Outlook on Canada's Resource-Based Economy: Analysis of the Sustainability of Mining Sector Doubling and Financial Stocks' 30% Growth

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on professional market data and multi-dimensional analysis, I provide you with this comprehensive in-depth report on Canada’s resource-based economy.

According to brokerage API data, the performance of the S&P/TSX Composite Index in 2024 is as follows [0]:

- 2024 Growth: +18.29% (from $20,904.30 to $24,727.90)

- Current Level(early 2026): $31,712.76, up approximately 28% from the end of 2024

- 52-Week Range: $22,227.70 - $32,081.90

- Volatility: Daily volatility of 0.64% (relatively low, indicating market stability)

- 2024 Growth: +29.96%(from $133.36 to $173.32)

- Past 1-Year Growth (as of early 2026): +35.83%

- Market Capitalization: $328.75B (Canada’s largest bank)

- P/E Ratio: 16.13x (relatively reasonable)

- Analyst Consensus: HOLD (57.1%), but Buy ratings account for 39.3%

- Key Finding: A 7.01% actual decline in the 2024 calendar year, but arolling 12-month growth of +159.84%

- This indicates that the main growth occurred in late 2024 to 2025

- Current Market Capitalization: $102.94B

- P/E Ratio: 20.70x

- Analyst Consensus: BUY(64.3%)

- Current Stock Price: $59.79

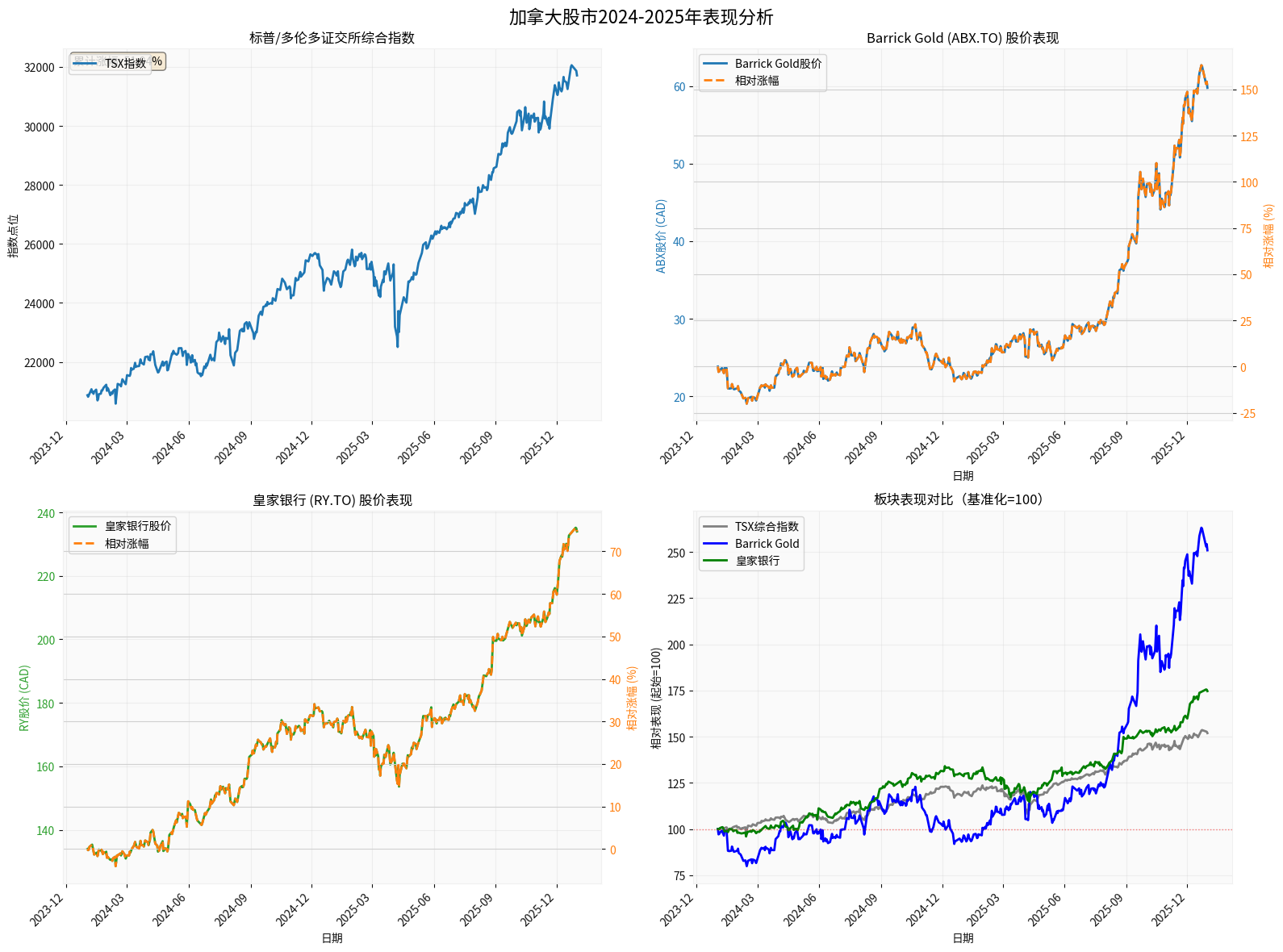

- Top-left chart: The TSX Composite Index rose steadily in 2024, with acceleration at the end of the year

- Top-right chart: Barrick Gold’s stock price (blue line) began to surge in the second half of 2024, with a steep relative growth (orange line) curve

- Bottom-left chart: Royal Bank’s stock price showed a steady upward trend

- Bottom-right chart: Sector comparison shows that mining stocks (blue line) significantly outperformed bank stocks (green line) and the broader market index (gray line) from late 2024 to 2025

- Current Price: $4,341.10/oz

- 52-Week Range: $2,624.60 - $4,584.00

- Annual Growth: Approximately 65% (calculated from the 52-week low)

- Historic Breakthrough: Gold prices hit a record high in 2025

- Current Price: $70.60/oz

- 52-Week Range: $28.31 - $79.70

- Volatility: A 9.39% single-day decline, indicating high volatility characteristics

- Gold grew by 137.4%in 2025

- Canadian precious metal miners performed excellently in an environment where the U.S. dollar was strong against the Canadian dollar

- Exchange Rate Advantage: Canadian miners pay costs in CAD and sell gold in USD; the decline in the CAD/USD exchange rate creates additional profit margins

- Direct Performance Improvement: Earnings of Barrick Gold and Agnico Eagle increased significantly

- Valuation Reassessment: The market gives gold stocks higher P/E multiples

- M&A Expectations: Accelerated industry consolidation

- Current Policy Rate: 2.25% (maintained unchanged in December 2025)

- Central Bank Stance: “The economy shows overall resilience”, and future growth will be “moderate”

- Inflation Outlook: Expected to remain near the 2% target

- Key Information: The central bank believes that a 2.25% interest rate level is appropriate to balance inflation and economic growth

- The market expects the Federal Reserve to continue cutting interest rates in 2025

- However, the Bank of Canada may maintain stable interest rates, or even consider raising rates under inflationary pressure

- Policy Divergence: The U.S.-Canada interest rate differential may narrow, supporting the Canadian dollar

- Net Interest Margin (NIM) Pressure: Interest rate cut expectations compress banks’ NIM

- Loan Growth: Economic resilience supports loan demand

- Asset Quality: Low default risk environment

- Valuation Recovery: Bank stock P/E ratios rebounded from historical lows to the 14-16x range

-

Continuation of Gold Bull Market:

- Global central banks continue to purchase gold

- Geopolitical uncertainty supports safe-haven demand

- Federal Reserve rate cuts reduce real interest rates, benefiting gold

-

Canada’s Mining Advantages:

- Political Stability: Lower risk in Canadian mining areas compared to those in Africa and Latin America

- Exchange Rate Advantage: Weak Canadian dollar enhances export competitiveness

- Resource Quality: Barrick and Agnico own world-class gold mine assets

-

Financial Health:

- Barrick Gold: ROE 14.51%, Net Profit Margin 24.53%, Current Ratio 2.94

- Agnico Eagle: ROE 15.45%, Net Profit Margin 32.68%

- Strong cash flow supports dividends and expansion

-

Valuation Concerns:

- Barrick’s P/E ratio of 20.70x is higher than the historical average

- Agnico’s P/E ratio of 24.90x is in the high range

- Analysts have recently taken rating downgrade actions

-

Price Volatility Risk:

- Silver’s 9.39% single-day plunge indicates increased market volatility

- Gold prices are close to historical highs, increasing the risk of correction

-

Supply Increase:

- High gold prices stimulate new mine development, and future supply may increase

- Short-term(first half of 2025): Still has upside potential, but volatility will intensify

- Mid-term(second half of 2025): Faces profit-taking pressure

- Long-term(2026): Depends on whether gold prices can remain high; returns are expected to normalize

-

Relatively Reasonable Valuation:

- Royal Bank’s P/E ratio of 16.13x is lower than its U.S. peers (e.g., JPM at 17-18x)

- P/B ratio of 2.36x is in the historically reasonable range

- ROE of 15.08% indicates strong profitability

-

Economic Resilience:

- Canada’s job market performed better than expected

- Real estate market stabilized

- Consumption maintained steady growth

-

Dividend Attractiveness:

- Canadian banks typically have a dividend yield of 4-5%

- Attractive in a low-interest rate environment

-

Interest Rate Downward Pressure:

- Interest rate cut cycle compresses NIM

- Consumption growth expectations slowed from 2.8% in 2025

-

Mortgage Risk:

- High household debt levels in Canada

- Housing price adjustments may affect loan quality

-

Regulatory Pressure:

- Increased capital adequacy ratio requirements

- Intensified competition in digital financial services

- 2025: Expected growth of 10-15%, lower than 2024 but still positive

- 2026: If the economy achieves a soft landing, there is still 5-10% upside potential

- Investment Strategy: Focus on quality, choose banks with high capital adequacy ratios (e.g., RY, TD)

-

Interest Rate → Discount Rate → Valuation Model:

- Interest rate cuts reduce equity risk premium

- Lower discount rate in DCF model increases present value

- Especially significant impact on growth stocks

-

Interest Rate → Economic Activity → Corporate Earnings:

- Interest rate cuts stimulate investment and consumption

- Reduce corporate financing costs

- Improve corporate earnings expectations

-

Interest Rate → Exchange Rate → Export Competitiveness:

- Canada’s interest rate cuts → CAD depreciation

- Benefit resource exports

- The Bank of Canada maintains a 2.25% interest rate, indicating a neutral policy stance

- Canada has limited room for interest rate cuts compared to the U.S.

- Key Variable: If the Federal Reserve cuts rates faster than the Bank of Canada, the U.S.-Canada interest rate differential will widen

- Earnings of Barrick Gold and Agnico Eagle increased significantly

- Improved free cash flow supports capital returns (dividends + buybacks)

- Gold stock P/E ratios expanded from 15x to 20-25x

- The market gives higher sustainability expectations to the industry

- Increased weight of precious metals drives changes in the TSX index structure

- Higher proportion of resource stocks increases Canada’s stock market sensitivity to commodity prices

- Safe-haven capital inflows into the Canadian market

- Increased demand for resource exposure in global asset allocation

-

Core Allocation (60%): Financial Sector

-

Tactical Allocation (30%): Mining Sector

-

Opportunistic Allocation (10%): Other Resource Stocks

- Sub-sectors benefiting from global demand such as energy and copper mines

- Focus on lithium, rare earths, etc. under the carbon neutrality theme

⚠️

-

Commodity Price Correction Risk:

- If gold prices fall by 20%, mining stocks may correct by 30-40%

- Response: Set stop-loss, control single stock position

-

Policy Risk:

- If the Bank of Canada shifts to raising rates, it will suppress stock market valuation

- Response: Monitor CPI and employment data, adjust in time

-

Exchange Rate Risk:

- Significant appreciation of CAD will weaken export competitiveness

- Response:适当 hedge exchange rate exposure

-

Geopolitical Risk:

- Sino-U.S. relations and global trade tensions affect resource demand

- Response: Diversify investments, avoid over-concentration

-

Mining Sector’s Doubling Growth: ⚠️Partially Sustainable, but Expectations Need to Be Lowered:

- Growth from late 2024 to 2025 mainly came from the surge in gold prices

- Returns from 2025 to 2026 will normalize (15-25% vs previous 159%)

- Valuation is at a high level; current prices need further gold price breakthroughs to support

-

Financial Sector’s 30% Growth: ✅Sustainable but Slowing:

- Bank stocks have solid fundamentals and reasonable valuation

- Expected growth of 10-15% in 2025 and 5-10% in 2026

- Suitable as core holdings

-

Impact of Interest Rate Cut Cycle: 🔄Neutral to Positive:

- Federal Reserve rate cuts benefit global risk assets

- Bank of Canada’s policy independence limits room for rate cuts

- Actual impact may be less than market expectations

-

Precious Metal Market: 📈Structural Opportunity:

- Gold enters a long-term bull market cycle

- But short-term volatility intensifies; need to把握 entry timing

- Recommended to invest via dollar-cost averaging or batch position building

- Gold Price: Monitor the $4,000 support level; be alert if it breaks below

- Bank of Canada Policy: Whether 2.25% is the peak

- Federal Reserve Rate Cut Pace: Difference between expectations and actual

- CAD Exchange Rate: CAD/USD exchange rate trend

- China’s Economic Data: Affect resource demand

[0] Gilin API Data - Stock Prices, Financial Indicators, Market Data

[1] Yahoo Finance - “Gold and Silver Are on Fire—These Canadian Miners Ride the Wave” (https://finance.yahoo.com/news/gold-silver-fire-canadian-miners-143300039.html)

[2] Yahoo Finance - “Bank of Canada leaves key interest rate unchanged as…” (https://ca.finance.yahoo.com/news/bank-canada-set-announce-last-090008233.html)

[3] Bloomberg - “Bank of Canada Holds at 2.25%, Economy ‘Resilient Overall’” (https://www.bloomberg.com/news/articles/2025-12-10/bank-of-canada-holds-at-2-25-economy-resilient-overall)

[4] Yahoo Finance - “Should This Gold Mining Stock Be on Your TFSA Buy List?” (https://ca.finance.yahoo.com/news/gold-mining-stock-tfsa-buy-014500771.html)

[5] Yahoo Finance - “Locking in Gains by Selling Gold Stocks? Here’s Where to…” (https://ca.finance.yahoo.com/news/locking-gains-selling-gold-stocks-020000647.html)

票房复苏推动中国影视板块估值修复

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.