Peru Copper Mining Conflict: Global Supply and Mining Stock Impacts

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

- On New Year’s Eve 2024, attacks on informal miners in Peru escalated into broader violent conflicts, triggering a chain reaction of government actions including mine safety restructuring, troop deployment, and operational suspensions. The Peruvian government has ordered the resumption of mining operations in some affected areas and strengthened local security and patrols to block the influence of illegal mining organizations [2].

- Peru’s 2024 copper output is approximately 2.7 million tons, second only to Chile, making it the world’s second-largest copper producer. It is also a key global exporter of copper concentrates and electrolytic copper, with both domestic demand and exports highly dependent on the giant deposits in the Andean Plateau and relatively concentrated infrastructure [1]. Therefore, any regional security shock will immediately disrupt port shipments, concentrate processing, and overseas delivery schedules.

-

Systemic Disruption from Informal Mining

Informal miners (especially in the northern gold-copper mixed mining areas) are both a source of labor and a catalyst for conflict. Violent incidents have prompted the government to take tougher security and legal actions, which in the short term will lead to the shutdown of local informal mines, road blockades, and delays in raw material transportation, thereby reducing concentrate export capacity. If the conflict spreads to the vicinity of large copper mines such as Toquepala, the global spot and futures markets will reprice supply prospects, further increasing short-term copper price volatility. -

Medium-Term Production Risk

Although the Peruvian government is striving to coordinate and resume formal operations in conflict-affected areas, investors’ reassessment of security risks may slow down capital expenditure approvals, make foreign investment cautious, and delay copper mine expansion or new mine development (especially projects requiring new miner safety agreements). In addition, security incidents may inherently increase enterprises’ operating costs (security and insurance premiums). Given that global production is only growing moderately, the loss of supply from Peru cannot be quickly offset by other mining areas. -

Market Psychology and Inventory Behavior

As an important base metal for electric vehicles and new energy grids, copper has rigid demand, especially as many countries have started copper inventory and supply chain diversification. If the Peruvian security incident continues or repeats, downstream buyers will stock up in advance, increasing the frequency of LME/COMEX price adjustments, which will amplify the existing supply gap and push copper prices to remain high.

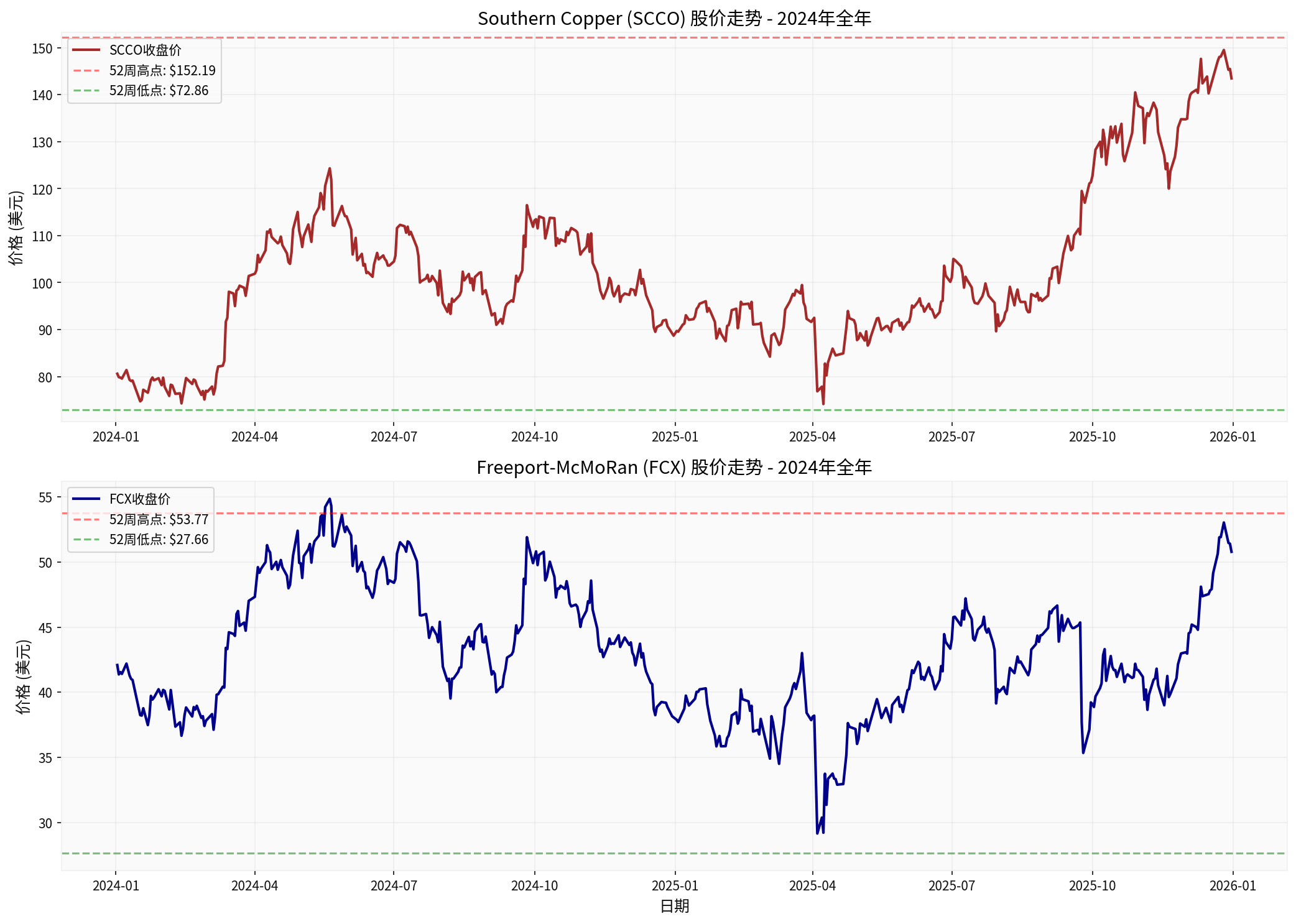

- Southern Copper (SCCO):It operates the large open-pit copper mines Toquepala and Cuajone in Peru. Copper still accounts for 76.6% of the company’s revenue in 2024, and although Peru’s revenue share is only 5.8%, the mines in this region contribute significantly to production. The current market capitalization is approximately $117.2 billion, with a PE ratio of 30.9x and ROE of 39%, indicating high profitability; however, analyst consensus is neutral/flat, with a target price slightly lower than the current level [0].

- Freeport-McMoRan (FCX):Although its main assets are in the Americas and Indonesia, its global integrated supply chain and futures hedging strategy make it sensitive to global copper supply and demand. The market capitalization is approximately $73 billion, with a PE ratio of 35.5x, and analyst consensus is “Buy”, with a target price slightly lower than the current value, reflecting that current copper prices have partially priced in supply risks [0].

- Positive:If the Peruvian conflict escalates, it can be regarded as a copper supply risk event, which may continue to support overall copper prices, benefiting miners with high leverage and strong cash flow (such as SCCO) to obtain higher free cash flow under rising prices. Its 2024 full-year share price rose by more than 78%, reflecting that the market has already adjusted valuations based on the supply story [0].

- Negative:If security incidents lead to operational disruptions or overseas buyers readjust their procurement sources, companies with revenue concentrated in Peru/Mexico and insufficient security guarantees may face production capacity shrinkage. Investors need to pay attention to enterprises’ emergency plans, security investment, and communication effects with the government/communities.

The chart shows the daily closing prices of SCCO and FCX in 2024, with the X-axis as the date and Y-axis as the price in USD. SCCO rose by 78.02% for the year, with a significantly higher volatility than FCX’s 20.67%, reflecting its higher concentration of assets in Peru and sensitivity to copper prices; the red and green dashed lines in the chart are their respective 52-week high/low prices, indicating that SCCO has approached historical highs and has a higher risk premium [0].

-

Short-Term: Maintain Differentiated Positions

- If you prefer the copper price rising logic, focus on miners with stable cash flow and low debt ratios (such as SCCO), and use the price premium brought by temporary security incidents; however, set a reasonable profit-taking point to avoid retracement risks due to high valuations.

- Risk-averse investors can choose more diversified mining ETFs or giant miners that have hedged through futures (such as FCX), whose geographical distribution and smelting strategies can provide a buffer in local conflicts.

-

Medium-Term: Focus on Security Policies and Regulations

- Pay attention to mining safety supervision measures introduced by the Peruvian government and communities in the process of restoring production capacity. Once the government reaches a more stable protection agreement with legal mining areas, the long-term risk premium can be reduced; conversely, if illegal mining/conflicts persist, it may drag down capital expenditure plans and investor confidence.

-

Combine with New Energy Demand

- Copper prices are linked to electric vehicle and renewable energy grid construction, so it is necessary to track the expansion of the global demand side simultaneously. If the supply side (Peru) continues to be caught in security or social conflicts and coincides with the upward trend of global demand, it will help raise the copper price center, thereby benefiting leading mining companies with large market capitalization and high production share.

-

Recommend Regular Review

- Update the Peruvian situation, inventory data, and copper price-sensitive indicators (such as LME inventory, futures basis) and related miners’ performance monthly. If necessary, consider enabling the deep research mode to obtain more detailed A-share/US stock miner data and industry analysis.

[0] 金灵券商API数据

[1] Finance Yahoo – “Adani, Hindalco explore Peru copper mining assets” (https://finance.yahoo.com/news/adani-hindalco-explore-peru-copper-151552738.html)

[2] The Straits Times – “Peru orders mining operations restart in violence-hit north” (https://www.straitstimes.com/world/peru-orders-mining-operations-restart-in-violence-hit-north)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.