Analysis of 2025 US Dollar Weakness Drivers and Their Impact on Cross-Asset Allocation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on 2025 market data and latest analysis, I will systematically analyze the drivers of the US dollar’s sustained weakness and their impact on cross-asset allocation.

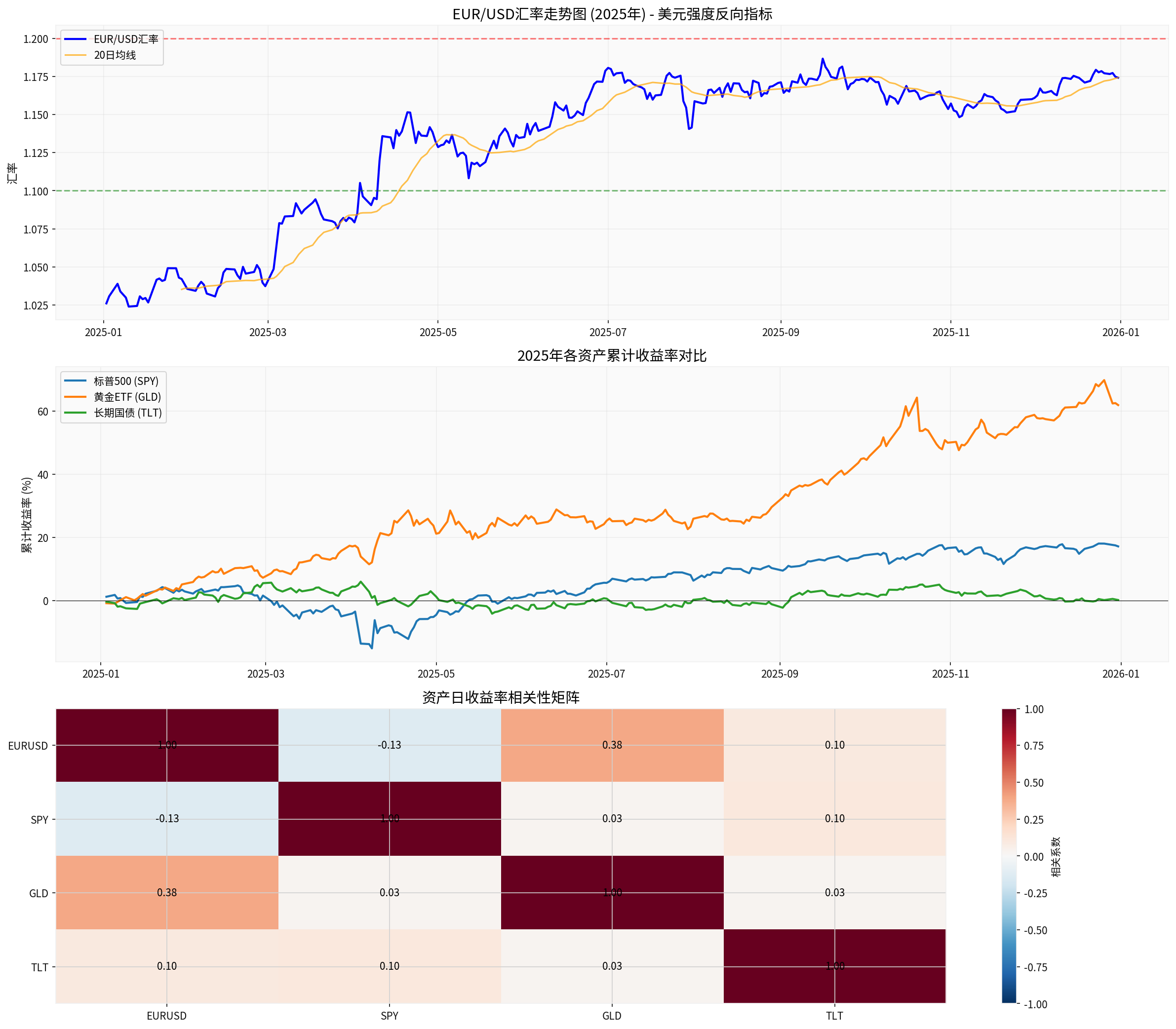

According to market data analysis, the US dollar experienced a significant depreciation trend in 2025. The EUR/USD exchange rate climbed from 1.0261 at the start of the year to 1.1742, an increase of 14.43% [0], which directly reflects the weakening pattern of the US dollar.

- The Federal Reserve cut interest rates in three consecutive meetings at the end of 2025 to respond to the softening labor market [2]

- Interest rate cuts led to a decline in US Treasury yields, weakening the attractiveness of US dollar assets

- Market expectations for further rate cuts in 2026 continued to rise; institutions predict the US dollar may fall another 5% in the first half of 2026 [1]

- The interest rate spread between the US and major economies (such as the Eurozone, Japan) narrowed significantly

- When US Treasuries pay lower interest, the attractiveness of US debt decreases, leading to international capital outflow from US dollar assets [1]

- The loss of yield advantage directly weakened the US dollar’s safe-haven status

- The global economy showed resilience, with non-US economies recovering faster than expected

- Investors’ risk appetite increased, shifting from safe-haven US dollars to risk assets (stocks, emerging market assets, etc.)

- The de-dollarization trend accelerated in global trade and financial sectors

- The huge fiscal deficit and national debt scale exert long-term pressure on US dollar credit

- The trend of international reserve diversification reduced dependence on the US dollar

In 2025, the gold ETF (GLD) achieved a cumulative return of up to 61.91% [0], far exceeding other asset classes:

- US dollar depreciationdirectly pushed up the price of gold denominated in US dollars

- Interest rate cuts reduced the opportunity cost of holding gold

- Gold’s attractiveness as an inflation hedge and safe-haven asset increased significantly

The S&P 500 index rose by 17.19% cumulatively in 2025 [0]:

- Export-oriented enterprisesbenefited from the competitive advantage brought by US dollar depreciation

- Multinational companiesgained exchange gains when converting overseas revenues into US dollars

- Export sectors such as technology and industry performed relatively better

The long-term Treasury ETF (TLT) rose by only 0.22% in 2025 [0]:

- Interest rate cuts theoretically benefit bonds, but rising inflation expectations limited the increase

- The yield curve steepened, with long-end interest rates relatively stable

- US dollar depreciation reduced the attractiveness of US bonds to foreign investors

- US dollar depreciation reduced the US dollar debt pressure of emerging market countries

- Capital flowed to emerging markets in search of higher returns

- Local currency appreciation reduced import costs and improved trade terms

- Long non-US currencies: Euro, commodity currencies (AUD, CAD) performed strongly against the US dollar

- Carry trade: Borrow low-interest currencies (e.g., JPY) to invest in high-yield emerging market assets

- Hedging strategy: Use currency options or futures to manage exchange rate exposure

-

Increase the proportion of physical assets: Gold and commodities have natural hedging properties during US dollar depreciation cycles

-

Stock Sector Rotation:

- Overweight: Export-oriented, multinational companies, cyclical industries

- Underweight: Import-dependent, domestic-only enterprises

-

Duration Management: Shorten the duration of bond portfolios to reduce interest rate risk

-

Geographic Diversification:

- Increase the allocation weight of emerging markets

- Focus on markets that benefit from global trade recovery

-

Currency Hedging: Moderately hedge US dollar exposure to protect portfolio value

- US dollar rebound risk: If the Federal Reserve stops cutting interest rates or economic data is unexpectedly strong, the US dollar may rebound quickly

- Unexpected inflation: Inflationary pressure may lead to central bank policy tightening and trigger market volatility

- Geopolitical risk: Trade frictions and geopolitical conflicts may disrupt global supply chains and capital flows

The sustained weakness of the US dollar in 2025 was mainly due to the Federal Reserve’s interest rate cut policy, narrowing interest rate spreads, and global economic recovery expectations. This had a profound impact on cross-asset allocation: gold and stocks performed excellently, bonds had flat returns, and emerging market assets ushered in allocation opportunities.

[0] Gilin API Data - 2025 Cross-Asset Market Data and Analysis

[1] Investopedia - “Why the Dollar Isn’t as Strong as It Used to Be” (https://www.investopedia.com/why-the-dollar-isn-t-as-strong-as-it-used-to-be-11875778)

[2] Wall Street Journal - “Fed Minutes Suggest Caution About Further Cuts Early Next Year” (https://www.wsj.com/economy/central-banking/fed-minutes-suggest-caution-about-further-cuts-early-next-year-f36148c7)

[3] Yahoo Finance - “Fed Cuts Rates, Signals Caution Ahead” (https://finance.yahoo.com/news/fed-cuts-rates-signals-caution-170000478.html)

[4] Bloomberg - “Deutsche Bank, Goldman See Fed Cuts Rekindling Dollar’s Slide” (https://www.bloomberg.com/news/articles/2025-12-12/deutsche-bank-goldman-see-fed-cuts-rekindling-dollar-s-slide)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.