In-depth Analysis of Alibaba's Instant Retail Competition Strategy: The Breakthrough Path and Market Impact of Taobao Flash Sale

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

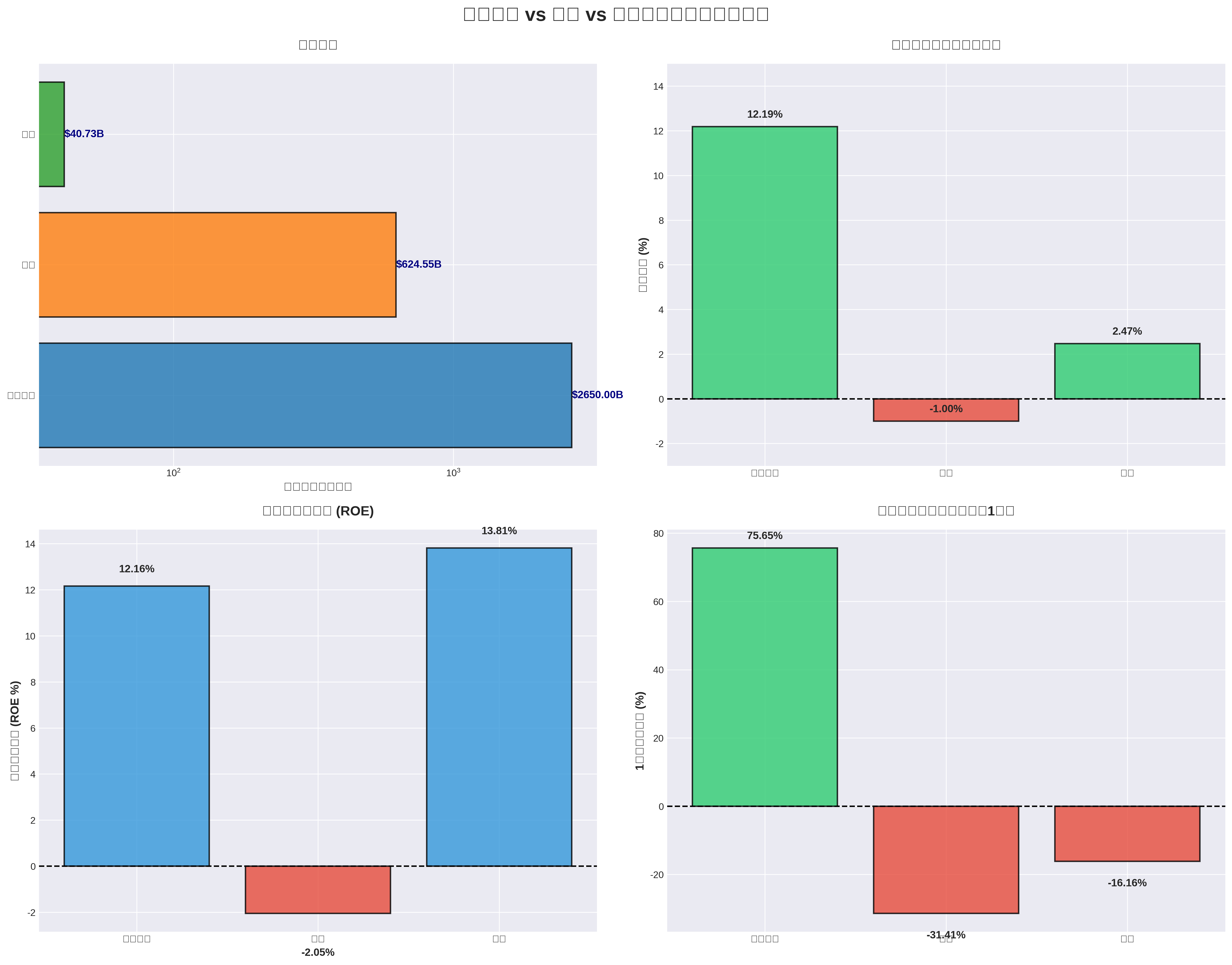

- Alibaba: +91.2% — Best performance

- Meituan: +30.1% — Medium performance

- : +5.5% — Weakest performance [0]

This contrast clearly reflects the market’s recognition of Alibaba’s instant retail strategy and concerns about Meituan’s prospects in the fierce competition.

In May 2025, Taobao Flash Sale officially became a first-level entry on the Taobao App homepage, a strategic adjustment marking Alibaba’s elevation of instant retail to a core strategy [2]. Within just six months:

- Daily Order Peak: Reached 120 million orders

- Average Daily Orders in August: 80 million orders

- Monthly Transaction Users: Exceeded 300 million [2]

More importantly, Taobao Flash Sale directly drove a 20% year-on-year growth in Taobao’s DAU, achieving ecological synergy effects [2].

The key to Taobao Flash Sale’s success lies in the

- Vast commodity ecosystem

- 300 million monthly transaction users

- About 3,500 Tmall brands accessed instant retail (as of October 2025) [2]

- Strong subsidy capability (50 billion yuan subsidy plan) [2]

- Socialized warehouse and distribution network

- Instant fulfillment capability

- Supercomputing platform and map technology

- 30-minute delivery capability [2]

This synergy not only avoids internal resource competition but also achieves a “1+1>2” combined effect.

Taobao Flash Sale’s core competitiveness lies in its unique

- Access to Alibaba ecosystem businesses such as Tmall Supermarket and Hema

- Access to offline stores of brand official flagship stores

- Commodity richness far exceeds traditional takeaway platforms [2]

- Ele.me’s 30-minute delivery network

- Covers full categories such as department stores, supermarkets, alcohol, and fresh food

- Focuses on four high-frequency scenarios: reunion, travel, gifting, and dressing & entertainment [1]

This model breaks the boundary between “far-field e-commerce” and “near-field retail”, enabling Taobao’s massive commodities to gain instant delivery capability.

Since September 2025, Taobao Flash Sale’s unit economic benefits have improved significantly [2]:

- Order Price Increase Month-on-Month: Exceeded double digits

- Non-tea Drink Order Share: Increased to over 75%

- Year-on-Year Growth of Instant Retail Revenue: 60% (Q3 2025) [2]

This indicates that Taobao Flash Sale’s growth does not come from simple “subsidy for volume” but from deeper user value creation.

Meituan’s core local business segment in Q3 2025:

- Revenue: 67.447 billion yuan (down 2.8% year-on-year)

- Operating Loss: 14.1 billion yuan (profitable 14.6 billion yuan in the same period of 2024)

- Operating Loss Rate: -20.9% (21.0% in the same period of 2024) [3]

This is the

Facing fierce competition, Meituan has taken a series of response measures:

- Launched the “Brand Official Flagship Store Flash Warehouse” model to reduce brand owners’ warehousing costs

- On the first day of Double 11 in October, hundreds of flash warehouses saw sales grow by 300%

- Sales of mobile air conditioners, gold, and sports shoes & clothing increased by more than 10 times year-on-year [3]

- Q3 sales and marketing expenses surged 90.9% year-on-year

- New business losses narrowed to 1.3 billion yuan month-on-month [3]

- Strengthened advantages in high-order price segments (over 2/3 share in orders above 15 yuan, over 70% in orders above 30 yuan) [4]

- Focused on the “universal life entrance” mindset, expanding scenarios such as oral medical beauty and medical health [3]

JD.com has adopted a differentiated strategy in the instant retail competition:

- With quality supply chain as the pillar,开拓 the “quality instant” market

- Focus on high-value categories and quality services

- Avoid head-on competition with Meituan and Taobao Flash Sale in the mass market [1]

JD.com’s new business including takeaway saw a single-quarter loss expand to 15.736 billion yuan, a year-on-year increase of over 25 times, and marketing expenses doubled year-on-year to 21.1 billion yuan [1]. This indicates that JD.com’s investment in the instant retail sector is huge but has not yet achieved substantial breakthroughs.

JD.com faces main challenges:

- Insufficient Merchant Resources: Compared to Meituan’s local merchant network and Taobao’s brand resources

- Distribution Network Shortcomings: Compared to Meituan’s 50,000 flash warehouses and Taobao’s Ele.me network [1]

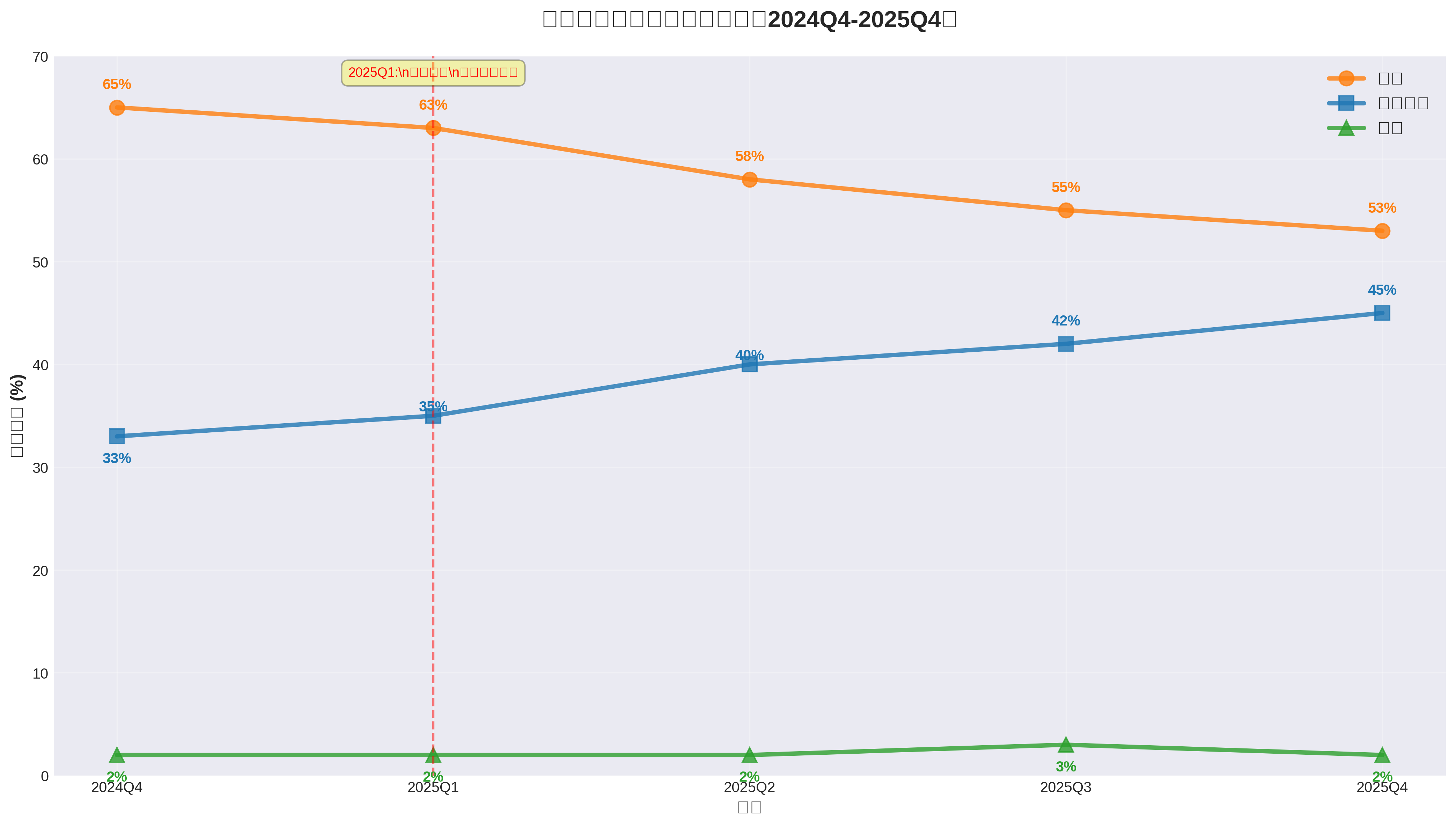

- Tiny Market Share: Only 2-3%, making it difficult to form scale effects

In Q2 and Q3 2025, the total sales and marketing expenses of the three platforms increased by 61.4 billion yuan [1]:

- Meituan: Increased by 16.3 billion yuan

- Alibaba: Increased by 11.1 billion yuan

- : Increased by 34 billion yuan [1]

Adding Q2 data, the three giants

- Simple “subsidy wars” are no longer sustainable

- Competition dimensions shift to fulfillment capability, commodity richness, and service experience [1]

- Instant retail enters a new stage of “both efficiency and quality” [1]

- Meituan strengthens the coverage depth of “30-minute everything home”

- Taobao Flash Sale relies on the huge commodity ecosystem to promote “far-field + near-field” integration

- JD.com开拓 the “quality instant” market with quality supply chain [1]

- Taobao’s DAU increased by 20% year-on-year (directly benefiting from Taobao Flash Sale) [2]

- Monthly transaction users exceeded 300 million [2]

- User structure optimization, with medium and low-frequency users transitioning to high-frequency

- Instant retail becomes an important traffic supplement for traditional e-commerce

- “Far-field + near-field” integration creates new consumption scenarios

- Expected to bring 1 trillion yuan of transaction increment to the platform in the next three years [1]

- Alibaba’s sales and marketing expenses doubled to 66.5 billion yuan in Q3 2025

- Operating profit plummeted 85% year-on-year, mainly due to instant retail subsidies [1]

- Although the unit economic benefits of the instant retail business have improved significantly, it still requires a lot of investment

- DCF valuation shows that Alibaba’s fair value in the basic scenario is $378.77, which is 165.2% higher than the current price [0]

- The instant retail business has achieved a 60% year-on-year growth in revenue, with huge growth potential

- Market share increased from 33% to 45%, and strategic position was significantly enhanced

- Capital Strength: Market cap is 4.2 times that of Meituan, with the ability to continue investing

- Ecological Synergy: The “divide and conquer” strategy of Taobao + Ele.me has been effective

- Commodity Richness: Access to Tmall brands forms a differentiated advantage

- Growth Momentum: Market share is catching up rapidly, with the gap narrowing to 8 percentage points

- Meituan’s Solid Defense: Still maintains over 70% share in high-order price segments [4]

- Subsidy Consumption: Still requires a lot of capital investment in the short term

- Fulfillment Network: Meituan’s 50,000 flash warehouses are still a strong barrier [1]

JD.com’s influence in the instant retail sector is limited (share only 2-3%), and Taobao Flash Sale has overall advantages in scale, resources, and technology. Although JD.com’s “quality instant” positioning is differentiated, it is difficult to form effective competition against Taobao Flash Sale.

- 2025: 1.5 trillion yuan

- 2030: 2-3.6 trillion yuan

- Annual Compound Growth Rate: About 25% [2]

- From “scale expansion” to “efficiency optimization”

- From “price war” to “value war”

- AI-driven fulfillment, “commodity + service”, and network integration become new trends [1]

According to DCF valuation analysis, Alibaba’s intrinsic value is significantly higher than the current price [0]:

- Conservative Scenario: $257.38 (+80.2%)

- Basic Scenario: $378.77 (+165.2%)

- Optimistic Scenario: $840.11 (+488.3%)

As the core component of Alibaba’s “big consumption platform” strategy, the instant retail business will become an important engine for future growth.

- Strong growth in instant retail business, rapid increase in market share

- DCF valuation shows 165% upside potential

- 87.5% of analysts give a Buy rating [0]

- Stock price performance has reflected market recognition of the strategy

- Core business suffered its first loss, profitability under pressure

- Market share continues to decline

- 100% of analysts give a Sell rating [0]

- Stock price fell 31.41% in the past year

- Huge investment in instant retail but limited results

- Tiny market share, difficult to form scale effects

- Highest ROE but sluggish growth

- Stock price fell 16.16% in the past year

- Competition Intensification Risk: The industry may restart large-scale subsidy wars

- Regulatory Policy Risk: Supervision on takeaway industry subsidies and rider management may become stricter [4]

- Macroeconomic Risk: Consumer demand recovery is less than expected

- Profit Below Expectation Risk: The profit cycle of the instant retail business may be longer than expected

Alibaba’s instant retail competition strategy has achieved remarkable results. Through the ecological synergy of “Taobao + Ele.me”, Taobao Flash Sale has increased its market share from 33% to 45%, effectively checking Meituan. Although it has put pressure on profitability in the short term, in the long run, as the core of Alibaba’s “big consumption platform” strategy, instant retail will create huge value for the company.

[0] Gilin API Data (Brokerage Data)

[1] Securities Times - “Breaking Through the Instant Retail Station on the Threshold of Trillion-level Market” (https://www.stcn.com/article/detail/3557078.html)

[2] 36氪 - ““Orange” Ele.me: Continuing to Fight the Next Battle in the Name of Taobao Flash Sale” (https://m.36kr.com/p/3582385674091397)

[3] Sina Finance - ““Orange” Ele.me, Moving Towards a Larger Consumption Battlefield” (https://finance.sina.com.cn/stock/t/2025-12-06/doc-infzvwze6811058.shtml)

[4] Jiemian News - “Meituan Lost 1.41 Billion Yuan, the Most Intense Season of Takeaway War Has Passed” (https://www.jiemian.com/article/13708929.html)

[5] Caizhongshe - “Trillion-level War: Takeaway Changes in 2025” (https://m.caizhongshe.cn/news-5683620211379166023.html)

[6] Caifuhao - “Instant Retail That Can’t Be Rolled, Who Can Get the 2026 Admission Ticket?” (https://caifuhao.eastmoney.com/news/20251226134731206083210)

[7] 36氪 - “Takeaway War, Meituan Survived the “Extreme Test” of Industry Competition” (https://m.36kr.com/p/3578093023460228)

[8] Sina Finance - “Meituan’s 800 Million Users and 10 Billion Losses, “Infinite Game” Must Be “Bounded”” (https://finance.sina.com.cn/stock/t/2025-12-31/doc-inhesnwr5226439.shtml)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.