Analysis of the Sustained Growth Potential of NVIDIA’s AI Chip Market Share

1. Overview of Core Company Data

According to the latest market data, NVIDIA (NVDA), as a leading enterprise in the global AI chip field, currently has a market capitalization of $4.54 trillion and a stock price of $186.50 [0]. The company’s financial performance in Fiscal Year 2025 (FY2025) is strong, with data center business revenue reaching $115.19 billion, accounting for 88.3% of total revenue, becoming the absolute revenue pillar [0]. The company maintains a high net profit margin of 53.01% and an operating profit margin of 58.84%, demonstrating excellent profitability [0].

2. Current Market Share and Competitive Landscape

2.1 NVIDIA’s Dominant Position

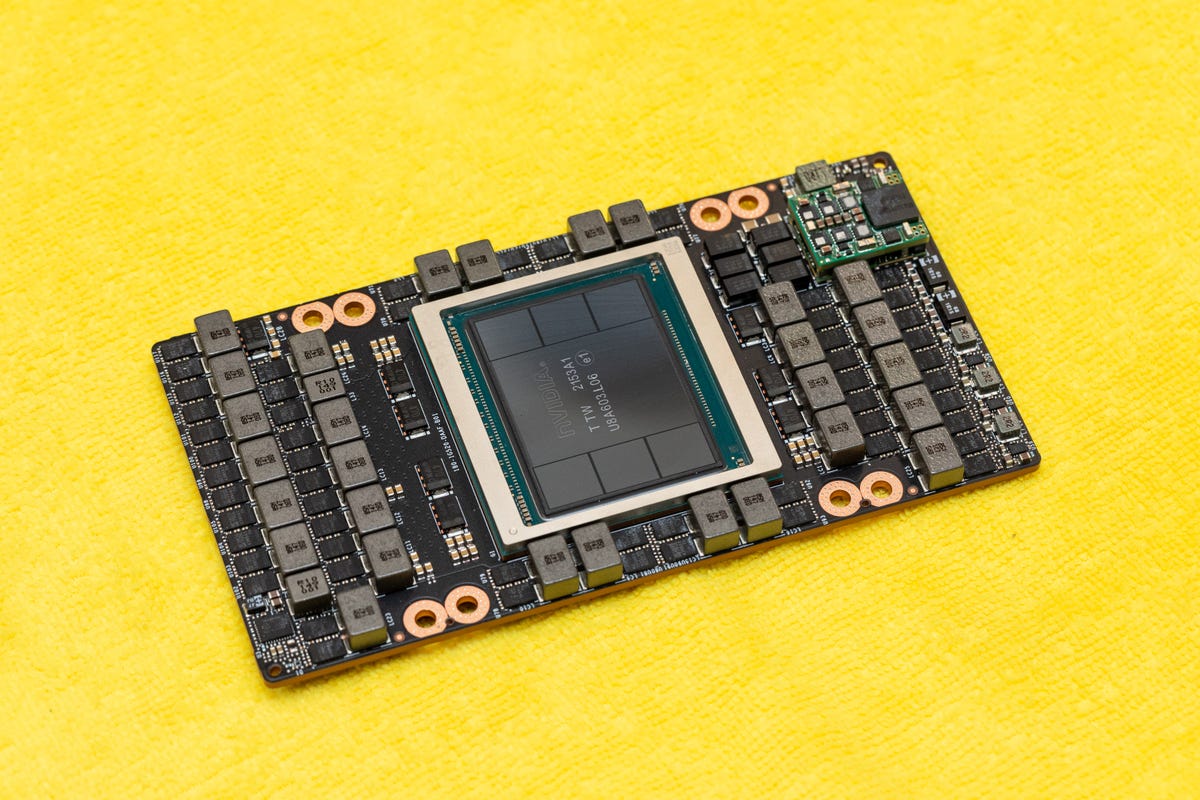

NVIDIA has long held an absolute dominant position in the data center GPU market. According to industry analysis reports, NVIDIA has built a strong competitive moat through continuous technological innovation, GPU architecture upgrades (such as Blackwell, H200, L40S series), and a well-established CUDA software ecosystem [1]. Its AI inference performance leads in cloud, workstation, and data center scenarios [1]. The company’s market performance in the AI chip field from 2024 to 2025 confirms its technological leading edge, with an annual increase of 34.84% and a three-year increase of up to 1202.37% [0].

2.2 Challenges from Competitors

AMD’s Strong Rise

: With its Instinct MI350 series GPUs and open ROCm software platform, AMD is quickly becoming a major alternative to NVIDIA [1]. Its EPYC server processors have gained significant market share in the data center market, and its strategic focus is fully shifting to the AI accelerator market. AMD continues to break through in performance and energy efficiency, posing substantial competitive pressure on NVIDIA [1].

Intel’s Counterattack

: Intel has launched a new generation of data center GPUs designed specifically for AI inference workloads, integrating Xeon 6 processors, aiming to gain competitive advantages in emerging vertical fields such as AI PCs, AI data centers, and industrial edges [1]. According to Grand View Research predictions, the global AI inference market size will reach $97.24 billion in 2024, and is expected to maintain a compound annual growth rate of 17.5% from 2025 to 2030 [1].

Threat from Google’s Self-developed TPU

: Google, an important customer of NVIDIA, is accelerating the deployment and application of its self-developed TPU (Tensor Processing Unit). This trend not only weakens NVIDIA’s potential revenue sources but also represents a long-term structural challenge from cloud vendors’ self-developed chips [2].

3. Evaluation of Sustained Growth Potential

3.1 Favorable Factors

Continuous Expansion of Market Demand

: The strong growth of the AI inference market (17.5% CAGR) provides broad growth space for NVIDIA [1]. The global AI market size is expected to continue expanding from 2018 to 2030, with demand in multiple fields including generative AI and high-performance computing continuing to rise [1].

Leading Advantage in Technological Iteration

: NVIDIA maintains a GPU architecture update cycle of every 18-24 months, with the Blackwell and H200 series continuing to lead in inference speed and energy efficiency. The deep accumulation of the CUDA ecosystem forms a significant switching cost barrier.

Analysts Remain Optimistic

: The current analyst consensus is a “Buy” rating, with an average target price of $257.50, representing a 38.1% upside from the current price [0]. More than 75% of analysts have given “Buy” or “Strong Buy” ratings [0].

3.2 Risks and Challenges

Profit Margin Pressure Risk

: The Wall Street Journal analysis points out that NVIDIA’s high profit margin is becoming an opportunity window for competitors, and profit margins are facing downward pressure [2].

Market Share Dilution Trend

: In the AI inference market, AMD and Intel are accelerating their share gains. Intel’s diversified hardware solutions and AMD’s cost-performance strategy may erode NVIDIA’s pricing power [1].

Geopolitical Risk

: Changes in U.S. chip export control policies to China have an impact on NVIDIA’s China market revenue. The company is developing customized chips (such as H20) for the Chinese market, but its strategic space is limited [2].

4. Technical Analysis and Price Trend

Technical indicators show that NVIDIA’s stock price is currently in a sideways consolidation phase (sideways/no clear trend), with a trading range of $182.50-$189.14 [0]. The MACD indicator shows a bullish signal (no_cross), and the KDJ indicator also shows a bullish trend (K:76.8, D:75.3), but the RSI is in the normal range [0]. The Beta coefficient is 2.28, indicating that its volatility is significantly higher than the overall market level [0].

5. Conclusion and Investment Recommendations

NVIDIA’s market share in the AI chip market will still maintain a leading position in the short term, but the certainty of sustained growth faces multiple challenges:

Short Term (6-12 Months)

: With technological leading advantages and CUDA ecosystem barriers, NVIDIA is expected to maintain a 70-80% market share in data center GPUs, with high growth certainty.

Mid Term (1-3 Years)

: The mass production of AMD’s Instinct MI350 series and the launch of Intel’s new generation GPUs will intensify competition. NVIDIA’s market share may decline slightly to 60-70%, but the overall market expansion will offset the share loss.

Long Term (3-5 Years)

: The trend of cloud vendors developing their own chips (Google TPU, Amazon Trainium, etc.) may pose structural challenges to NVIDIA. It is necessary to pay attention to the company’s strategic layout in the software ecosystem and emerging application scenarios (such as edge AI).

Comprehensive Evaluation

: NVIDIA’s AI chip market share

can continue to grow, but the growth rate will slow down

. The rapid expansion of the overall market size will support the company’s revenue growth, but competitors’ catch-up and cloud vendors’ self-developed trends will limit further expansion of market share. It is recommended that investors pay attention to the company’s technological innovation rhythm, software ecosystem advantages, and changes in profit margins.

References

[0] Jinling API Data - NVIDIA Real-Time Quotes, Company Profile, Technical Analysis

[1] Yahoo Finance - “Data Center GPU Company Evaluation Report 2025” (https://finance.yahoo.com/news/data-center-gpu-company-evaluation-132300436.html)

[2] Wall Street Journal - “NVIDIA’s High Profit Margin Is an Opportunity for Google and AMD” (https://cn.wsj.com/articles/英伟达的高利润率正是谷歌和amd的机遇-63e30e17)