Analysis of the Pull Effect on Tourism Consumption Industry and Impact on Listed Companies' Performance Post Customs Closure of Hainan Free Trade Port

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The Hainan Free Trade Port officially implemented full-island customs closure operation on

- Sustainable Pull Effect: Supported by three pillars: continuous release of policy dividends, expansion of international route networks, and diversification of consumption scenarios

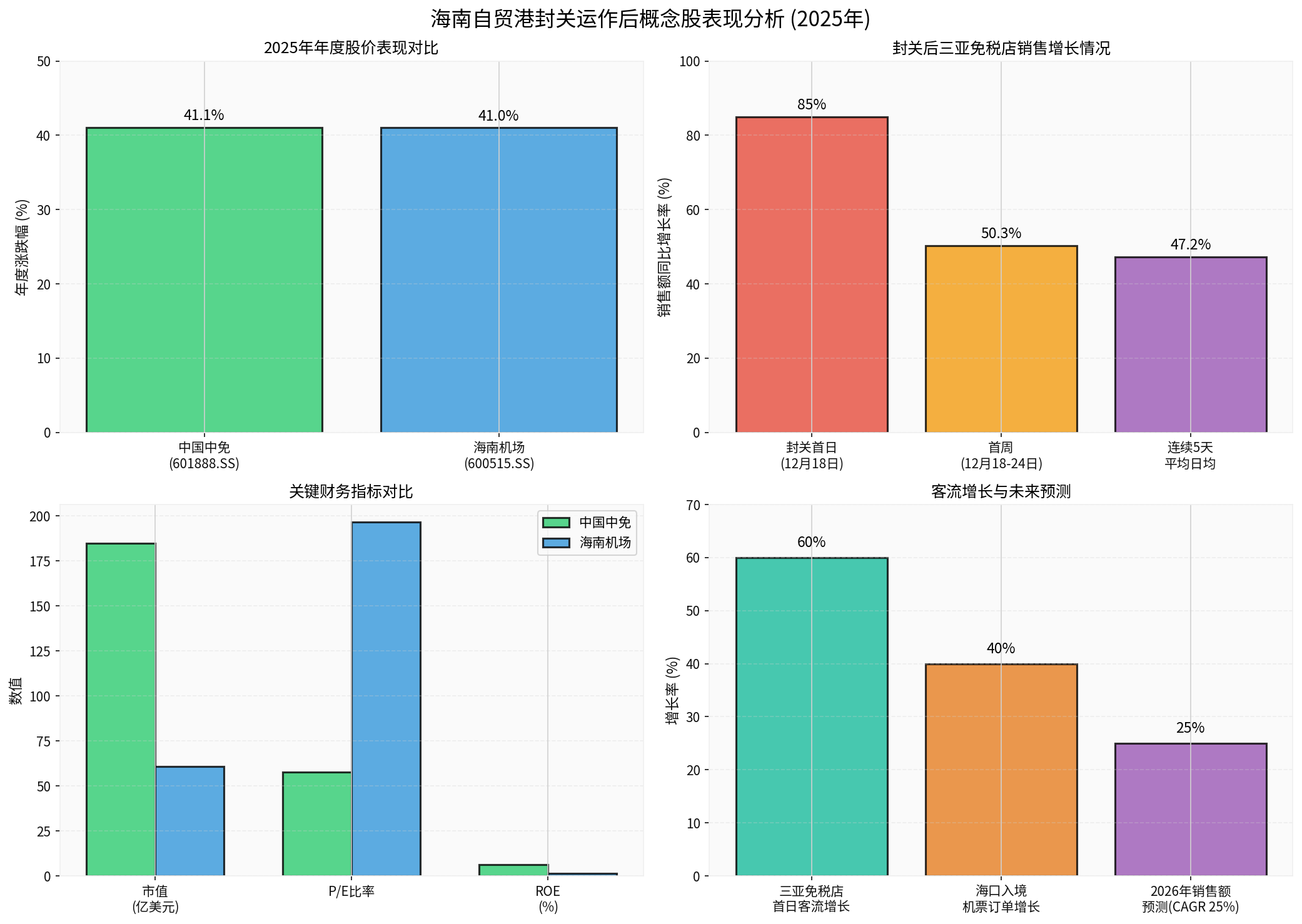

- Differentiated Benefits for Listed Companies: China Duty Free Group (601888.SS) and Hainan Airport (600515.SS) saw stock price increases of over41%; Wangfujing (600859.SS) and Jinjiang Hotels (600754.SS) performed mediocrely

- Long-Term Growth Prospects: Standard Chartered Bank predicts that Hainan offshore duty-free sales will exceed120 billion yuanin 2026, with a compound annual growth rate of25%[1]

In the first week of customs closure (December 18-24, 2025), the Hainan offshore duty-free market delivered outstanding results [1][2]:

| Indicator | First Week Data | YoY Growth |

|---|---|---|

| Offshore Duty-Free Shopping Amount | 1.1 billion yuan | +54.9% |

| Number of Shoppers | 165,000 person-times | +34.1% |

| Number of Purchased Items | 775,000 pieces | +11.8% |

| Sales of Four Duty-Free Stores in Sanya | 630 million yuan | +47.2% |

| First-Day Sales of Sanya International Duty-Free City | Specific amount not disclosed | +85% |

| First-Day Foot Traffic of Sanya International Duty-Free City | 36,000 person-times | +60% |

Hainan Province’s tourism market performed strongly in 2025 [3][4]:

- Annual Tourist Volume: Expected to receive106 million tourists, a YoY increase of9%

- Total Tourism Spending:224.984 billion yuan, a YoY increase of10.3%

- Inbound Tourism Growth: From January to October, it received4.4686 million inbound overnight tourists, a YoY increase of58.7%

- International Routes: A total of82 overseas passenger routeshave been opened, covering core cities in the Russian-speaking region, major source markets in Southeast Asia, and Hong Kong, Macau and Taiwan regions

- Haikou air ticket bookings increased by 19%YoY

- Sanya air ticket bookings increased by 51%YoY

- Haikou inbound international air ticket orders increased by over 40%

- International air ticket sales to Haikou for the 2026 Spring Festival doubled YoY [1][2]

After customs closure, the “zero tariff” policy has been significantly upgraded [1][2]:

| Policy Dimension | Pre-Customs Closure | Post-Customs Closure | Change Magnitude |

|---|---|---|---|

| Zero Tariff Item Coverage | 1,900 items | Approx. 6,600 items |

+247% |

| Proportion of Total Commodity Items | 21% | 74% |

+53 percentage points |

| Offshore Duty-Free Quota | No clear increase | 100,000 yuan/year |

New Policy |

| Visa-Free Countries | Not disclosed | 86 countries |

Policy Enhancement |

- The traditional consumption peak seasons of New Year’s Day and Spring Festival overlap with the customs closure effect, forming a “dual-drive”

- The government continues to issue offshore duty-free consumption vouchers, leveraging consumption potential through leverage effect

- The “shopping + vacation” model has become a new hot spot, with the average occupancy rate of high-end hotels like Sanya Atlantis exceeding 90%[2]

- Sanya City has launched more than 70 large-scale eventsintensively to increase duty-free consumption conversion rate

- “0 Tax Group” IP-themed promotion to expand the influence of the new policy

- Residents on the island can purchase “buy-now-take-now” duty-free products unlimited times with one offshore record, lowering the consumption threshold

- The duty-free policy for processed value-added goods has been implemented, and the first batch of self-produced goods has been sent to the mainland through the “second-line port” [2]

- The expansion of fifth and seventh freedom of the air services is expected to increase the number of overseas routes opened in Hainan Province to 90

- The target of international passenger throughput reaches 2.4 million person-times, with a more abundant route network [1]

- Haikou Customs supervised over 400 million yuanof “first-line” imported “zero tariff” benefit goods (first week)

- Supervised over 20 million yuanof “second-line” domestic sales processed value-added duty-free goods (first week) [2]

- Intelligent customs clearance and classification management optimize processes and alleviate logistics bottlenecks

- Total tourism revenue doubled from 95.016 billion yuan in 2018to204.014 billion yuan in 2024[4]

- The comprehensive contribution rate of tourism to GDP increased from 27.3% in 2018to33.4% in 2024[4]

- Build a multi-level visa-free system, and visa-free entry has become the main way for foreigners to enter Hainan

- The annual output value of Nanfan Seed Industry is expected to exceed 20 billion yuan

- The proportion of marine GDP in GDP reaches 35.5%

- Commercial space launch site realizes dual-workstation normalized launch

- The country’s first digital bonded zone pilot operation [5]

- Standard Chartered Bank predicts that Hainan offshore duty-free sales will exceed 120 billion yuan in 2026, and China Duty Free Group is expected to receive84 billion yuan(based on 70% market share) revenue contribution

- 2025 full-year increase: +41.07%(closing price 94.56 USD)

- 52-week range: 54.75 - 95.66 USD

- Recent strong trend: +35.75%in 3 months,+55.83%in 6 months,+46.15%in 1 year

| Indicator | Value | Evaluation |

|---|---|---|

| Market Capitalization | 184.63 billion USD |

A-share duty-free leader |

| P/E Ratio | 57.54x | High valuation, reflecting high growth expectations |

| ROE | 6.10% | Profitability needs improvement |

| Net Profit Margin | 6.38% | At a reasonable level |

| Current Ratio | 5.82 | Financially sound, sufficient liquidity |

- Q4 2025: Revenue 11.71 billion USD, showing significant recovery

- Q3 2025: Revenue 11.40 billion USD

- Q2 2025: Revenue 16.75 billion USD (peak season effect)

- Hainan offshore duty-free sales reached 1.1 billion yuan in the first week of customs closure. Assuming China Duty Free Group has a 70% market share, it contributes about770 million yuan

- If the 54.9% YoY growth rate is maintained, the annual revenue increment of Hainan business can reach 15-20 billion yuan

- Standard Chartered Bank predicts Hainan offshore duty-free sales of 120 billion yuan in 2026, and China Duty Free Group is expected to receive 84 billion yuan(based on 70% market share) revenue contribution

- The current P/E ratio of 57.54x seems high, but based on the 2026 25%CAGR expectation, the PEG (Price/Earnings to Growth Ratio) is about2.3, which is in the acceptable range

- Compared with international duty-free giant Dufry (P/E ratio around 30-40x all year round), the growth premium of China Duty Free Group is reasonable

- 2025 full-year increase: +41.01%(closing price 5.33 USD)

- 52-week range: 3.28 - 5.90 USD

- The increase is comparable to China Duty Free Group, reflecting the market’s consistent expectation of the customs closure effect

| Indicator | Value | Evaluation |

|---|---|---|

| Market Capitalization | 60.90 billion USD |

Medium-sized target |

| P/E Ratio | 196.45x | Extremely high valuation, mainly due to low performance base |

| ROE | 1.32% | Weak profitability |

| Net Profit Margin | 6.89% | Better than ROE, indicating low asset turnover rate |

| Revenue (Latest Quarter) | 913 million USD | Stable operation |

- Airport passenger growth directly drives commercial leasing, duty-free store rent and advertising revenue

- Sanya Phoenix International Airport’s passenger throughput reached 434,100 person-timesfrom December 18 to 23, showing a significant YoY increase [2]

- Hainan Province’s international passenger throughput target is 2.4 million person-times, with significant room for improvement compared to the current level [1]

- 2025 full-year increase: Only +1.11%(closing price 15.53 USD)

- Far lower than the average increase of Hainan concept stocks, with limited market recognition

- Although it obtained a duty-free license, its Hainan business layout is relatively lagging

- The national department store business is dragged down by weak consumption, affecting overall performance

- The scale effect of duty-free business has not yet appeared, and the gap with China Duty Free Group continues to expand

- 2025 full-year increase: -5.92%(closing price 25.27 USD)

- Underperformed the market, reflecting concerns about its national business structure

- Market Capitalization: 23.00 billion USD

- P/E Ratio: 48.71x (high valuation)

- ROE: 3.55% (weak profitability)

- Current Ratio: 0.98 (liquidity pressure)

- As a national hotel group, Hainan business accounts for a low proportion

- Dragged down by business in other regions (e.g., slow recovery of business travel in Shanghai and Beijing)

- Intensified competition in the high-end hotel market, limited improvement in RevPAR (Revenue Per Available Room)

- The official customs closure operation of Hainan Free Trade Port marks a full transition from policy pilot to institutional arrangement [5]

- The “14th Five-Year Plan” proposal includes “high-standard construction of Hainan Free Trade Port” into the national strategy

- The Central Economic Work Conference clearly proposes “solidly promoting the construction of Hainan Free Trade Port” [5]

- Coverage of 86 visa-free countries, and visa-free entry has become the main way for foreigners to enter Hainan [4]

- 82 overseas passenger routes, with 5 long-distance routes to Europe and America opened [4]

- In 2025, actual utilized foreign investment increased by 51.5%, and service import and export total increased by23.1%[5]

- The three consumption business cards of “duty-free shopping” + “high-end medical care” + “studying in Hainan” have achieved level leap [4]

- Characteristic formats such as aerospace research, health vacation and cultural tourism performances are booming

- New productivity such as commercial aerospace, Nanfan seed industry and marine economy is being cultivated at an accelerated pace [5]

- Hainan is mainly connected to the mainland through the Qiongzhou Strait. After customs closure, strict supervision is required for personnel and goods in and out

- It may cause two-way logistics congestion of goods, items and vehicles, affecting economic linkage between the two places

- It is necessary to optimize processes through intelligent customs clearance and classification management to avoid practical operation bottlenecks caused by system design [6]

- Hainan has 37 yearssince its establishment as a province, and there is still no clear development idea in terms of industrial development

- The transition from agricultural orientation to modern industrial system has been tortuous

- The industrial development direction after customs closure still needs time to test [6]

- Weak global economic recovery may affect international tourists’ consumption willingness

- There are twists and turns in the domestic consumption recovery process, which may affect the offshore duty-free per capita consumption

- External factors such as exchange rate fluctuations and geopolitics need to be closely monitored

- The phenomenon of “package purchasing” smuggling in offshore duty-free needs to be continuously cracked down [2]

- Criminals use college students’ offshore duty-free quotas under the pretext of part-time jobs

- Provide free one-day tours in Hainan to the elderly through travel agencies to defraud duty-free quotas [2]

- China Duty Free Group’s P/E ratio is 57.54x, and Hainan Airport’s P/E ratio is 196.45x, both at historical highs

- If performance growth is lower than expected, it may face valuation correction pressure

- Need to be alert to short-term selling pressure from “profit taking after good news is realized”

- High Policy Certainty: Customs closure operation is not the end but a new starting point, and institutional dividends will last for 3-5 years

- Solid Demand Foundation: China has more than 400 million middle-income groups, and the trend of consumption upgrading is clear

- Strong International Competitiveness: Compared with duty-free shopping destinations such as Hong Kong and South Korea, Hainan has advantages in price and convenience

- Improved Industrial Ecology: The multi-format synergy of “tourism + duty-free + health care + culture” has been formed

- Q1-Q2 2026: Observe whether the consumption heat continues after the New Year and Spring Festival

- H2 2026: Observe the progress of international route expansion and the recovery of inbound tourists

- Full Year 2026: Verify the achievement rate of Standard Chartered Bank’s 120 billion yuan sales forecast

- Logic: Core beneficiary of Hainan duty-free market, with a market share of about 70%

- Catalyst: Expected offshore duty-free sales in Hainan to exceed 120 billion yuan in 2026

- Target Price: Based on 2026 performance forecast (Hainan business contributes 84 billion yuan in revenue), the reasonable valuation range is110-120 USD(current 94.56 USD, upside potential16-27%)

- Risk Tips: High valuation, need to pay attention to the rhythm of performance realization

- Logic: Traffic entry target, directly benefiting from international passenger flow growth

- Catalyst: 2025 international passenger throughput reaches the target of 2.4 million person-times

- Risk Tips: Extremely high valuation (P/E ratio 196.45x), limited performance elasticity

- Focus on trading opportunities brought by the continuous release of customs closure effects

- Lay out China Duty Free Group on dips, and intervene when回调 5-10%

- Pay attention to sales data verification after the New Year and Spring Festival holidays

- Focus on the progress of international route expansion

- Pay attention to the increase in the proportion of China Duty Free Group’s Hainan business revenue (target 30%+)

- Pay attention to business breakthroughs of new duty-free license companies (such as Wangfujing)

- Pay attention to the improvement of the internationalization level of Hainan Free Trade Port (proportion of foreign entry)

- Pay attention to the possibility of further optimization of offshore duty-free policies (quota increase, category expansion)

- Pay attention to duty-free consumption model innovation (online duty-free, cross-border e-commerce integration)

- The position of Hainan Free Trade Port thematic investment is recommended to be controlled at 10-15% of the portfolio

- The position of China Duty Free Group as a single target should not exceed **5 of the portfolio

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.