In-depth Analysis of the Growth Sustainability and Investment Value of Voyah Automobile

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to the latest data, Voyah Automobile delivered a total of

- Monthly delivery in September reached 15,224 units, indicating strong monthly growth momentum

- Acceleration was obvious in the second half of the year; the Voyah Taishan model was delivered to 5,000 users just 26 daysafter its launch [5]

- Five new models were launched intensively throughout the year, rapidly improving the product matrix

The Voyah Dreamer performed brilliantly in the high-end new energy MPV segment, with sales reaching

Voyah has achieved multiple

-

Three-chamber Air Suspension: First mass-produced by a Chinese brand, equipped with an 110mm adjustment stroke, 100 times/second road preview intelligent adjustment, 4-level stiffness adjustment, and 5-level height adjustment [5]. The leading nature of this technology provides a product competitiveness barrier for high-end models.

-

800V High-Voltage Platform + 5C Ultra-fast Charging: Supports a CLTC pure electric range of 350km and a combined range of over 1400km, effectively alleviating users’ range anxiety [5].

-

In-depth Integration with Huawei Ecosystem:

- Huawei Kunlun Intelligent Driving ADS 4.0 system (four-lidar solution)

- HarmonyOS Cockpit HarmonySpace 5 (first to be equipped with AI voice large model)

- This collaboration has brought rapid improvements to Voyah’s intelligent experience [5][6]

The Voyah Taishan is priced at

The penetration rate of new energy vehicles in China exceeded

The

Voyah needs to address:

- BYD’s comprehensive product line coverage and cost advantages

- NIO, Xpengand other new forces’ technological innovation competition

- Huawei series(Aito, Zhijie) ecosystem synergy advantages

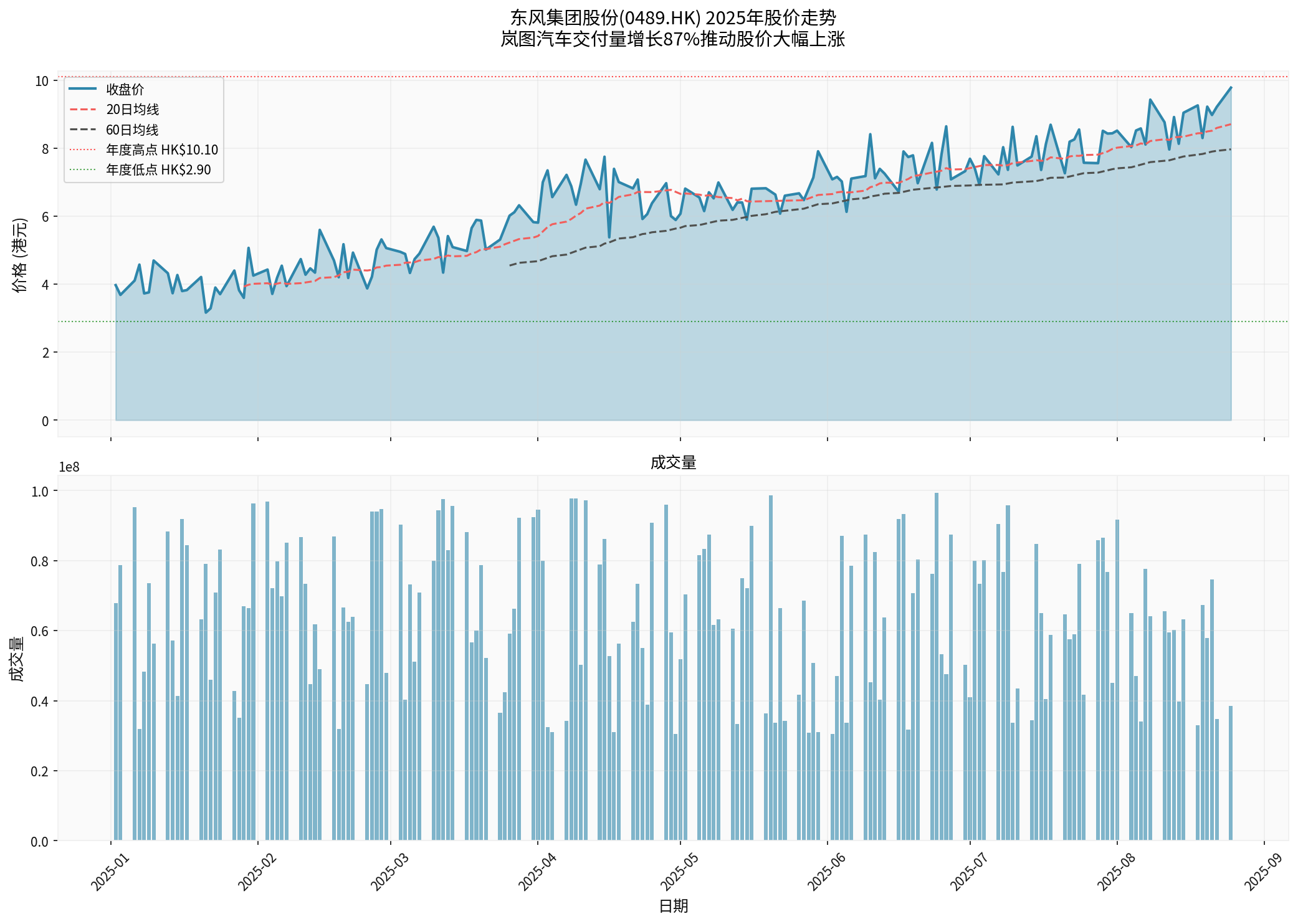

Dongfeng Group Co., Ltd. (0489.HK) is currently in a

- EPS (TTM): -$0.08

- Net profit margin: -0.52%

- Operating margin: -5.90%[0]

High R&D investment and channel expansion will continue to drag down profitability in the short term.

The domestic auto market growth slowed significantly in 2025, and experts predict that it may only achieve a slight growth of about

Voyah Automobile’s

- Chassis Technology: Systematic solution for three-chamber air suspension, solving the driving pain points of large-size SUVs [6]

- Intelligent Driving: ADS 4.0 system in cooperation with Huawei, integrating 4D millimeter-wave radar and lidar

- Battery Technology: Application of semi-solid-state batteries, with energy density and safety superior to traditional liquid batteries [4]

- Intelligent Cockpit: AI voice large model and five Agent intelligent bodies [5]

Patent advantages → Product differentiation → High-end market positioning → Brand premium → Investment value

- Voyah Taishan received over 10,000 orders in just 21 minutesafter its launch [5]

- High-end model pricing capability (379,900-509,900 yuan range)

- Cooperation with Huawei to improve intelligent experience and enhance brand attractiveness

- BYD Yun Nian-Z: Response time compressed to 5 milliseconds

- Voyah Three-chamber Air Suspension: System-level integration solution, providing four spring stiffness combinations

Through different technical paths, both are jointly promoting Chinese brands from “imitation and catch-up” to

Chart shows: Dongfeng Group Co., Ltd.'s stock price rose sharply from HK$3.72 at the beginning of 2025 to a high of HK$10.10, with an annual increase of over 137%. Voyah Automobile’s growth is an important driving factor [0]

- Current stock price: HK$5.97

- Annual increase: +197.01%(1-year period) [0]

- 52-week range: HK$1.84 - HK$6.30

- Market capitalization: HK$49.27B

- Growth Certainty: As the core carrier of Dongfeng’s new energy transformation, Voyah continues to receive resource inclination

- Technology Premium: Patent advantages are expected to be transformed into product premium and brand value

- Hong Kong IPO Expectation: Voyah has submitted an IPO application to the Hong Kong Stock Exchange, and spin-off listing may create value for shareholders [3]

- Central and State-owned Enterprise Background: Dongfeng Group’s resource support provides relatively stable R&D investment guarantee for Voyah

- Valuation Pressure: P/B ratio is only0.30x, and the market is cautious about the transformation of traditional car companies [0]

- Profit Challenge: The path to turning losses into profits in the short term is unclear

- Intensified Competition: High-end market competition is fierce, and market share is uncertain

- Capital Expenditure Pressure: R&D and channel expansion require continuous large capital investment

- Cautiously Optimistic. Voyah’s high growth supports Dongfeng Group’s stock price, but the 87% growth rate is difficult to maintain. It is recommended to pay attention to the changing trend of monthly delivery data.

-

Value Investment Opportunity. If Voyah can:

- Steadily transform patent advantages into product competitiveness

- Gain a firm foothold in the high-end market (annual sales exceeding 300,000 units)

- Achieve break-even and start making profits

Then Dongfeng Group’s valuation is expected to be revalued, and the current 0.30x P/B has room for repair.

- Monthly Delivery Volume: Whether it can remain above 10,000 units

- Gross Margin: Whether it improves with the enhancement of scale effect

- High-end Model Proportion: Sales proportion of high-end models such as Voyah Taishan

- Depth of Huawei Cooperation: Whether the intelligent experience can continue to lead

Voyah Automobile’s 87% high growth

- 2026 Expected Growth Rate: Expected to fall to the30-50%range

- Supporting Factors: New product cycle, technical advantages, Huawei cooperation

- Restricting Factors: Slowdown in industry growth, intensified competition, base effect

| Dimension | Evaluation | Explanation |

|---|---|---|

Technical Moat |

★★★★☆ | Core technologies such as three-chamber air suspension are leading, but continuous innovation is required |

Market Positioning |

★★★★☆ | Precise high-end market positioning, avoiding red ocean competition |

Growth Potential |

★★★☆☆ | Short-term growth rate will slow down, long-term depends on scale effect |

Profit Prospect |

★★☆☆☆ | Still under pressure in the short term, break-even point is not clear |

Strategic Value |

★★★★☆ | Key carrier of Dongfeng’s new energy transformation |

Voyah Automobile’s patent advantages are gradually being transformed into market competitiveness, and the hot sales of Voyah Taishan prove that the product strength is recognized by the market. For investors, Dongfeng Group Co., Ltd. (0489.HK) current undervaluation (P/B 0.30x) provides a

But it is necessary to closely monitor

[0] Gilin API Data - Real-time quotes, financial analysis, company overview and 2025 stock price data of Dongfeng Group Co., Ltd. (0489.HK)

[1] Yicai - “Voyah Automobile delivered 150,000 units in 2025, up 87% year-on-year” (https://www.yicai.com/brief/102984213.html)

[2] Jiemian News - “Voyah Automobile delivered 150,169 units in 2025, up 87% year-on-year” (https://m.jiemian.com/article/13835906.html)

[3] Sohu Finance - “Capital Choices Behind the Top 10 IPOs in the Auto Circle: Who is Worth Investing In?” (https://m.sohu.com/a/970520857_180520?scm=10001.325_13-325_13.0.0-0-0-0-0.5_1334)

[4] Sina Finance - “2025 Automobile Industry Yearbook | New Technology Chapter: Story is the Beginning, Commercialization is the End” (https://finance.sina.com.cn/roll/2025-12-30/doc-inheqqfk9578433.shtml)

[5] IT Home - “Chinese First Three-chamber Air Suspension Flagship SUV ‘Voyah Taishan’ Delivered 5,000 Units in 26 Days, Starting from 379,900 Yuan” (https://www.ithome.com/0/909/043.htm)

[6] 36Kr - “2025 Auto Market Upheaval: Intelligent Driving Popularization, Fast Charging Counterattack, Chassis Revolution… Ten Trends Define the Future” (https://m.36kr.com/p/3603409949950722)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.