Analysis of the Impact of a Stronger US Dollar on Earnings and Valuations of S&P 500 Multinational Corporations

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to the latest market data,

- Light Market Trading: During the year-end holiday period (Christmas to New Year), market trading volume was significantly below average. The average daily trading volume of the SPY ETF was approximately 46.96 million shares, lower than the historical average of 80.34 million shares [0]

- Amplified Exchange Rate Volatility: In a low-liquidity environment, even small-scale trades can have a large impact on exchange rates

- Technical Factors: Year-end window dressing and portfolio rebalancing have exacerbated short-term volatility

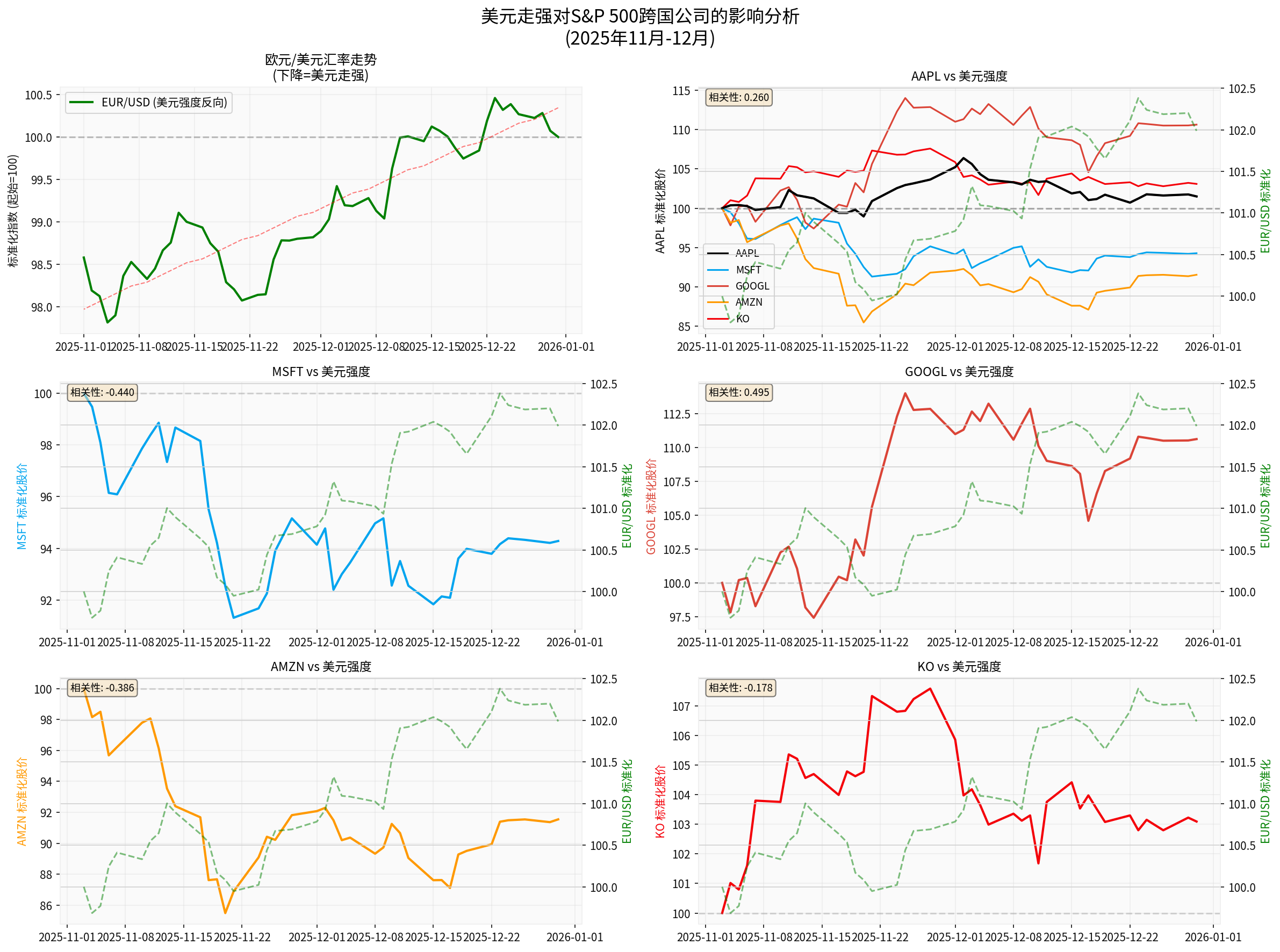

Chart: EUR/USD Exchange Rate Trend vs. Stock Prices of Major Multinational Corporations (November-December 2025)

From the chart, it can be seen that the EUR/USD exchange rate has shown a downward trend (stronger US Dollar) over the past two months, exhibiting a certain negative correlation with the stock prices of multinational corporations.

| Company | Overseas Revenue Share | 1-Month Stock Price Performance | Exchange Rate Sensitivity |

|---|---|---|---|

| Apple (AAPL) | ~58%[1] | -4.58% | High |

| Microsoft (MSFT) | Significant International Operations | -0.51% | High |

| Google (GOOGL) | Global Advertising Revenue | -0.62% | Medium-High |

| Amazon (AMZN) | International E-commerce/AWS | -0.81% | High |

| Coca-Cola (KO) | ~50% Emerging Markets[2] | -0.85% | Medium-High |

- Assume a company has €10 billion in revenue in Europe. When the EUR/USD rate drops from 1.18 to 1.15 (a 2.54% strengthening of the US Dollar), the converted US Dollar revenue will decrease from $11.8 billion to $11.5 billion, a reduction of $300 million in revenue, entirely attributable to exchange rate changes

- For a company with a gross margin of approximately 30%, this is equivalent to a $1 billion impact on profits

A stronger US Dollar also affects the

- Higher Export Prices: US products become relatively expensive in international markets, weakening price competitiveness

- Intensified Import Competition: Foreign competitors’ products gain more price advantages in the US market

- Emerging Market Pressure: Local currency-denominated sales face rising exchange rate hedging costs

- A stronger US Dollar is usually accompanied by Fed hawkish expectationsor strong US economic data

- Pushes up risk-free ratesandequity risk premiums

- Increases the weighted average cost of capital (WACC)

- Reduces discounted cash flow (DCF) valuations[0]

When the US Dollar strengthens:

- Analysts Downgrade Earnings Expectations: Exchange rate hedging costs and foreign revenue translation losses lead to downward revisions of EPS forecasts

- Valuation Multiples Come Under Pressure: Increased market uncertainty about future growth leads to compression of multiples like P/E and PEG

- Sector Rotation: Capital may flow to sectors with more domestic business exposure

- Account for 44% of the total return of the S&P 500[3], with significant international revenue exposure

- Q3 2025: “Mag 7” earnings grew by 28.3% year-over-year, but exchange rate factors may drag down future quarters

- Analyst Expectations: Average earnings growth of 21% over the next four quarters[3], but exchange rate headwinds need to be considered

- Coca-Cola (KO): ~50% of revenue from emerging markets[2], highly sensitive to a stronger US Dollar

- Recent stock price decline of 0.85% reflects exchange rate concerns

| Industry | Exchange Rate Sensitivity | Impact Level | Reason |

|---|---|---|---|

| Technology | High | High | Large overseas revenue, high growth expectations |

| Consumer Goods | Medium-High | Medium-High | Brand strength can partially offset, but profit margins are squeezed |

| Industrials | Medium | Medium | Global supply chain, more hedging tools available |

| Healthcare | Medium-Low | Medium-Low | Higher proportion of domestic operations, rigid demand attributes |

| Financials | Low | Low | Mainly serve the US market |

| Utilities | Low | Low | Almost entirely domestic operations |

Multinational corporations typically use the following tools to manage exchange rate risks:

- Forward Contracts and Options: Lock in future exchange rates

- Currency Swaps: Hedge long-term exchange rate exposure

- Natural Hedging: Match currencies in revenue and expenditure regions

- Perfect hedging is almost impossibleand costly

- Most companies only hedge 30-60%of their exposure

- Remaining exposure still faces exchange rate volatility risks

- Localized Pricing: Raise prices in strong currency markets to maintain profit margins

- Cost Transfer: Pass part of the exchange rate cost to consumers (may affect sales volume)

- Supply Chain Optimization: Source in regions with a strong US Dollar to offset exchange rate losses

- Increase Domestic Business Exposure: Allocate more to companies focused on the US market

- Focus on Exchange Rate Hedging Capabilities: Choose large multinational corporations with mature hedging strategies

- Sector Rotation: Overweight low-sensitivity sectors like financials and utilities

- Opportunities After Overreaction: When the market is overly pessimistic, high-quality multinational corporations may be mispriced

- Structural Hedging: Use USD call options or US Dollar Index futures to hedge portfolio risks

Investors need to consider the following when evaluating multinational corporations:

Adjusted EPS = Base EPS × (1 - Overseas Revenue Share × Exchange Rate Change Rate × Under-hedging Ratio)

- Company Base EPS: $10

- Overseas Revenue Share: 60%

- US Dollar Strengthening: 3%

- Hedging Ratio: 50% (50% under-hedged)

Adjusted EPS = $10 × (1 - 60% × 3% × 50%)

= $10 × (1 - 0.9%)

= $9.91

- Fed Policy: The 2026 interest rate path will dominate the US Dollar trend

- Ticklim Group points out, “If the tendency for further rate cuts in 2026 becomes clear, it may put pressure on the US Dollar and Treasury yields”[4]

- Global Economic Recovery: Growth differences between major economies will affect exchange rate trends

- Geopolitical Risks: Geopolitical events like trade policies and sanctions may cause sudden exchange rate changes

Although the year-end strengthening of the US Dollar creates short-term pressure, long-term investors should focus on:

- Corporate Fundamental Quality: Strong cash flow and moats can weather cycles

- Exchange Rate Cyclicality: Alternating strength and weakness of the US Dollar; overreactions may provide buying opportunities

- Structural Trends: Long-term drivers like AI and cloud computing are not dominated by short-term exchange rates

- Short-Term Impact is Real: A 1-2% strengthening of the US Dollar can significantly affect multinational corporations’ earnings, especially for tech companies with high overseas exposure

- Differentiated Impact Levels:

- Tech giants like Apple and Microsoft are more affected (over 50% overseas revenue share)

- Domestic-focused sectors like financials and utilities are relatively immune

- Valuations Face Adjustment Pressure: Downward revisions of earnings expectations and rising interest rate expectations jointly suppress valuation multiples

- Year-End Light Trading Amplifies Volatility: Technical volatility in a low-liquidity environment should not be overinterpreted

- Short-Term: Focus on exchange rate risk exposure and consider increasing domestic business allocations

- Medium-Term: Wait for clarity on the US Dollar trend and focus on high-quality companies with strong hedging capabilities

- Long-Term: Focus on corporate fundamentals; exchange rate fluctuations provide opportunities to add positions in high-quality targets

[0] Gilin API Data - Market Indices, Real-Time Quotes, EURUSD Exchange Rate Data, Financial Analysis

[1] Yahoo Finance - “Rising dollar pressures earnings as companies from Amazon to McDonalds signal more pain ahead”

https://finance.yahoo.com/news/rising-dollar-pressures-earnings-as-companies-from-amazon-to-mcdonalds-signal-more-pain-ahead-140248076.html

[2] Yahoo Finance - “Colgate-Palmolive (CL) Target Raised as Analysts Split on 2026 Staples Outlook”

https://finance.yahoo.com/news/colgate-palmolive-cl-target-raised-203843706.html

[3] Yahoo Finance - “Mag 7 Beats S&P 500 in Q3: Buy These 3 ETFs to Tap…”

https://finance.yahoo.com/news/mag-7-beats-p-500-174800064.html

[4] WSJ - “Dollar Stable as U.S. Layoffs Remain at Bay”

https://www.wsj.com/finance/currencies/malaysian-ringgit-may-remain-resilient-in-2026-17fab956

[5] WSJ - “The WSJ Dollar Index Rises 0.15% to 96.56”

https://www.wsj.com/finance/commodities-futures/singapore-dollar-consolidates-eyes-on-feds-rate-decision-06d57de5

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.