Analysis of the Impact of Disney (DIS) Film Business Performance on Valuation and Trends in China's Imported Film Market

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

-

Content Engine Releases Operating Leverage Again: Disney’s animated blockbuster Zootopia 2 has grossed over 4 billion yuan in China (2025 imported film champion) and exceeded $1 billion globally. Coupled with its previous cumulative box office of over 3.8 billion yuan in China, this verifies the high leverage effect and sustained monetization capability of high-quality IPs in the Chinese market [1]. Such blockbusters drive film industry revenue, directly improving the gross profit of film production and distribution. As globally synchronized IPs, they also boost international box office, merchandise, and derivative income, helping to support the company’s overall revenue growth assumptions.

-

Valuation Reflected in Scenario Distribution and Analysts’ Bullish Context: Currently, the stock price is around $113.77. The neutral scenario of DCF valuation gives $119.39, slightly higher than the market price (+4.9%), and the optimistic scenario even looks up to $171.56, with an upside potential of over 50% [0]. If Hollywood blockbusters, especially animated IPs, continue to expand their market share in China, it can gradually validate the 11.8% revenue growth and 16.4% EBITDA margin in the optimistic scenario, and further compress the risk premium in WACC (currently 12.9%). In addition, the latest market consensus still maintains a “Buy” rating with an average target price of $140 (+23%), and short-term negative factors are limited by China’s box office rebound, theme park recovery, and streaming profitability improvement [0].

-

Key Notes and Risk Preferences: Although strong box office drives positive cash flow through content (2025 FCF is approximately $10.08 billion), the company needs continuous high investment in capital-intensive sectors such as theme parks and streaming. Moreover, since 2025, valuation has been dragged down by macro interest rates and U.S. stock sentiment (DIS’s 5-year return is -35.97%) [0]. If overseas box office is constrained by regulation, content censorship, or declining local acceptance, cash flow sensitivity will shift toward the conservative scenario ($99.59). Therefore, investors can include imported film success as an information verification point but still need to pay attention to the matching between content cycles and capital expenditures.

-

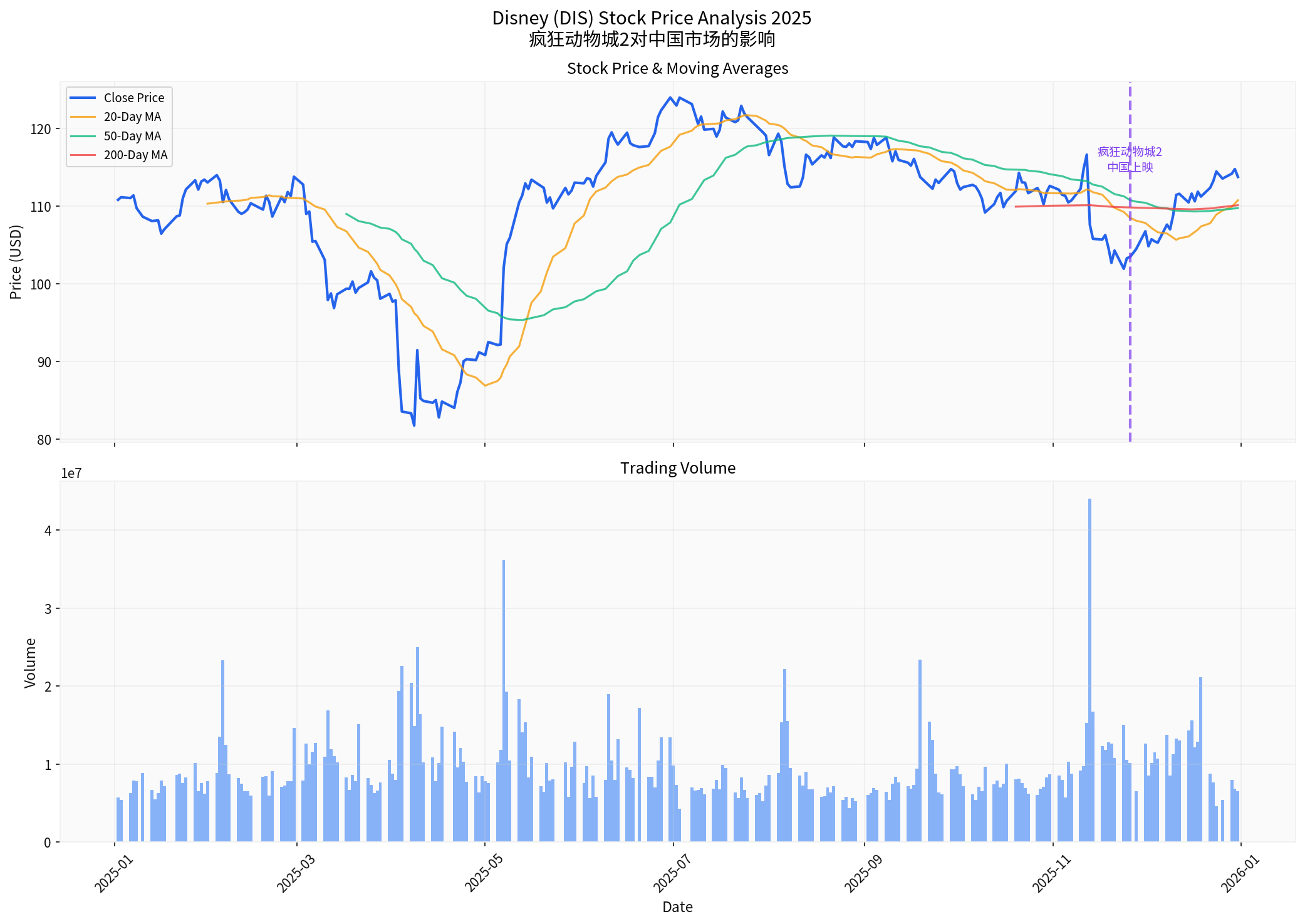

Technical Chart Evidence:

The chart shows the 2025 daily closing price and 20/50/200-day moving averages, with the X-axis as date and Y-axis as price in USD. In the second half of 2025, the stock price fluctuated around $110. After the Chinese release of Zootopia 2 in November (dashed line position), trading volume increased short-term, and the stock price slowly moved up along the 20-day line, reflecting the gradual accumulation of market positive expectations driven by content [0].

-

Imported Film Share Shrinks Year by Year but Still Has Demonstration Effect: The domestic industry chain continues to strengthen, with local films (especially animations and IP sequels) accounting for over 80% of the market. The imported film share has dropped from 38.7% in 2017 to 15.1% in 2024, indicating intensified local competition [2]. However, large-scale IPs like Disney and Marvel can still achieve outstanding performance in release schedules through promotional nodes and visual experiences (Zootopia 2 still冲击进口片历史榜首), proving that excellent imported content still has “scarce” marginal value.

-

Investment Logic: Balance Leading Content and Local Supply Chain:

- Upstream: IP Companies and Content Production— Copyright sharing, merchandise licensing, and streaming rights from high-quality imported/co-produced content help improve gross profit; meanwhile, local content production enterprises benefit from domestic consumption upgrade and policy support, and can obtain reverse premiums through linkage with leading international IPs (investment, licensing, cooperation) [3].

- Midstream: Distribution and Channels— National cinemas and “one-stop” digital distribution platforms see concentrated volume on blockbuster release days; imported film-related screening rights and advertising premiums remain profit highlights. Therefore, maintain attention on companies with continuous distribution capabilities and exclusive production/distribution networks.

- Downstream: Cinema + Consumption Ecosystem— Imported blockbusters re-verify the preference of moviegoers for large-screen immersive experiences, which helps drive box office and derivative services (catering, peripherals, membership services). Cinemas use themed interactive installations to enhance on-site experience during key events, indicating there is still room for marginal returns under consumption recovery [2].

- Strategy Recommendations:

- Mid-term Preference: Choose companies that both have strong content output capabilities (e.g., stable release of blockbuster animation/film IPs) and end-to-end (existing + new industry) operation capabilities to ensure local content can fill the gap when imported film performance is weak.

- Short-term Opportunities: Focus on distributors, cinema operators, and related advertising marketing platforms that benefit from high screenings around release periods; their revenue elasticity is higher and sensitive to single-film box office.

- Risk Reminder: Be alert to regulatory adjustments to imported film quotas, promotion/distribution rhythm, and content censorship; if overseas blockbusters see declining acceptance in the Chinese market (as shown by the poor word-of-mouth of Avatar 3), it may weaken the narrative that “imported film success drives listed company performance”.

Although the high box office performance of Zootopia 2 in China has not reversed the downward trend of imported film share, it continues to verify Disney’s attractiveness in content and strengthens its valuation elasticity. Current valuation is close to the baseline scenario; if imported film performance continues to exceed expectations in the next few quarters and further drives backend returns such as streaming/merchandise, the market may gradually digest existing performance differentiation risks. In the Chinese market, imported and domestic content each have their strengths; investors need to balance the short-term marginal improvement from “high-quality international IPs” and the stable growth from “local supply chains”. Holding a portfolio of Chinese media and film enterprises and distribution channels that can share in imported film success will be a better way to balance returns and risks.

[0] Jinling API Data (includes Disney company overview, technical analysis and DCF scenarios, real-time/historical prices, Python charts)

[1] Variety - “‘Zootopia 2’ Overtakes ‘Lilo & Stitch’ to Become 2025’s Highest Grossing Movie With $1.13 Billion” (https://variety.com/2025/film/box-office/zootopia-2-highest-grossing-movie-2025-1236608395/)

[2] East Money - “[Long Shot] ‘Avatar 3’ Fades: Poor Box Office Drags Bona Film to Two-Day Limit Down; Hollywood Blockbusters Can’t Escape the ‘Content is King’ Law” (https://finance.eastmoney.com/a/202512233599827682.html)

[3] Fund Quick Check Network - “Exceeds 5 Billion Yuan! A Comprehensive Guide to the 2025 New Year Film Season Box Office Secrets” (https://www.dayfund.cn/news/12643860.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.