Analysis of the Impact of Large-Scale Development of Low-Altitude Economy on Investment Value of A-Share Industry Chain Companies

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The Tianjin Low-Altitude Flight Service Platform officially started trial operation at Liulin Zhihui Building in Hexi District, marking Tianjin’s low-altitude economy entering a standardized and systematic development stage [1]. The “Low-Altitude Cloud” service system launched by the platform provides a digital base for airspace management, flight services, and industrial applications through cloud-integrated deployment, and

- The 15th Five-Year Planlists the low-altitude economy as a “strategic emerging industry” [1]

- China Telecom released the AI+ “1+1+4+N” low-altitude economy capability system, aiming to accelerate the large-scale application of connected drones [1]

- Tianjin Ninghe District established the first low-altitude safety technology industrial park in the Beijing-Tianjin-Hebei region[1]

The low-altitude economy industry chain can be divided into the following core links:

Upstream Core Components → Midstream Complete Machine Manufacturing → Downstream Operation Services

↓ ↓ ↓

Power Batteries/Chips eVTOL/UAVs Flight Service Platforms

Sensors/Navigation Aircraft Manufacturing Logistics Distribution

-

Investment Highlights:

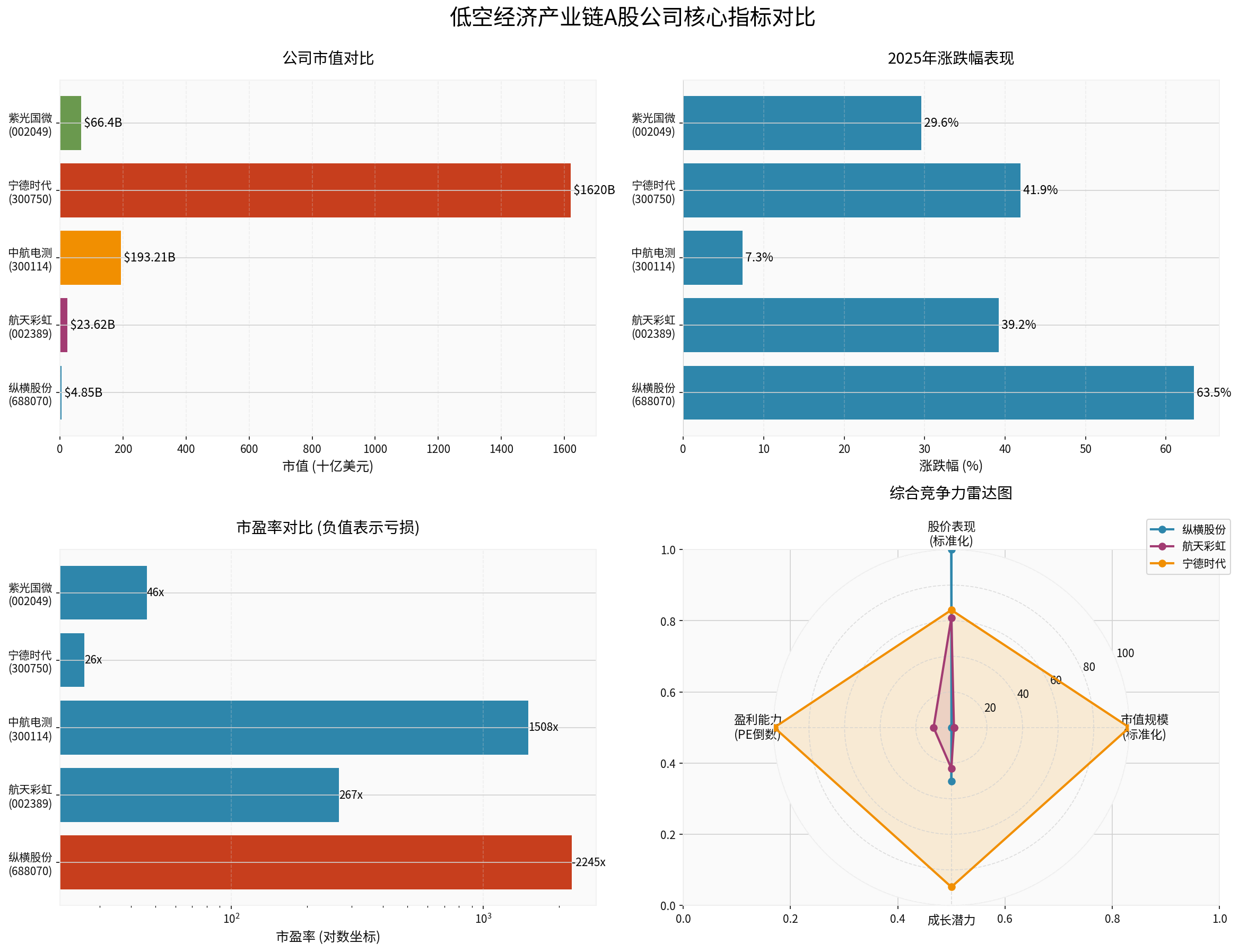

- 2025 stock price increase of +63.47%, ranking first in the industry chain for annual growth [0]

- Focuses on industrial-grade UAV systems, with leading positions in surveying and mapping, inspection, security, etc.

- Market value of 4.85 billion USD, with first-mover advantages among科创板 (STAR Market) UAV enterprises

-

Risk Tips:

- Currently in a loss state (PE: -2244.85x), ROE: -0.38% [0]

- High valuation (P/B:8.06x), need to pay attention to profit improvement progress

-

Investment Highlights:

- 2025 increase of +39.18%, market value of 23.62 billion USD [0]

- Rainbow series UAVs have high popularity in domestic and international markets

- Military business provides stable cash flow, and civilian market has large expansion space

-

Financial Performance:

- Net profit margin:3.15%, relatively stable operation capability

- Current ratio:2.97, sound financial status [0]

-

Strategic Value:

- Global power battery leader, market value of 1.62 trillion USD[0]

- 2025 increase of +41.92%, stable performance [0]

- Has technical barriers in high-energy-density battery field for eVTOL

- Global power battery leader, market value of

-

Financial Health:

- PE:26.13x, most reasonable valuation in the industry chain [0]

- ROE up to 22.84%, net profit margin:16.53%, excellent profitability [0]

- Sufficient cash flow to support high R&D investment

###3. Aerospace and Equipment (Technology Support)

- Market value:19.321 billion USD, 3-year increase: 447.23%[0]

- Mainly engaged in aerospace sensors, testing equipment, etc.

- Although current PE is as high as1508x, it benefits from the trend of military electronics

- Market value:6.64 billion USD, has advantages in security chip field

- Net profit margin:23.28%, strong profitability [0]

- Provides core chips for flight control, communication, etc. for low-altitude aircraft

| Industry Chain Link | Short-term Catalysts | Mid-to-Long Term Growth Potential | Recommendation Rating |

|---|---|---|---|

UAV Complete Machines |

Policy promotion, logistics demand outbreak | Trillion-level market space | ★★★★☆ |

Power Batteries |

eVTOL mass production, technological breakthroughs | High-nickel ternary, solid-state battery iteration | ★★★★★ |

Core Components |

Domestic replacement, military-civilian integration | Military + civilian dual drive | ★★★★☆ |

Flight Service Platforms |

Digital management, safety systems | Long-term value of operation services | ★★★☆☆ |

From 2025 price performance [0]:

- JOUAV: Jan $35.63 → Dec $55.40, increase:55.49%, volatility:3.46%

- Aerospace Rainbow: Jan $18.00 → Dec $23.98, increase:33.22%, volatility:2.65%

- Technical Risk: eVTOL technology is still in the early commercial stage, and technical routes have uncertainties

- Policy Risk: Adjustments to airspace management policies may affect the industrial landing rhythm

- Valuation Risk: Some companies have overvalued (e.g., JOUAV), need to be alert to underperformance

- CATL (300750.SZ): Power battery leader, reasonable valuation (PE:26x), strong profitability [0]

- Allocation Suggestion:30-40% position, as the cornerstone of low-altitude economy layout

- Aerospace Rainbow (002389.SZ): Military-civilian integration, stable business, 2025 increase:39% [0]

- Unigroup Guoxin Microelectronics (002049.SZ): Aerospace chips, net profit margin:23% [0]

- Allocation Suggestion:20-25% position each

- JOUAV (688070.SS): Pure industrial UAV target,2025 increase:63%, but currently in loss [0]

- Allocation Suggestion:10-15% position, suitable for investors with high risk preference

- Short-term (3-6 months): Focus on trading opportunities brought by policy catalysts

- Mid-term (1-2 years): Pay attention to eVTOL mass production progress and commercial landing

- Long-term (3-5 years): Trillion-level market of low-altitude economy is expected to form, companies with core technologies will win

According to industry forecasts [1]:

- By 2025, China’s low-altitude economy-related stocks have risen1.9x

- By 2030, low-altitude economy is expected to become a trillion-level emerging market

- The industry chain covers multiple fields such as aircraft manufacturing, operation services, infrastructure, etc.

The trial operation of Tianjin’s “Low-Altitude Cloud” platform marks the industry entering the stage of large-scale application from

[0] Gilin API Data - A-share company financial data, stock prices and market performance

[1] Yahoo Finance - “China Telecom Releases AI+ Low-Altitude Economy Capability System” (https://hk.finance.yahoo.com/news/中電信-00728-hk-發布ai-低空經濟能力體系-080119264.html)

[2] China Daily - “Tianjin leverages its district’s green assets for growth” (https://www.chinadaily.com.cn/a/202512/26/WS694dec38a310d6866eb30972.html)

[3] Market Digest - China Low-Altitude Economy and Flying Car Market Analysis (2025) (https://media.zenfs.com/en/market_digest_986/cc3f1c8e90229d1163b42c189ead70d1)

岚图汽车增长可持续性与投资价值深度分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.