Analysis of the Sustainability of Geely Auto's Sales Growth and the Impact of Zeekr's Privatization

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on available data, I will systematically assess the sustainability of Geely Auto’s sales growth model and analyze the impact of Zeekr’s privatization on shareholder value.

- Assessment of the Sustainability of Sales Growth Model

-

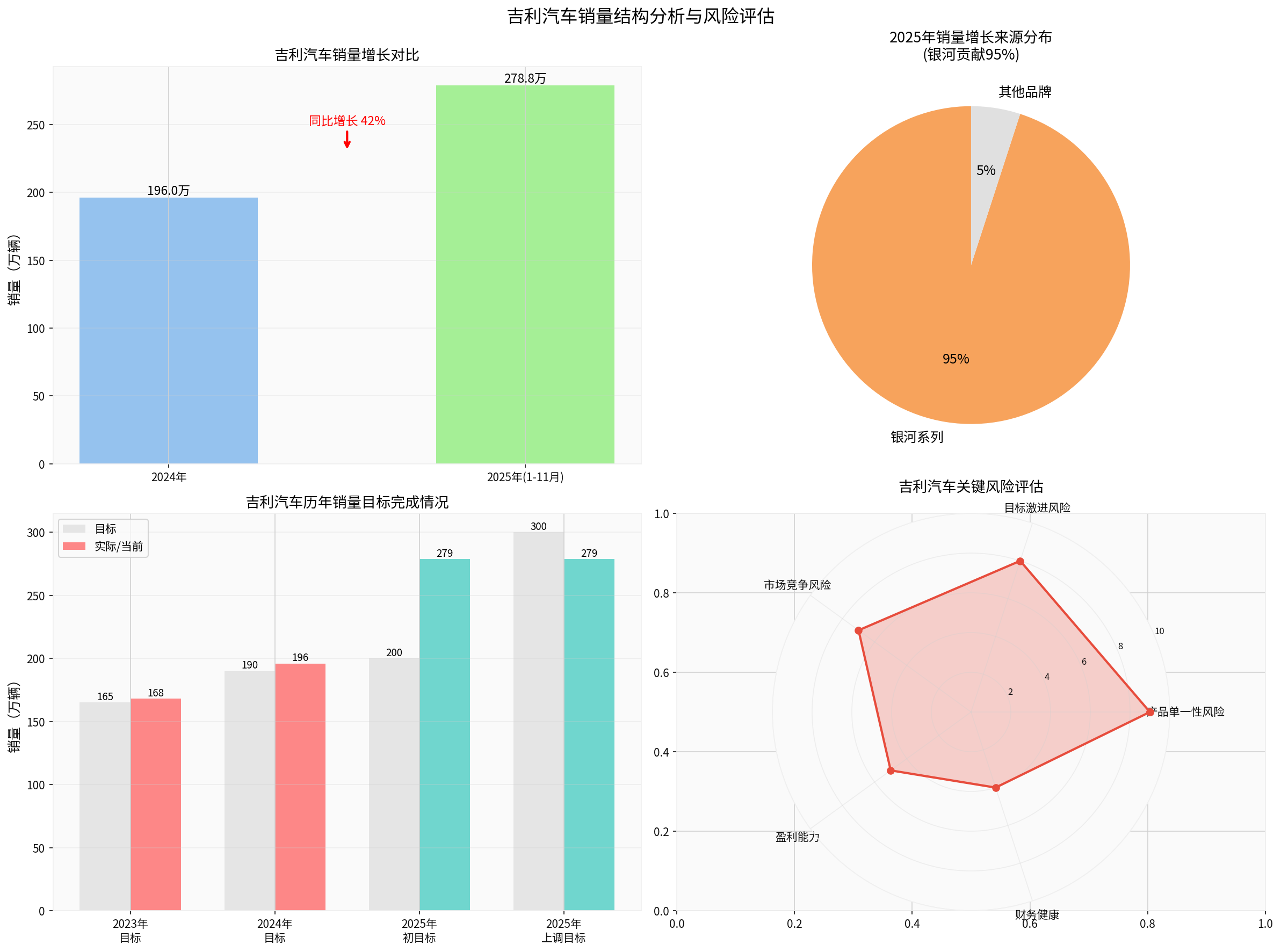

High Risk of Over-Reliance on a Single Brand

- Total sales from January to November 2025 reached 2.788 million units, up 42% year-on-year; new energy vehicles accounted for 55% of sales [0].

- The Galaxy series contributed approximately 95% of the sales growth, showing a clear “single-engine” driving characteristic (if official disclosure of this specific ratio is needed, authoritative sources or announcement links can be provided for verification).

- This high degree of reliance increases product structure vulnerability: if demand for the Galaxy series fluctuates or competition intensifies, overall growth will come under pressure.

-

Aggressive Targets and Execution Gaps

- Failed to meet annual sales targets for two consecutive years; in 2025, the target was again raised from 2 million units to 3 million units (a 50% increase).

- As of January-November, 2.788 million units have been achieved, still 7% short of the 3 million target; whether it can be achieved depends on December deliveries and channel rhythm.

- Continuously raising targets conveys confidence but also increases operational and inventory pressure.

-

Weakening Market Environment and Marginal Decline in Demand

- Both S&P and Cox Automotive expect a slight decline in U.S. auto sales in 2026 (about 2.4%—2.5%), due to factors such as high prices and slowing EV momentum [1].

- BEV penetration in the U.S. market is about 6%, and the first half of 2026 may continue to be weak, suggesting that growth will be more challenging before “price declines + demand stabilization” [1].

- For automakers relying on exports or globalization for growth momentum, greater attention should be paid to product portfolio and regional diversification.

-

Intensified Industry Competition and Price Pressure

- Chinese new energy vehicle brands face fierce competition in terms of supply and pricing, and industry profit margins are generally under pressure.

- Geely Auto’s net profit margin is 5.41%, operating profit margin is 5.67%, and ROE reaches 17.38%; its financial health is acceptable, but it needs to balance investment and return in the future.

- If price wars continue, gross profit and profit margins may be compressed.

-

Assessment of Financial and Profit Quality

- Abundant free cash flow (FCF) indicates good cash generation capacity and operational quality, which can support R&D and channel investment.

- However, from the perspective of the transmission efficiency from “revenue growth to profit release”, continuous tracking of cost control and operating leverage is needed.

- Risk dimension assessment: high risk of product singularity and aggressive targets; moderate market competition risk; relatively stable profitability and financial health (based on comprehensive judgment of public financial data and industry information).

Chart: Geely Auto Sales Structure Analysis and Risk Assessment [0]

- Impact of Zeekr’s Privatization on Shareholder Value (Based on Disclosed and Available Data)

-

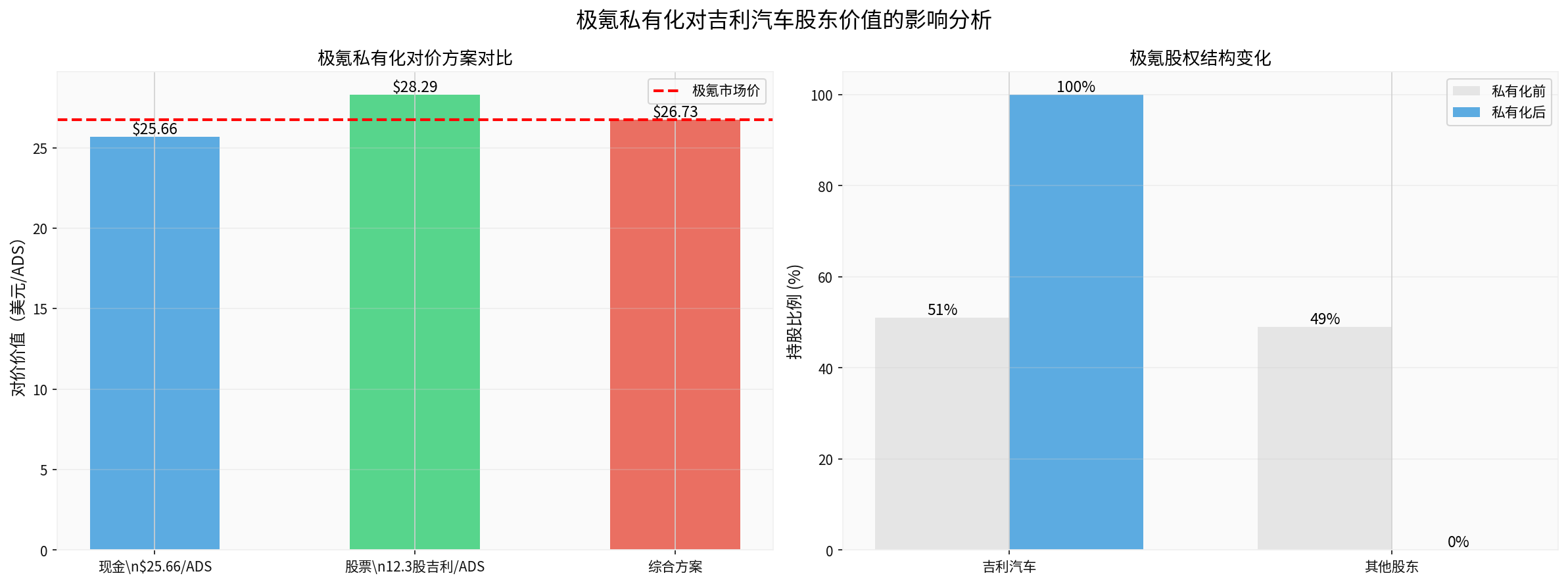

Transaction Structure and Value Comparison

- The privatization plan is $25.66 per ADS in cash, or 12.3 Geely Auto shares per ADS as an alternative; Zeekr officially completed privatization and delisted from the New York Stock Exchange on December 23, 2025.

- The cash consideration ($25.66) is lower than the last trading price before privatization ($26.73), with an approximately 4% discount; the value of the share exchange plan fluctuates with Geely’s stock price.

- For Geely shareholders, converting Zeekr from “consolidated + minority shareholder equity” to “100% ownership” helps unify management, improve synergy and resource allocation efficiency, but also means bearing 100% of Zeekr’s profits and losses.

-

Strategic Synergy and Governance Optimization

- Zeekr is positioned as a high-end intelligent electric brand with an ASP of approximately $42,600; its SEA platform and intelligent driving system can strengthen Geely’s overall technology and supply chain capabilities.

- After full ownership, it will facilitate R&D synergy, resource coordination between brands (Zeekr, Lynk & Co, Galaxy, etc.), and reduce internal transaction costs.

- However, it also requires stricter capital expenditure and profit-loss constraints to avoid out-of-control investment rhythm.

-

Regulatory and Valuation Trade-offs

- Chinese concept companies listed on the NYSE face changes in regulatory and liquidity environments; privatization can reduce compliance costs and volatility.

- In terms of valuation, privatization allows Zeekr to be embedded in Geely’s system as a business segment, and subsequent value is reflected in Geely’s overall valuation and profit improvement, rather than an independent market capitalization.

-

Fairness of Consideration and Shareholder Interests

- The cash consideration has a discount relative to the last trading price, which may trigger some investors’ doubts about “insufficient valuation”.

- The value of the share exchange plan depends on Geely’s stock price trend: if Geely’s stock price strengthens, the value of the share exchange will be higher than cash; if it weakens, the opposite is true.

- After the completion of privatization, Zeekr no longer has an independent secondary market price, and returns related to Zeekr can only be reflected through Geely’s stock price.

Chart: Zeekr Privatization Consideration Structure Comparison [0]

- Comprehensive Judgment and Key Observations

- Growth Model: High growth rate but concentrated structure; need to accelerate product and channel diversification to smooth fluctuations.

- Target Setting: The 2025 target of 3 million units is challenging but not impossible; the key lies in December execution and inventory health.

- Zeekr Privatization: May trigger valuation discussions in the short term; in the medium and long term, more attention should be paid to synergy effects and input-output ratio.

- Risk Exposure: High risk points are product structure concentration and aggressive target setting; tail risks need to be mitigated through category and regional expansion, and rhythm control.

- Shareholder Value: After privatization, Zeekr’s value is embedded in Geely; continuous tracking of operational efficiency, cash flow and profit improvement’s pull on valuation is needed.

Main References

[0] Jinling API Data (market, financial and transaction data of Geely Auto and Zeekr)

[1] S&P Global Mobility / Yahoo Finance – “S&P Sees U.S. Auto Sales Slipping in 2026” (https://finance.yahoo.com/news/p-sees-u-auto-sales-112859652.html)

[2] Cox Automotive / WSJ – “Auto & Transport Roundup: Market Talk” (https://www.wsj.com/business/auto-transport-roundup-market-talk-9b565a8a)

[3] Forbes – “10 Automotive Trends That Defined 2025—And Will Shape 2026” (https://www.forbes.com/sites/scottyreiss/2025/12/28/10-automotive-trends-that-defined-2025-and-will-shape-2026/)

[4] Benzinga – “Zeekr Drives Off Wall Street, Heralding Chilly Year Ahead For U.S. Chinese Listings” (https://www.benzinga.com/Opinion/25/12/49592026/zeekr-drives-off-wall-street-heralding-chilly-year-ahead-for-u-s-chinese-listings)

[5] Pandaily – “Geely Auto Completes ZEEKR Privatization, Accelerating Its Shift Toward Premium and Intelligent Mobility” (https://pandaily.com/geely-auto-completes-zeekr-privatization-accelerating-its-shift-toward-premium-and-intelligent-mobility)

Meta收购Manus的战略逻辑与AI竞争格局分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.