Analysis of Sunong Bank's Village Bank Acquisition and Cross-Regional Expansion Strategy

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest data and market information I have obtained, I will provide a detailed analysis of the effectiveness of Sunong Bank’s absorption and merger of village banks and its cross-regional expansion strategy.

According to industry data, since 2025, the reform process of village banks has accelerated significantly, with 90 head office-level village banks exiting the market, exceeding the total of 83 for the whole year of 2024 [1]. These young banks established after 2010 are exiting the market in an orderly manner through absorption and merger.

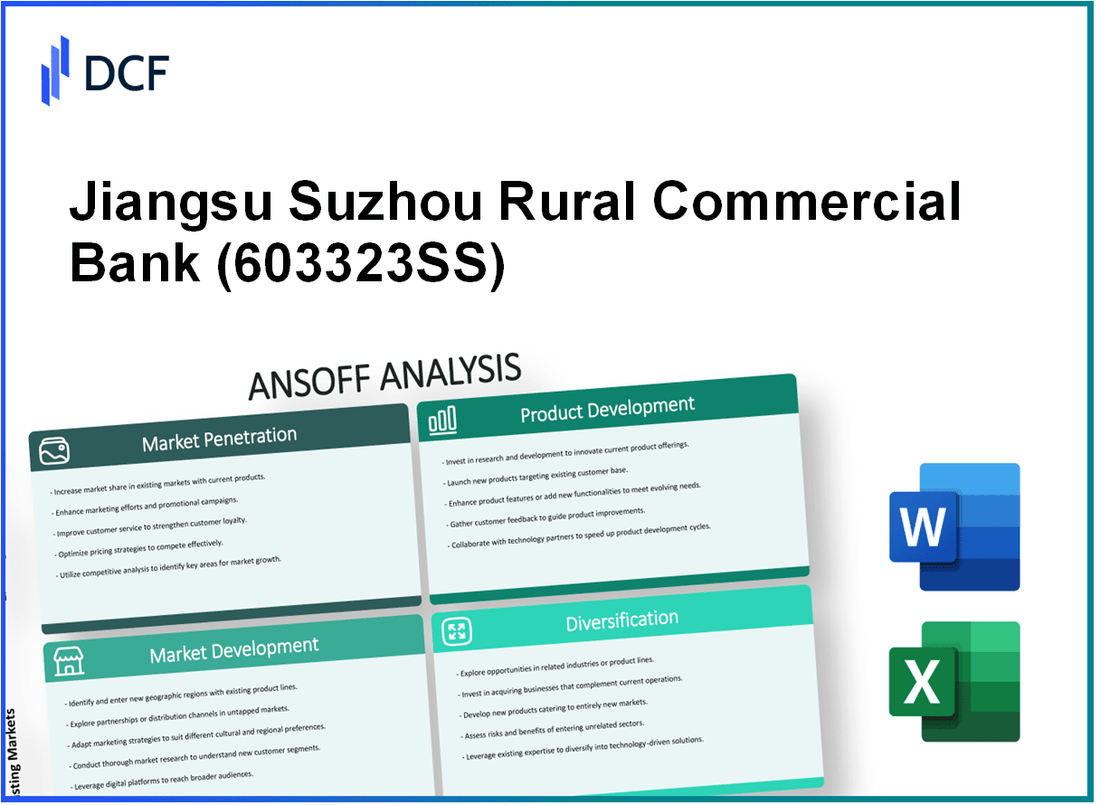

As an important rural commercial bank in Jiangsu Province, Sunong Bank’s cross-regional expansion strategy is mainly realized through the acquisition of village banks.

-

Obvious Valuation Advantage: Currently, the P/B ratio is only 0.55x, and the valuation is at a low level, providing favorable capital market conditions for merger and acquisition expansion [0].

-

Stable Profitability: ROE reaches 11.01% and net profit margin is 26.74%, indicating that it has good asset profitability [0].

-

Scale Growth Potential: Through the acquisition of village banks, it can achieve rapid network expansion and customer base growth, breaking through regional restrictions.

-

Policy Dividends: Against the backdrop of accelerated village bank reform, Sunong Bank is expected to become an integration entity and obtain more high-quality merger and acquisition targets.

-

Integration Difficulty: Village banks generally have problems such as uneven asset quality and weak risk management capabilities, so the integration cost may be high.

-

Regional Differences: Cross-regional expansion needs to face different regional economic environments, customer structures and regulatory requirements, increasing operational complexity.

-

Capital Consumption: Merger and acquisition expansion will consume capital, so it is necessary to balance the relationship between growth and capital adequacy ratio.

From the perspective of secondary market performance, Sunong Bank has increased by 4.99% in the past year and 18.54% in three years, showing relatively stable performance [0]. Combined with its low valuation level and the expansion opportunities brought by village bank reform, the bank has certain investment value.

[0] Jinling API - Sunong Bank (603323.SS) Market Data and Financial Indicators

[1] Yahoo Finance - “Six Days, Four Provinces Merge Closely! China’s Village Bank Reform Accelerates, 90 Exits This Year” (https://hk.finance.yahoo.com/news/六天四省密集合併-中國村鎮銀行改革加速-今年來已90家退場-065003483.html)

信诺维BD交易及医药行业BD模式分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.