Based on collected data, I conducted a systematic analysis of the sustainability of order growth for Topping Technology’s semiconductor equipment:

1. Current Status and Drivers of Order Growth

1. Sustained High Growth in Orders

Topping Technology’s contract liabilities rose from approximately RMB 3 billion at the end of 2024 to

RMB 4.894 billion

in Q3 2025, a record high, increasing by over 60% from the beginning of the year. This indicates a full backlog of orders, providing high visibility for future revenue conversion [1][2]. The company’s revenue in the first three quarters reached

RMB 4.22 billion

, with a year-on-year growth rate of

85.27%

, continuing the high-growth trend of 2023 (58.60%) and 2024 (51.70%) [1].

2. Core Growth Drivers

Deepening Domestic Substitution

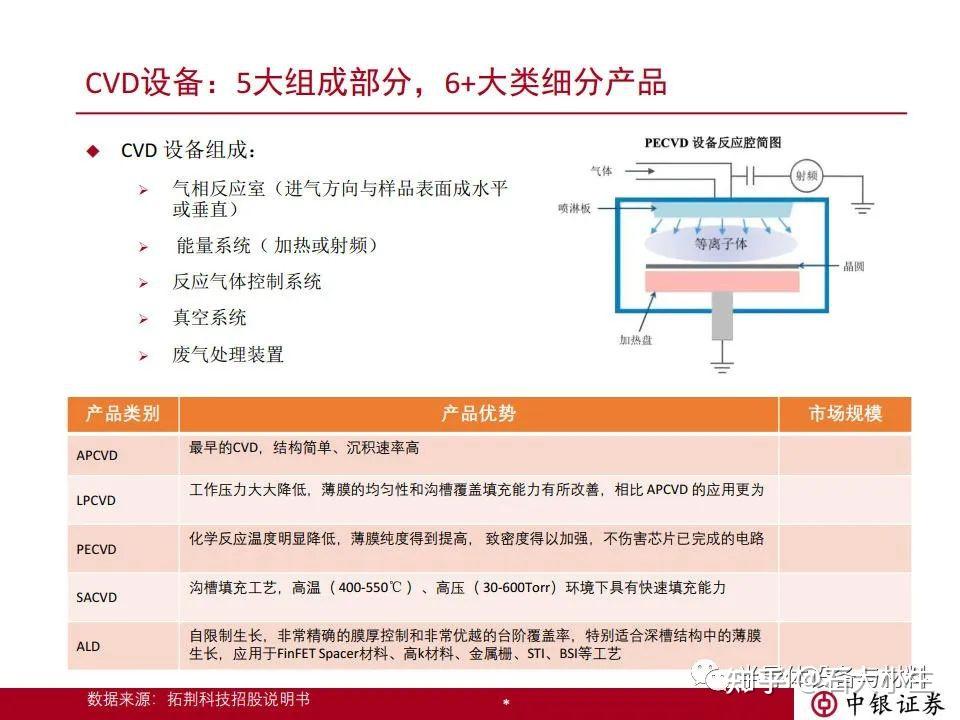

: Huatai Securities predicts that the localization rate of China’s semiconductor equipment is expected to rise from 16% in 2024 to 25% in 2025, leaving broad room for domestic substitution [1][2]. As a leading domestic PECVD equipment provider, Topping Technology directly benefits from this structural opportunity.

Booming Demand for AI and Memory Chips

: Guojin Securities points out that AI large models are driving the evolution of memory technology toward 3D, and coupled with the implementation of expansion projects by domestic memory giants such as Changxin and Changcun, demand for thin film deposition equipment continues to expand [1]. Topping Technology’s PECVD, ALD, and other thin film equipment, as well as advanced bonding series products, have been industrialized in memory chip manufacturing.

Expansion of Global Equipment Market

: The Semiconductor Industry Association (SEMI) estimates that global semiconductor manufacturing equipment shipments will grow by 7% to

USD 125.5 billion

in 2025 and further increase by 10% to

USD 138.1 billion

in 2026 [1].

2. Analysis of Order Sustainability

1. Positive Factors

Leading Technological Advantages

: Topping Technology entered the front-end deposition market for integrated circuits with PECVD, and has achieved stable mass production in key processes such as dielectric layers, anti-reflective layers, and etch stop layers. Several new products (PF-300TPlus/PF-300M platform, pX/Supra-D reaction chamber) have been introduced into advanced process chip production lines, passed customer verification, and entered large-scale mass production [3]. PECVD accounts for 33% of the value of thin film deposition equipment, making it the highest-value segment [4].

Adequate Preparation for Capacity Expansion

: The company’s Shenyang and Shanghai Lingang industrial bases can support a capacity of

over 700 units/year

, and the second Shenyang factory is under construction to further expand capacity support [3]. In December, the company’s RMB 4.6 billion private placement was accepted, with RMB 1.5 billion for the high-end semiconductor equipment industrial base construction project and RMB 2 billion for the cutting-edge technology R&D center construction, proactively conducting equipment innovation and process development around the cutting-edge technical requirements brought by AI chips [1][2].

Breakthrough in Customer Validation

: As of the first half of 2025, the cumulative wafer throughput of the company’s thin film deposition equipment in customer production lines exceeded

343 million wafers

, doubling from the same period last year [4], indicating that the products have been fully recognized by mainstream customers.

Improved Inventory Turnover Efficiency

: In the first three quarters of 2025, the company’s inventory turnover rate reached

0.37 times

, increasing both year-on-year and quarter-on-quarter, indicating that products are entering a critical window of sequential delivery to realize revenue [4].

2. Risk Factors

Capacity Bottleneck Risk

: The 2025 semi-annual report shows that among the company’s RMB 8.32 billion inventory, goods in transit account for nearly 60%, and raw materials and work-in-progress together account for 39.53%, so delivery capacity still faces certain pressure [4].

Increasing Competition Risk

: International giants such as Applied Materials and Lam Research still dominate the global market, and domestic peers like AMEC are also accelerating their layout in etching and thin film metrology testing businesses, leading to increasingly fierce market competition [1].

Downstream Cyclical Fluctuations

: The semiconductor industry has strong cyclicality. If memory chip prices fall or end-demand slows down, it may affect manufacturers’ expansion rhythms.

3. Conclusion and Outlook

Comprehensive judgment shows that Topping Technology’s order growth

has strong sustainability

, based on the following main reasons:

High Order Visibility

: RMB 4.894 billion in contract liabilities provides solid support for short-term performanceStable Technical Barriers

: PECVD equipment breaks overseas monopoly and continues to make breakthroughs in advanced process verificationFavorable Market Structure

: Double drive from domestic substitution and AI computing power demand, with global equipment market continuing to expand in 2025-2026Forward-looking Capacity Layout

: Private placement projects will significantly improve delivery capacity and support order conversionSolid Customer Base

: Continuous order introduction from memory giants, and doubled wafer throughput verifies product competitiveness

Risks to watch include the progress of capacity expansion, downstream memory price fluctuations, and changes in the industry competition pattern. If the second Shenyang factory is constructed smoothly and new products continue to be introduced to mainstream customers, order growth is expected to continue until 2026.

References

[1] Securities Market Weekly - “Net Capital Inflow Exceeds RMB 2 Billion, Up 74%! Semiconductor Equipment Dividend Period Arrives” (https://static.weeklyonstock.com/25/1229/qdy201516.html)

[2] Sohu Finance - “Net Capital Inflow Exceeds RMB 2 Billion, Up 74%! Semiconductor Equipment Dividend Period Arrives” (https://m.sohu.com/a/970592167_135869)

[3] Securities Times Network - “Topping Technology: Will Continue to Deepen in Thin Film Deposition Equipment and 3D Integration Equipment Fields” (https://www.stcn.com/article/detail/3524811.html)

[4] Eastmoney.com - “Breaking Through Technical Monopoly, Semiconductor Giant, Profit Surges 600%!” (https://caifuhao.eastmoney.com/news/20251229081942054510140)

[5] Shanghai Stock Exchange - Topping Technology 2025 Third Quarter Report (https://static.sse.com.cn/stock/disclosure/announcement/c/202512/688072_20251229_6EO7.pdf)

[6] Cailian Press - “Topping Technology: Full Backlog of Orders; Memory Price Increases May Drive Manufacturers to Continue Expansion | Directly Hit the Earnings Conference” (https://www.cls.cn/detail/2219648)