Turkcell (TKC) Strategic Analysis and Investment Evaluation in Turkish Telecom Market

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

- The Turkish mobile communication market is highly concentrated, with Turkcell, Turk Telekom, and Vodafone collectively accounting for over 95% of users. Competition in the market is more focused on technology/experience and service ecosystems rather than price wars, so Turkcell maintains its leading position through network density and technological leadership (Turkcell market share ≈40.1%, Turk Telekom≈29.6%, Vodafone≈30.3%) [1].

- The first 5G spectrum auction in 2025 requires an investment of at least $2.13 billion, and the three major operators must upgrade their networks simultaneously in the next round of capital expenditure. Turkcell aims to gain cost advantages and quickly deploy 5G and enterprise-level services through its virtualization target (40% network function virtualization by 2025) and cloud-native operation capabilities [1].

- Although the 5G auction has increased short-term capital expenditure, about 45% of smartphones already support 5G, giving operators high commercialization potential. Meanwhile, the government and regulators are promoting 5G-based digital transformation, strengthening requirements for service quality, data centers, and cloud capabilities, which in turn provides growth space for Turkcell’s high-quality network and technical services [2][3].

- Mid-2025 results show that data center and cloud revenues increased by 53% year-on-year, Paycell revenues grew by 36%, and the consumer finance business added 1.3 billion Turkish Lira. This indicates Turkcell is using digital services and Techfin ecosystem to offset the slowdown in traditional voice/data growth [4].

- The CFO stated in the latest earnings guidance that 5G upfront expenditures will push net leverage to 0.7-0.8x (target remains below 1x), reflecting Turkcell’s willingness to use controlled leverage to drive long-term network and digital service expansion [4].

- In November, it announced a partnership with Google to build Turkey’s first hyperscale data center, with an expected investment of about $1 billion by 2032 and doubling of data center capacity. As both an infrastructure provider and Google Cloud reseller, Turkcell will consolidate its market growth in cloud/AI services [5].

- Turkcell’s stock performance in 2025 was slightly weak: it fell 18.0% year-to-date (YTD) and about 9.5% in the past six months, but still rose 1.6% cumulatively over the past five years, indicating certain resilience amid macro and local risks [0].

- In terms of valuation, it has a P/E ratio of 8.26x, P/B ratio of 0.92x, and EV/OCF of 3.01x. Compared to its growth capabilities in communication and digital services, it is still relatively undervalued; ROE of 12.4% and net profit margin of 12.7% both support its stable profit range [0].

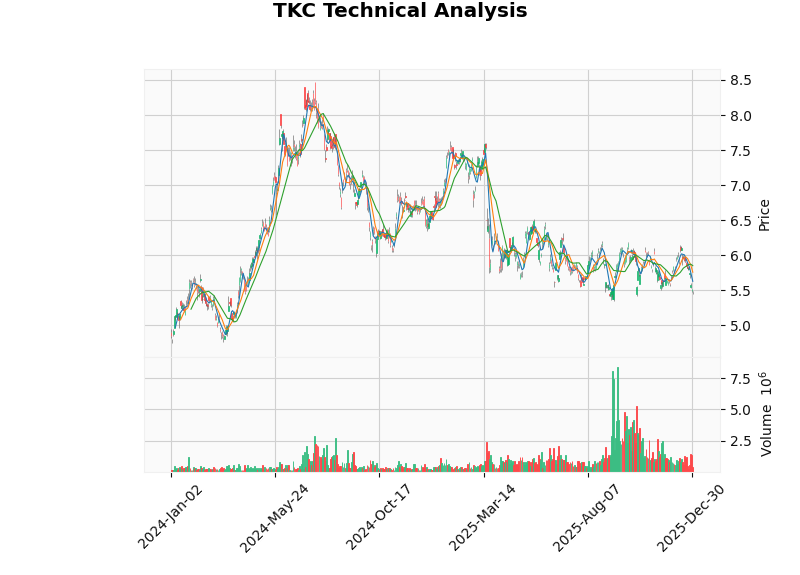

- The technical chart (attached) shows it is currently in a downward trend; MACD has not formed a bullish crossover, but KDJ/RSI indicators suggest it has entered a short-term oversold zone. If it holds the support around $5.45, a rebound may occur; if it breaks below $5.34, further correction should be watched for [0].

Chart Description: X-axis is calendar dates, left Y-axis is USD price (high/low/open/close), right Y-axis is trading volume (millions of shares). The chart shows prices gradually weakened from around $7 in H2 2025 and recently fell to ~$5.4; trading volume slightly increased/fluctuated during correction, corresponding to downward pressure. Data source: Broker API daily line data [0].

- Short-term pressure: After the 5G auction, high capital expenditures and spectrum replacement fees mean operators must maintain synchronized investments in a concentrated competitive environment; otherwise, they will fall behind in service experience. Thus, Turkcell’s profit outlook will be pressured by rising leverage and increased capitalized depreciation, leading the market to take a cautious stance on short-term EPS expectations (already reflected in recent stock price declines).

- Mid-to-long-term opportunities: Since the three major operators form an ‘oligopoly but non-aggressive price war’ pattern, Turkcell can maintain higher ARPU through technological differentiation (leading network coverage/speed, cloud and digital platform expansion). Its foreign ownership ratio of up to 68% also strengthens attractiveness to overseas capital. The Google partnership data center and high growth of cloud+Techfin show Turkcell is transforming from ‘traditional MNO’ to ‘digital life platform’, forming a new moat in competition [4][5].

- Valuation support: Against macro volatility (Lira depreciation, high inflation), Turkcell as a stable earnings and positive cash flow company has current low valuation providing flexibility for foreign capital. If digital services and data center revenues continue to expand, P/E ratio is expected to converge to upper-middle peer levels [0].

- Technical observation: Even with a downward trend, if oversold indicators and $5.45 support hold, short-term rebound may bring structural buying; if it breaks below this range, deeper trend restructuring should be monitored [0].

- Macro currency risk: Lira volatility has not completely subsided (depreciated by 11% in one day in March 2025, exchange rate against USD soared to 38). High inflation environment compresses household consumption and corporate capital expenditures, especially affecting exchange gains of dollar-denominated revenues and cost pass-through capabilities [6].

- Competition pace: Turk Telekom committed to investing $1.7 billion in network modernization over the next few decades; Vodafone will also launch 5G synchronously in 2026 relying on global experience. If Turkcell stalls in capital or execution, it may lose leading position in B2B/high-speed data market.

- Leverage and cash flow: Even with CFO’s target leverage below 1x, installment payments for 5G spectrum and data center expansion require close monitoring of cash conversion cycles and free cash flow fluctuations, especially as dollar cost of capital expenditures rises with Lira depreciation [4].

Turkcell’s current stock price reflects pressure from short-term 5G capital expenditures and macro volatility, but its leading position in Turkish communication market, stable cash flow, and expanding digital services (cloud, data centers, Paycell) provide growth space beyond traditional operators. If it controls leverage while ensuring capital expenditure efficiency, Turkcell is expected to resume growth in the 5G/digitalization cycle and drive valuation re-rating. Recommendations:

- Core investors: Deploy in batches around $5.30~$5.45, focusing on whether quarterly cash flow matches 5G expenditure pace.

- Short-term traders: Watch if it maintains $5.45 support and breaks through initial resistance at $6.15 (breakthrough可望形成反弹).

- Risk alerts: Focus on Turkey’s macro environment (Lira, inflation) and competitors’ synchronous upgrades — if policy shift or sudden currency depreciation occurs, re-evaluate valuation and risk premium.

For further comparison of Turkcell’s segmented businesses with Turk Telekom/Vodafone or simulation of 5G investment impact on finances, consider activating Jinling AI’s deep research mode to access more detailed industry research, financial report data, and scenario simulation models.

[0] Jinling API Data (Turkcell Company Profile, Real-time Quotes, Historical Daily Lines, Financial and Technical Analysis)

[1] Mordor Intelligence – Turkey Telecom Market Size, Share & Growth Analysis 2030 (https://www.mordorintelligence.com/industry-reports/turkey-telecom-market)

[2] Opensignal Insights – Connecting a Digital Türkiye: 5G Auction Marks a Turning Point (https://insights.opensignal.com/2025/11/turkiye-5g-auction/dt)

[3] Bloomberg – Turkey’s 5G Auction Set to Drive Billion-Dollar Carrier Spending (https://www.bloomberg.com/news/articles/2025-10-15/turkey-s-5g-auction-set-to-drive-billion-dollar-carrier-spending)

[4] Yahoo Finance – Turkcell Iletisim Hizmetleri AS (IST:TCELL) Q2 2025 Earnings Highlights (https://finance.yahoo.com/news/turkcell-iletisim-hizmetleri-ist-tcell-071230485.html)

[5] Bloomberg – Google Partners with Turkcell for Turkey’s First Hyperscale Data Center (https://www.bloomberg.com/news/articles/2025-11-12/google-partners-with-turkcell-for-turkey-s-first-hyperscale-data-center)

[6] Bloomberg – Turkey Markets Stabilize as Focus Shifts to Dollar Demand (https://www.bloomberg.com/news/articles/2025-03-20/turkey-turmoil-pushes-lira-borrowing-costs-to-highest-in-years)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.