Gaming & Leisure Properties (GLPI) Year-End Insider Stock Sales Impact Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on my comprehensive analysis of GLPI, here is a systematic assessment of the impact of insider year-end stock sales on the company’s stock price and REIT valuation.

GLPI is a US real estate investment trust (REIT) focused on gaming and leisure properties, with a current market capitalization of approximately $12.65 billion [0]. As a specialized REIT, the company generates stable rental income by providing real estate assets to gaming operators, featuring a defensive business model.

The company’s financial condition is robust:

- Strong Profitability: Net profit margin of 49.14%, operating margin of 72.67%, and ROE of 17.60% [0]

- Conservative Financial Strategy: Financial analysis indicates the company adopts conservative accounting policies with moderate debt risk [0]

- Adequate Liquidity: Current ratio of 1.47 and quick ratio of 1.47, showing good short-term solvency [0]

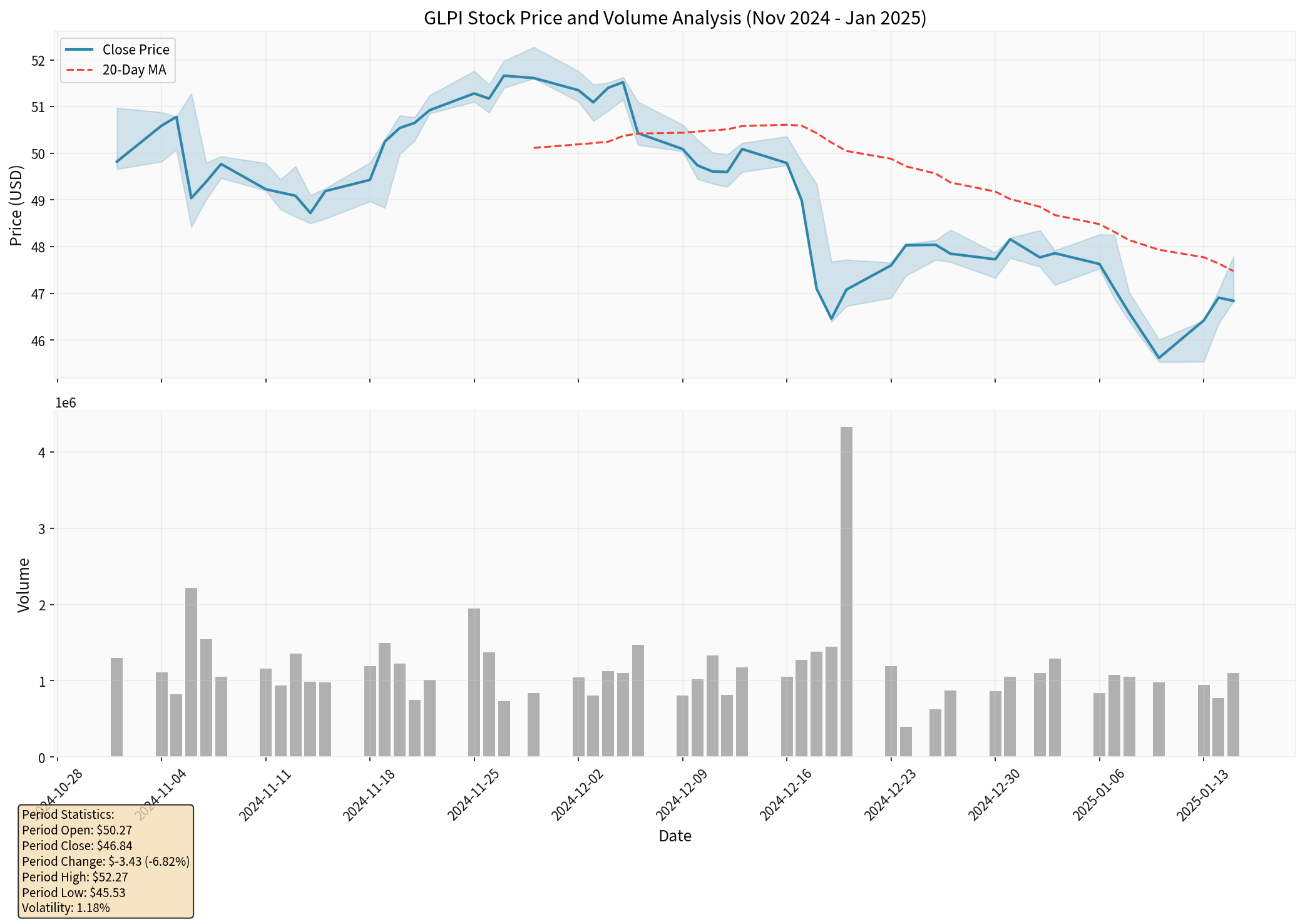

According to data analysis, GLPI’s performance from November to December 2024 is as follows:

- Period Performance: Fell from $50.27 to $48.16, a 4.20% decline [0]

- Volatility: Standard deviation of daily returns is 1.17%, indicating relatively mild volatility [0]

- Technical Indicators:

- Trend Status: Sideways

- Support Level: $47.76

- Resistance Level: $49.02

- Beta Value: 0.7 (lower than market volatility) [0]

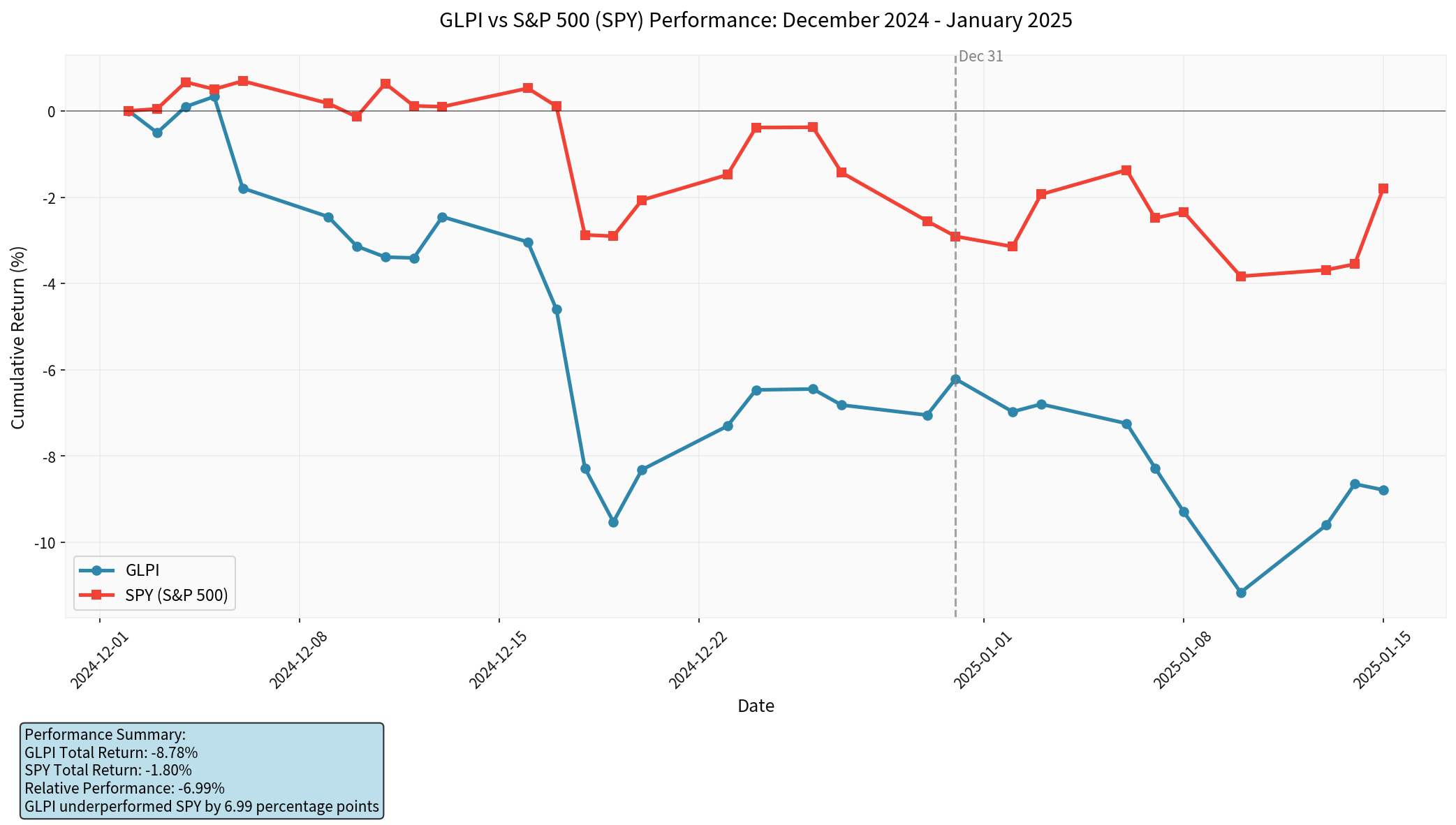

Comparison with the S&P 500 shows GLPI performed relatively stably at the end of December, with no abnormal selling pressure.

Form 144 is a pre-notification document required by the SEC for insiders to submit before selling restricted stocks, usually within 90 days prior to the actual sale. Although I have not obtained detailed information on GLPI’s specific insider sales in December 2024, the potential impact can be analyzed from the following dimensions:

Insider sales are usually interpreted as negative signals by the market, but there may be special considerations at the end of the year:

- Tax Planning: Year-end insider sales often involve tax optimization strategies and do not necessarily reflect negative views on the company

- Portfolio Rebalancing: Institutional investors and insiders may adjust positions for risk management needs

- Liquidity Demand: Year-end bonus distribution or personal financial planning may lead to selling demand

For REITs, the impact of insider sales needs special consideration:

- Dividend Yield Priority: REIT investors focus more on dividend yield and FFO (Funds From Operations) rather than pure price appreciation

- Asset Quality is King: Real estate quality and lease stability are core value drivers; insider transactions do not directly affect fundamentals

- Regulatory Constraints: REIT insiders may be subject to stricter shareholding ratio requirements

Judging the impact requires considering:

- Sale Scale: Proportion relative to average daily trading volume (approximately 1.2 million shares) and total share capital

- Seller Identity: Different signal implications between executive sales and director sales

- Historical Patterns: Whether it is a regular year-end sales plan

GLPI’s valuation metrics show:

- P/E Ratio: 16.32x (TTM) [0]

- P/B Ratio: 2.76x [0]

- Analyst Target Price: $50.00 (11.9% upside potential from current price) [0]

Among 27 analysts:

- 66.7% gave Buy ratings

- 25.9% gave Hold ratings

- Only 7.4% recommended Sell [0]

Recent positive analyst actions:

- December 17, 2025: Mizuho upgraded from Neutral to Outperform

- December 12, 2025: JPMorgan upgraded from Neutral to Overweight [0]

GLPI’s intrinsic value is mainly driven by the following factors:

- Asset Quality: Geographic location of gaming properties and lease quality

- Lease Stability: Long-term lease relationships with major gaming operators

- Interest Rate Environment: As interest rate-sensitive assets, Fed rate cut expectations are beneficial to REIT valuation

- Dividend Policy: Stable dividend growth record supports long-term investor confidence

Based on data analysis, the

- Technical analysis shows the stock price is in a sideways consolidation phase with no obvious selling panic [0]

- Trading volume in December was 1.20M shares, lower than the average level of 2.48M shares, indicating a lack of aggressive selling pressure [0]

- Beta value of 0.7, stock price volatility is lower than the market, showing defensive characteristics [0]

From a long-term investment perspective:

- Solid Fundamentals: High profit margins, stable cash flow, and conservative financial policies support long-term value [0]

- Industry Position: As a specialized REIT in gaming real estate, it has a moat effect

- Dividend Yield: The dividend特性 of REITs provides stable cash flow returns for long-term investors

Investors should pay attention to the following subsequent developments:

- Form 4 Disclosures: Follow detailed information when actual sales occur

- Q1 2025 Earnings Report: Verify whether fundamentals have changed

- Interest Rate Policy: Systemic impact of Fed monetary policy on the REIT sector

- Gaming Industry Recovery: Operating conditions of major tenants affect rent payment capacity

Based on current data analysis:

- Long-Term Investors: May consider holding, focus on dividend yield and asset quality; short-term insider transactions should not unduly affect long-term decisions

- Short-Term Traders: Be alert to the test of the support level at $47.76; if broken, it may further decline

- Risk Level: Medium risk, mainly affected by interest rate changes and gaming industry cycles

[0] Jinling API Data - GLPI Real-Time Quotes, Company Overview, Technical Analysis, Financial Analysis, Historical Price Data (Nov 2024 - Jan 2025)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.