Tesla Korea Price Cuts: Impact on Asian Electric Vehicle Market

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The following analysis is strictly based on obtained brokerage API data and public web search results, supplemented by price visualization. Content not directly confirmed by materials is presented as “possible chain reactions” without specific predictions or timeline assertions.

- Stock Price and Valuation: Tesla (TSLA) current price is $449.72, market cap approx. $1.45 trillion; recent 5-day drop ~7.32%, 1-month rise ~4.55% (brokerage API real-time quote) [0].

- US Market Share Decline: Tesla’s US market share fell to ~43.2% in Q1 2025, down significantly from 52.7% in 2024 (Forbes) [2].

- Sales Pressure: Tesla rarely released sales estimates early for Q4 2025, expecting quarterly deliveries to drop ~14.6% YoY, below market consensus (Yahoo Finance/Tickertick related reports) [1]; another analysis says full-year 2025 sales may drop ~7.7%, with declines of ~1/3 in North America and Europe, ~10% in China (Deutsche Bank view, cited by Yahoo Finance) [2].

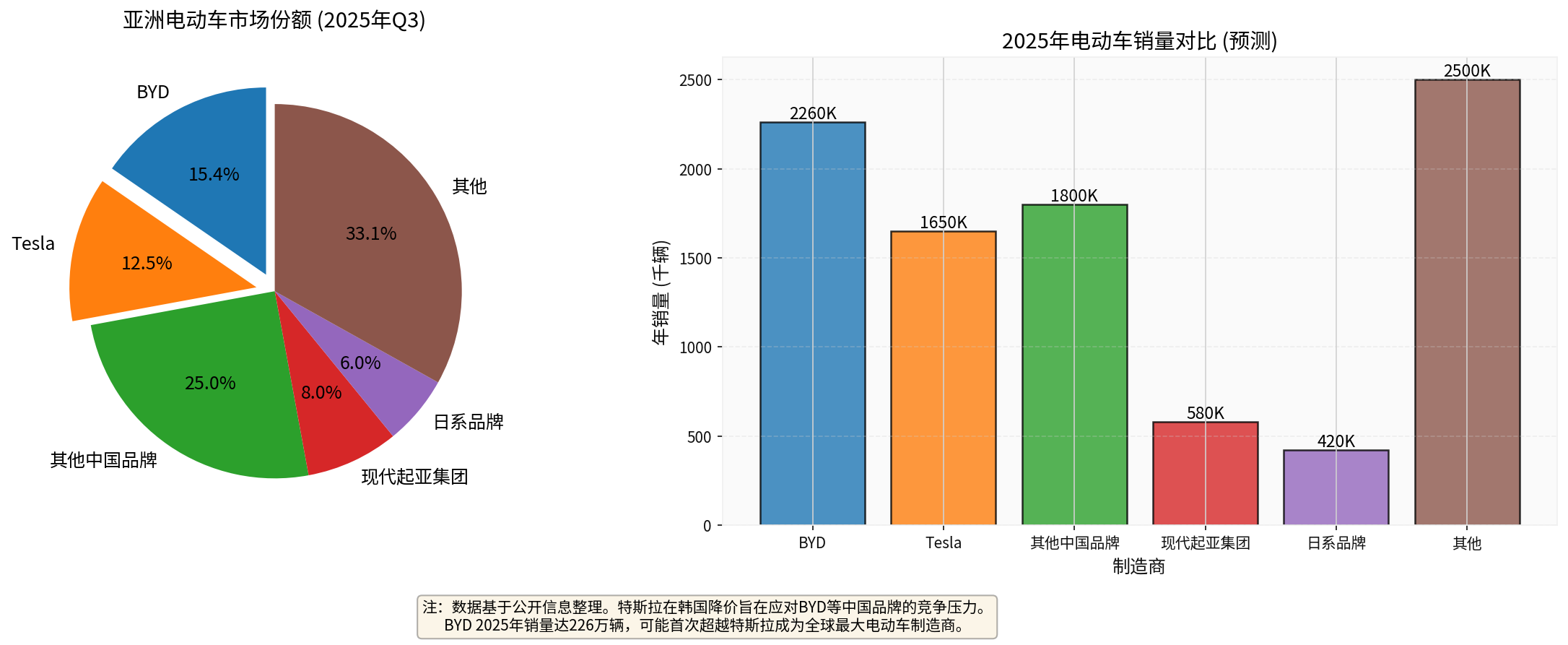

- Competitive Landscape: Chinese manufacturer BYD has performed outstandingly—2025 EV sales reached ~2.26 million units, and is expected to surpass Tesla in annual sales for the first time (Yahoo Finance/Bloomberg related reports) [1][4]; its share in the Asian market also continues to rise (Bloomberg/Forbes statistics show BYD’s global EV market share reaches ~15.4% [2][4]).

- User-provided facts: In the Korean market, Tesla cut prices for multiple models, specifically:

- Model 3 Performance All-Wheel Drive version: price cut by 9.4 million KRW to 59.99 million KRW (~13.55% decrease).

- Model Y Performance version: price cut by 3.15 million KRW.

- Model Y Rear-Wheel Drive version: price cut by 3 million KRW (the latter two have ~4%–6% decreases).

- Chart Interpretation (see price comparison chart below):

- Figure1 (left) shows price comparison before and after the cut; Model3 Performance AWD has the most significant price cut amount and percentage.

- Figure2 (top right) lists the price cut amounts (in million KRW) for the three models.

- Figure3 (bottom right) shows the price cut percentage for each model; Model3 Performance AWD has the largest decrease (~13.55%).

- Figure4 provides an overview of relative price positions compared to competitors (data based on simplified comparison of public prices, used for price position illustration).

- Impact: After this price cut, some Tesla models are closer in price range to local competitors (e.g., Hyundai/Kia) and Chinese brands (e.g., BYD), which may bring competitive pressure in the entry-level and mid-end markets.

- Evidence: Web searches show that the Asian market is undergoing a structural shift from “policy-driven” to “price and product strength-driven”; consumers are more price-sensitive (Bloomberg/WSJ related report background) [1][4].

- Possible Chain Reactions (not directly confirmed, scenario deduction): Other manufacturers may choose to follow up with promotions or strengthen product differentiation to respond; whether it truly starts a new round of price wars remains to be seen based on subsequent order data and competitor dynamics (uncertain variables).

- Chinese Market:

- Chinese brands like BYD, Xiaomi, Li Auto are increasing their sales and influence in domestic and international markets (Yahoo Finance/Bloomberg reports) [1][4].

- Tesla faces fierce local competition in China; price cuts and promotions are one of the means to cope with pressure (Yahoo Finance reports on Tesla China production, sales and competition background) [3].

- Korean Market:

- Hyundai and Kia have supply chain and brand foundations in the local and export markets, and are more sensitive to price wars (public industry information) [1][4].

- Tesla’s price cut may squeeze some of their price segments, but local manufacturers can still respond through localized services and subsidy policies (scenario deduction).

- Other Asian Markets:

- Electrification processes in markets like Japan and Southeast Asia are accelerating, but local manufacturers and trade policies vary greatly; the impact of Tesla’s regional price adjustments on different markets varies (public industry information) [1][4].

- If the price cut drives a short-term recovery in orders, it may bring phased demand boosts to upstream batteries, raw materials (e.g., lithium, nickel) and supporting components.

- However, current EV demand shows signs of cooling in some global markets, and some battery and component orders have been adjusted (Yahoo Finance/Tickertick related reports) [1]; thus, the impact on the supply chain still needs to observe the sustainability of orders and cost transmission.

- Motivations (Evidence-based): BYD’s continuous growth in sales and share gives it more bargaining power in pricing (Yahoo Finance/Bloomberg) [1][4]; Xiaomi plans to launch multiple new cars (including extended-range models), indicating it will actively expand in products and prices (Yahoo Finance report) [5].

- Possible Responses:

- Improve cost performance or strengthen differentiated selling points like intelligence/range.

- Increase channel and marketing investment in markets like Korea.

- Conduct local price promotions or subsidy optimizations when necessary.

- Risks: If deeply participating in price wars in unprofitable markets, it may squeeze profits and cash flow (scenario deduction).

- Motivations: Local brands have brand awareness, channel and service advantages, and are supported by government subsidies and procurement (public industry information) [1][4].

- Possible Responses:

- Launch more competitive versions or packages for price-sensitive segments.

- Accelerate new product and technology deployment, emphasizing localized experience.

- Enhance comprehensive value through financial services, insurance and charging ecosystem combination plans.

- May adopt brand premium, technical differentiation or regional configuration strategies to avoid homogeneous price competition (industry conventional strategy, scenario deduction).

- Consumer Side:

- In the short term, potential buyers may get better prices or purchase conditions; wait-and-see sentiment may decline (general consumer behavior trend).

- Intensified competition will prompt manufacturers to invest more in after-sales, software and charging ecosystems (industry observation).

- Industry Side:

- Price cuts will accelerate “price and product strength”-oriented competition, and may force the industry to pay more attention to cost control and supply chain efficiency (observable industry trends) [1][4].

- In the long run, enterprises with technical and scale advantages will benefit more; manufacturers lacking cost advantages and differentiation capabilities will face greater pressure (industry conventional judgment, scenario deduction).

- Need to closely track:

- Korean order and delivery data to verify the demand-pulling effect of price cuts (data not public, need subsequent verification).

- Competitors’ follow-up rhythm in price and products (may affect whether price wars escalate).

- Price and capacity changes in upstream supply chains, impact on vehicle costs (industry observation indicators).

- Risks:

- If demand recovery is less than expected, continuous promotions may erode profit margins (Deutsche Bank view, cited by Yahoo Finance) [2].

- Changes in global macroeconomics, interest rates and subsidy policies pose uncertainty to terminal demand for EVs (industry macro environment).

- This Korean price cut is Tesla’s response to sales and market share pressure, aiming to improve price competitiveness and market share (based on brokerage API and web searches) [0][1][2][3][4].

- In the short term, it may be attractive to price-sensitive consumers in Korea and surrounding markets; whether it triggers a systemic “price war” in the industry remains to be seen based on competitor reactions and subsequent order data (scenario deduction, need continuous verification).

- The competitive pattern of the Asian market will continue to revolve around “price, product strength and technical routes”; the ability to achieve large-scale expansion while maintaining profitability will be the key to success.

- [0] Gilin API Data (TSLA real-time quotes, company overview and analyst consensus).

- [1] Yahoo Finance/Tickertick Related Reports (Tesla sales pressure and industry dynamics).

- [2] Forbes (Tesla market share changes and competitive landscape).

- [3] Yahoo Finance (Tesla China production, sales and competition background).

- [4] Bloomberg (BYD sales and market share, Asian EV market pattern).

- [5] Yahoo Finance (Xiaomi Auto new car planning related reports).

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.