Capchem Saudi Lithium Battery Materials Project Investment Analysis Report

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Capchem plans to invest

- Annual 200,000-ton carbonate solventproduction line

- Co-produced 100,000-ton ethylene glycolproduction line

- Supporting utility engineering and environmental protection treatment facilities [2]

According to brokerage API data and market research:

- China Market: 2024 electrolyte shipments reached1.47 million tons, up32%year-on-year; expected to reach1.67 million tonsin 2025 [7]

- Global Market: The lithium battery industry is expected to reach a market size of5022 GWhby 2030, with a compound annual growth rate (CAGR) of approximately26%[7][8]

- Core Drivers: Continuous expansion of new energy vehicles, energy storage systems, and consumer electronics sectors

Carbonate solvents are core components of electrolytes (accounting for approximately

- Market Capitalization: 39.18 billion USD

- Net Profit Margin: 11.24%

- ROE: 9.89%

- Current Ratio: 1.92 (sound financial condition)

- 2025 Stock Price Performance: Up39.40%, reflecting market confidence in the company’s prospects

- USD 260 million accounts for approximately 0.66%of the company’s market capitalization

- Relative to the company’s 2024 revenue of approximately USD 2.4 billion, the investment scale is moderate and risks are controllable

Conservative estimates:

- Annual capacity of 200,000 tons of carbonate solventafter the project reaches full production

- Calculated based on current market prices of approximately CNY 15,000-20,000 per ton

- Expected annual output value to reach CNY 3-4 billion(approximately USD 420-560 million)

- Expected investment payback period: 5-7 years

Advantages of Yanbu Heavy Industrial Park in Saudi Arabia:

- Low Energy Costs: Saudi electricity and natural gas prices are significantly lower than China’s

- Raw Material Advantages: Co-production of ethylene glycol can reduce unit costs

- Tax Incentives: Industrial parks under Saudi Arabia’s “Vision 2030” offer tax relief [6]

- Logistics Advantages: Close to Red Sea ports, facilitating exports to European and African markets

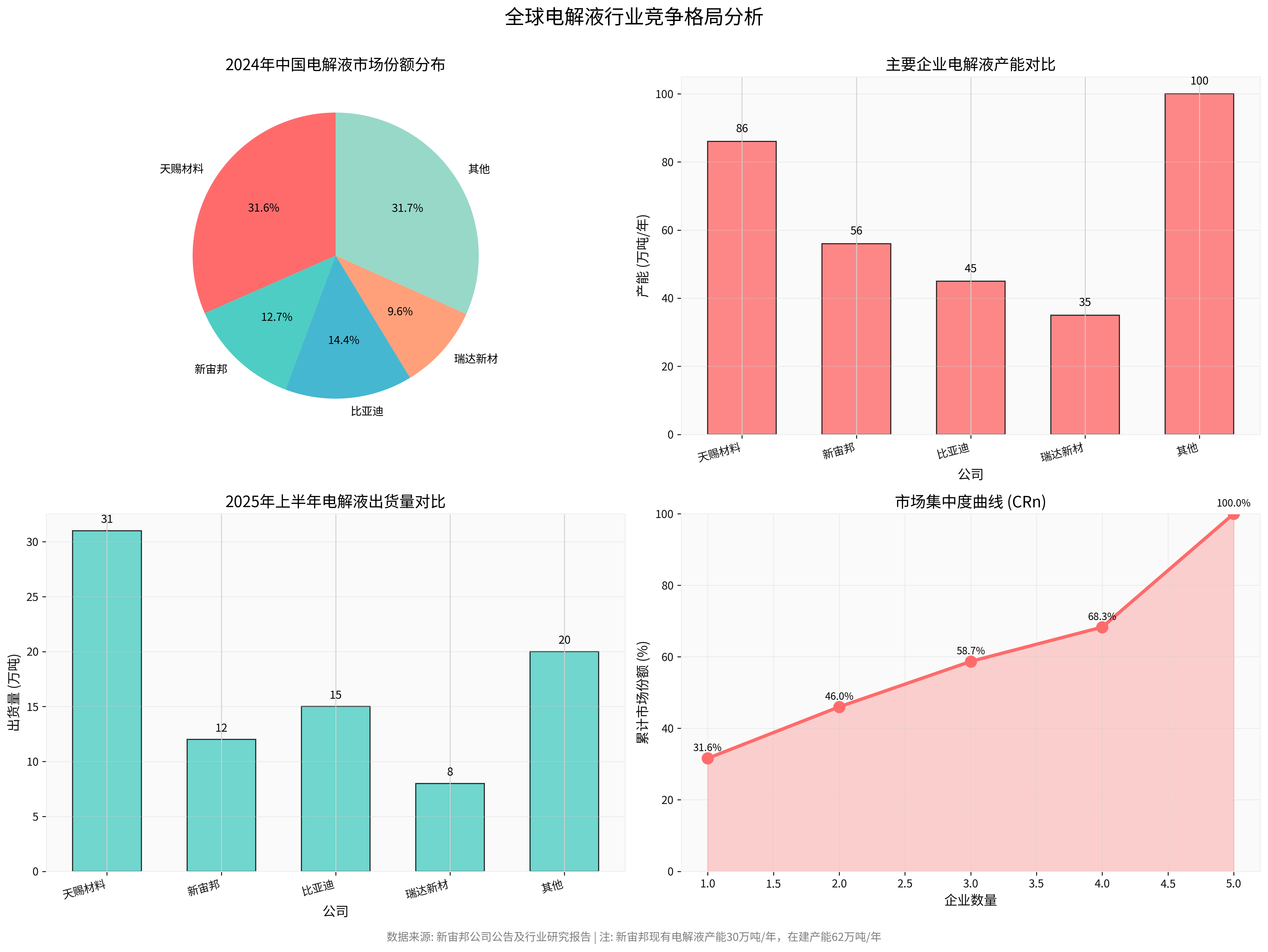

- Tinci Materials: 31.6% market share, capacity of 860,000 tons/year

- BYD: 14.4% market share

- Capchem: 12.7% market share, existing electrolyte capacity of 300,000 tons/year, under-construction capacity of 620,000 tons/year

- Ruida New Materials: 9.6% market share

- Others: 31.7%

- Capchem’s electrolyte shipments in H1 2025 are approximately 120,000 tons

- The company has a total battery chemical capacity of approximately 560,000 tons, with under-construction capacity of approximately620,000 tons

- Customer coverage: CATL, EVE Energy, BYD, LGES, SKOn, Panasonic, Samsung SDI, and other global leading battery enterprises

- Reduce dependence on a single region

- Enhance global delivery capabilities

- Shorten delivery cycles for European, Middle Eastern, and African customers

- Carbonate solvents are key raw materials for electrolytes

- In-house production can reduce raw material costs by 15-20%

- Enhance bargaining power in the industrial chain

- Capchem has already established presence in Poland, the United States, Japan, South Korea, Malaysia, Singapore, and other countries

- The Saudi project will further strengthen the strategic pivot in the Middle East[5]

- The situation in the Middle East is complex and volatile

- Need to establish good relations with local governments and institutions to reduce risks [6]

- Significant cultural differences between China and Saudi Arabia

- Need to adapt to Islamic cultural customs and business practices

- Increased difficulty in managing cross-border teams

- Tinci Materials is also accelerating overseas layout (200,000-ton plant in Texas, USA; Morocco project) [5]

- Industry overcapacity may occur, leading to fierce price competition

- Saudi environmental protection standards are becoming increasingly strict

- Supporting environmental protection treatment facilities increase investment costs

- ✅ High Certainty of Market Growth: Global electrolyte market CAGR reaches 26%, with strong demand

- ✅ Superior Strategic Location: Policy support and convenient logistics at Yanbu Heavy Industrial Park in Saudi Arabia

- ✅ Obvious Cost Advantages: Low energy costs, cost reduction via co-production, tax incentives

- ✅ Supply Chain Security: Diversified layout reduces geopolitical risks

- ✅ Vertical Integration: Enhance profitability of electrolyte business

- ✅ Sound Finances: Company has sufficient cash flow, project risks are controllable

- ⚠️ Geopolitical uncertainty

- ⚠️ Cross-cultural management challenges

- ⚠️ Intensified industry competition

Capchem’s Saudi lithium battery materials project has

- Investment Payback Period:5-7 years

- Project IRR (Internal Rate of Return): Expected12-15%

- Strategic Value: Far greater than financial returns

-

Market Share Increase: After the project is put into production, Capchem’s total electrolyte capacity will increase from300,000 tons/yeartoover 500,000 tons/year(including solvent conversion), and market share is expected to rise from12.7%to15-18%

-

Enhanced Global Competitiveness:

- Middle East production base covers European and African markets

- Forms a global supply networkwith production bases in China, Poland, and the United States

- Shortens delivery cycles and enhances customer stickiness

-

Profitability Improvement: Vertical integration is expected to increase the gross profit margin of the electrolyte business by3-5 percentage points

-

Industry Position Consolidation: Further narrows the gap with Tinci Materials and consolidates itstop three globalindustry position

[0] Gilin API Data - Capchem’s financial data, stock quotes, technical analysis

[1] Yicai - “Plans to invest USD 260 million in Saudi Arabia to build Middle East Capchem lithium battery materials project” (https://www.yicai.com/brief/102983586.html)

[2] Phoenix Finance - “Capchem: Plans to invest USD 260 million in Saudi Arabia to build Middle East Capchem lithium battery materials project” (https://finance.ifeng.com/c/8pXOmAIY1bs)

[3] Sina Finance - “Plans to invest USD 260 million in Saudi Arabia to build Middle East Capchem lithium battery materials project” (https://cj.sina.com.cn/articles/view/5182171545/134e1a99902002b7p2)

[4] Gilin API - Capchem financial analysis data

[5] Sina Finance - “2025 China Lithium Battery Industry Electrolyte Annual Competitive Brand List” (https://finance.sina.com.cn/roll/2025-10-12/doc-inftrcmu4772399.shtml)

[6] Sina Finance - “USD1.1 trillion infrastructure boom: Saudi Arabia is becoming a new global investment hot spot!” (https://finance.sina.com.cn/roll/2025-03-10/doc-inepcwtr6545987.shtml)

[7] The Paper - “2025 China Lithium Battery Material Industry Chain Sorting and Investment Layout Analysis” (https://m.thepaper.cn/newsDetail_forward_30371717)

[8] Sina Finance - “Foresee 2025: ‘2025 China Lithium Battery Industry Panoramic Map’” (https://finance.sina.com.cn/roll/2025-12-20/doc-inhcmhcr1505453.shtml)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.