Analysis of the Reference Value of Insider Stock Sales: A Case Study of Olympic Steel

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Insiders (executives, directors, major shareholders) selling stocks have important

- Normal Cash-out: Executives sell stocks for personal financial planning, diversification, tax payments, etc.

- 10b5-1 Plan: Pre-arranged, regularized sales plan, usually routine transactions

- Option Exercise: Selling immediately after exercising options to lock in profits, which is normal compensation realization

- Large-scale Reduction: Executives significantly reduce their shareholding ratio, especially key decision-makers

- Concentrated Selling: Multiple executives sell in the same period

- Sensitive Timing: Selling before major company announcements, during earnings release windows, or other sensitive periods

- Deviation from Historical Patterns: Selling behavior明显 deviates from the executive’s historical trading habits

According to professional analysis frameworks, judging the nature of insider sales requires attention to the following key factors [2]:

Judgment Dimension |

Normal Cash-out Characteristics |

Warning Signal Characteristics |

|---|---|---|

Transaction Type |

10b5-1 plan, option exercise, RSU tax deduction | Open market large-value sales |

Sale Scale |

Small proportion of holdings (<5%) | Large proportion of holdings (>10%) |

Sale Timing |

Regular, rule-based sales | Sudden, concentrated sales |

Executive Identity |

Non-core decision-makers | Core executives like CEO, CFO, COO |

Multi-person Synchronization |

Individual executive selling | Multiple executives selling同期 |

Fundamental Alignment |

Stable fundamentals | Declining performance, uncertain prospects |

Valuation Background |

Stock price at historical high | Stock price at low or reasonable range |

Olympic Steel (NASDAQ: ZEUS) is a leading U.S. metal processing and steel distribution company founded in 1954, with main businesses including:

- Carbon steel flat products: 57.1% of revenue

- Specialty metal flat products:25.6% of revenue

- Tubular and pipe products:17.3% of revenue[0]

Indicator |

Value |

Evaluation |

|---|---|---|

| Market Cap | $479 million | Mid-cap stock |

| Current Stock Price | $42.78 | 52-week range: $26.32 - $45.41 |

| P/E Ratio | 37.2x | High |

| Net Profit Margin | 0.73% | Low |

| ROE | 2.39% | Low |

| Current Ratio | 3.12 | Good |

| Quick Ratio | 1.17 | Reasonable |

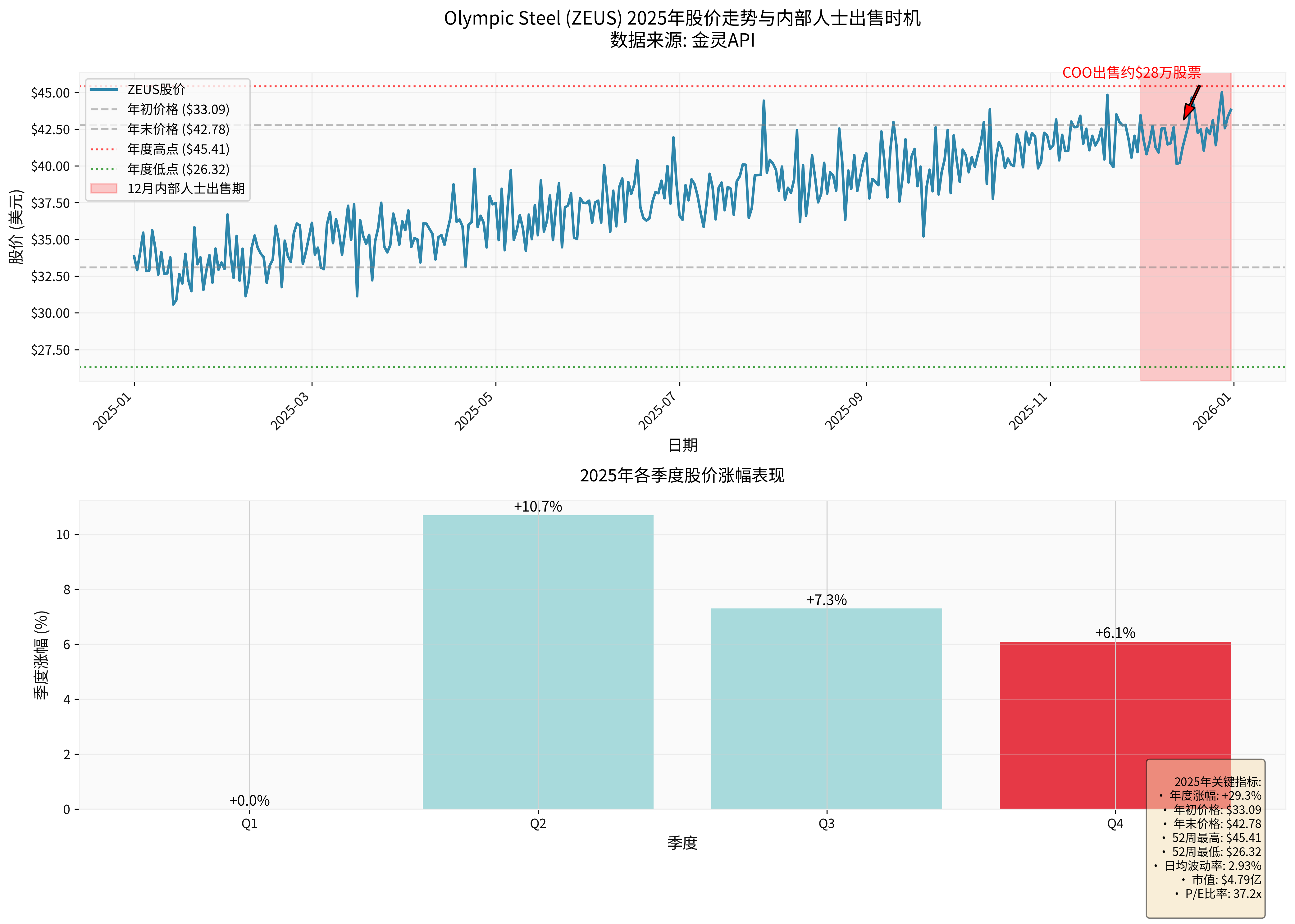

- Annual increase: +29.3%

- 3-month increase: +40.5%

- 6-month increase: +31.3%

- YTD increase: +33.8%

- Position: President & COO

- Tenure:9.3 years

- Shareholding Ratio:0.17% (approx. $874,000)

- Total Compensation: $2.72 million/year[2]

- Sale Amount: approx. $280,000

- Sale Timing: December 2025, stock price in annual high range ($43-$44)

- Change in Shareholding Ratio: Assuming the holding value is $874,000, $280,000 accounts for approx.32%

- Price Background: Close to 52-week high ($45.41)

Based on the above analysis, my judgment on this insider sale is as follows:

- Stock price at annual high when sold (after +29.3% increase)

- Close to 52-week high, reasonable timing for technical profit-taking

- Year-end sale may involve tax planning needs

- Although accounting for a high proportion of personal holdings (32%), the absolute amount is small ($280,000)

- Not fully liquidated, still retains most holdings

- Minimal impact relative to $479 million market cap

- Strong 2025 stock performance (+29.3%)

- Good liquidity (current ratio:3.12)

- Debt risk at “medium” level[0]

- Positive free cash flow ($4.19 million)[0]

- Steel industry benefited from infrastructure demand and manufacturing recovery in 2025

- Analyst consensus rating is “Buy”, target price $41[0]

-32% reduction ratio is relatively high, indicating some willingness to realize profits

-P/E ratio of37.2x is high, valuation is expensive

-Net profit margin of only0.73%, weak profitability

-ROE of only2.39%, low return on capital

-Financial attitude classified as “aggressive”[0]

-Low depreciation/capital expenditure ratio, limited upside potential for earnings

Based on comprehensive analysis of insider sales and fundamentals:

Evaluation Dimension |

Score(1-5) |

Explanation |

|---|---|---|

| Stock Performance | 4/5 | Annual increase of29.3%, strong performance |

| Financial Health | 3/5 | Good liquidity but weak profitability |

| Valuation Level | 2/5 | P/E37.2x, high |

| Industry Outlook | 3/5 | Steel industry is highly cyclical |

| Insider Signal | 3/5 | May be normal cash-out but needs continuous observation |

- Existing Holders: Consider partial profit-taking but do not panic sell due to one sale

- Potential Investors: Wait for better entry point as current valuation is high

- Continuous Monitoring: Watch for subsequent同步 sales by other executives

For future insider sales, it is recommended to analyze according to the following process:

- Who sold? (Position, importance)

- How much was sold? (Amount, shareholding proportion)

- When was it sold? (Timing, sensitive period)

- How was it sold? (10b5-1 plan vs open market)

- Has the executive had similar sales behavior in the past?

- Is the sale regular and rule-based?

- Is the scale of this sale abnormal compared to the past?

- What is the company’s performance trend?

- Is the valuation in a reasonable range?

- Is the industry outlook optimistic?

- Are there any major positive/negative news?

- Are multiple executives selling simultaneously?

- Does the company have a buyback plan to offset the impact?

- What is the situation of insider purchases?

- Large-scale reduction by CEO/CFO (>20% holdings) + declining performance period + low stock price

- Concentrated sales by multiple executives + negative news + high valuation

- Sudden sale outside 10b5-1 plan + before important product launch

- Routine 10b5-1 plan sales + stable performance + reasonable valuation

- Immediate sale after option exercise + unchanged long-term holdings

- Regular year-end/quarter-end sales + personal financial planning needs

- Risk Level: Medium-low risk

- Recommended Action: Holders can continue holding but set stop loss;观望者 wait for回调 to below $38 before considering entry

- Monitoring Focus: Whether other executives follow suit in the next3 months; Q4 2025 earnings report (January2026)

Insider stock sales do have important reference value, but

- More likely a normal cash-outbecause of reasonable timing (high stock price), moderate scale, and stable company fundamentals

- But need to remain moderately vigilantdue to high shareholding reduction ratio, expensive valuation, and weak profitability

- Recommended attitude: Neutral to cautious— do not panic due to one sale, but do not ignore its signal value

[0] Jinling API Data - Olympic Steel (ZEUS) Company Overview, Financial Analysis, Stock Price Data

[1] TIKR.com - “How to Track Whether Insiders Are Selling Their Stocks” (https://www.tikr.com/zh/blog/how-to-track-whether-insiders-are-selling-their-stock)

[2] Simply Wall St - Olympic Steel Management Shareholding Data (https://simplywall.st/stocks/us/materials/nasdaq-zeus/olympic-steel/management)

[3] Olympic Steel Official Website - Management Team Introduction (https://www.olysteel.com/management-profile)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.