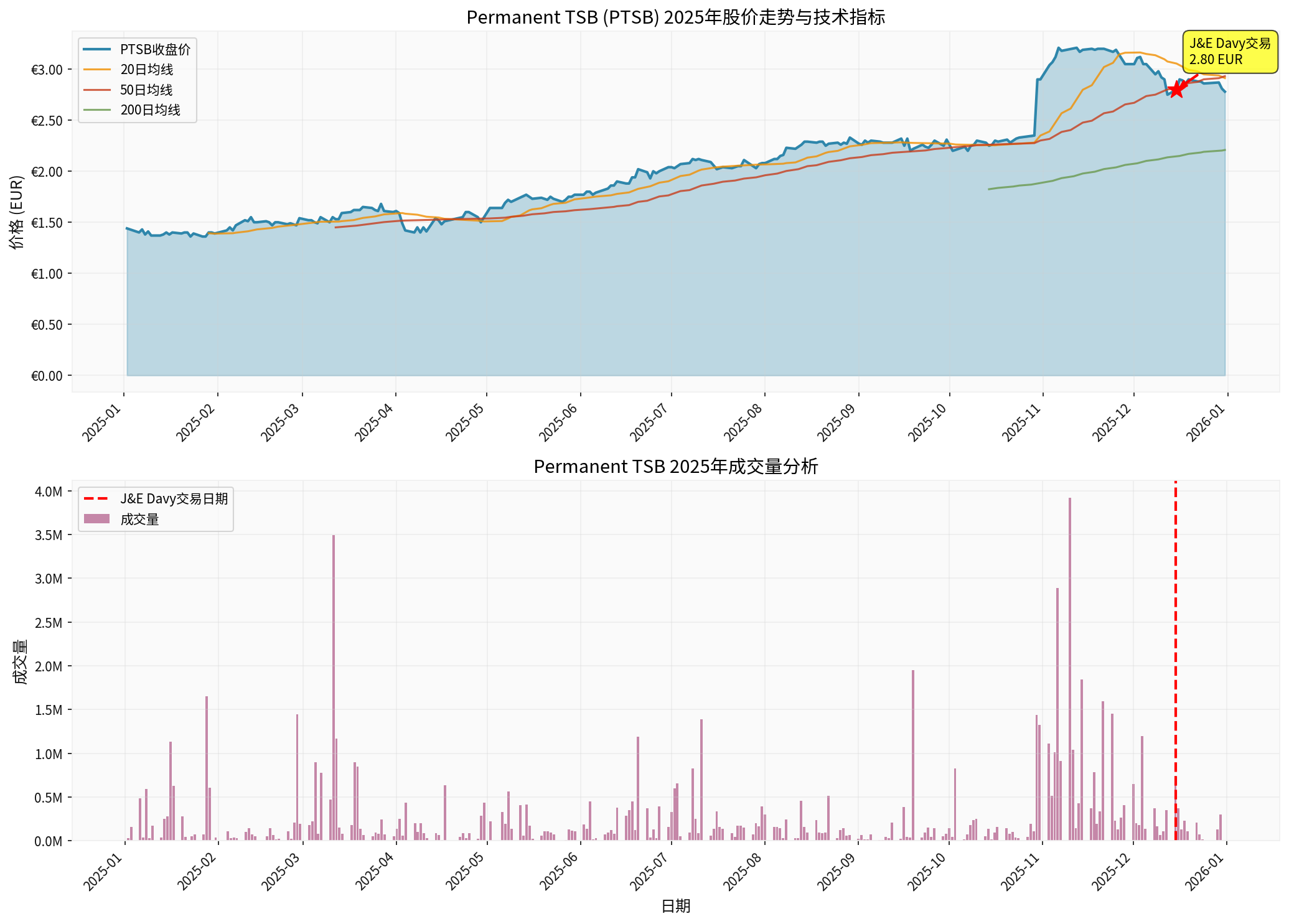

| Price at the start of the year | €1.44 |

| Price at the end of the year | €2.78 |

| Annual increase | +93.06% |

| Highest price during the period | €3.21 (early December 2025) |

| Lowest price during the period | €1.36 (February 2025) |

| Price fluctuation range | 136.03% |

| Average daily trading volume | 299,285 shares |

| Total market capitalization | €1.52 billion |

- 20-day moving average (€2.91): The current stock price (€2.78) is slightly below the short-term average, indicating some short-term technical correction pressure [0]

- 50-day moving average (€2.93): Also above the current price, indicating signs of slowing in the medium-term trend [0]

- 200-day moving average (€2.21): The long-term average is significantly below the current price, confirming that the long-term upward trend remains intact [0]

- The stock price rose strongly from €1.44 at the start of the year to a high of €3.21 in early December, with a technical correction after an increase of over 120%

- A pullback of about 13% from the high is a normal technical profit-taking

- Trading volume was relatively moderate around December 15 (2,326 shares), far below the average daily level, indicating limited market impact on that trading day [0]

2025 was a historic year for Irish bank stocks, with the entire sector delivering impressive performance [3]:

| Bank | Annual Increase (as of December 18) |

|---|---|

| PTSB | +93.06% |

| AIB | +77% |

| Bank of Ireland | Similar strong performance |

- Macroeconomic ‘sweet spot’: The Irish economy shows resilience, and the interest rate environment is favorable for banks’ net interest margins [3]

- Improved profitability: High interest rate policies drive growth in net interest income and improve asset quality

- Capital return initiation: AIB resumed interim dividends in 2025, marking the industry’s return to normalization [3][4]

- Wealth management growth: RBC Capital Markets points out that Irish household wealth will expand for a decade, with banks being the main beneficiaries [5]

- Wellington Management disclosed a shareholding ratio of 7.52% [1]

- FMR LLC and FIL Limited hold a combined 4.51% stake [1]

- Private equity firms Sretaw and Hunters Moon Capital continued to increase their holdings in December 2025 [2]

- Goodbody (a subsidiary of AIB) gave a target price of 423 euro cents(currently about 290 euro cents), implying significant upside potential [2]

- Autonomous Research estimates that acquiring PTSB for €1.7 billion (about 306 euro cents per share) could bring a 25.5% return on investment to the acquirer (such as Austria’s BAWAG) [2]

- Below the Irish government’s ‘break-even’ price (391 euro cents) and Goodbody’s target price (423 euro cents), indicating possible room for value revaluation [2]

- Liquidity provision role: As an exempt principal trader, J&E Davy’s main responsibility is to provide liquidity to the market; buying and selling are normal market-making behaviors [1]

- Extremely small net sell size: A net sell of less than 100,000 shares accounts for a negligible proportion of free float and will not cause a substantial impact on the market

- Stable transaction price: The buying and selling price ranges overlap highly (€2.75-€2.82), reflecting market recognition of this price range [1]

- Significance of timing: The transaction occurred in mid-December, during the year-end institutional position adjustment period, and may be part of normal portfolio rebalancing

- Other institutions (such as Goldman Sachs) bought PTSB shares on December 29 during the same period [1]

- Multiple institutions continued to increase their holdings in December, showing confidence from long-term investors

- Market expectations for potential acquisitions may provide support for the stock price

| Indicator | PTSB Value | Industry Comparison |

|---|---|---|

| Price-to-Earnings Ratio (P/E) | 21.97x | Higher, reflecting growth expectations |

| Price-to-Book Ratio (P/B) | 1.50x | Reasonable valuation level |

| Return on Equity (ROE) | 4.51% | Still has room for improvement |

| Net Profit Margin | 16.91% | Healthy level |

| Operating Profit Margin | 28.34% | Strong profitability |

- Increasing competitive pressure: Digital banks such as Revolutplan to enter the Irish mortgage market in 2026 (already having 3 million Irish customers) [3]

- High valuation: A P/E ratio of 21.97x is relatively high compared to historical levels and needs to be supported by performance growth

- Technical correction: A pullback of about 13% from the annual high may continue to fluctuate in the short term

- Macroeconomic uncertainty: Changes in interest rate policies may affect net interest margin income

- Accelerated digital transformation: AIB invested €40 million to upgrade its branch network [4], and overall industry technology investment increased

- Green finance opportunities: AIB issued €650 million in green bonds [4], and ESG transformation opens new revenue sources

- Wealth management potential: Bank of Ireland manages assets of €58 billion, with wealth and insurance contributing 9% of revenue [5]

- Regulatory support: Although the Irish government exited AIB, it maintains a supportive attitude towards the stability of the banking system

The industry has shifted from a ‘European laggard’ to a ‘competitive investment target’ [3]:

✅

- The historic performance in 2025 has changed investors’ perceptions

- Fundamental improvement: Profit growth, asset quality improvement, capital return initiation

- Macroeconomic environment support: Household wealth growth, economic resilience

- Relatively reasonable valuation: P/B ratio of about 1.5x, still has room for revaluation

⚠️

- Digital bank competition (especially Revolut’s entry)

- Sustainability of growth after valuation repair

- Long-term impact of European interest rate policies

- Annual increase of 93% shows strong momentum, long-term trend upward

- Highly concentrated institutional holdings may trigger acquisition premiums

- Stable market position (about 3.7% market share), among Ireland’s top three banks

- 200-day moving average (€2.21) is significantly below current price, long-term technicals are good

- Private equity valuation models show potential 25%+ return space [2]

- Short-term technical pressure: Price breaks below 20-day and 50-day moving averages

- P/E ratio of 21.97x is relatively high compared to history

- Pullback of about13% from December high, may continue to fluctuate in short term

- December trading volume shrank, showing temporary weakening of buying power

-

Short-term (1-3 months):Cautiously Bullish

- Technical correction may continue to the €2.60-€2.70 area (near 50-day moving average)

- Support level around €2.70 (200-day moving average and previous platform)

- If breaking through the psychological barrier of €3.00, may retest the annual high

-

Medium-term (6-12 months):Actively Bullish

- Acquisition expectations may provide support for the stock price

- If 2026 financial reports verify growth expectations, there is room for valuation improvement

- Pay attention to the progress of formal private equity acquisitions

-

Long-term (1-3 years):Structural Opportunity

- Irish banking sector is moving from cyclical trough to recovery

- Digital transformation and wealth management open new growth curves

- As the third largest bank, PTSB has integration value

- Overweight rating: The trend of fundamental improvement in the industry is clear, and there is still room for valuation repair

- Key allocation: AIB (largest market size) + PTSB (high acquisition elasticity)

- Risk control: Pay attention to changes in interest rate policies and the progress of digital bank competition

J&E Davy’s stock trading activities in PTSB are essentially

- Short-term technical correction is a healthy market behavior and does not change the long-term upward trend

- PTSB’s highly concentrated institutional holdings may trigger acquisition premiums

- The Irish banking sector has shifted from a ‘European laggard’ to a ‘competitive investment target’ and is worth strategic allocation in 2026

- Investors should pay attention to key catalysts such as acquisition progress, 2026 performance verification, and digital bank competition

— References —

[0] Jinling API Data - PTSB Stock Real-Time Quotes, Historical Prices, Technical Indicators and Financial Data

[1] Investegate.co.uk - “Form 38.5A - PERMANENT TSB GROUP HOLDINGS PLC” (https://www.investegate.co.uk/announcement/rns/permanent-tsb-group-holdings-cdi---ptsb/form-38-5a-permanent-tsb-group-holdings-plc-/9300080)

[2] Investing.com - “Goldman Sachs discloses dealings in Permanent TSB shares” (https://www.investing.com/news/company-news/goldman-sachs-discloses-dealings-in-permanent-tsb-shares-93CH-4425022)

[3] Irish Examiner - “John Whelan: Government may have left €81m on the table exiting AIB” (https://www.irishexaminer.com/business-columnists/arid-41763989.html)

[4] Statzon.com - “Allied Irish Banks Plc - Strategic SWOT Insights” (https://app.statzon.com/pdfs/OAJLV)

[5] Investing.com - “Best Irish Bank Stocks: RBC Capital Markets Flags Top Picks in Sector” (https://www.investing.com/news/stock-market-news/best-irish-bank-stocks-rbc-capital-markets-flags-top-picks-in-sector-93CH-4420988)

[6] Financials Unshackled - “Weekly Briefing of 21st Dec 2025 (Irish Banking)” (https://www.financialsunshackled.com/p/financials-unshackled-weekly-briefing-d36)

[7] Stockopedia - “PTSB — Permanent TSB group Share Price” (https://www.stockopedia.com/share-prices/permanent-tsb-group-ISE:PTSB/)

[8] FT.com - “Permanent TSB Group Holdings PLC, PTSB:LSE summary” (https://markets.ft.com/data/equities/tearsheet/summary?s=PTSB:LSE)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.