Impact Assessment of Weibo's $200 Million Share Repurchase Plan

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to Weibo’s announcement on the Hong Kong Stock Exchange, the board of directors approved the repurchase of up to $200 million worth of shares (including American Depositary Shares) over the next 12 months [0]. The repurchase will be conducted via open market transactions, private negotiations, block trades, etc., depending on market conditions, using existing cash reserves.

- Current Stock Price: $10.22 (U.S. shares) / Hong Kong Stock Code: 09898.HK [0]

- Current Market Capitalization: $2.44 billion [0]

- Cash Reserves: $2.04 billion (as of September 30, 2025) [0]

- Repurchase Amount: $200 million [0]

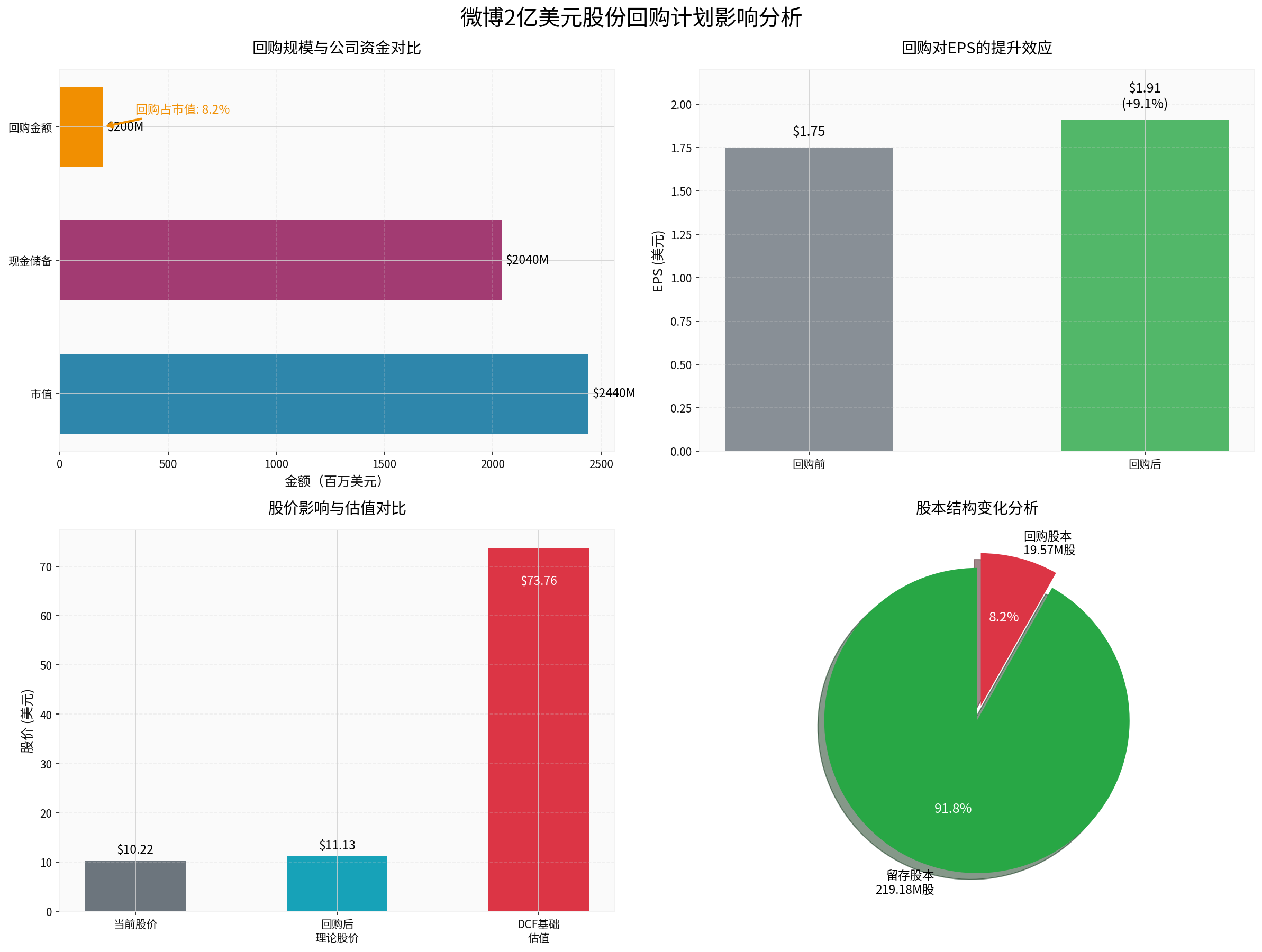

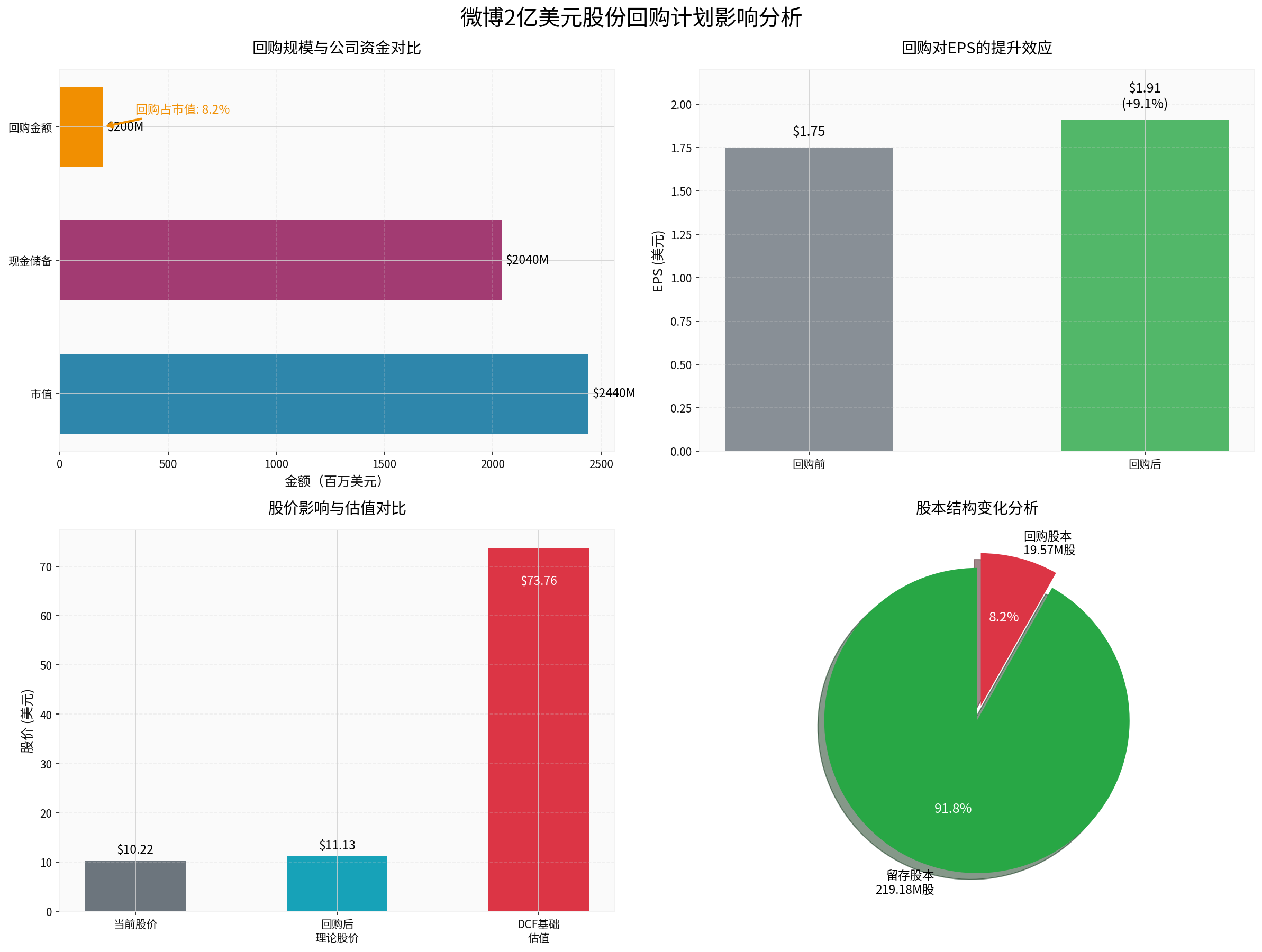

Figure 1: Comprehensive Impact Analysis of Weibo’s $200 Million Share Repurchase Plan

- This is a medium-scale repurchase planthat demonstrates management confidence while retaining sufficient financial flexibility

- In comparison, large tech companies typically repurchase shares ranging from 5% to 10% of their market capitalization

- For a Chinese concept stock like Weibo, an 8.20% repurchase ratio shows strong management recognition that the current stock price is undervalued

According to financial analysis data [0]:

- Debt Risk Level: Low Risk

- Free Cash Flow: $578 million (latest period)

- Operating Margin: 30% (Non-GAAP, Q3 2025) [0]

- Net Margin:25% (Q3 2025) [0]

The repurchase will directly reduce the number of outstanding shares, thereby increasing earnings per share (EPS) [0]:

| Metric | Before Repurchase | After Repurchase | Change |

|---|---|---|---|

| Total Shares Outstanding | 238.75M shares | 219.18M shares | -8.20% |

| EPS | $1.75 | $1.91 | +8.93% |

- Assuming net profit remains unchanged, the repurchase can boost EPS by 8.93%

- This will directly increase the earnings per share for existing shareholders

- For value investors, this is a ‘free’ shareholder return

Calculated based on the current P/E ratio of 5.84x [0]:

| Scenario | Stock Price | Change Rate |

|---|---|---|

| Current Stock Price | $10.22 | - |

| Theoretical Price After Repurchase | $11.13 | +8.93% |

| DCF Base Valuation | $73.76 | +621.7% |

- In the short term, the repurchase plan may drive the stock price up by approximately 8.93% to $11.13

- However, based on DCF valuation, Weibo is still significantly undervaluedby 621.7% [0]

- Even after the repurchase is completed, there is still significant upside potential for the stock price

Share repurchase is one of the two main ways to return cash to shareholders (the other is dividends):

- Tax Efficiency: Shareholders do not need to pay taxes immediately for the repurchase (only when they actually sell their shares)

- Flexibility: Repurchases can be adjusted based on market conditions, while dividends are usually considered a commitment

- Signal Effect: Repurchases send a strong signal to the market that management believes the stock price is undervalued

- ROE Improvement: Reducing equity can increase return on equity (ROE)

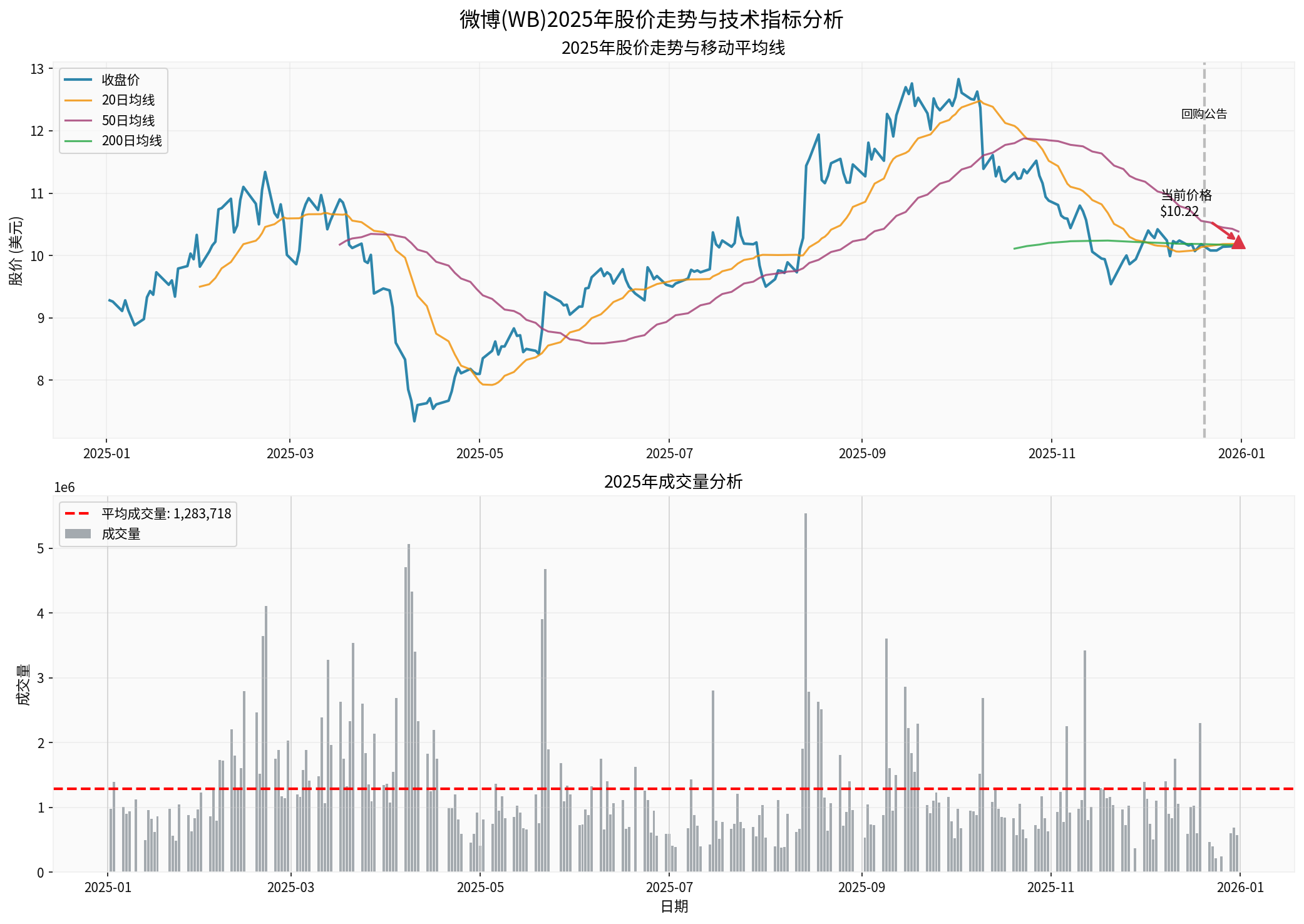

Figure 2: Analysis of Weibo’s 2025 Stock Price Trend and Trading Volume

Weibo is listed on both the U.S. NASDAQ (WB) and the Hong Kong Stock Exchange (09898.HK). This repurchase plan

- Chinese concept stocks generally have a valuation discount in Hong Kong

- The Hong Kong stock market has a lower risk appetite for Chinese concept stocks

- Liquidity is relatively weaker compared to the U.S. stock market

- Liquidity Support: The repurchase will directly provide buying support in the Hong Kong stock market

- Valuation Repair: Helps narrow the valuation gap with U.S. shares

- Investor Confidence: Sends positive signals to Hong Kong investors

- Price Discovery: Helps discover reasonable value through open market repurchases

Although the latest data on Weibo’s Hong Kong shares cannot be directly obtained, based on historical experience:

- The price of Chinese concept stocks in Hong Kong usually has a 5%-15% discount compared to their U.S. ADRs

- The repurchase plan may help narrow this discount

- In the long term, prices in both markets should converge (considering exchange rate factors)

- Hong Kong shares may achieve excess returnsrelative to U.S. shares

- The repurchase will be prioritized in markets with lower valuations to maximize the repurchase effect

- Helps increase the liquidity and market attention of Hong Kong shares

| Metric | Value | YoY Change |

|---|---|---|

| Monthly Active Users (MAU) | 578 million | Slight decrease (due to high base from Paris Olympics in the same period last year) |

| Daily Active Users (DAU) | 257 million | DAU/MAU ratio steadily improving |

| Smart Search MAU | Over 70 million | Strong growth |

- User engagement continues to improve

- DAU and query volume of the smart search function increased by more than 50% QoQ

- The platform’s user base remains stable, with over 500 million users

| Metric | Value | YoY Change |

|---|---|---|

| Total Revenue | $442.3 million | -5.0% |

| Advertising and Marketing Revenue | $375.4 million | -6.0% |

| Value-added Service Revenue | $66.9 million | +2.0% |

| Operating Profit | $132 million | Margin:30% |

- High base effect from the Paris Olympics in the same period last year

- Decreased advertising spending in some industries (FMCG, food and beverage)

- Budget cuts in the gaming and smartphone industries

- Advertising revenue from the e-commerce industry increased by more than 50%, becoming the main growth driver

- Advertising revenue from the automotive industry achieved steady growth

- Advertising revenue related to Alibaba increased by 112% to $45.5 million

###3. Strategic Layout

- AI advertising creative platform “Lingchuang” is widely used

- AI-generated advertising creatives account for nearly 30%

- Smart search technology upgraded, MAU exceeding 70 million

- AI real-time bidding advertising products achieved double-digit growth

- Homepage feed revised to strengthen recommended content distribution

- Video content recommendation algorithm optimized

- Super Topic community functions continuously enhanced

- Major events such as the 2026 Winter Olympics and World Cup

- In-depth application of AI technology in advertising monetization

- Recovery trend in the brand advertising market

| Scenario | Fair Value | Relative to Current Stock Price |

|---|---|---|

| Conservative Scenario | $45.28 | +343.1% |

| Base Scenario | $73.76 | +621.7% |

| Optimistic Scenario | $251.88 | +2364.6% |

| Component | Value |

|---|---|

| Beta Coefficient | 0.15 (very low) |

| Risk-free Rate | 4.5% |

| Market Risk Premium | 7.0% |

| Cost of Equity (CAPM) | 5.6% |

| Cost of Debt | 5.5% |

WACC |

5.0% |

- Weibo’s Beta is only 0.15, far below the market average, indicating low volatility

- A WACC of 5.0% is at a historical low, reducing the drag of the discount rate on valuation

- Even in the conservative scenario, the stock price should be above $45

- Revenue Growth Rate:0.9%

- EBITDA Margin:29.2%

- Net Margin:15.8%

- Free Cash Flow:$578 million

###1. Historical Stock Price Performance (2025) [0]

- Price at the Start of the Year:$9.45

- Current Price:$10.22

- Annual Increase:+8.15%

- 52-Week Range:$7.10 - $12.96

- Volatility:Daily standard deviation of 2.44%

- Weibo’s stock price performance in 2025 was relatively stable with low volatility

- The current price is close to the 52-week median level

- The stock price is at a relatively low historical level, providing a good opportunity for the repurchase

###2. Technical Indicator Analysis [0]

| Technical Indicator | Value | Interpretation |

|---|---|---|

| 20-day MA | $10.18 | Stock price is above the MA; short-term trend is upward |

| 50-day MA | $10.38 | Stock price is slightly below the50-day line; mid-term trend is weak |

| 200-day MA | $10.16 | Long-term trend is relatively stable |

| RSI(14) | ~50 | In neutral zone |

- Short-term technical indicators suggest the stock price may stabilize

- The repurchase news may become a catalyst for a technical breakthrough

- Need to pay attention to the coordination of trading volume

###3. Investor Sentiment

Based on news and market comments [1][2]:

- The market remains cautious about Chinese concept stocks overall

- However, Weibo’s repurchase plan is regarded as a positive signal

- Investors focus on Weibo’s AI strategy and e-commerce business growth

###1. Repurchase Plan Risks

- Market volatility may affect the timing and cost of the repurchase

- If the stock price rises sharply, the number of shares that can be repurchased with the $200 million budget will decrease

- The repurchase may be seen as a signal that there are no better investment options

- Using $200 million for repurchase means it cannot be used for other investments (e.g., mergers and acquisitions, R&D)

- If the company has investment opportunities with higher returns, the repurchase may not be the optimal choice

- Chinese concept stocks face regulatory and geopolitical risks overall

- Sustained weakness in the advertising market may affect revenue

- Intensified competition (e.g., Douyin, Xiaohongshu) may erode market share

###2. Business Risks

- Q3 2025 revenue decreased by5% YoY [0]

- Revenue growth has slowed for multiple consecutive quarters

- Relies on advertising revenue; business model is relatively single

- MAU growth is weak

- Needs to rely on major events (e.g., Olympics, World Cup) to drive traffic

- Short video platforms divert user time

- Emerging social platforms compete for young users

###3. Regulatory Risks

- Audit supervision of Chinese concept stocks continues

- Cybersecurity and data security regulations are being strengthened

- Changes in regulatory policies for the advertising industry

###1. Evaluation of the Repurchase Plan

- ✅ Sound financial position with sufficient cash reserves

- ✅ Moderate repurchase scale (8.2% of market cap), demonstrating confidence while retaining flexibility

- ✅ Can boost EPS by approximately9%, directly increasing shareholder earnings

- ✅ Repurchasing when the stock price is undervalued, with high cost-effectiveness

- ✅ Covers both Hong Kong and U.S. markets, fully protecting shareholder interests

- ⚠️ The repurchase cannot solve the fundamental business growth problem

- ⚠️ Needs to be accompanied by business improvement to sustainably increase the stock price

- ⚠️ Weak revenue growth remains the core challenge

###2. Valuation Assessment

- P/E ratio:5.84x (very low) [0]

- P/B ratio: expected to be below1.0x

- DCF valuation: $73.76 (base scenario) [0]

- Undervaluation extent: over600%

- Current valuation has already reflected the market’s pessimistic expectations for Chinese concept stocks

- Book cash ($2.04 billion) is already close to 83.6% of market cap ($2.44 billion) [0]

- From the perspective of margin of safety, investment risk is limited

###3. Investment Recommendations

- The repurchase plan may push the stock price to the $11-$12 range

- Pay attention to Q4 earnings report and 2026 guidance

- E-commerce and automotive advertising revenue growth are key catalysts

- Major events in2026 (Winter Olympics, World Cup) will drive advertising demand

- The effect of AI technology application in advertising monetization will gradually emerge

- Pay attention to the opportunity of convergence in the price gap between Hong Kong and U.S. shares

- If Weibo can stabilize revenue and resume growth, the stock price has the potential to return to DCF valuation

- Current valuation provides an extremely high margin of safety

- However, need to continuously monitor user growth and changes in competitive landscape

###4. Investor Strategy Recommendations

- ✅ Value Investors: Current valuation is highly attractive with high margin of safety

- ✅ Contrarian Investors: Looking for undervalued high-quality assets when the market is pessimistic

- ✅ Long-term Investors: Believe in Weibo’s platform value and profitability

- ❌ Short-term Speculators: Weibo’s stock price has low volatility, with limited short-term profit potential

- ❌ High-growth Preference Investors: Weibo has entered the mature stage and is difficult to achieve high growth

- Existing Holders: It is recommended to continue holding; the repurchase will boost EPS and ROE

- Potential Buyers: Consider building positions in batches; the current price has an excellent risk-reward ratio

- Hong Kong Share Investors: Pay attention to the opportunity of convergence in the price gap between Hong Kong and U.S. shares

Weibo’s $200 million share repurchase plan is a

- Financial Feasibility: Sufficient cash reserves, no impact on normal operations

- Shareholder Value: Expected to boost EPS by9%, directly increasing shareholder earnings

- Valuation Rationality: Current stock price is undervalued by over600%, with excellent repurchase timing

- Strategic Significance: Conveys management confidence and improves capital structure

- Impact on Hong Kong Shares: Provides liquidity support for Hong Kong shares and helps with valuation repair

[0] Gilin API Data (real-time stock prices, company finances, DCF valuation, earnings call transcripts, etc.)

[1] Yahoo Finance Hong Kong - “Weibo (09898.HK) Plans to Repurchase Up to $200 Million Shares” (https://hk.finance.yahoo.com/news/微博-09898-hk-擬回購不超過2億美元股份-新浪訴訟收到不利判決-143507869.html)

[2] AASTOCKS - Reports related to Weibo’s repurchase announcement

[3] Seeking Alpha - “Weibo Corporation (WB) Q3 2025 Press Conference Call Transcript” (https://seekingalpha.com/article/4845012-weibo-corporation-wb-q3-2025-press-conference-call-transcript)

[4] GuruFocus - “Weibo Corp (WB) Q3 2025 Earnings Call Highlights” (https://www.gurufocus.com/news/3214770/weibo-corp-wb-q3-2025-earnings-call-highlights-navigating-revenue-challenges-with-ai-and-user-engagement-growth)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.