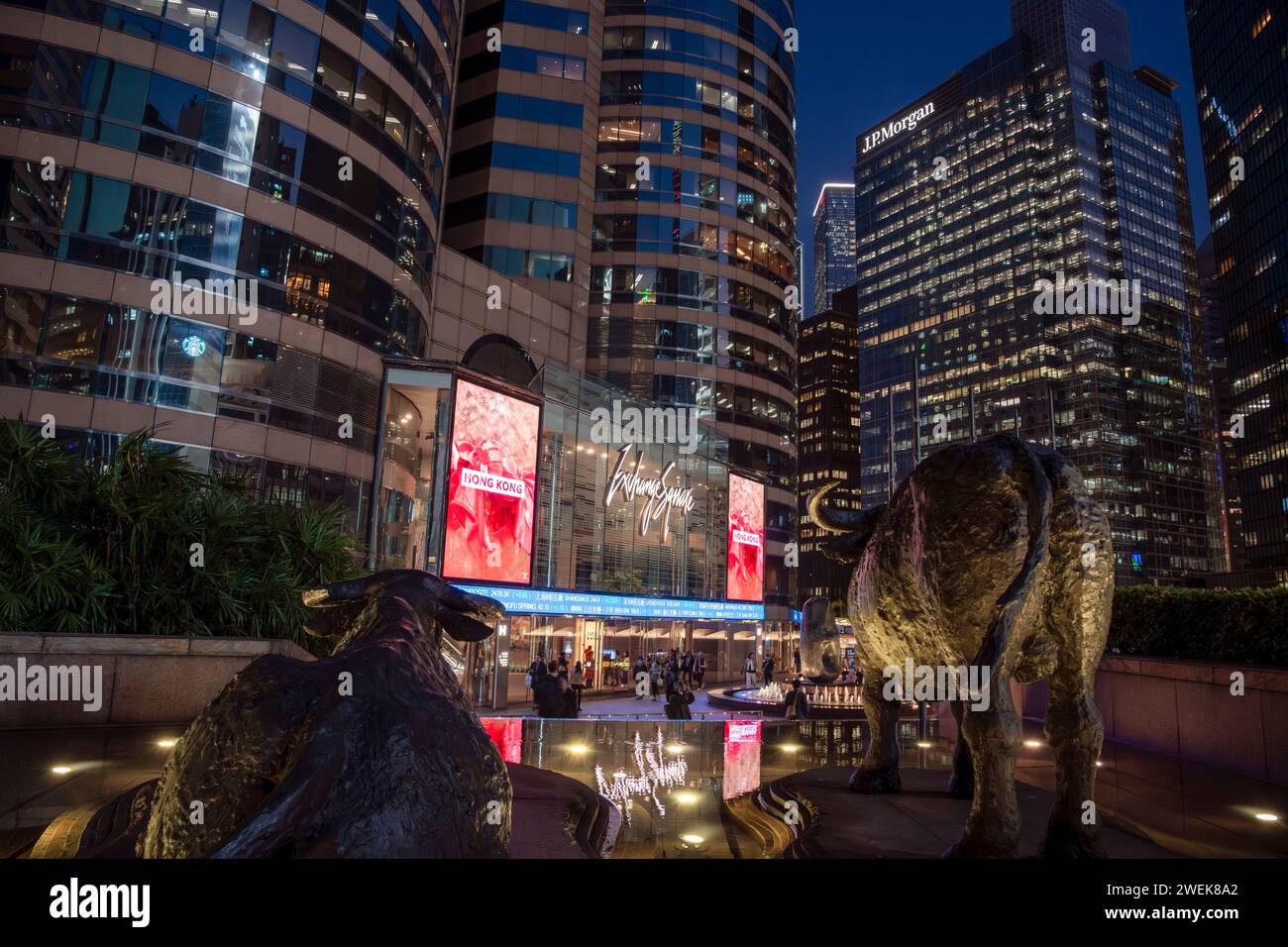

2026 New Year Market Update: Gold Gains, Hong Kong Stocks Rally, Dow Futures Rise

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

This analysis is based on the January 2, 2026 Wall Street Journal live coverage [7] detailing post-holiday market moves.

The HSI closed at 26,338.48 on January 2, marking a 2.41% gain, extending its 28% annual 2025 rise (best since 2017) driven by the AI boom [0][6]. Key drivers include:

- China’s fiscal stimulus signals emphasizing tech innovation and growth [5]

- A record $75 billion in 2025 Hong Kong IPOs (triple 2024’s tally) with momentum expected into 2026 [4]

- Continuing strength in tech and AI sectors [6]

Spot gold prices exceeded $4,500 per ounce, up ~1.10% on January 2 [3]. The rally follows a record-breaking 2025, driven by:

- Safe-haven demand amid global volatility [1]

- A weakening U.S. dollar and Fed rate cut expectations [2]

While exact data is limited (U.S. markets closed Jan 1), WSJ reported positive Dow futures sentiment, likely reflecting optimism about global fiscal stimulus and ongoing equity momentum [3].

- China Policy as a Global Catalyst: Beijing’s supportive fiscal policy is boosting both Hong Kong stocks (via tech and growth focus) and broader market sentiment (affecting Dow futures expectations).

- AI Sector Continuity: The AI boom that drove 2025’s 28% HSI gain is transitioning into 2026, indicating sustained structural momentum in tech-related equities [6].

- Dual Market Drivers: Gold’s safe-haven rally coexists with equity strength, highlighting mixed investor sentiment between growth and risk-averse assets.

- Overbought Precious Metals: Gold trades 25.2% above its 200-day moving average, signaling potential volatility or corrections [2].

- Stimulus Uncertainty: The size and effectiveness of planned global fiscal stimulus remain uncertain.

- Tech Valuations: Elevated valuations in AI and tech stocks may lead to profit-taking [6].

- Geopolitical & Policy Risks: Tensions and central bank decisions could disrupt market trends.

- Hong Kong IPO Pipeline: $75 billion in 2025 IPOs and expected momentum into 2026 support market liquidity and growth [4].

- Tech & AI Growth: China’s policy focus on tech innovation provides ongoing tailwinds for related sectors [5].

- Gold Demand: Persistent safe-haven needs or dollar weakness may continue supporting gold prices [1][2].

- HSI closed at 26,338.48 (Jan 2, 2026), up 2.41% [0]

- Gold exceeded $4,500 per ounce (Jan 2, 2026), up ~1.10% [3]

- Hong Kong 2025 IPOs raised $75 billion [4]

- HSI recorded 28% annual gain in 2025 (best since 2017) [6]

- Dow futures showed positive sentiment (Jan 2, 2026) [3]

- Gold is 25.2% above 200-day moving average [2]

巨子生物(02367.HK)热门股分析报告

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.