In-depth Analysis of Silver Market Volatility Amplification and Precious Metals Investment Strategies

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

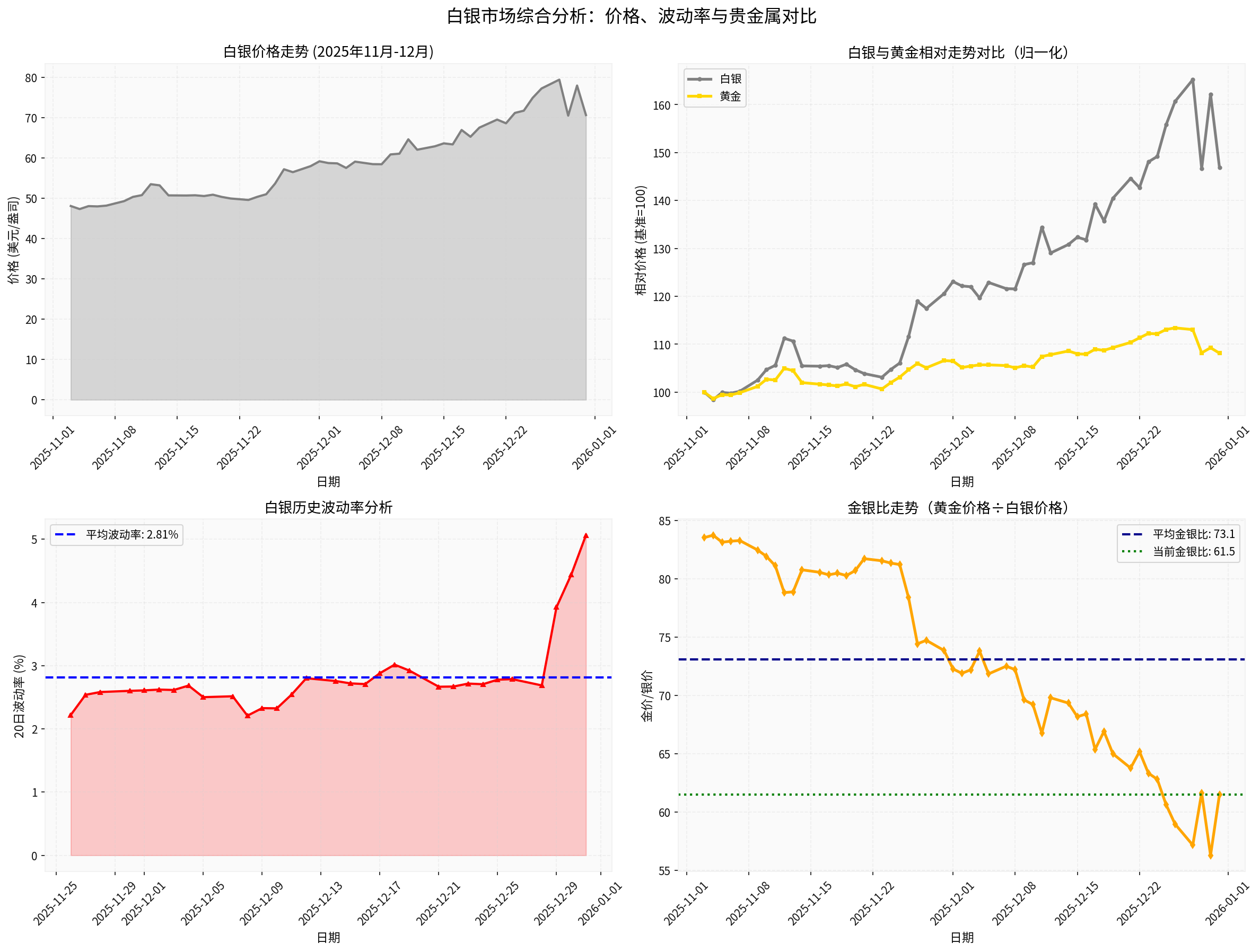

According to the latest market data [0], silver experienced a historic rise in 2025, with an annual increase of

- Current 20-day volatility: 5.06%(historical average is only 2.81%) [0]

- Recent high: $82.67, 17% above current price

- Gold-silver ratio: 61.49(long-term average is 73.09), at a historical low

Technical chart analysis [0] shows that silver continued to rise by 46.94% from November to December 2025, but volatility increased significantly, indicating the market has entered a highly unstable state.

Daniel Ghali, Senior Commodities Strategist at TD Securities, stated in his latest research report [1,2]:

“It is expected that about 13% of open interest in the COMEX silver market will be sold off in the next two weeks, which may lead to a dramatic repricing decline in silver prices.”

The core logic of this warning is:

- Post-holiday liquidity decline: Market participants decrease after year-end holidays, leading to liquidity exhaustion

- Crowded long positions: A large number of speculative long positions are concentrated in a few contracts

- Stampede risk: Simultaneous liquidation of 13% of open interest will trigger a chain reaction

The Wall Street Journal report confirms [3] that silver has seen its

| Risk Factor | Impact Level | Key Data |

|---|---|---|

| Concentrated Contract Liquidation | ⚠️ Extremely High | 13% open interest to be sold off [1,2] |

| Post-holiday Liquidity Decline | ⚠️ Extremely High | Post-holiday trading volume decline |

| Volatility Surge | ⚠️ High | Current 20-day volatility:5.06% [0] |

| Profit-taking Pressure | ⚠️ High | Annual increase of140.88% [0] |

-

Reduce Position Risk Exposure

- It is recommended to reduce silver positions by 30-50%from current levels

- Avoid using leverage to prevent forced liquidation

- Keep sufficient cash (40-50% recommended) to seize buying opportunities after potential crashes

- It is recommended to

-

Option Protection Strategy

- Investors holding silver ETFs/physical silver may consider buying put optionsfor hedging

- Strike price is recommended to be set in the $65-68 range (8-12% below current price of $74.06)

- Choose contracts with a term of 2-4 weeks to cover the peak liquidation period

- Investors holding silver ETFs/physical silver may consider buying

-

Stay Away from Short-term Contracts

- Avoid holding expiring futures contracts

- If futures must be held, choose contracts with more distant months (over 3 months)

Despite short-term correction pressure, silver’s

- Supply-demand imbalance: Global silver inventory is at a 10-year low, with continuous supply shortages for five consecutive years

- Rigid industrial demand: Demand from solar photovoltaic, electronics, and medical fields continues to expand

- Shift in investment demand: Silver has shifted from a safe-haven tool to a momentum trading asset, changing investor structure

- De-dollarization trend: U.S. federal debt reaches 115% of GDP, and the U.S. dollar depreciated by about 10% in 2025

-

Batch Buying on Dips

- Start building positions if silver falls to the $60-65 range (about -15% to -20%)

- Adopt the pyramid buying method: Buy more as prices drop

- Target price ranges:

- First batch: $65-68 range

- Second batch: $58-62 range

- Third batch: $52-55 range

-

Focus on Gold-Silver Ratio Repair

- Current gold-silver ratio of 61.49 is far below the historical average of73.09 [0]

- If silver corrects more than gold and the ratio rebounds to above 70, consider a pair trade of going long silver and short gold

-

Choose Low-Volatility Tools

- Prioritize physical silverorsilver ETFs(e.g., SLV)

- Avoid leveraged ETFs (e.g., AGQ), as their volatility amplification effect may lead to huge losses in turbulent markets

- Prioritize

According to market analysis [4,5,6]:

- Interest rate cut cycle: The Federal Reserve continues to cut interest rates, reducing the holding cost of precious metals

- Geopolitical uncertainty: Global trade tensions intensify safe-haven demand

- Shift from central bank gold purchases to investor demand: Strong investor demand has become the dominant force driving gold prices

| Asset Class | Recommended Allocation Ratio | Core Reason |

|---|---|---|

| Gold | 60-70% | Lower volatility (1.27% vs silver’s2.32%) [0], strong safe-haven attribute |

| Silver | 30-40% | Supported by industrial demand, high upside elasticity |

| Precious Metal Mining Stocks | 0-20% (optional) | Gold mining stocks outperformed gold prices in2025, but need to be alert to corporate operational risks [4] |

- Position Control: Silver allocation should not exceed5-10% of the total portfolio

- Tool Selection: Only hold physical silver or highly liquid silver ETFs

- Operation Strategy:

- Temporarily wait and see until the end of Januaryto wait for the end of the contract liquidation wave

- If prices fall below $60, slightly build positions of 3-5%

- Set a -15% stop-loss and strictly implement it

- Temporarily

- Position Control: Silver allocation of10-15%

- Tool Selection:70% silver ETFs +30% call options (limit downside risk)

- Operation Strategy:

- Immediately reduce current silver positions to 50%

- Buy 50% of the remaining positions in the $65-68 range

- Adopt the collar strategy: Hold ETFs while buying put options + selling call options

- Position Control: Silver allocation can reach 20-30%

- Tool Selection: Combination of futures, options, and ETFs

- Operation Strategy:

- Short-term short: Use high volatility to establish short positions in the $74-76 range (target $65)

- Medium-term long: Establish long positions in the $58-62 range (target $75-80)

- Option Strategy: Buy a straddle combination to bet on large two-way fluctuations

##4. Key Risk Monitoring Indicators

Indicators to closely monitor in the next two weeks:

| Monitoring Indicator | Importance | Observation Points |

|---|---|---|

| COMEX Open Interest | 🔴 Critical | Whether it continues to decline by more than13% |

| Intraday Trading Volume | 🔴 Critical | Whether it is below 50% of the average level |

| Volatility Index (VIX) | 🟡 Important | If it exceeds30, indicating market panic |

| Gold-Silver Ratio | 🟡 Important | Rebound to 65-70 range for entry |

| U.S. Dollar Index | 🟢 Reference | Stronger dollar puts pressure on silver |

| Stock Market Performance | 🟢 Reference | Sharp decline may trigger silver sell-off |

##5. Conclusion and Action Recommendations

The silver market is in a

✅

- Reduce silver positions to50% or lower

- Review leverage ratio in holdings

- Buy put option protection for remaining positions

✅

- Monitor changes in COMEX open interest

- Start batch building positions if prices fall to $65-68

- If liquidity is completely exhausted (daily volume below 50% of average), exit completely

⚠️

- Full positions in silver during the contract liquidation period

- Using leverage above 2x during high volatility

- Chasing ups and downs to capture short-term fluctuations

Despite short-term adjustment pressure, silver, as a “dual-attribute” asset (financial + industrial), still has

[0] Gilin Data API - Silver, gold price and technical analysis data

[1] Yahoo Finance - “Cardano’s ADA pops7%, bitcoin, ether show steady gains”

https://finance.yahoo.com/news/cardanos-ada-pops-7-bitcoin-034920670.html

[2] Yahoo Finance - “Gold and Silver Open2026 With Gains Following Huge”

https://finance.yahoo.com/news/gold-silver-open-2026-gains-040226353.html

[3] Wall Street Journal - “Silver Posts Biggest One-Day Decline in Nearly Five Years”

https://www.wsj.com/finance/stocks/global-stocks-markets-dow-news-12-29-2025-fb2f6ec3

[4] Yahoo Finance Hong Kong - “Gold, silver, platinum, palladium, cobalt prices surge collectively! Which metal is the next investment opportunity?”

https://hk.finance.yahoo.com/news/黃金-白銀-鉑-鈀-鈷價格集體瘋漲-204003433.html

[5] Yahoo Finance Hong Kong - “Can gold and silver gains cross the year? Interest rate cuts and de-dollarization are all in place; experts warn bull market enters high volatility zone”

https://hk.finance.yahoo.com/news/金銀漲勢能跨年嗎-降息-去美元化全到位-專家警告牛市進入高波動區-020435901.html

[6] Yahoo Finance Hong Kong - “Gold and silver prices both fall but do not change record performance in2025”

https://hk.finance.yahoo.com/news/黃金和白銀價格雙雙下挫-但不改2025年全年創紀錄表現-073627723.html

长安汽车2025年电动化转型及投资价值评估

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.