Analysis of the Impact of Sustained Dollar Weakening on 2026 US Stock Investment Strategies and Multinational Corporate Earnings

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The Dollar Index (DXY) weakened significantly in 2025, recently trading around the 98.7 level [5]. As shown in the chart, the dollar exhibited an overall downward trend in 2025, which is closely related to market expectations for the Federal Reserve’s monetary policy.

- The Federal Reserve has cut the benchmark interest rate to the range of 3.5%-3.75% [7]

- The dot plot indicates an expected 1 rate cut in 2026, but 8 officials support at least 2 cuts [7]

- Goldman Sachs predicts the Federal Reserve will cut rates by 50 basis points to 3%-3.25% in 2026, with a dovish risk [1]

- The start of an interest rate cut cycle will reduce the yield attractiveness of dollar assets, pushing the dollar weaker

- As of October 2025, the total US government debt exceeded 38 trillion USD, approximately125%of GDP [6]

- Per capita debt exceeded 110,000 USD, and the debt scale nearly doubled in less than 100 months [6]

- Huge fiscal deficits and continuous debt issuance have weakened the dollar’s long-term credit foundation

- Goldman Sachs predicts global economic growth of 2.8% in 2026 and US growth of 2.6% [1]

- The expected total return of the MSCI Asia Pacific (excluding Japan) and MSCI Emerging Markets indices in USD terms could reach 18%, higher than the S&P 500’s expected 15% [2]

- Strong recovery in emerging market economies attracts capital outflows from dollar assets

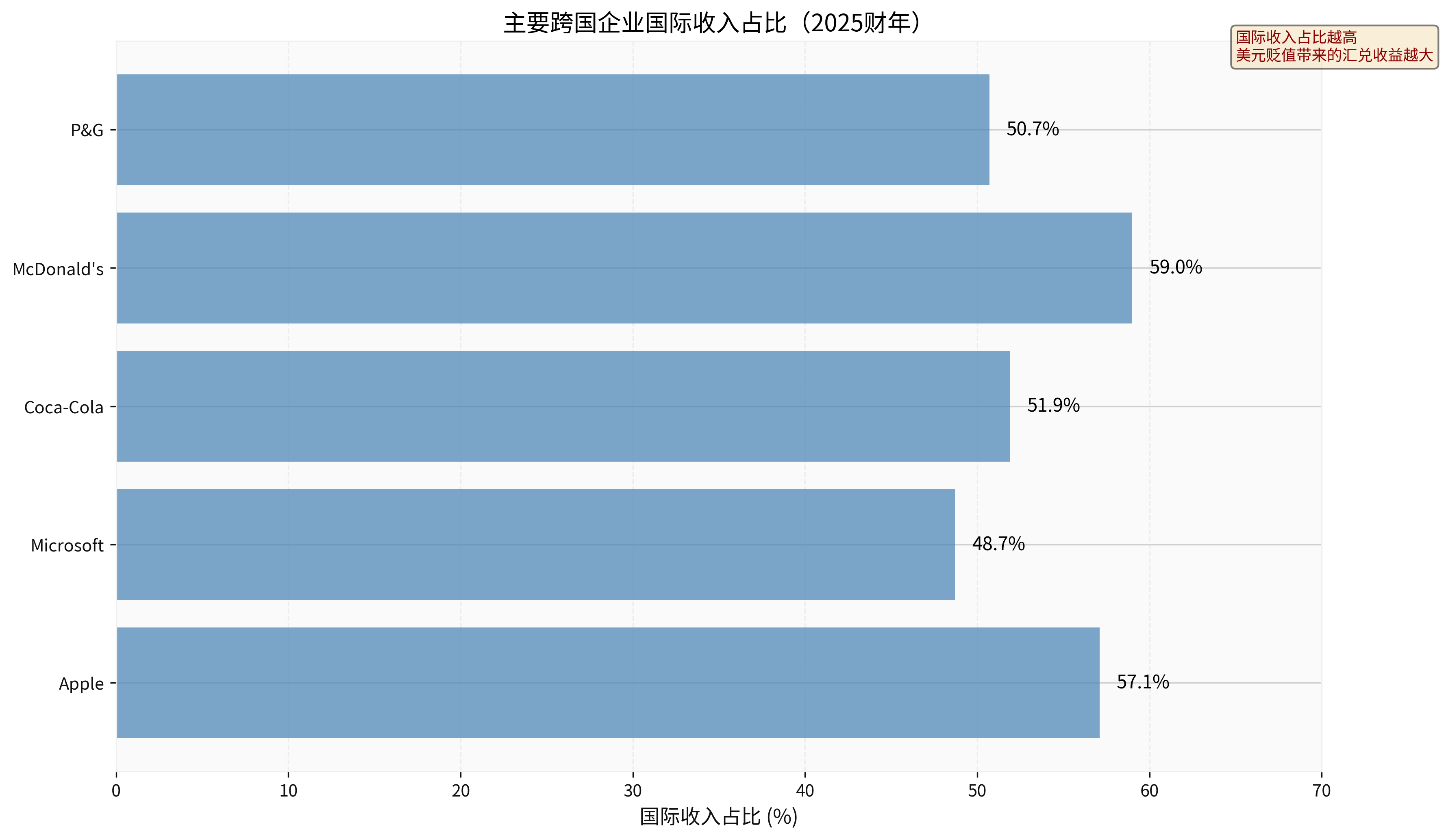

- McDonald’s (MCD):59.0% international revenue

- Apple (AAPL):57.1% international revenue (Europe 26.7%, Greater China 15.5%, Others 14.6%)

- Procter & Gamble (PG):50.7% international revenue

- Coca-Cola (KO):51.9% international revenue

- Microsoft (MSFT):48.7% international revenue

Taking Apple as an example, its international revenue in FY2025 was approximately 237.4 billion USD (total revenue 416.1 billion USD ×57.1%):

- If the dollar depreciates by 5%, these international revenues will generate approximately 11.9 billion USDin exchange gains when converted back to USD

- This is equivalent to an increase of approximately 7.5%in Apple’s net profit in FY2025

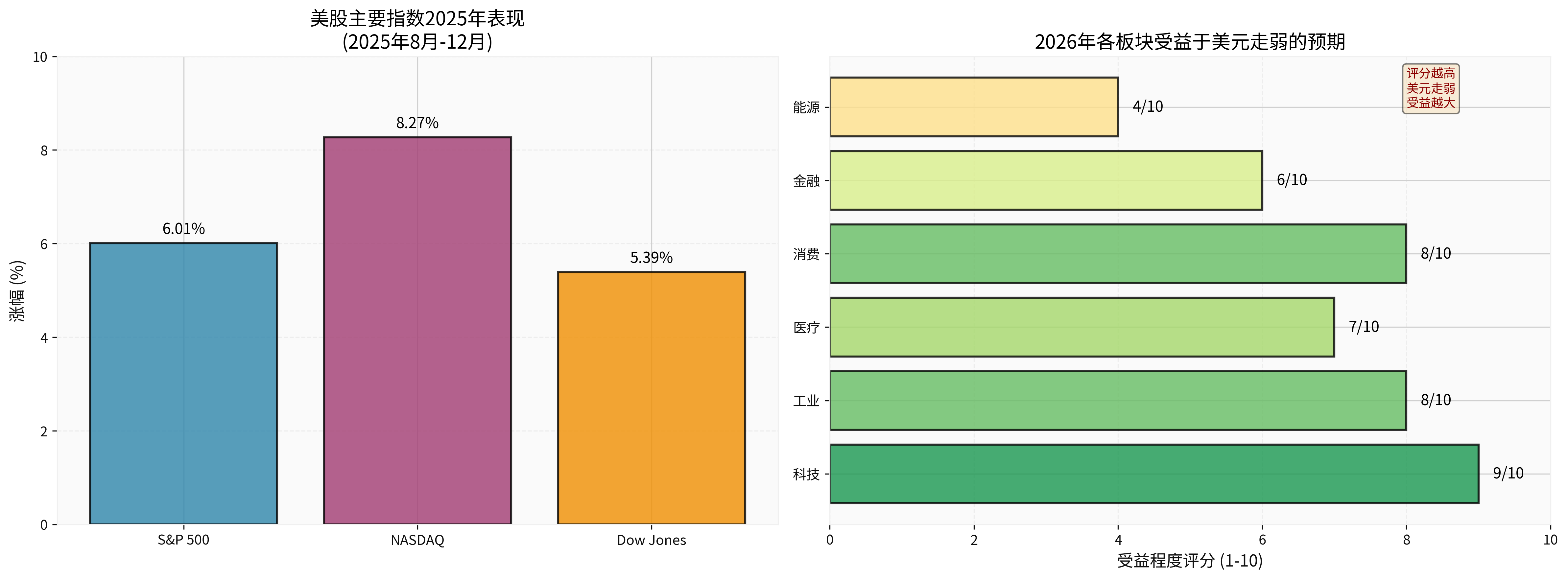

- JPMorgan predicts that the S&P 500’s earnings per share will reach 315 USD in 2026, an annual increase of about 15%, with exchange gains being one of the important driving factors [2]

Dollar weakening makes US export goods more price-competitive in international markets:

- Overseas orders for industrial enterprises (such as Boeing and Caterpillar) are expected to increase

- The international market share of technology products may further expand

- Service exports (software, cloud services, financial services) benefit significantly

Dollar weakening also brings negative effects:

- Rising costs of imported raw materials and components squeeze corporate profit margins

- Form cost pressure on enterprises dependent on imports

- May push up domestic inflation levels, affecting the Federal Reserve’s monetary policy space

- Logic:High proportion of international revenue (Apple 57.1%, Microsoft48.7%), significant exchange gains

- Catalyst:Continuation of the AI super cycle; JPMorgan predicts 2026 will still be a strong year for AI stocks [2]

- Key Targets:

- Apple (AAPL): Analyst target price $312.50, upside potential 14.9% [0]

- Microsoft (MSFT): Analyst target price $640.00, upside potential32.3% [0]

- Risk:High valuation (AAPL P/E36.28x, MSFT P/E34.26x); need to pay attention to AI commercialization implementation

- Logic:Obvious export-oriented characteristics; dollar depreciation directly improves competitiveness

- Catalyst:Global economic recovery (Goldman Sachs predicts 2.8% global growth in2026) [1]; expansion of capital expenditure cycle

- Key Focus:Aerospace, machinery manufacturing, construction equipment

- Risk:Rising supply chain costs, tariff policy uncertainty

- Logic:Overseas sales of pharmaceuticals and medical devices benefit from exchange rate advantages

- Catalyst:Accelerated application of AI in drug research and development reduces R&D costs

- Anti-Drop Attribute:Defensive allocation during strong economic uncertainty

- Logic:Multinational consumer brands (Coca-Cola, Procter & Gamble) have over 50% international revenue

- Catalyst:Emerging market consumption upgrade; USD-denominated profit增厚

- Key Targets:

- Coca-Cola (KO): Analyst target price $79.00, upside potential13.0% [0]

- Procter & Gamble (PG): Analyst target price $175.50, upside potential22.5% [0]

- Risk:Rising import costs may squeeze profit margins

- Positive:Dollar weakening stimulates economic activity and increases loan demand

- Negative:Interest rate cuts compress net interest margins; intensified competition in international business

- Strategy:Choose regional banks with low overseas business proportion

- Logic:Oil is denominated in USD; dollar weakening is often accompanied by rising oil prices

- Risk:Currency appreciation of oil-producing countries weakens the competitiveness of US shale oil

- Strategy:Choose integrated energy companies with overseas asset allocation

- Screening Criteria:International revenue proportion >50%, stable growth of overseas business

- Preferred Targets:Apple, Microsoft, Coca-Cola, Procter & Gamble, McDonald’s

- Logic:Dollar weakening reduces capital expenditure costs of US AI enterprises overseas

- Key Focus:Cloud services, data centers, AI chip companies

- JPMorgan View:The AI spending boom will continue and spread to multiple industries such as banking, healthcare, and logistics [2]

- Beneficial Industries:Aerospace, mechanical equipment, electronic equipment

- Catalyst:Global capital expenditure cycle starts; US manufacturing price competitiveness improves

- Logic:Dollar weakening improves emerging market purchasing power

- Beneficial Industries:Luxury goods, consumer electronics, internet services

- Risk:Geopolitical uncertainty, tariff policy fluctuations

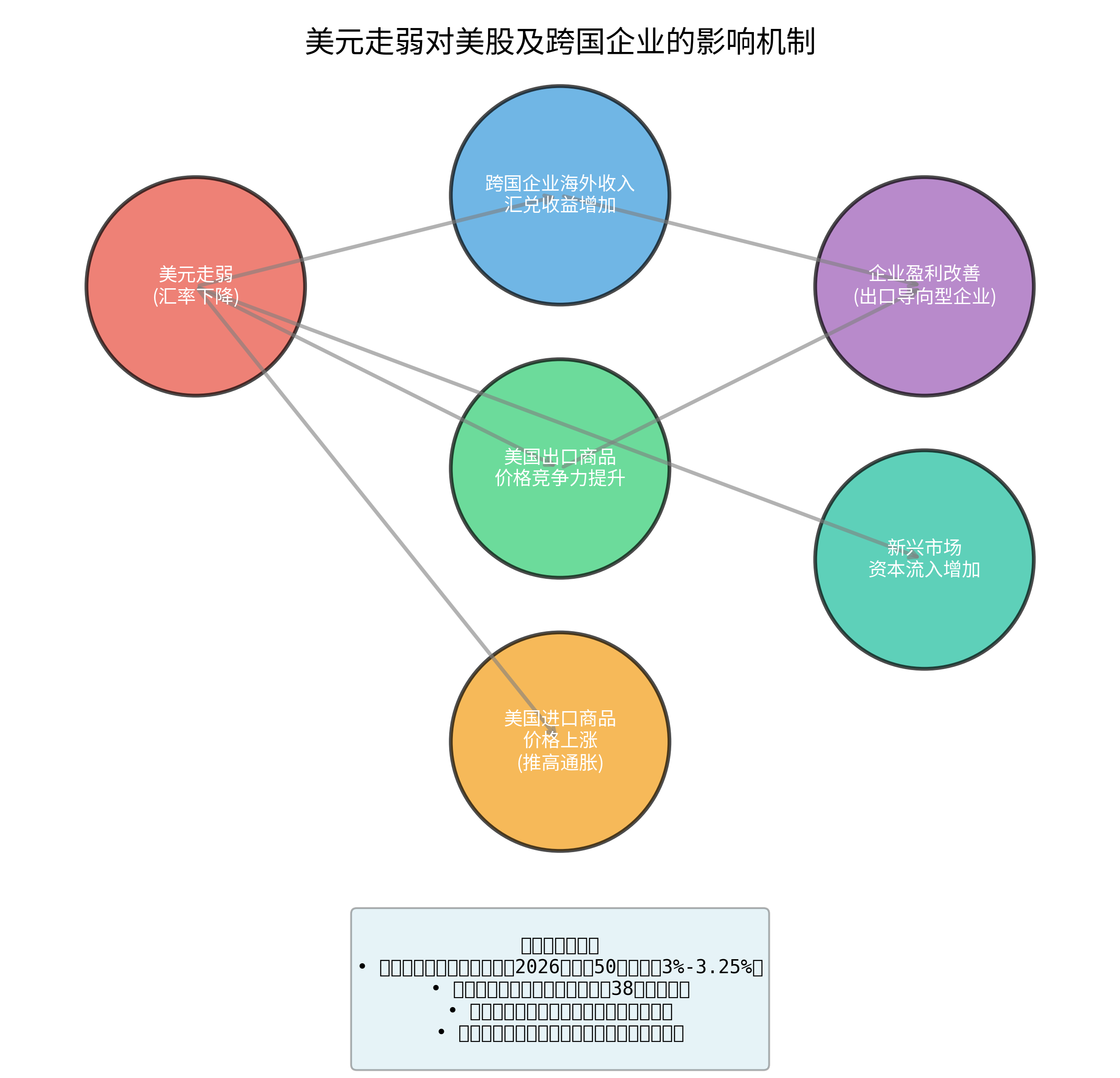

This chart shows the multiple impact paths of dollar weakening on the US stock market and multinational corporations:

- Dollar weakening → Increased exchange gains from overseas revenue → Improved corporate earnings(Main beneficiaries: Technology, Consumer, Healthcare)

- Dollar weakening → Improved export price competitiveness → Order growth(Main beneficiaries: Industrial, Materials)

- Dollar weakening → Enhanced purchasing power of emerging markets → Overseas market expansion(Main beneficiaries: Consumer, Technology)

- Dollar weakening → Rising import costs → Profit margin pressure(Main losers: Import-dependent enterprises)

- Dollar weakening → Pushes up imported inflation → Limits Fed’s easing space(Macro-level risk)

- Obvious divergence within the Federal Reserve (3 votes against the latest rate cut decision) [7]

- Inflation stickiness may limit rate cut space (latest inflation rate 2.8%, higher than 2% target) [7]

- The dot plot shows a baseline forecast of only 1 rate cut in2026, which may be lower than market expectations

- 38 trillion USD government debt scale continues to expand [6]

- The proportion of interest expenditure in GDP rises, which may squeeze fiscal policy space

- Debt ceiling negotiations may trigger market volatility

- China-US trade relations remain an important variable

- Tariff policies may impact some multinational corporations

- Accelerated supply chain restructuring affects global layout of enterprises

- Current valuation of S&P500 is at a historical high

- High concentration of AI-related stocks (JPMorgan AI30 stocks account for 44% of S&P500 market capitalization) [2]

- Risk of earnings growth falling short of expectations

###5.2 Investment Strategy Recommendations

- Allocation Ratio:It is recommended to allocate 30%-40% of the stock position to enterprises with international revenue proportion exceeding50%

- Preferred Targets:Apple, Microsoft, Coca-Cola, Procter & Gamble

- Hedging Strategy:Pay attention to exchange rate hedging tools to reduce volatility

- Screening Criteria:Enterprises where every 1% dollar decline brings >2% net profit growth

- Industry Focus:Technology, Consumer, Healthcare

- Timing:Increase allocation around Federal Reserve rate cuts

- Overweight:Industrial and technology enterprises with high export revenue proportion

- Underweight:Enterprises with high dependence on imported raw materials

- Neutral:Enterprises mainly engaged in domestic business

- Geographical Diversification:Not only focus on US multinational corporations, but also allocate to emerging market assets that benefit from dollar weakening

- Currency Hedging:Consider using currency hedging ETFs or derivatives

- Dynamic Adjustment:Dynamically adjust positions according to dollar index trends and Federal Reserve policy expectations

###5.3 Key Observation Indicators for2026

- Federal Reserve rate cut rhythm and dot plot changes

- Changes in US fiscal deficit and debt scale

- Global economic growth rate, especially the performance of emerging markets

- Inflation trend and its impact on monetary policy

- Exchange gain/loss items in quarterly financial reports of multinational corporations

- Relationship between overseas revenue growth and exchange rate changes

- Export order growth

- Profit margin change trend

- Key technical levels of the dollar index (98-100 range)

- Relative strength of major US stock indices

- Sector rotation rhythm

- Market Volatility Index (VIX)

Dollar weakening may become an important theme in the US stock market in 2026, and its impact on multinational corporate earnings is

- Exchange gains will directly increase the financial reports of enterprises with high international revenue

- Improved export competitiveness will support performance growth of industrial and manufacturing enterprises

- Recovery in emerging market demand will create new growth space for consumer and technology enterprises

- Rising import costs may squeeze profit margins of some enterprises

- Dollar weakening may push up inflation and limit the Federal Reserve’s further easing space

- Exchange rate fluctuations increase business uncertainty for enterprises

In 2026, investors should

In the long run, the trend of structural dollar weakening may continue, with US fiscal deficits and global reserve currency diversification being long-term structural factors. However, in the short term, the dollar trend will still be highly dependent on the Federal Reserve’s monetary policy path and relative global economic performance. It is recommended that investors remain flexible and dynamically adjust investment strategies according to changes in the dollar index trend and Federal Reserve policy expectations.

[0] Gilin API Data - Corporate financial data, stock prices, market indices, sector performance

[1] Goldman Sachs - “Goldman Sachs Expects Global Economic Growth of 2.8% Next Year, Predicts Fed Will Cut Rates by 50 Basis Points” (https://hk.finance.yahoo.com/news/大行-高盛料明年全球经济增長2-8-预期美聯儲減息50個基點-035926894.html)

[2] Yahoo Finance - “JPMorgan’s 2026 US Stock ‘Battle Plan’ Revealed! Selected Stocks to Watch at Once, ‘Selective…’” (https://hk.finance.yahoo.com/news/摩根大通2026年美股-作戰圖-曝-精選股票一次看-選擇性-064004726.html)

[3] Yahoo Finance - “Goldman Sachs 2026 Global Stock Market Outlook: Broader Bull Market, Broader AI Beneficiaries!” (https://hk.finance.yahoo.com/news/高盛2026年全球股市展望-更廣泛的牛市-更廣泛的ai受益者-054004342.html)

[4] Wall Street Journal - “Trump Wants a Weaker Dollar; Some Chinese Economists Agree” (https://cn.wsj.com/articles/特朗普希望美元走弱-一些中国经济学家表示认同-53b6fef8)

[5] Yahoo Finance - “<New York Foreign Exchange Market> Dollar Falls Slightly as Market Predicts BOJ Will Raise Rates This Week” (https://hk.finance.yahoo.com/news/〈紐約匯市〉美元小跌-市場預測日央本周升息-220033197.html)

[6] Yahoo Finance - “Just No Money! 9 Million Americans Are Delinquent on Student Loans” (https://hk.finance.yahoo.com/news/就是沒錢-900萬美國人拖欠學生貸款-203102942.html)

[7] Yahoo Finance - “Fed Cuts Rates by25 Basis Points, Opposed by Three People; Dot Plot Predicts One Rate Cut Next Year” (https://hk.finance.yahoo.com/news/聯儲會降息25基點遭三人反對點陣圖預示明年利率下調一次-192324913.html)

— tags (codes, translate to display labels) —

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.