In-depth Analysis of Tesla's 89.1% Surge in Norway Sales

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

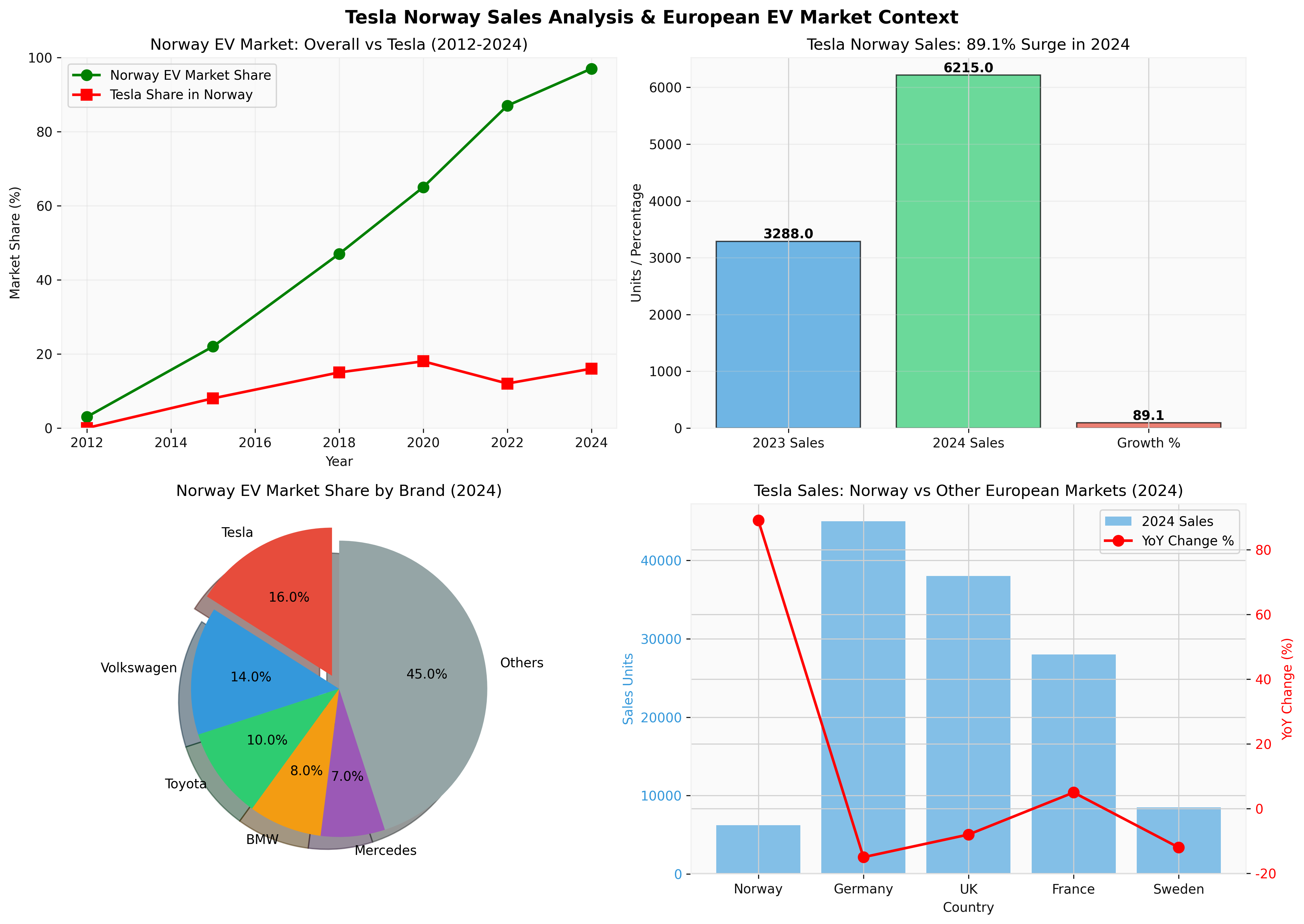

According to the latest data, Tesla’s new car registrations in Norway surged by 89.1% year-on-year in December 2024[2]. Behind this growth is Norway’s unique market environment:

- Tax Relief: Electric vehicles are exempt from value-added tax (25%) and registration tax

- Usage Privileges: Free parking, free charging, ferry discounts

- Infrastructure: The density of charging piles ranks among the highest in the world

- Market Penetration: The electric vehicle market share reached 97.4% in December 2024, the highest level globally[2]

- In mid-2024, Tesla launched the upgraded Model Y (Juniper version) in Norway

- Improved interior and longer range (up to 565 km WLTP)

- Price Competitiveness: The starting price of the Norwegian version is about 380,000 Norwegian kroner (approximately $35,000), which has a price advantage in the European market

- Norway has the densest Supercharger network in Europe

- As of the end of 2024, Norway had more than 1,200 Superchargers

- Free charging policy reduces usage costs

- Volkswagen Group’s ID series faced software issues and delivery delays in 2024

- Although BYD expanded rapidly in Europe, its layout in Norway was relatively lagging

- Chinese brands (Xpeng, Zeekr) still have a small market share in Norway

- Tesla’s Berlin factory increased production capacity, shortening delivery cycles in Norway

- Localized production in Europe reduces tariffs and logistics costs

- Norway: Registrations increased by 89.1%[2], becoming Europe’s strongest growth market

- Sales reached 6,215 units (full year 2024, up 89.1% YoY)[5][6]

- Market share of approximately 16%, maintaining its position as Norway’s largest automaker[2]

- Germany: Sales of approximately 45,000 units, down about 15% YoY

- UK: Sales of approximately 38,000 units, down about 8% YoY

- France: Sales of approximately 28,000 units, up 5% YoY

- Sweden: Sales of approximately 8,500 units, down about 12% YoY

- BYD surpassed Tesla in sales in multiple European countries in 2024

- Denmark Market: Tesla has been surpassed by BYD, Xpeng, and Zeekr[4]

- Price Advantage: Chinese brand models are generally 20-30% cheaper than Tesla’s

- Volkswagen ID.3 and ID.4 sales grew steadily in Europe

- BMW i4 and iX series compete in the high-end market

- Mercedes-Benz EQ series has brand advantages in the luxury segment

- FSD (Full Self-Driving) technology is leading, although European regulatory approval has not been fully passed

- Supercharger network is still the most complete in Europe

- OTA remote upgrade capability remains competitive

- In mature markets like Norway, Tesla has become synonymous with electric vehicles

- High brand loyalty, with repurchase and recommendation rates leading the industry

According to the latest financial analysis[0]:

- Net Profit Margin: 5.51% (lower than 10.8% in 2023)

- Operating Profit Margin:4.74% (significant decline)

- ROE (Return on Equity):6.91% (at historical low)

- P/E Ratio:275.48x

- P/B Ratio:18.15x

- P/S Ratio:15.14x

- Market Cap: $1.45 trillion

According to DCF model analysis[0]:

| Scenario | Intrinsic Value | Gap vs Current Stock Price |

|---|---|---|

| Conservative | $141.08 | -68.6% |

| Baseline | $147.21 | -67.3% |

| Optimistic | $188.14 | -58.2% |

- Even in the most optimistic scenario, Tesla’s stock price is still overvalued by more than 58%

- Market pricing reflects more expectations for Robotaxi and Optimus robots than the current fundamentals of the electric vehicle business

- High Beta value (1.88) indicates high stock price volatility

- Proves Tesla can still achieve high growth in high-penetration markets

- Demonstrates market acceptance of product upgrades (Model Y Juniper)

- Verifies the value of Supercharger network and brand loyalty

- Norwegian market is relatively small (annual sales of about 150,000 units)

- Strong policy dependence, difficult to replicate in other markets

- Sales in Norway fell by 50% YoY in October 2025[3][4], indicating challenges to growth sustainability

- Technical Aspect: Sideways oscillation, trading range [$441.59, $464.70], Beta 1.88[0]

- Valuation Level: P/E275x, P/B18x, significantly higher than historical averages and peers[0]

- Analyst Consensus: Median target price of $483 (+7.4%), rating as “Hold” (31 Buy/32 Hold/17 Sell)[0]

- Short-term (0-6 months):European sales volatility (Norway +89.1% in December2024[2], but declines in multiple countries in October2025[3][4]) coexists with valuation pressure; stock price may remain volatile

- Mid-term (6-18 months):Whether the success of Model Y Juniper in markets like Norway[5][6] can stabilize European share is key; Robotaxi commercialization progress (currently about160 units, far below the2025 target of 1,500 units) will dominate expectations

- Long-term (18+ months):European market faces dual competition from Chinese brands and traditional automakers; valuation needs to shift from electric vehicle business to Robotaxi/robot narrative, but execution risks and regulatory barriers are high

- Intensified Competition: BYD has surpassed Tesla in multiple European countries[4], and may become the world’s largest BEV manufacturer in2025

- Policy Risk: European subsidy reduction and policy adjustments for Chinese brands

- Technical Risk: Unclear progress of FSD regulatory approval in Europe

- Execution Risk: The actual scale of Robotaxi targets in 2025 was reduced from1,500 to about30 units, showing a gap between execution and commitments

- Product Strategy Verification: Model Y Juniper upgrade is recognized in mature markets

- Brand Advantage Confirmation: Maintains about16% market share in a highly competitive environment[2]

- But Warnings Are Obvious: Norway’s registrations fell by50% YoY in October2025[3][4], indicating growth sustainability is affected by policy and competition

- Norway’s success cannot offset overall European pressure:2024 sales in Germany/UK fell by about15%/8% YoY, France grew by5%, Sweden fell by12%

- Current stock price ($449.72, P/E275x) already reflects optimistic expectations for many years ahead, while Norway’s growth is more of a “point” breakthrough rather than a “broad” improvement

- Valuation support needs to shift to Robotaxi and robot businesses, but Robotaxi execution progress (about160 units vs1,500 unit target) increases uncertainty

- Short-term: European market differentiation intensifies (contrast between Norway +89.1% in Dec2024 and -50% in Oct2025[2][3][4]), high volatility (Beta 1.88)

- Mid-term: Focus on the stability of Model Y Juniper’s share in Europe and Robotaxi commercialization milestones

- Long-term: Norway case proves competitive barriers in high-penetration markets, but overall European competitive landscape and rise of Chinese brands remain structural challenges

[0] Gilin API Data - TSLA Company Profile, Financial Analysis, Technical Analysis, DCF Valuation (December31,2025)

[1] Investing.com - “Tesla Norway registrations surge89.1% in December” (January2,2026)

https://www.investing.com/news/stock-market-news/tesla-norway-registrations-surge-891-in-december-93CH-4427371

[2] CleanTechnica - “EVs Take97.4% Share In Norway — Tesla Model Y Best Seller” (May9,2025)

https://cleantechnica.com/2025/05/09/evs-take-97-4-share-in-norway/

[3] Sina Finance - “Tesla’s European Sales Fall to Low Again in October; France Is the Only Bright Spot” (November3,2025)

https://finance.sina.cn/stock/jdts/2025-11-03/detail-infwczmf2200054.d.html

[4] TOM Auto - “Tesla’s Sales in Multiple European Countries Slump Again in October” (November4,2025)

https://car.tom.com/202511/1033217409.html

[5] FourWeekMBA - Tesla Norway Sales Chart (showing89% growth)

https://fourweekmba.com/daily-roundup-anthropics-2-year-billion-teslas-915-billion-paradox-and-the-demographic-destiny-mckinsey-reveals/

[6] Sina Finance - Norway2024 Automobile Brand Sales Ranking (showing Tesla leading with significant growth)

https://n.sinaimg.cn/spider20241007/82/w1080h602/20241007/122f-d48b26cc2ca1f96cfd8c2fff4d4c862d.png

[7] ICCT - “2024 Global Light Electric Vehicle Market Tracking Report” (July2025)

https://theicct.org/wp-content/uploads/2025/07/ID-426-–-Global-monitor_CH_research-brief_final.pdf

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.