Analysis of the Impact of the Cooling UK Real Estate Market on Hong Kong Stock Market Real Estate-Related Investments

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

- UK house prices unexpectedly fell 0.4% month-on-month in December, with a full-year year-on-year increase of only +0.6% in 2025, the weakest annual increase since April 2024; previously, the market expected a month-on-month increase of +0.1% and a year-on-year increase of +1.2% in December [1].

- House prices rose 0.3% month-on-month in November, but the year-on-year increase fell to 1.8%, the lowest since June 2024 [2].

- Under the high interest rate environment, housing purchase costs are high, mortgage burdens are increased, suppressing demand and reducing the motivation for asset repricing [2].

- REITs:

- Developers:

- Building Materials:

- Xinyi Glass (0868.HK): $8.49 (+2.66%) [0]

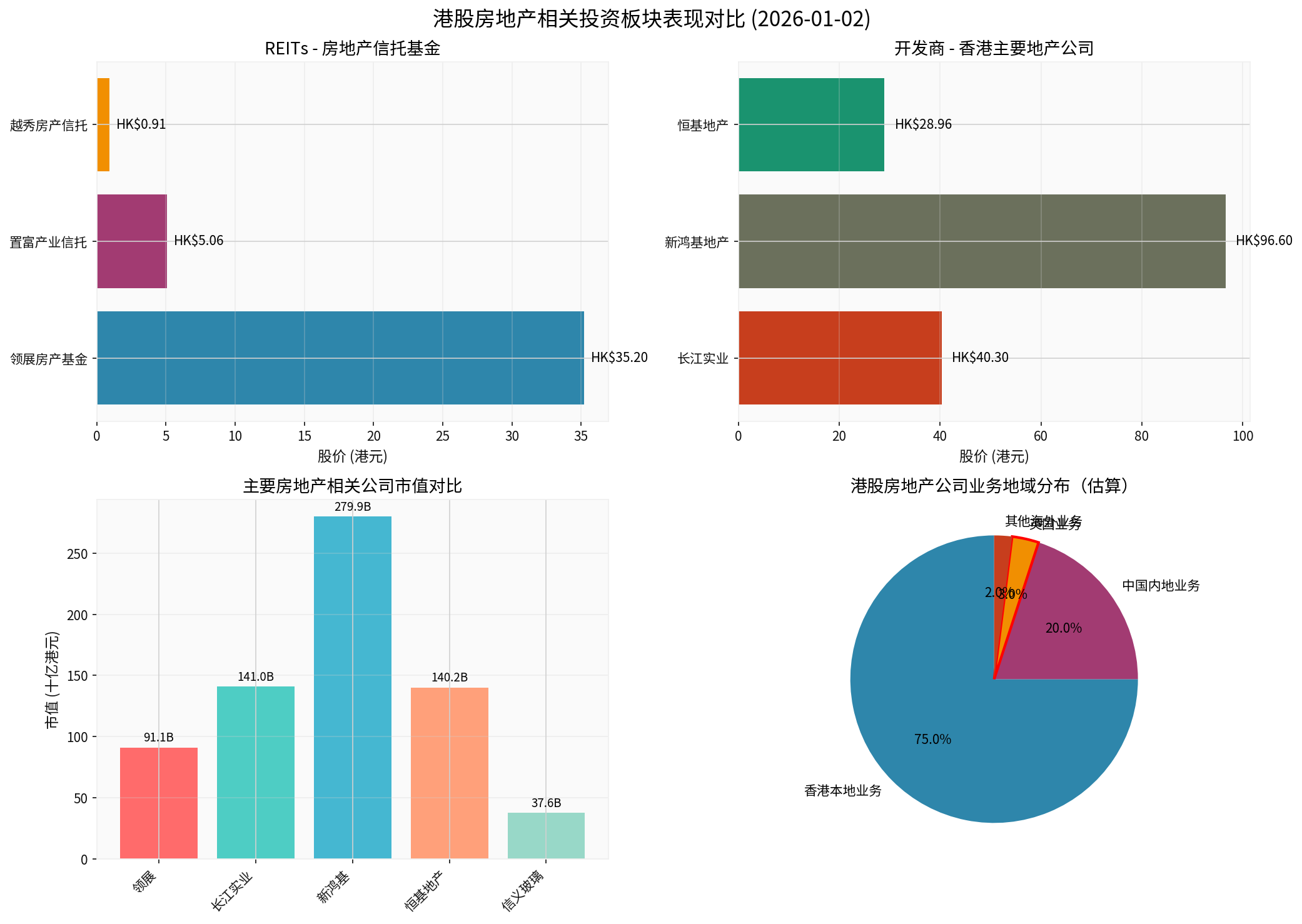

- Link REIT (0823.HK) company overview shows: Main business is REIT-Retail (market capitalization approx. $91.07B) [0]; Recent stock price under pressure (3 months: -12.57%, 6 months: -16.59%), operating profit margin 67.56% but net profit margin negative [0].

- Cheung Kong Holdings (1113.HK) company overview shows: Main business is Real Estate-Development (market capitalization approx. $141.04B) [0]; Stock price up +28.96% in the past year [0]; Price range from 2024-10-01 to 2025-01-02 was $30.15–$37.25, with a decline of approx. 10.07% during this period [0].

- Fortune REIT (0077.HK) and other REITs usually have high dividend yields (e.g., 6–7% range) [3].

- Market capitalization examples: Sun Hung Kai ~$279.93B [0], Henderson Land ~$140.21B [0], Xinyi Glass ~$37.56B [0].

- Geographic business distribution (qualitative):

- Most major Hong Kong-listed REITs and developers have assets concentrated in Hong Kong and the Chinese mainland [0]; UK business accounts for a small proportion and is non-mainstream (specific ratios are subject to disclosure by each company; current tools do not provide a unified standard).

- Asset repricing: If Hong Kong-listed companies hold UK assets (such as commercial properties, land, development projects), the weakening of UK house prices/rents may bring pressure on valuation impairment or rental income, affecting current profits and net assets. Judgment needs to be combined with the UK asset weight and type disclosed by each company.

- Development and sales: Hong Kong-listed developers with development and sales in the UK (if any) may face pressure of slower de-stocking, price and profit margin decline.

- Valuation method linkage: Global real estate cycles and interest rate expectations will affect the valuation discount rate and risk premium of REITs and developers; tight UK interest rate environment is often accompanied by a decline in global risk appetite, which may drag down the valuation center of Hong Kong real estate stocks.

- Exchange rate and capital side: GBP fluctuations and global capital flows will affect foreign capital inflows/outflows in Hong Kong stocks, thus causing periodic disturbances to the valuation of the real estate sector.

- Industry chain transmission: If UK real estate activity slows down, the marginal demand for upstream building materials and equipment will weaken, which may indirectly affect Hong Kong-listed building materials export enterprises (but the impact magnitude depends on their revenue structure).

- Local and mainland demand: Hong Kong’s local rent and consumer confidence, mainland real estate policies and sales recovery speed have a more direct and higher weight impact on Hong Kong-listed REITs and developers [0].

- Interest rate and financing environment: The interest rate trends of the Federal Reserve/Hong Kong Monetary Authority, local credit spreads, etc., have more immediate impacts on the financing costs and valuations of Hong Kong real estate stocks.

- When global risk appetite declines, funds often withdraw from the high-beta real estate sector, amplifying short-term volatility.

- Long-term institutional investors pay more attention to fundamental cash flow and asset quality; if UK asset exposure is limited and corporate governance is sound, the long-term impact is controllable.

Chart description:

- Figure 1 is a comparison of stock prices of major Hong Kong-listed REITs [0]; Figure 2 is a comparison of stock prices of developers [0]; Figure 3 is a comparison of market capitalization [0]; Figure 4 is a geographic business distribution (estimated example, only for intuitive understanding; specific details are subject to company disclosure).

- Risk control: Prioritize companies with clear asset structure, small UK exposure and sound balance sheets.

- Diversified allocation: Diversify between REITs and developers; avoid over-concentration in individual stocks with high overseas exposure.

- Focus on local recovery: Signals of Hong Kong’s local consumption recovery, improvement in retail/office rents, and stabilization and recovery of mainland real estate will be the core of valuation repair for Hong Kong-listed REITs and developers [0].

- Selective allocation: Prefer REITs with high dividend yields, good cash flow and debt management, and leading developers with de-stockable projects on hand and controllable leverage.

- Overseas exposure uncertainty: The higher the proportion of UK assets, the greater the impact from local macro and interest rate cycles; need to refer to the latest disclosure of the company [0].

- Exchange rate and interest rate risks: Fluctuations in GBP/HKD exchange rates, rise or tightening of global interest rate centers may affect financial expenses and asset valuation.

- Local policies and economy: Hong Kong’s local economy and policies (stamp duty, mortgage policies, rent control, etc.) also have a key impact on the sector [0].

[1] Sina Finance - “UK House Prices Unexpectedly Fell in December, Recording the Weakest Annual Increase Since April 2024” (https://finance.sina.com.cn/stock/bxjj/2026-01-02/doc-inhewzat4629368.shtml)

[2] Sina Finance - “GBPUSD Under Increased Pressure: CBI Output Expectations Plunge” (https://finance.sina.com.cn/money/forex/forexinfo/2025-12-03/doc-infznekr2102365.shtml?cre=tianyi&mod=pchp&loc=16&r=0&rfunc=41&tj=cxvertical_pc_hp&tr=12)

[3] Futu Securities - “How to Use High-Dividend Hong Kong Stocks to Support Retirement Life + Uncle Lu’s High-Dividend Stock Recommendations” (https://www.futuhk.com/blog/detail-high-dividend-hongkong-stock-8-968011)

[0] Jinling API Data

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.