2025 Passive Investing Outperformance, Big Tech Concentration, and K-Shaped Economy Dynamics

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

The 2025 outperformance of passive investors (in low-cost S&P 500 ETFs) over active managers, with only about a quarter of large-cap funds beating the market, can be traced to two key factors: market concentration in Big Tech and the Federal Reserve’s monetary policy.

The Fed’s three rate cuts in 2025 (0.75 percentage points total) supported asset prices [0], which disproportionately benefited the largest tech companies (“Magnificent Seven”), which composed 37% of the S&P 500 by October 2025 [0]. While some tech giants (Amazon, Apple) had moderate returns, others like Alphabet and NVIDIA delivered strong performance, driving the S&P 500’s overall gains [0]. This concentration meant passive investors gained from the index’s top performers, while active managers struggled to outperform despite the broader market rally.

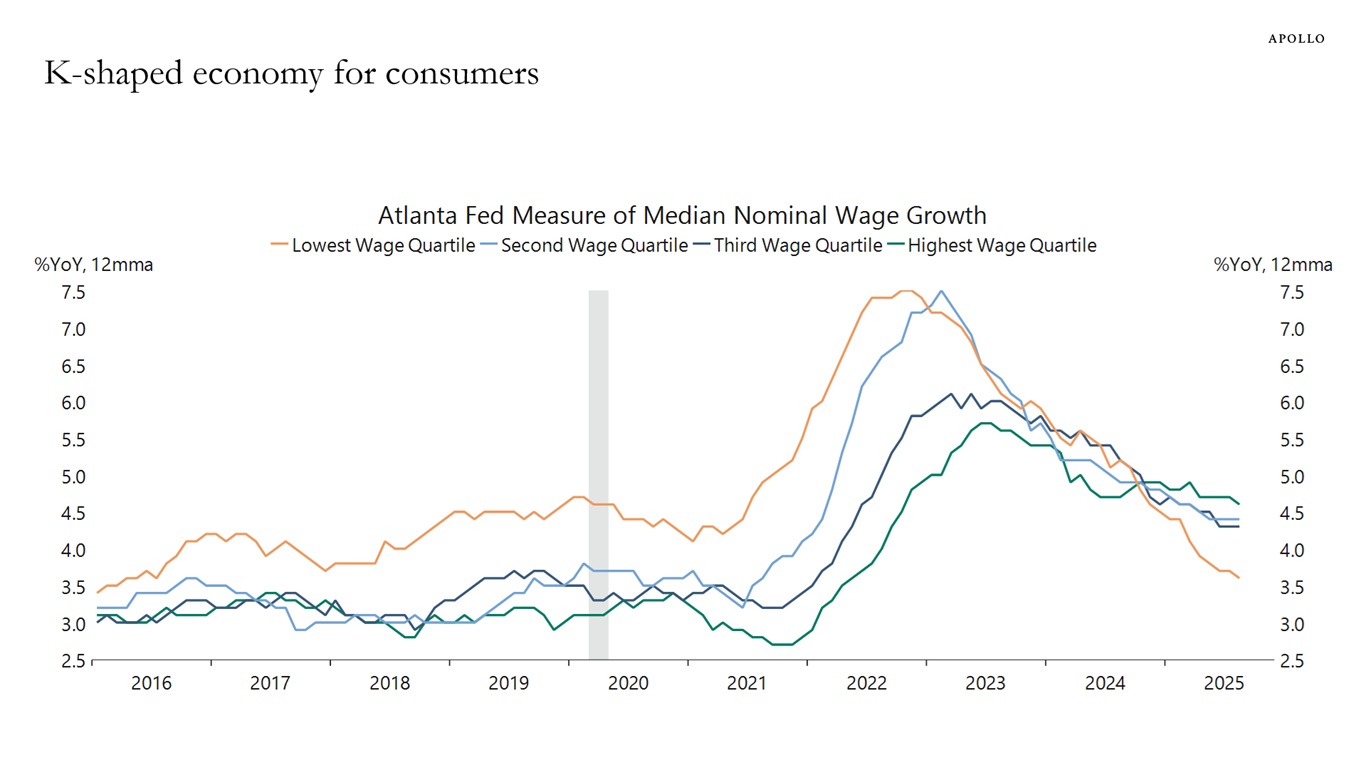

Compounding this, the market dynamics created a K-shaped economy: asset owners (benefiting from rising equity and housing prices) saw their wealth grow, while non-owners faced worsening affordability—with 44.6% of income required for the median home in 2025 [0]. This divergence presents a dilemma for the Fed, which must balance its mandate of price stability and full employment with the unintended consequence of increasing wealth inequality [1].

-

Passive Investing’s Structural Advantage: The S&P 500’s concentration in high-performing Big Tech gives passive funds a built-in edge, as active managers struggle to outperform by devoting less capital to these dominant stocks. This trend aligns with long-term data showing passive strategies often outperform active management, especially during concentrated market rallies [0].

-

Fed Policy Amplifies Inequality: While rate cuts aim to stimulate economic growth, they also inflate asset prices, widening the wealth gap between asset owners and non-owners. The housing market’s affordability crisis exacerbates this, as low rates support home prices while wage growth lags [0].

-

Big Tech Concentration Risks: The market’s heavy reliance on a handful of tech stocks creates systemic risk—any negative news affecting these companies could trigger broader market volatility, challenging both passive and active investors [0].

-

Risks:

- Market concentration in Big Tech increases vulnerability to sector-specific shocks [0].

- Worsening wealth inequality could lead to policy changes (e.g., higher taxes on asset gains) that impact market returns [1].

- Housing affordability issues may dampen consumer spending, slowing economic growth [0].

-

Opportunities:

- Passive S&P 500 ETFs remain a cost-effective way to capture broad market gains, especially during concentrated rallies [0].

- Active managers may find opportunities in underperforming sectors (outside Big Tech) that passive funds overlook [0].

2025 market performance was defined by passive investing outperformance, Big Tech concentration, and a K-shaped economy. The Fed’s rate cuts supported asset prices but amplified wealth inequality, creating a challenge for its dual mandate. Passive investors benefited from the S&P 500’s structural concentration, while active managers faced headwinds. Market participants should be aware of the risks associated with Big Tech concentration and the potential for policy changes addressing inequality.

This analysis is based on verified market data [0] and the original Seeking Alpha report [1]. No prescriptive investment recommendations are provided.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.