Traction Path of CDB Urban Construction Loans on the Three Major A-Share Sectors

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

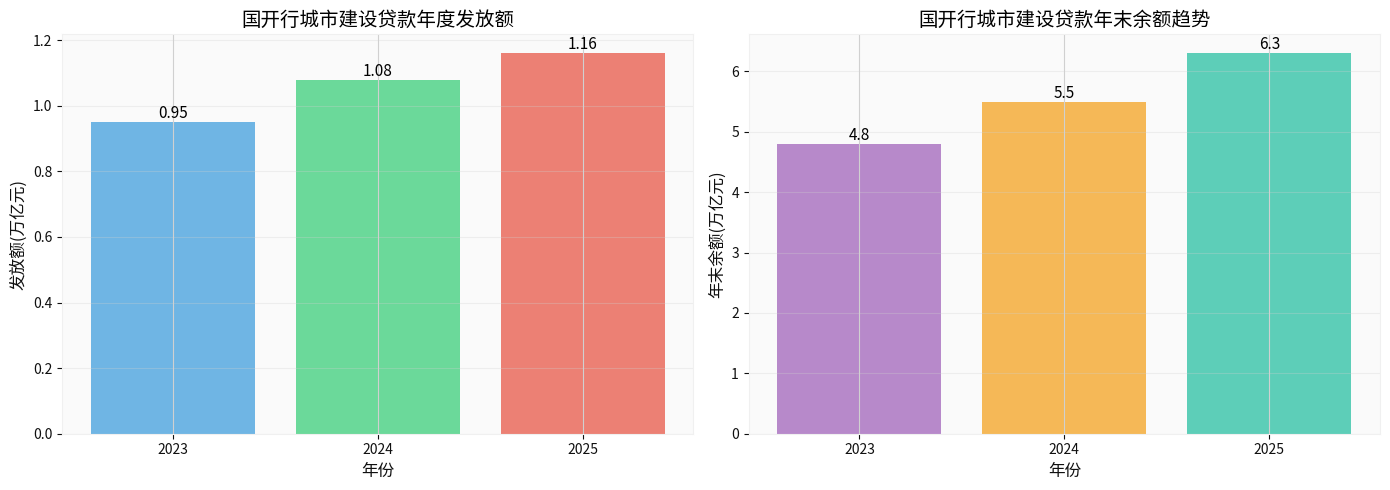

In 2025, the China Development Bank (CDB) allocated 1.16 trillion yuan in credit to the urban construction sector, increasing the account balance to 6.3 trillion yuan and maintaining a high-intensity lending rhythm for three consecutive years (Figure 1). The funds focus on “serving the improvement of urban functional quality and living environment”, and consolidate the foundation of high-quality urban development through “four guarantees” such as government-bank-enterprise collaboration, financing and product innovation [1]. This large-scale investment has grasped the core drivers of relevant A-share sectors under the background of alleviating urban investment financing, driving the implementation of infrastructure and renewal projects, and supporting the overlapping policies of “stable property market + urban renewal”; especially in the 2025 environment where the policy of “urban renewal + infrastructure REITs expansion” continues and financing tools are diversified, the capital effect is more sustainable [2].

Figure Explanation: The left chart shows the annual urban construction loan disbursement from 2023 to 2025 (unit: trillion yuan), and the right chart shows the year-end loan balance (unit: trillion yuan); the X-axis is the year, and the Y-axis is the numerical value. In 2025, the disbursement increased by 7.4% year-on-year and the balance increased by 14.5% year-on-year, reflecting the expansion of policy banks and the rhythm of medium and long-term project investment.

- Infrastructure Sector (Construction and Engineering Consulting)

- Loans primarily serve the construction of “urban function improvement” and “modern people’s cities”, requiring a large number of long-term infrastructure projects such as urban rail transit, roads, bridges, underground pipelines, and water utilities, directly providing orders and输血 (transfusing blood) to leading construction enterprises through PPP/EPC models [1].

- Combined with the 15th Five-Year Plan’s infrastructure investment rhythm of high first and then stable, and current policies focusing on national-level major projects and new-quality productivity (canal systems, Tibet railway, new energy infrastructure, etc.), engineering central state-owned enterprises (SOEs) and local SOEs with regional resource advantages will benefit from concentrated order release and high dividend valuation revaluation [3].

- Real Estate Sector (Urban Renewal, Affordable Housing, Decoration, etc.)

- The upstream and downstream of loans cover old community renovation, urban renewal actions, public service facilities and other fields, embedded with “subsidy instead of award” and “fund-land” combinations, which help improve the quality of stock assets and support the policy linkage of “stable property market + living environment” [2].

- The expansion of REITs policy (infrastructure REITs add urban renewal standards) means that real estate assets can obtain long-term low-cost funds through the “capital market + policy bank” dual-wheel structure, enhance the securitization capacity of urban construction assets, and benefit urban construction properties and decoration leaders with high cash flow and asset securitization capabilities [2].

- Urban Investment Platforms (Local Investment and Financing Platforms)

- In the 2025 urban investment interest-bearing debt structure, the proportion of bank loans rose to 57%, indicating that policy credit has become the main channel for urban investment to supplement low-interest funds, effectively replacing non-standard high-interest debt and reducing financing costs [4].

- CDB loans provide medium and long-term funds, reduce financial debt repayment pressure, help urban investment carry out low-yield but policy-oriented infrastructure projects such as municipal utilities, sponge cities, and charging piles, and obtain refinancing windows to mitigate the transmission of local debt risks [4].

| Serial Number | Sub-Sector | Logic and Reasons |

|---|---|---|

| 1 | Municipal Utilities (Sewage/Waste Treatment, Water Supply and Drainage, Street Lights) |

Belong to the category of “infrastructure shortcomings” in urban construction, dominated by policy funds, urban investment platforms and infrastructure central enterprises have integrated construction, operation and maintenance capabilities, pro-cyclical orders + long-term operating cash flow. |

| 2 | Rail Transit and Road Bridges (Including Rail Transit Equipment/Signals) |

Urban function improvement and metropolitan area expansion rely on rail transit networks; fund support + ultra-long disbursement period advantages promote large-scale project procurement, bringing deterministic demand to construction machinery, railway equipment, and digital centralized control systems. |

| 3 | Urban Renewal/Old Community Renovation (Including Prefabricated Decoration, Smart Communities) |

Urban renewal is included in the scope of infrastructure REITs and financial subsidies, increasing the government’s willingness to allocate funds for renovation projects, driving orders and gross profits of prefabricated buildings, decoration, intelligentization, and energy-saving renovation enterprises. |

| 4 | Affordable Housing and Supporting Facilities Around Shantytown Renovation |

Debt risk is controllable and policy demand is strong; urban investment and real estate are combined, and relevant targets can obtain low-cost funds through CDB loans, covering materials, construction and property services. |

| 5 | New Infrastructure (Low-Altitude Economy/New Energy Infrastructure/Smart Transportation) |

Some projects are emerging but have the label of “urban function + new-quality productivity”, and can be laid out with policy guidance and supporting funds from urban investment platforms, such as low-altitude economic scenarios, urban charging piles/energy storage, and power grid upgrading projects. |

- Valuation and Dividend Advantages: Under the background of strengthened regulatory constraints on dividends and emphasis on allocation value, construction central SOEs with high dividend rates and undervalued values and local SOEs with comprehensive service capabilities will attract capital attention [3].

- Presentation of Orders and Cash Flow: Leading enterprises that win national-level projects, expand overseas and urban renewal projects will show performance elasticity in the 2026 spring “project concentration landing + accounting” stage, while private construction enterprises will pursue new tracks such as clean rooms and AI computing power through flexible mechanisms, and are expected to form a second growth curve [3].

- Capital End Risk Mitigation: While CDB loans replace non-standard financing and reduce costs, continuous attention should be paid to the upper limit of local government non-standard balances, regulatory requirements that financing costs do not exceed 6%, and urban investment may still face liquidity pressure in some weak provinces [4].

- Local Debt/Urban Investment Liquidity: In case of tight liquidity, if project回款 (return of funds) and land income are lower than expected, urban investment may still face short-term debt repayment pressure; regional credit differentiation (Shandong, Guizhou, Yunnan, Shaanxi, Henan, etc.) needs to be identified [4].

- Project Execution and Fund Matching: CDB loans require precision, efficiency and compliance; investors must have compliance, contract performance and risk control capabilities, otherwise the lending speed may lag; for projects with long construction cycles or long revenue recovery cycles, they need to cooperate with the “government-bank-enterprise” collaborative system.

- Policy Rhythm and Fund Reallocation: Although the credit scale is large in 2025, future attention should be paid to whether there is a trend of “policy fund tightening” and whether the issuance of REITs products truly drives asset securitization and attracts long-term funds.

- Configuration Focus: State-owned enterprise-led engineering construction leaders (central enterprises + local SOEs) + urban renewal decoration/construction decoration leaders + urban investment platforms with operational capabilities.

- Sub-Sector Opportunities: Focus on municipal utilities, smart transportation/low-altitude economic supporting facilities, charging piles/new energy infrastructure, and assets securitizable by REITs.

- Monitoring Indicators: Pay attention to CDB定向贷款 (targeted loan) announcements, special fund allocation, urban investment bond stock/new regulations, local fiscal pressure relief, and REITs project landing progress.

- Data Connection: It is recommended to combine industry orders (bid-winning data), REITs filing project lists and urban investment bond issuance quotas to dynamically calibrate equity positions.

For further enterprise-level valuation models, cash flow discounting or cross-industry comparisons, consider enabling the

[0] Internal analysis results of Jinling AI (2023-2025 CDB urban construction loan disbursement and balance trend chart).

[1] Xinhua News Agency, “CDB Disburses 1.16 Trillion Yuan in Urban Construction Loans in 2025”, https://www.xinhuanet.com/fortune/20260101/fe66e243b14b466ab518d2ab3873568b/c.html

[2] Securities Times, “Innovative Land Use, Diversified Financing, Urban Renewal Presses the ‘Acceleration Button’”, https://www.stcn.com/article/detail/3526182.html

[3] Huayuan Securities Research Institute, “Attach Importance to ‘Spring Restlessness’, Seek ‘Major Projects’ Trajectory Layout”, https://pdf.dfcfw.com/pdf/H3_AP202512251807878827_1.pdf

[4] Southern Weekend, Local Debt “Bomb Disposal”: Blocking the Spread of Local Risks to the Whole Province, https://news.southcn.com/node_64549305f1/c0be694600.shtml

土耳其免签政策对出境游航司与OTA业绩提振的评估框架

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.