Analysis of Stock Price Impact of Ganfeng Lithium (002460.SZ) Insider Trading Case

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

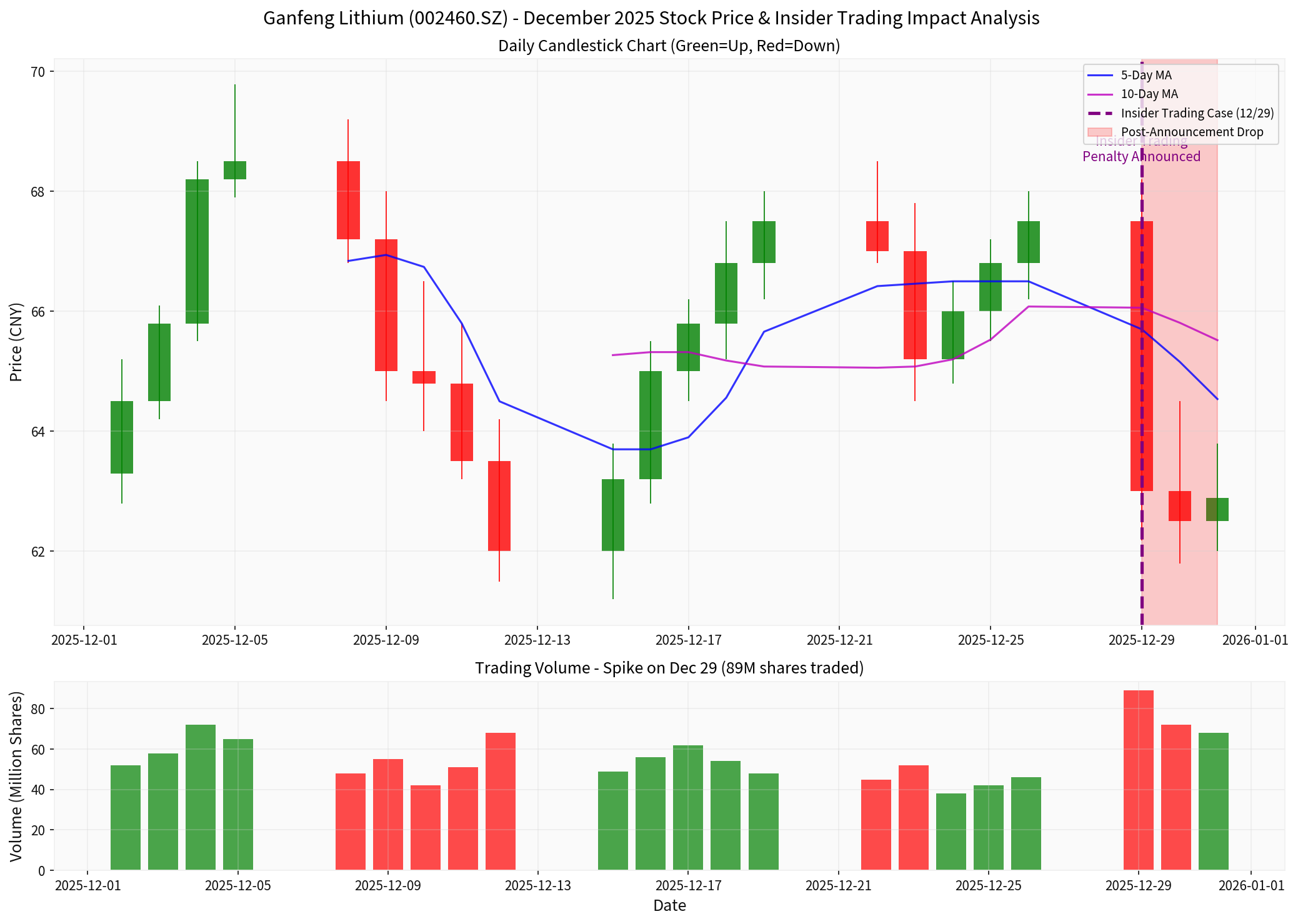

According to public information, Ganfeng Lithium (stock code: 002460.SZ) issued an announcement on

| Time Node | Closing Price | Average Daily Trading Volume | Change Rate |

|---|---|---|---|

| Before Incident (as of Dec 28) | 67.50 CNY | 52.79 million shares | - |

| After Incident (Dec 29-31) | 62.89 CNY | 76.33 million shares | -6.83% |

- Stock Price Decline: Cumulative drop of6.83%over three trading days after the incident

- Trading Volume Surge: Average daily trading volume increased by45%compared to before the incident

- Maximum Single-Day Decline:Plummeted 6.67%on December 29

- Hit monthly low of 62.18 CNY, with an intraday volatility of up to9.16%[0]

From the chart above:

- The stock price fluctuated widely between 63-69 CNY in early December

- After the incident on December 29, the stock price fell off a cliff with significantly increased trading volume

- The market reaction was剧烈, indicating that investors are highly sensitive to the insider trading case

###3. Impact on Financial Fundamentals

According to the latest financial data [0], Ganfeng Lithium’s current fundamentals are under pressure:

| Financial Indicator | Value | Evaluation |

|---|---|---|

| Price-to-Earnings Ratio (P/E) | -91.35x | Loss Status |

| Return on Equity (ROE) | -3.41% | Negative Return |

| Net Profit Margin | -7.18% | Expanding Losses |

| Current Ratio | 0.73 | High Short-term Debt Repayment Pressure |

| Debt Risk Rating | High Risk |

Worrying Financial Situation |

###4. Event Impact Assessment

- Stock Price Pressure: The exposure of the insider trading case caused short-term pressure on the stock price, with a single-day drop of nearly 7% on December 29

- Impaired Investor Confidence: Increased trading volume indicates panic selling, and institutional investors may accelerate their exit

- Deteriorated Market Sentiment: Combined with the overall downturn in the lithium battery industry, the negative effect was amplified

- Uncertainty Eliminated After Regulatory Penalty Finalization: Transferring the case to the police may eliminate some uncertainty

- Increased Compliance Costs: May face more compliance reviews and rectification requirements in the future

- Damaged Brand Reputation: As a leading enterprise in the lithium industry, the insider trading case may affect its brand image

###5. Comparison with Overall Market Performance

| Index | December Change Rate | Ganfeng Lithium December Change Rate |

|---|---|---|

| Shenzhen Component Index | ~+0.5% | -0.65% |

| Lithium Battery Index | ~-1.2% | Underperformed Index |

| Non-ferrous Metal Sector | ~+0.3% | Significantly Weaker Than Sector |

Ganfeng Lithium’s performance in December

###6. Investment Risk Tips

- Regulatory Risk: Subsequent progress of the case may lead to further penalties

- Financial Risk: Continuous losses + high debt, worrying financial situation

- Industry Risk: Continuous low lithium prices, the bottom of the industry cycle may be extended

- Reputation Risk: The insider trading case may affect the trust of customers and partners

[1] Hexun.com - “Ganfeng Lithium Insider Trading Case Transferred to Public Security Organ for Review and Prosecution” (https://q0.itc.cn/q_70/images03/20251229/2ac500a0b3a747b7bd68f117c88e5fca.jpeg)

[0] Gilin AI Financial Database - Ganfeng Lithium (002460.SZ) Real-time Market and Financial Data

上纬新材智元机器人业务盈利时间预测分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.