In-depth Analysis of Zhipu AI's R&D Investment and Profitability Prospects

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on Zhipu AI’s HKEX prospectus and latest financial data, the company demonstrates typical characteristics of a large model startup:

- 2022: 84.4 million yuan

- 2023: 528.9 million yuan (527% year-on-year growth)

- 2024: 2.1954 billion yuan (315% year-on-year growth)

- First half of 2025: 1.5947 billion yuan

- Cumulative R&D investment exceeds 4.4 billion yuan[3]

- 2022: 57.4 million yuan

- 2023: 124.5 million yuan (117% year-on-year growth)

- 2024: 312.4 million yuan (151% year-on-year growth)

- First half of 2025: 190 million yuan

- Compound annual growth rate (CAGR) of up to 130%[2]

In the first half of 2025, Zhipu AI’s R&D expense to revenue ratio reached as high as

- 2022: Loss of 144 million yuan

- 2023: Loss of 788 million yuan

- 2024: Loss of 2.958 billion yuan

- First half of 2025: Loss of 2.358 billion yuan[3]

- High R&D Investment: R&D expense is the main operating expense item; in 2024, R&D expenditure was 7 times revenue

- Computing Power Infrastructure Construction: Large model training requires massive GPU computing power investment

- Talent Reserve Cost: The R&D team has 657 people, accounting for 74% of total employees, with substantial salary expenses

- Commercialization Still in Early Stage: Although revenue growth rate is fast, the absolute value is still small, making it difficult to cover high costs

- Stable Gross Margin: Maintained in the range of 50%-65% over the past three years, 50% in the first half of 2025[2]

- Sufficient Cash Reserves: As of the end of June 2025, cash and cash equivalents amounted to 2.52 billion yuan[1]

- Cumulative Financing Exceeds 8.3 Billion Yuan: Shareholders include well-known institutions such as Meituan, Tencent, Xiaomi, etc.[3]

- GLM architecture achieved nationwide localization breakthrough, compatible with over 40 domestic chips

- Multimodal models and agent models cover full scenarios such as language, code, vision, etc.

- Core research team published 500 top high-impact papers, with cumulative citations exceeding 58,000 times

- OpenAI listed Zhipu as a major global competitor in its industry analysis report in June 2025[3]

- Enterprise customers: 12,000 (as of September 30, 2025)

- Terminal devices: Over 80 million units

- Developers: Over 45 million

- Daily cloud token call volume: Over 4.2 trillion times (November 2025)

- GLM Coding Plan overseas business: Revenue over 100 million yuan, paid developers over 150,000[1]

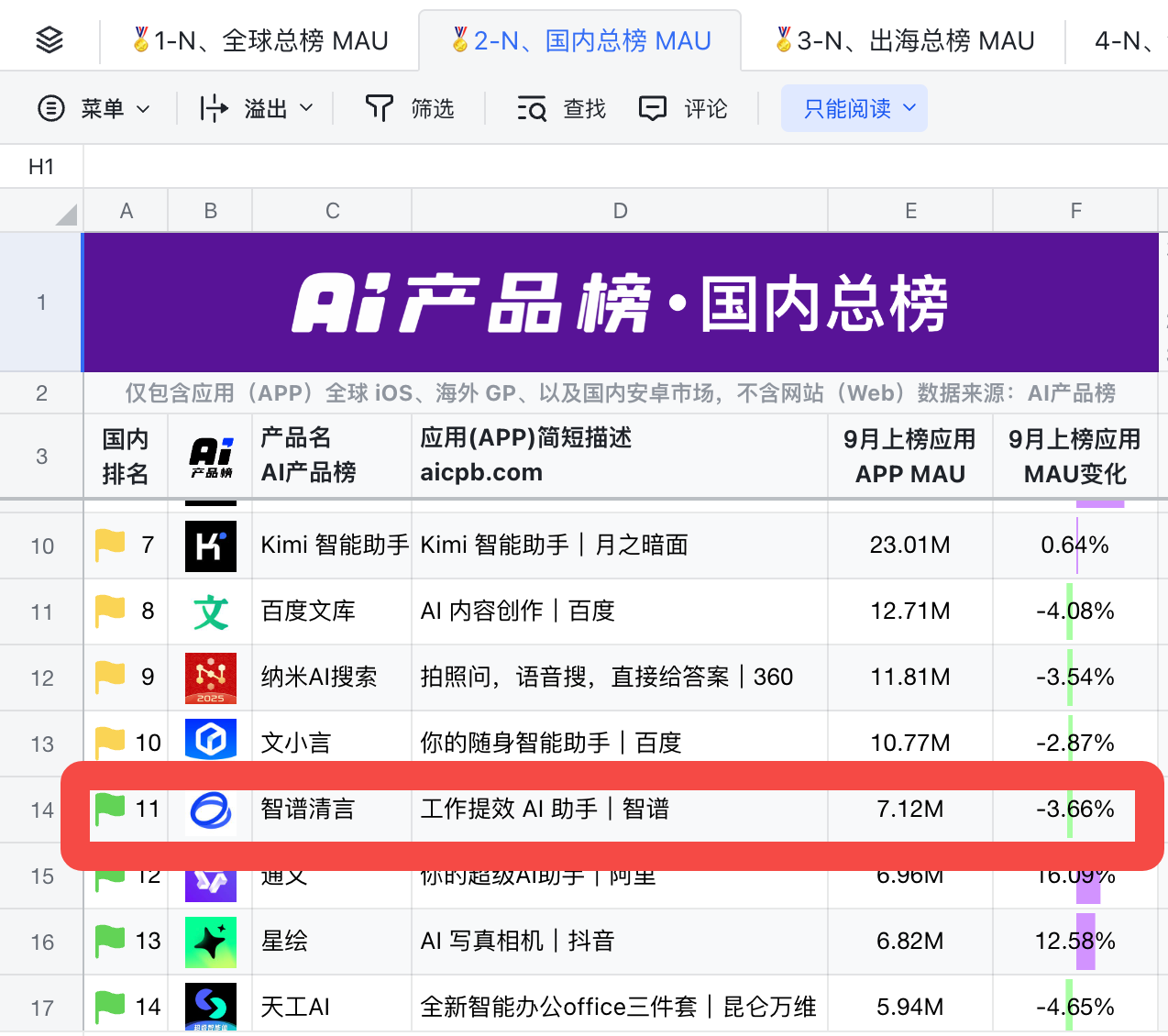

Based on 2024 revenue, Zhipu is China’s largest independent large model vendor, ranking second among all general-purpose large model developers with a market share of 6.6%[2].

Based on existing financial data and development trends, a scenario analysis of Zhipu AI’s profitability prospects is conducted:

- Revenue maintains current 130% CAGR (optimistic) or drops to 80% (neutral)

- R&D investment growth rate gradually slows down

- Scale effect gradually emerges, gross margin maintains around 50%

- Cash reserves can support operations until the end of 2027

| Scenario | 2027 Revenue Scale | R&D Expense Ratio | Break-even Time |

|---|---|---|---|

| Optimistic | 1.5-2.0 billion yuan | 200%-300% | Second half of 2027 |

| Neutral | 800 million-1.2 billion yuan | 300%-400% | 2028 |

| Conservative | 500 million-800 million yuan | 400%-500% | 2029 or later |

- Short-term (2025-2026): Profitability is extremely unlikely. R&D investment will remain high; the company’s strategic priority is technical leadership rather than profit

- Mid-term (2027-2028): Key turning point. If revenue can reach a scale of over 1 billion yuan, combined with slowing R&D investment growth, it is expected to approach break-even

- Long-term (after 2029): With the expansion of commercialization scale and emergence of scale effects, profitability will gradually improve[3]

- Technology Iteration Risk: AI technology changes rapidly; continuous large-scale investment may be needed to maintain competitiveness

- Increased Competition: Fierce competition among domestic and foreign large model vendors; price wars may compress gross margins

- Commercialization Below Expectations: Uncertainty exists in enterprise customers’ willingness and ability to pay

- Valuation Pressure: As the “world’s first large model stock”, the market will scrutinize its commercialization capabilities with strict standards

- First-mover Advantage: The earliest independent vendor to layout large models in China

- Technical Barriers: 500 high-impact papers and localized architecture

- Capital Reserves: 2.52 billion yuan in cash + 8.3 billion yuan in financing, sufficient to support R&D for many years

- Shareholder Background: Supported by industrial capital such as Meituan, Tencent, Xiaomi, etc.

Zhipu AI’s current R&D expense ratio (over 800%) reflects the

As the “world’s first large model stock”, Zhipu’s listing will fill the gap of lack of public market valuation references in the large model industry, and also means that its business model and profitability will undergo public scrutiny from the capital market. For investors, it is necessary to closely monitor its commercialization progress, technology iteration speed, and changes in the competitive landscape.

[1] QbitAI - Breaking Analysis of Zhipu AI’s Prospectus: Annual Revenue 300 Million Yuan, 130% Growth Rate, Leading the Sprint for the World’s First Large Model Stock (https://www.qbitai.com/2025/12/362256.html)

[2] Wall Street CN - Breaking Analysis of Zhipu AI’s Prospectus: Annual Revenue 300 Million Yuan, 130% Growth Rate (https://wallstreetcn.com/articles/3761776)

[3] CLS - Is the “World’s First Large Model Stock” Coming? Zhipu’s “Fundamentals” Exposed: Revenue 312 Million Yuan, Valuation 24.3 Billion Yuan (https://www.cls.cn/detail/2235451)

快手直播事件非金融研究范畴

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.