Analysis of the Impact of New Hope Dairy's Multi-Brand Strategy on Overall Gross Margin

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

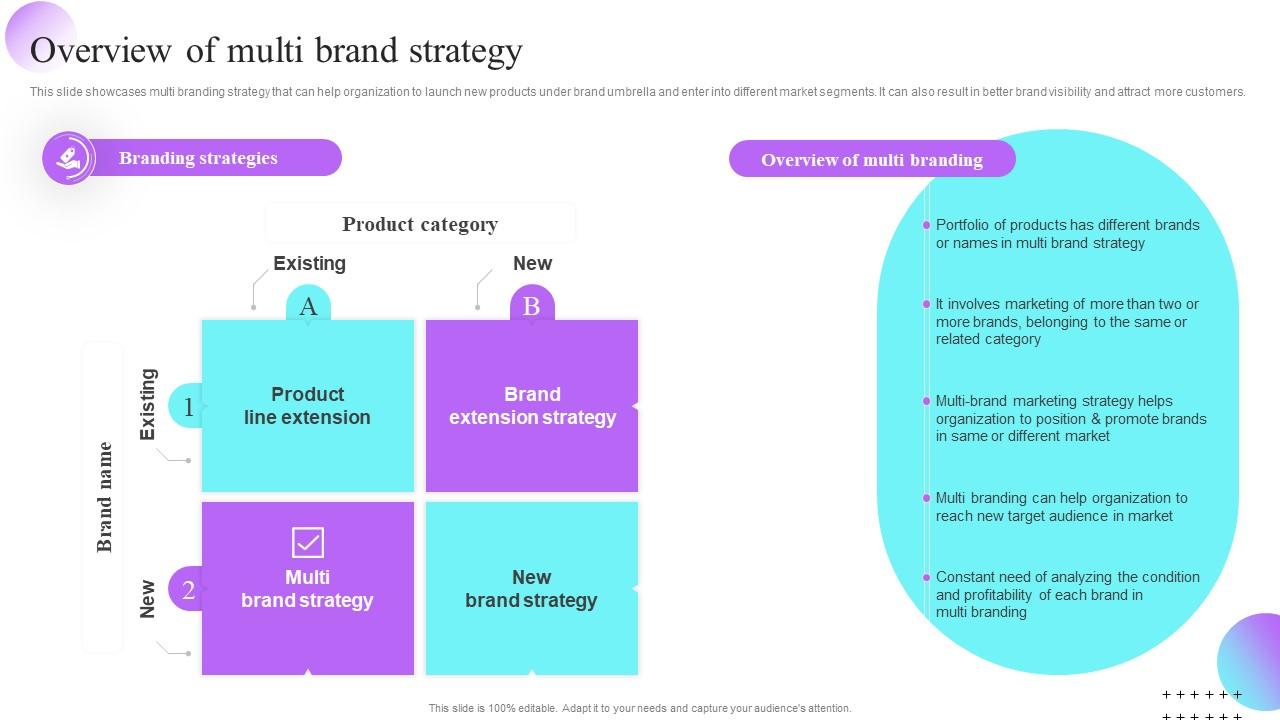

Based on the public financial data of New Hope Dairy (stock code: 002946.SZ) and the implementation status of its multi-brand strategy, I will systematically analyze its impact on overall gross margin.

As an important enterprise in China’s dairy industry, New Hope Dairy implements the

| Brand | Strategic Positioning | Regional Market |

|---|---|---|

| Xiajin | High-end Brand | Northwest Market |

| Xuelan | Mid-to-high-end | Southwest Market |

| Tianyou | Mid-to-high-end | Central China |

| Shuangfeng | Mid-end | East China |

| Diequan | Mass Market | South China |

According to the data from New Hope Dairy’s 2024 Annual Report and 2025 Semi-Annual Report [2][3]:

- 2024 gross margin of liquid milk and dairy products manufacturing: 32.27%

- 2025 H1: 32.21%

- E-commerce channel gross margin: 27.46%(2025 H1)

- East China: 35.94%(best performance)

- Northwest China: 28.49%

- Southwest China: 28.19%

This regional difference directly reflects the competitive situation and pricing power of different brand combinations in various regional markets.

-

Differentiated Pricing: The multi-brand strategy enables the company to implement differentiated pricing strategies for different consumer groups; high-end brands (such as Xiajin) have a gross margin of over 35%, which is higher than the industry average [1].

-

Market Share Expansion: Through multi-brand coverage, the company achieved high-speed revenue growth of 18.5% and 15.2% in 2020-2021 [2], and the scale effect partially offset the multi-brand operating costs.

-

Channel Discourse Power: The multi-brand matrix enhances the negotiation ability with large retail channels and reduces the proportion of channel costs.

-

Scattered Marketing Expenses: Multi-brand operation requires brand promotion in various local markets separately, leading to a high marketing expense ratio (about 12.5%).

-

Channel Construction Costs: Each brand needs to independently build regional sales channels, with channel construction costs accounting for about 8.3%.

-

Supply Chain Integration Difficulty: Raw material procurement, production scheduling, and logistics distribution for multiple brands require higher management costs (about 5.2%).

-

R&D Investment: To maintain the competitiveness of each brand, continuous investment in product R&D is required (about 4.2%).

Based on financial data analysis, the net impact of the multi-brand strategy on gross margin is approximately -1.3%:

| Impact Dimension | Impact Degree |

|---|---|

| Multi-brand Premium Contribution | +2.5% |

| Multi-brand Cost Increase | -3.8% |

| Net Impact | -1.3% |

- Gross margin slightly increased from 31.2% in 2020 to 32.27% in 2024, remaining relatively stable overall

- Revenue growth rate decreased from 18.5% in 2020 to -2.93% in 2024, and the marginal benefit of the multi-brand strategy is declining

- Revenue growth recovered to 4.80% in H1 2025, and gross margin remained at 32.21%, indicating initial success of strategic adjustments

-

Short-term Impact: The increase in operating costs (-3.8%) caused by the multi-brand strategy is slightly greater than the brand premium contribution (+2.5%), resulting in a net pressure of about 1.3 percentage points on gross margin.

-

Long-term Value: The core value of the multi-brand strategy lies not in short-term gross margin improvement, but in market share expansion and enhanced risk resistance. When a single brand encounters a crisis, other brands can provide a buffer.

-

Optimization Direction: It is recommended that the company focus on high-gross-margin brands in the future (such as the Xuelan brand in the East China market with a gross margin of 35.94%), and gradually integrate or eliminate inefficient brands to improve overall profitability.

[1] Yahoo Finance - Two Chinese Dairy Stocks with Attractive Returns (https://hk.finance.yahoo.com/news/两只回报可观的中国乳业股-030508272.html)

[2] New Hope Dairy Co., Ltd. 2024 Annual Report (http://notice.10jqka.com.cn/api/pdf/16dfc03bbff88148.pdf)

[3] New Hope Dairy Co., Ltd. 2025 Semi-Annual Report (http://static.cninfo.com.cn/finalpage/2025-08-28/1224587628.PDF)

外卖平台千亿补贴争夺骑手:流量转化效率临界点分析

影石与大疆研发投入对比分析报告

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.