Comprehensive Evaluation of Shenzhen's Trade-in Subsidy Policy: Consumption Stimulus Effect and Impact Analysis on Listed Companies

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to the Notice on Implementing Large-scale Equipment Renewal and Consumer Goods Trade-in Policy in 2026 jointly issued by the National Development and Reform Commission and the Ministry of Finance on December 30, 2025, the first batch of

- New Energy Vehicles (NEVs): 12% of car price as subsidy, maximum 20,000 yuan

- Fuel Vehicles (2.0L and below): 10% of car price as subsidy, maximum 15,000 yuan

- NEVs: 8% of car price as subsidy, maximum 15,000 yuan

- Fuel Vehicles (2.0L and below):6% of car price as subsidy, maximum13,000 yuan

- Applicable Categories: Refrigerator, Washer, TV, Air Conditioner, Computer, Water Heater (1st level energy efficiency or water efficiency standard)

- Subsidy Standard:15% of selling price, maximum1500 yuan per item, 1 item per category per person

- Applicable Categories: Mobile Phone, Tablet, Smart Watch/Bracelet, Smart Glasses (unit price not exceeding6000 yuan)

- Subsidy Standard:15% of selling price, maximum500 yuan per item,1 item per category per person

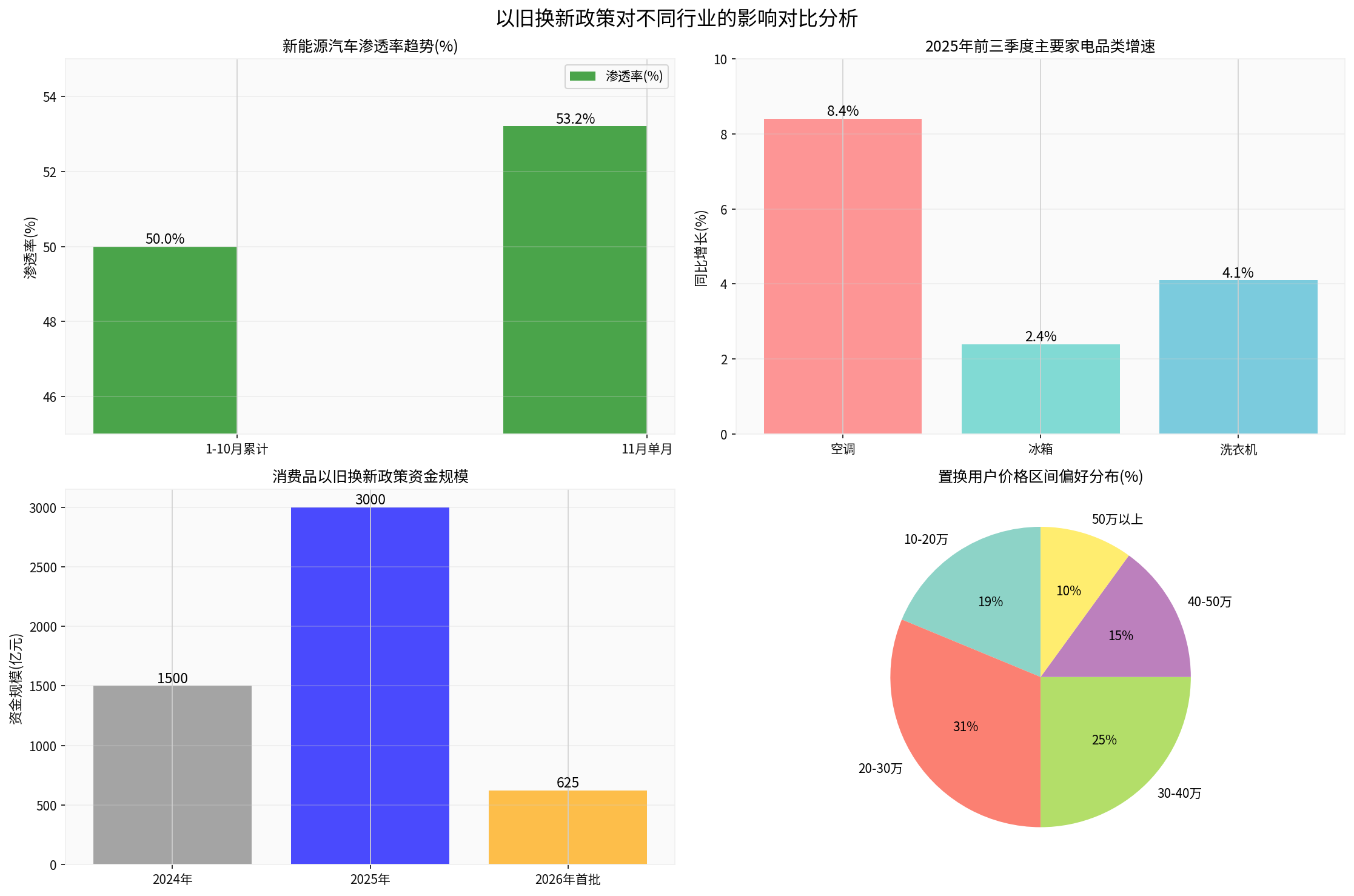

According to brokerage API data analysis, the scale of the 2025 ‘Two New’ policy (large-scale equipment renewal and consumer goods trade-in) reached

###2.2 New Energy Vehicle Market: Most Significant Policy Effect

Based on web search data and industry statistics [4][5]:

- NEV sales reached 14.78 million unitsfrom January to November 2025, a year-on-year increase of31.2%

- The proportion of NEVs in total domestic new car sales (penetration rate) reached 53.2%in November

- The retail penetration rate of NEV passenger cars approached 60%in November, marking a decisive shift in market structure

- Nearly 70%of private car buyers realized replacement through trade-in

- More than 50%of replacement users tended to choose mid-to-high-end models priced at200,000-500,000 yuan

- From January to October 2025, the retail share of independent brands reached 64.2%, an increase of5.6 percentage pointsyear-on-year

- Mainstream car companies such as BYD, Geely, Chery, and Changan broke the foreign monopoly in the mid-to-high-end market of 200,000-500,000 yuan

- Hefei City reported driving over 20 billion yuanin car transaction volume

- Zhengzhou City, Henan Province, ranked among the top three cities in China in terms of passenger car terminal sales

###2.3 Home Appliance Industry: Showing ‘High Early, Stable Late’ Trend

Based on Industrial Online data and industry analysis [6][7]:

- Home appliance social retail maintained strong growth in the first half of the year

- The year-on-year growth rate in May reached 53.0%

- The cumulative year-on-year growth rate in June reached the annual high of 30.7%

- The growth rate fell to 3% in the third quarter and turned to -15%in October

- Shipment volume in the first three quarters: Air Conditioner +8.4%, Refrigerator +2.4%, Washer +4.1%

- Overall showing a ‘high middle, low both ends’ base trend

- Online Share: Haier increased by1.9 percentage points, Midea increased by0.4 percentage points

- Gree, Hisense, and Xiaomi slightly declined

###2.4 Digital Products: New Subsidy Categories

The 2025 policy added 3 categories of digital products: mobile phones, tablets, smart watches/bracelets, but due to the unit price limit (not exceeding6000 yuan), the pulling effect on high-end flagship products is limited [2].

##3. Trend of Diminishing Marginal Effect of Policy Stimulus

###3.1 Reduction in Fiscal Matching Funds

According to brokerage API data [8]:

- In the second half of 2025, the central government’s funds for consumer goods trade-in dropped to 138 billion yuan(about 69 billion yuan in the fourth quarter)

- Lower than the 162 billion yuan in the first half of the year and 150 billion yuan in 2024

- The reduction in fiscal matching funds will weaken the marginal support intensity

###3.2 Overdraft Effect Appears

- The previous trade-in policy has overdrafted part of the demand

- Residents’ replacement of large durable goods has a one-time characteristic

- Leading to a decline in month-on-month momentum

###3.3 Base Effect Pressure

The fund allocation in Q4 2024 raised the year-on-year growth rate of the durable goods chain, making it vulnerable to high base suppression in the corresponding period of 2025 [8].

##4. Impact Analysis on Related Listed Companies’ Performance

###4.1 New Energy Vehicle Industry

According to brokerage API data [0]:

- Current Stock Price: 95.35 HKD(down 2.31% today)

- Market Capitalization: 898.72 billion HKD

- Price-Earnings Ratio (P/E):59.97 times

- Free Cash Flow: 36.094 billion yuan

- Financial Attitude: Conservative

- Positive Impact:As a leading NEV company, it directly benefits from both scrappage renewal and replacement renewal subsidies

- Market Share Increase:Independent brand share reached64.2% from January to October, with BYD as the core beneficiary

- Consumption Upgrade Trend:More than 50% of replacement users choose mid-to-high-end models of 200,000-500,000 yuan, which is in line with BYD’s product positioning

- Risk Factors:Policy intensity may decline; the 3.16% drop in stock price in December reflects market concerns

According to web search data [9], the Hong Kong stock auto sector rose significantly on December29:

- Xpeng Motors-W increased by 6.37%

- BYD Company Limited increased by 6.14%

- NIO-SW increased by 5.88%

- Li Auto-W increased by 3.38%

This reflects the catalytic effect of positive policy signals.

###4.2 Home Appliance Industry

According to brokerage API data [0]:

- Current Stock Price: 78.15 yuan(down0.89% today)

- Market Capitalization: 592.83 billion yuan

- Price-Earnings Ratio (P/E):13.43 times

- Free Cash Flow: 52.672 billion yuan

- Financial Attitude: Positive

- Positive Impact:Product line covers 4 categories of subsidies: Air Conditioner, Refrigerator, Washer, Water Heater

- Online Share Increase:Online share increased by0.4 percentage points in the first three quarters, and by3.5 percentage points in Q2 alone

- Diversified Layout:Compared with Gree’s over-reliance on air conditioners, Midea’s product structure is more balanced

- Risk Factors:Home appliance retail sales fell by3.2% year-on-year in Q3 2025, and the industry is under overall pressure

According to brokerage API and web search data [0][10]:

- Current Stock Price: 40.22 yuan(down0.76% today)

- Market Capitalization: 222.75 billion yuan

- Price-Earnings Ratio (P/E):7.04 times

- Free Cash Flow: 26.069 billion yuan

- Financial Attitude: Neutral

- Revenue in the first three quarters: 137.65 billion yuan, down6.6%year-on-year

- Net Profit Attributable to Parent Company: 21.46 billion yuan, down2.3%year-on-year

- This is the first time since 2022 that Gree has seen simultaneous negative growth in revenue and net profit

- Limited Impact:Over-reliance on a single air conditioner business (accounting for nearly 80% of revenue)

- Intensified Competition:Cross-border new forces like Xiaomi are rapidly eroding the market (Xiaomi’s air conditioner shipment volume surged by over60% year-on-year in the first half of2025)

- Channel Transformation Dilemma:The huge offline dealer system has become a shackle for transformation in the e-commerce era

- Market Capitalization Surpassed:Its market capitalization was surpassed by Haier Smart Home within the year, ranking third among domestic white goods leaders

According to web search data [10], Haier’s localized deep cultivation strategy in overseas markets is worth attention. Recently, it transferred 49% equity of its Indian company to an investment company and reserved 2% for management incentives, showing a new model of Chinese enterprises’ overseas operation.

##5. 2026 Outlook and Investment Recommendations

###5.1 Policy Continuity

According to People’s Daily report [3], the Central Economic Work Conference clearly stated to ‘optimize the implementation of the Two New policy’, and the Ministry of Finance also proposed to ‘continue to support the Two New work’, so the ‘national subsidy’ will continue to be implemented in 2026.

###5.2 Investment Recommendations

- Overweight Rating:Leading companies like BYD benefit from penetration rate increase and consumption upgrade

- Focus Points:Diminishing marginal effect of policy, increased pressure in Q1 off-season

- Catalysts:Continuous increase in independent brand share, breakthrough in export market

- Cautiously Optimistic:Policy pulling effect gradually weakens, the industry is under overall pressure

- Prefer Leading Companies:Midea (diversified layout) and Haier (overseas expansion) are better than Gree

- Risk Tips:The white goods industry fell by2.02% within the year, and the decline in real estate boom led to a drop in new demand

- Limited Impact:The 6000 yuan unit price limit restricts sales of high-end products

- Focus Brands:Brands with comprehensive mid-to-high-end product lines like Huawei and Xiaomi

###5.3 Risk Tips

- Decline in Policy Intensity:Reduction in fiscal matching funds, emergence of overdraft effect

- Base Effect Pressure:High base in Q42024 suppresses the same period in2025

- Intensified Industry Competition:Price wars, false parameter labeling, compressed supply chain profits

- Rise in Raw Material Costs:Copper price continues to rise to the 100,000 yuan mark, increasing cost pressure for air conditioner companies

##6. Conclusion

As an important part of the national ‘Two New’ policy, Shenzhen’s trade-in subsidy policy achieved significant results in2025:

- New Energy Vehicles: Most significant, with sales growth of31.2% and penetration rate exceeding53%

- Home Appliance Industry: Obvious short-term pulling effect, but diminishing marginal effect

- Digital Products: New categories, relatively limited impact

- NEV Leaders: BYD and others benefit the most, with continuous increase in market share

- Home Appliance Leaders: Midea and Haier are better than Gree, with obvious advantages in diversified layout

- Overall Judgment: The policy is favorable to leading enterprises, accelerating the increase in industry concentration

- Short-term: Obvious policy catalysis effect (collective rise of auto stocks on December29)

- Mid-term: Focus on policy continuity and improvement of company fundamentals

- Long-term: Consumption upgrade and technological innovation are core competitiveness

[1] Shenzhen Bendibao - 2026 National Subsidy Policy is Here (with full policy text)

https://m.bendibao.com/show996480.html

[2] Securities Times - 62.5 Billion First Batch of ‘National Subsidy’ Allocated! 2026 Car and Home Appliance Renewal Benefits Are Here

https://www.stcn.com/article/detail/3565357.html

[3] People’s Daily Overseas Edition - In2026, the ‘National Subsidy’ Will Continue (Sharp Finance)

http://paper.people.com.cn/rmrbhwb/pc/content/202512/19/content_30125667.html

[4] Sina Finance - From ‘Short-term Stimulus’ to ‘Long-term Ecology’, Trade-in Reshapes the Car Consumption Market

https://finance.sina.com.cn/roll/2025-12-25/doc-inhcymnr9109239.shtml

[5] CAIHUA Net - Policy利好! Auto Stocks Rise Collectively, Xpeng and BYD Both Up Over6%

https://www.finet.hk/newscenter/news_content/69521a7d5a77127e882f4614

[6] Sina Finance - 2026 Home Appliance Industry Annual Strategy: Embrace Leading Companies, Attach Importance to Going Overseas

https://finance.sina.com.cn/stock/relnews/cn/2025-12-26/doc-inhecmrn0983059.shtml

[7] Sina Finance - Changes in Home Appliance National Subsidy? Midea, Haier, Dreame, Changhong, JD Launch Big Moves; Aucma and Daikin Are Turbulent

https://finance.sina.com.cn/stock/relnews/hk/2025-12-29/doc-inhemqaw5017358.shtml

[8] Sina Finance - [Zheshang Macro || Li Chao] November Economic Outlook: Weak Demand, Resilient Production

https://finance.sina.com.cn/stock/stockzmt/2025-12-02/doc-infzksih2314360.shtml

[9] 36Kr - Top 10 Worst Performing Sectors This Year, Plummeted

https://m.36kr.com/p/3617928191657218

[0] Jinling API Data (Stock Price, Financial Analysis, Market Data, etc.)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.