Datadog (DDOG) Insider Selling: Impact on Investor Sentiment and Valuation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on my analysis of Datadog (DDOG) amid the recent insider selling activity, here is a comprehensive assessment of the impact on investor sentiment and valuation:

- Date:December 17, 2025

- Shares Sold:11,195 shares

- Value:$1,544,126 at average price of $137.93

- Ownership Impact:2.11% reduction in CEO’s holdings

- Post-Transaction Holdings:518,133 shares (~$71.5 million)[1]

- SEC records show multiple Form 144 filings (reports of proposed sales of securities) in late December[1]

- These filings indicate planned insider sales, though specific details on the CTO’s $8.3M sale require direct SEC Form 4 verification

- Pre-Planned Sales (Rule 10b5-1):Many executive stock sales are pre-scheduled under trading plans, reducing concerns about opportunistic timing

- Diversification:C-level executives often sell for personal portfolio diversification, not necessarily due to company concerns

- Historical Context:Consistent with insider behavior at high-growth tech companies after significant share price appreciation

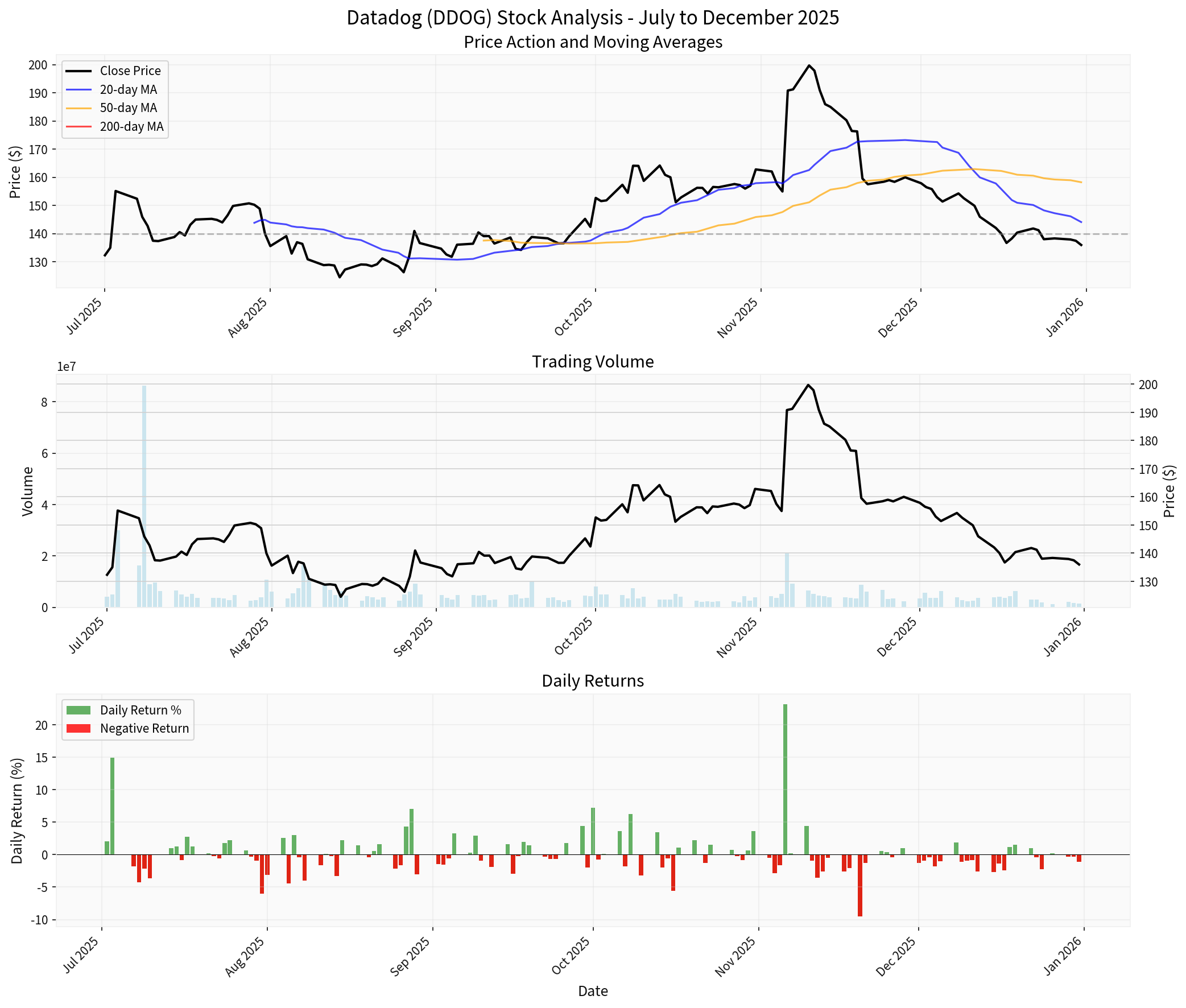

- December Performance:-13.88% decline[0]

- Year-to-Date:-5.32% (underperforming broader market)[0]

- 6-Month Performance:+1.24% (minimal gains)[0]

- 52-Week High/Low:$201.69 / $81.63 (currently near lower end of range)[0]

- Volume Patterns:December average daily volume of 3.43M exceeded typical levels, suggesting increased selling pressure[0]

- Technical Weakness:Stock trading below all major moving averages (20-day, 50-day, 200-day)[0]

- Retail Investor Uncertainty:While viewed as a “cleaner AI play” than volatile chip stocks, retail sentiment appears pressured[1]

- Strong Analyst Consensus:80% of analysts rate DDOG as “Buy” with only 2.2% rating “Sell”[0]

- Price Target Upside:Consensus target of $185.00 represents 36.0% upside from current levels[0]

- AI Tailwinds:Datadog positioned as “toll booth” for AI-driven economy with unique AI observability offerings[1]

- P/E Ratio:444.07x (extremely elevated)[0]

- P/B Ratio:13.79x[0]

- EV/OCF:49.00x[0]

- Market Cap:$47.69 billion[0]

- Q3 2025 Revenue:$885.65M (most recent quarter)[0]

- Q2 2025 Revenue:$826.76M[0]

- Net Profit Margin:3.32% (thin for current valuation)[0]

- ROE:3.48% (relatively low)[0]

- Rich Multiples:Despite recent decline, DDOG trades at significant premium to growth

- Profitability Challenges:Operating margin of -1.38% indicates ongoing investment phase[0]

- Competitive Risks:Hyperscaler (AWS, Microsoft) native monitoring tool improvements pose long-term competitive threat[1]

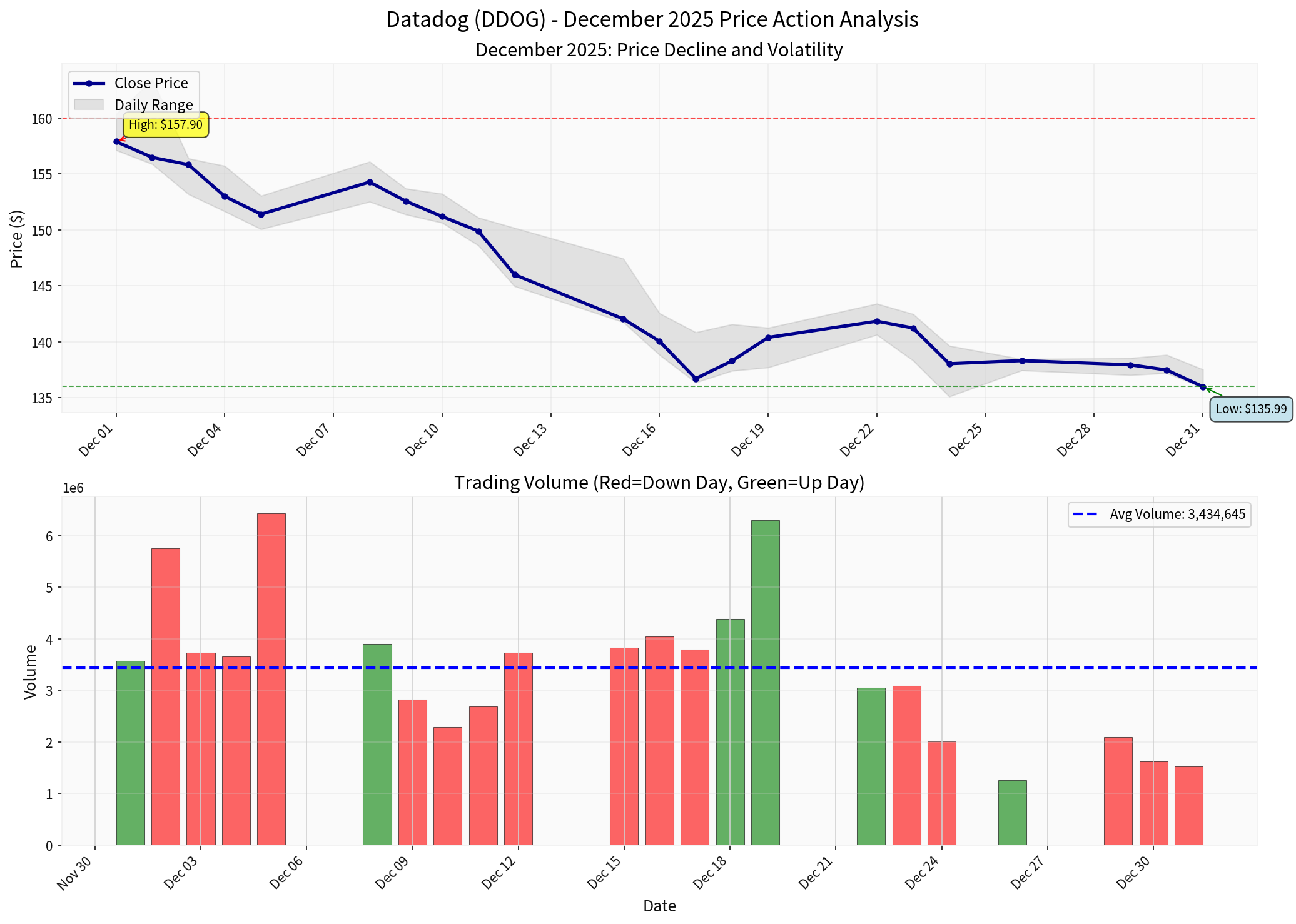

- Period High:$163.43

- Period Low:$135.11

- Monthly Decline:-13.88%

- Peak-to-Trough Drawdown:17.33%[0]

- Trend:SIDEWAYS (no clear directional trend)[0]

- Support Level:$140.46

- Resistance Level:$153.55

- Beta:1.23 (higher volatility than market)[0]

- RSI:Oversold territory suggests potential bounce opportunity[0]

- Price Action:Stock rallied from July lows to November highs near $200, then sharply declined in December

- Moving Averages:Price currently trading below 20-day, 50-day, and 200-day moving averages, indicating bearish short-term momentum

- Support Zone:The $135-140 level represents critical support (currently being tested)

- Volume Spikes:Increased volume in December correlates with insider selling news and technical breakdown

- Downside Momentum:Consistent selling pressure throughout the month

- Volume Correlation:Red (down) days frequently showed above-average volume, indicating institutional selling

- Low Testing:Stock successfully tested and held $135 support zone multiple times

-

Financial Position:

- Current Ratio:3.66 (strong liquidity)[0]

- Quick Ratio:3.66 (no immediate liquidity concerns)[0]

- Debt Risk:Low risk classification[0]

-

Business Positioning:

- Cloud-Native Platform:Built from cloud-first principles vs. legacy on-premise competitors[1]

- AI Observability:Unique positioning in LLM monitoring, token cost tracking, security vulnerability detection[1]

- Regulatory Tailwinds:Proposed AI safety laws may mandate LLM monitoring for bias/safety[1]

-

Market Opportunity:

- AI/Cloud Expansion:Enterprise AI workloads requiring production-scale monitoring

- Revenue Diversification:North America (41.9%), International (18.1%)[0]

-

Competitive Pressures:

- Hyperscaler Risk:AWS/Microsoft improving native monitoring could reduce external platform need[1]

- Market Saturation:Large customer penetration may slow growth

-

Profitability Challenges:

- Operating Margin:-1.38% indicates heavy investment spending[0]

- ROE:3.48% suggests inefficient capital deployment[0]

- Net Margin:3.32% (very thin for growth stock)[0]

- Buy Ratings:36 analysts (80.0%)

- Hold Ratings:8 analysts (17.8%)

- Sell Ratings:1 analyst (2.2%)[0]

- High Target:$215.00

- Low Target:$105.00

- Consensus:$185.00 (36.0% upside)[0]

- Citigroup: Maintained Buy (November 12)

- Barclays: Maintained Overweight (November 7)

- Scotiabank: Maintained Sector Outperform (November 7)[0]

- AI Workload Monitoring:Enterprise AI deployments driving new product adoption

- Regulatory Compliance:AI safety regulations potentially creating mandatory monitoring requirements

- Cost Optimization:Cloud Cost Management features helping enterprises reduce spend[1]

- Valuation Compression:If growth slows, premium multiples could contract

- Competition Intensification:Hyperscaler improvements, new entrants

- Execution Risk:Maintaining growth while achieving profitability

- Mixed Signals:Strong analyst ratings vs. insider selling

- Valuation Debate:Growth opportunities vs. stretched multiples

- Technical Weakness:Price below major moving averages triggering stop-losses

- Sentiment Pressure:December decline testing conviction

- AI Narrative:Viewing DDOG as “cleaner AI play” vs. chip volatility[1]

- Insider Trust:Executive sales raising questions about confidence

- Support Test:Critical $135-140 support zone being tested

- Technical Damage:Stock below all major moving averages

- Sentiment Fragile:Insider selling adding to negative psychology

- Recommendation:HOLD/Wait- Wait for stabilization and support confirmation before adding

- Growth Catalysts:AI/Cloud monitoring tailwinds remain intact

- Valuation Risk:Rich multiples limit upside unless growth accelerates

- Competitive Threat:Monitor hyperscaler native tool improvements

- Recommendation:BUY on Weakness- Accumulate on further weakness below $130 for long-term growth exposure

- Market Position:Leader in cloud observability with AI tailwinds

- Product Innovation:AI observability, cost management, security differentiation

- Regulatory Moat:Potential AI compliance requirements creating stickiness

- Recommendation:BUY- Long-term winner in cloud infrastructure monitoring, but patient entry recommended

- Continued Insider Selling:Multiple executives selling significant holdings

- Technical Breakdown:Break below $130 would trigger significant stop-loss selling

- Competitive Encroachment:AWS/Microsoft native tool improvements

- Growth Deceleration:Revenue growth slowing below 20-25% range

- Profitability Miss:Failure to improve margins despite scale

- Insider Buying:Executive purchases would signal confidence

- Technical Breakout:Close above $150 moving averages

- Strong Earnings:Beats on both revenue and profitability

- AI Contract Wins:Major enterprise AI monitoring deployments

- Part of a Pattern:Multiple insider sales (CEO, planned sales via Form 144) in December

- Likely Pre-Planned:Most executive sales follow 10b5-1 plans for diversification

- Exacerbating Factor:Occurring during technical weakness, amplifying negative sentiment

- Not Fundamental:Company fundamentals remain strong with solid financial position

- Negative Psychology:Adding to technical pressure

- Support Test:Critical $135-140 zone under stress

- Sentiment Deterioration:Retail confidence shaken

- Limited Fundamental Impact:Business prospects unchanged

- Valuation Dependent:If growth accelerates, selling forgotten; if growth slows, selling prescient

- Market Barometer:Reflects broader high-growth tech sentiment pressure[1]

- Technical breakdown after strong Q4 rally

- General growth stock rotation

- Rich multiple compression

- Insider sale timing (even if pre-planned)

[0] 金灵API数据 (Datadog company overview, stock price data, technical analysis, financial analysis, trading data)

[1] News sources and web search results including:

- Yahoo Finance - “3 Reasons We’re Fans of Datadog (DDOG)” (Dec 23, 2025)

- Financial Content Markets - “Datadog (DDOG): The ‘Single Pane of Glass’ for the AI and Cloud Era” (Dec 29, 2025)

- SEC.gov - Multiple Form 144 filings (Dec 22-29, 2025)

- InsiderTrades.com - “Olivier Pomel Sells 11,195 Shares of Datadog Stock” (Dec 27, 2025)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.